Workers Compensation for Business Owners: Key Insights

Workers compensation for business owners is an essential consideration for entrepreneurs looking to safeguard their financial well-being. While many business owners focus on providing coverage for their employees, it’s equally important to evaluate their own need for workers compensation benefits. Understanding the nuances of business owner insurance, including sole proprietor coverage and LLC workers compensation, is crucial for effective risk management. By exploring these options, business owners can ensure they meet their business insurance needs while protecting themselves from potential losses due to work-related injuries. Don’t overlook the importance of self-protection; a comprehensive approach to workers compensation can provide peace of mind and security for your business.

When discussing coverage for business proprietors, terms like self-insurance for entrepreneurs and indemnity for sole proprietors come into play. These phrases highlight the importance of securing a safety net for personal injuries sustained in the course of business operations. Protecting oneself as a business owner is not just about employee welfare; it involves understanding the implications of workers compensation insurance on one’s financial stability. Various legal structures, from partnerships to LLCs, dictate the necessity of this coverage, emphasizing that each business’s unique circumstances influence their insurance decisions. Ultimately, ensuring adequate compensation coverage is vital for both personal and professional security.

The Importance of Workers’ Compensation Insurance for Business Owners

Workers’ compensation insurance is crucial for business owners as it safeguards their financial interests in the event of work-related injuries or illnesses. While this type of coverage primarily protects employees, it can also extend to business owners, depending on the legal structure of the business and the specific state regulations. By investing in workers’ compensation, business owners ensure that they are not left vulnerable to overwhelming medical expenses or lost income due to an unforeseen accident, thus maintaining both personal and business financial stability.

Moreover, having workers’ compensation coverage can enhance a business owner’s credibility with employees and clients. It demonstrates a commitment to workplace safety and employee welfare, which can foster a positive work environment and improve employee morale. In industries with higher risks, such as construction or manufacturing, this coverage becomes even more vital, as it protects the owner from potentially devastating financial repercussions stemming from workplace accidents.

Evaluating Workers’ Compensation Benefits for Business Owners

The benefits of workers’ compensation for business owners extend beyond just financial protection. It also includes peace of mind, knowing that there is a safety net in place should an accident occur. In high-risk industries, this becomes especially important, as the likelihood of injuries is significantly increased. Business owners who prioritize their safety and the safety of their employees often find that this coverage can also lead to lower insurance premiums over time, as they implement safer work practices.

Additionally, business owners must consider the legal implications of workers’ compensation. In some states, it is mandatory for owners to include themselves in their company’s workers’ compensation coverage, particularly if they have employees. Failing to comply with state laws can lead to penalties or fines, which can further strain a business’s financial resources. Therefore, understanding your state’s requirements and the specific benefits of including yourself in workers’ compensation coverage is critical.

Understanding Sole Proprietor Coverage and Its Implications

Sole proprietors often face unique challenges when it comes to workers’ compensation coverage. In many states, they are not legally required to include themselves under workers’ compensation unless they have hired employees. However, opting for this coverage can provide significant advantages. It offers financial protection against work-related injuries, ensuring that sole proprietors do not bear the full brunt of medical expenses or lost wages that could arise from an accident.

Moreover, understanding the nuances of sole proprietor coverage is essential for effective risk management. Even though sole proprietors might operate in lower-risk environments, accidents can still happen. Securing workers’ compensation can mitigate the impacts of unexpected incidents, allowing business owners to focus on their operations without the constant worry of potential financial burdens. It is vital for sole proprietors to assess their individual circumstances and consider the long-term benefits of inclusion in workers’ compensation.

LLC Workers Compensation: What You Need to Know

For business owners operating under a Limited Liability Company (LLC), understanding workers’ compensation is crucial. In many states, LLC members may not automatically be covered by workers’ compensation insurance, creating potential gaps in protection. Business owners in an LLC should review their state laws to determine their specific coverage needs. Even if it’s not a legal requirement, obtaining coverage can safeguard members from the financial fallout of work-related injuries.

Additionally, LLC workers’ compensation can enhance a business’s credibility and professionalism. By providing this coverage, LLCs demonstrate a commitment to employee safety and well-being, which can improve retention and attract quality talent. Moreover, having a comprehensive workers’ compensation policy can streamline compliance with state regulations, ensuring that LLC owners focus on growing their business rather than navigating legal complexities.

Assessing Your Business Insurance Needs

Evaluating your business insurance needs is a critical step for any business owner. This involves a thorough analysis of the risks associated with your specific industry and understanding how workers’ compensation fits into your overall insurance strategy. Business owners should consider factors such as the nature of their work, the number of employees, and the potential financial implications of workplace injuries when determining their insurance needs.

Engaging with a knowledgeable insurance advisor can provide valuable insights into the best coverage options available. This professional can help tailor a policy that meets your unique requirements, ensuring that you have the necessary protection in place. Whether you are a sole proprietor, part of an LLC, or managing a larger business, a comprehensive evaluation of your insurance needs will ultimately lead to better protection and peace of mind.

The Financial Impact of Workers’ Compensation Claims

The financial impact of workers’ compensation claims can be significant for business owners. When an employee files a claim, it can lead to increased insurance premiums, legal fees, and potential lost productivity. For business owners who opt to include themselves in their coverage, the implications can be even more pronounced, especially in high-risk industries where claims may be more frequent.

Planning for these potential costs is essential. Business owners should create a comprehensive risk management strategy that includes safety training and workplace assessments to minimize the likelihood of accidents. By proactively addressing workplace safety, business owners can reduce the risk of claims, thereby protecting their business’s financial health in the long run.

Reassurance Through Workers’ Compensation Coverage

Obtaining workers’ compensation coverage provides business owners with reassurance that they are protected against unexpected incidents. Knowing that you have a safety net can alleviate stress and allow business owners to focus on their operations without the constant worry of potential financial ruin due to workplace injuries. This peace of mind is invaluable, particularly in high-stakes environments where the risk of accidents is inherent.

In addition to personal reassurance, providing workers’ compensation coverage can foster a culture of safety within the organization. Employees are likely to feel more valued and secure knowing that their employer has taken steps to protect them. This can enhance overall morale and productivity, creating a more engaged workforce that is committed to the success of the business.

Navigating State-Specific Workers Compensation Laws

Navigating state-specific workers’ compensation laws is essential for business owners. Each state has its own regulations regarding who must be covered, the requirements for coverage, and the benefits provided. Understanding these laws is crucial for compliance and can help business owners avoid costly penalties or legal issues.

Additionally, being aware of state-specific nuances can aid in making informed decisions about your coverage. For instance, some states may require additional coverage for business owners, while others may not. Staying informed and consulting with an insurance professional can ensure that your business is adequately protected while adhering to local regulations.

How Abbate Insurance Associates Can Help You

At Abbate Insurance Associates Inc., we understand that each business has unique insurance needs. Our team of experts is dedicated to helping you navigate the complexities of workers’ compensation and other business insurance requirements. We offer tailored solutions that align with your specific business structure, whether you are a sole proprietor, an LLC, or part of a larger organization.

By partnering with us, you can ensure that you have the right coverage in place to protect both yourself and your employees. We provide comprehensive assessments of your insurance needs and help you understand the potential benefits of including workers’ compensation coverage. Contact us today to learn more about how we can support your business insurance journey and secure your financial future.

Frequently Asked Questions

What is workers compensation for business owners and why is it important?

Workers compensation for business owners is a type of insurance that provides financial protection for business owners in the event of work-related injuries or illnesses. It covers medical expenses, lost wages, and rehabilitation costs, similar to coverage offered to employees. This insurance is crucial for safeguarding business owners from financial loss due to accidents that could occur while operating their business.

Do sole proprietors need workers compensation coverage for themselves?

In many states, sole proprietors are not required to carry workers compensation coverage for themselves unless they have employees. However, obtaining this coverage can be beneficial as it offers financial protection against work-related injuries or illnesses, ensuring that sole proprietors are safeguarded in case of accidents.

Are LLC members required to have workers compensation insurance?

The requirement for LLC workers compensation insurance varies by state. In some states, LLC members may not automatically be covered under workers compensation laws. However, even if not mandated, it is advisable for LLC members to consider obtaining coverage to protect themselves from potential financial losses due to workplace injuries.

What are the benefits of workers compensation for business owners?

The benefits of including workers compensation for business owners include financial protection against medical expenses and lost wages due to work-related injuries, peace of mind knowing that coverage is in place, and compliance with state laws that may require coverage for business owners, especially those with employees.

How does the nature of work affect the need for workers compensation coverage?

The nature of work significantly affects the need for workers compensation coverage. Business owners in high-risk industries, like construction, are more likely to need coverage due to higher rates of workplace injuries. Conversely, those in low-risk industries, such as consulting, may feel less urgency, but should still assess their risks and consider obtaining coverage.

How can business owners evaluate their workers compensation insurance needs?

Business owners can evaluate their workers compensation insurance needs by considering their business structure (sole proprietor, partnership, LLC), the nature of their work (high-risk vs low-risk), and their personal risk tolerance. Consulting with an insurance professional can also help in tailoring a policy that meets their specific coverage requirements.

Is workers compensation for business owners mandatory in all states?

No, workers compensation for business owners is not mandatory in all states. Requirements vary based on the business structure and state law. Business owners should check their state regulations to determine if they are required to have coverage, especially if they employ others.

What should business owners do to protect themselves with workers compensation?

Business owners should assess their business structure, the risks associated with their work, and consider obtaining workers compensation coverage for themselves. Consulting with an insurance agency, like Abbate Insurance Associates Inc., can help business owners tailor a policy that adequately protects them against potential financial risks.

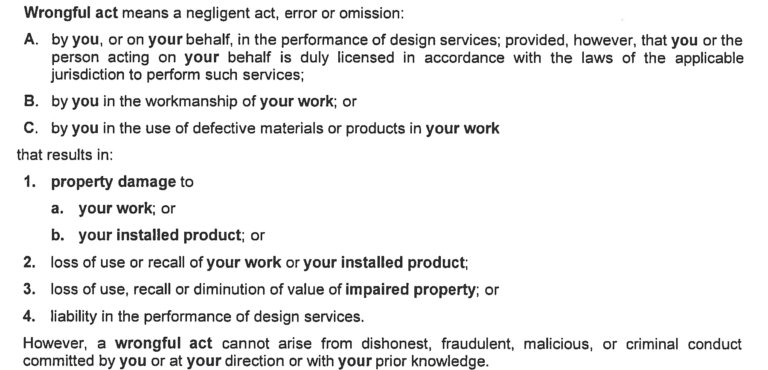

| Key Aspect | Details |

|---|---|

| Understanding Workers’ Compensation Insurance | Provides financial protection for employees injured at work, covering medical expenses and lost wages. |

| Do Business Owners Need Coverage? | It varies based on the legal structure of the business and the nature of the work. |

| Legal Structure of the Business | Sole Proprietors may not need coverage unless they have employees; Partnerships and LLCs should consider it for protection. |

| Nature of the Work | High-risk industries may require coverage; low-risk industries may not feel the need, but risks still exist. |

| Risk Tolerance | Business owners must assess their personal finances and risk tolerance before deciding on coverage. |

| Benefits of Coverage | Includes financial protection, peace of mind, and compliance with legal requirements. |

Summary

Workers compensation for business owners is essential for protecting yourself in case of work-related injuries or illnesses. As a business owner, it’s crucial to understand the dynamics of workers’ compensation insurance, including its necessity based on your business structure and the nature of your work. Evaluating your risk tolerance and the benefits of obtaining coverage can provide you with financial security and peace of mind. Contacting a knowledgeable insurance provider like Abbate Insurance Associates Inc. can further help you tailor a policy that meets your specific needs, ensuring both you and your business are adequately protected.