Variable Universal Life Insurance: What You Need to Know

Variable universal life insurance (VUL) is an intriguing option for those seeking a flexible life insurance product that combines investment opportunities with permanent coverage. Unlike traditional whole life policies, VUL allows policyholders to invest their premiums in various sub-accounts, such as stocks and bonds, potentially increasing the cash value of their policy. However, it’s crucial to weigh the pros and cons of variable universal life insurance, as the risks associated with market fluctuations can lead to unexpected outcomes. Understanding the cash value of variable universal life insurance is essential, especially when considering factors like surrender charges and policy loans. This article will explore the complexities of VUL, comparing it to whole life and indexed universal life insurance options, to help you make an informed decision about your financial future.

When it comes to securing financial protection for your loved ones, individuals often explore various life insurance solutions, including flexible options that allow for both investment growth and coverage. Among these choices, variable universal life insurance stands out as a hybrid product that merges the benefits of traditional whole life insurance with investment components. This type of policy provides the flexibility to adjust premiums and investment choices, catering to different financial strategies and risk tolerances. As you consider the indexed universal life insurance benefits and the unique features of VUL, it’s important to recognize the inherent risks of variable universal life insurance, particularly regarding cash value fluctuations and market volatility. This comprehensive overview will guide you through the key aspects of VUL, ensuring you are well-equipped to navigate the intricacies of life insurance.

Understanding Variable Universal Life Insurance: A Comprehensive Overview

Variable universal life insurance (VUL) is a unique financial product that blends the benefits of permanent life insurance with an investment component. This type of insurance provides a death benefit while enabling policyholders to invest their premiums in various sub-accounts, including stocks, bonds, or mutual funds. This flexibility allows for the potential growth of cash value, making it an attractive option for those looking to combine insurance with investment strategies. However, this potential for growth comes with inherent risks, as the cash value is directly tied to the performance of the underlying investments.

Unlike whole life insurance, which guarantees a fixed cash value growth, VUL offers a variable cash value that can fluctuate significantly based on market conditions. This introduces a level of uncertainty that prospective policyholders must consider. Understanding the pros and cons of variable universal life insurance is crucial; while it offers premium flexibility and investment options, it also poses risks that could impact the financial security of the policyholder’s beneficiaries.

Frequently Asked Questions

What are the pros and cons of variable universal life insurance?

Variable universal life insurance (VUL) offers several advantages, including premium flexibility, potential cash value growth linked to various investment options, and tax-deferred growth. However, its cons include market risk, potential policy lapses if premiums aren’t paid, and high surrender charges, which can significantly impact your financial security.

How does whole life vs variable universal life insurance compare?

Whole life insurance provides guaranteed cash value and a fixed premium, making it a stable option. In contrast, variable universal life insurance allows for premium flexibility and investment in various sub-accounts, offering the potential for higher returns but with increased risk. The choice depends on your risk tolerance and financial goals.

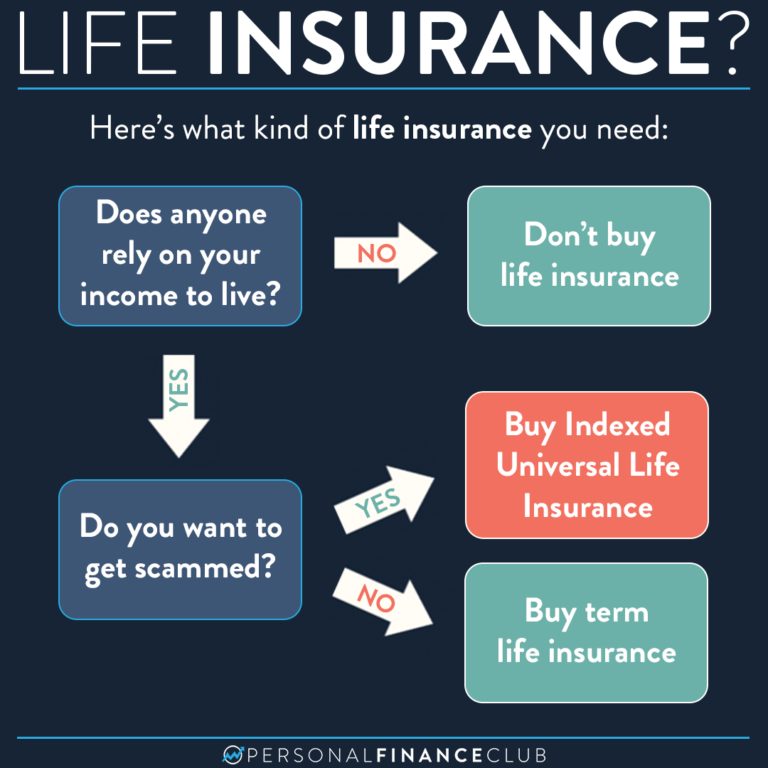

What are the indexed universal life insurance benefits compared to variable universal life insurance?

Indexed universal life insurance (IUL) offers benefits such as a guaranteed minimum interest rate tied to a market index, providing more stability than variable universal life insurance. While VUL’s cash value can fluctuate with market performance, IUL provides a safety net during poor market conditions, making it a safer alternative for those seeking growth.

How is the cash value of variable universal life insurance affected by market performance?

The cash value of variable universal life insurance is directly tied to the performance of the investment sub-accounts you choose. If the markets perform well, your cash value can grow significantly; however, poor market performance can lead to a decrease in cash value, impacting both your policy’s value and death benefit.

What are the risks of variable universal life insurance that policyholders should consider?

The risks of variable universal life insurance include market volatility impacting cash value, the potential for policy lapses if premiums are not maintained, high surrender charges, and the complexities of managing investment allocations. These factors can lead to unexpected financial consequences if not carefully monitored.

| Key Features of Variable Universal Life Insurance | |

|---|---|

| Flexibility | Premiums can be adjusted and allocated to various investment sub-accounts. |

| Cash Value Accumulation | Cash value growth depends on the performance of selected sub-accounts. |

| Investment Risks | Higher potential returns come with increased investment risks; poor market performance can reduce cash value. |

| Policy Loans | Loans against cash value can reduce death benefits and incur interest. |

| Surrender Charges | Early surrender can lead to significant charges, eating into cash value. |

| Alternatives | Whole life and indexed universal life insurance offer more predictable and stable options. |

Summary

Variable universal life insurance is a flexible option in the realm of life insurance, allowing policyholders to tailor their coverage and investment strategies. However, it comes with significant risks, including market volatility and potential cash value loss. Those considering this type of insurance should weigh the benefits against the dangers, and explore safer alternatives such as whole life or indexed universal life insurance, which provide more stability and predictability.