Universal Life Insurance: Debunking Common Misconceptions

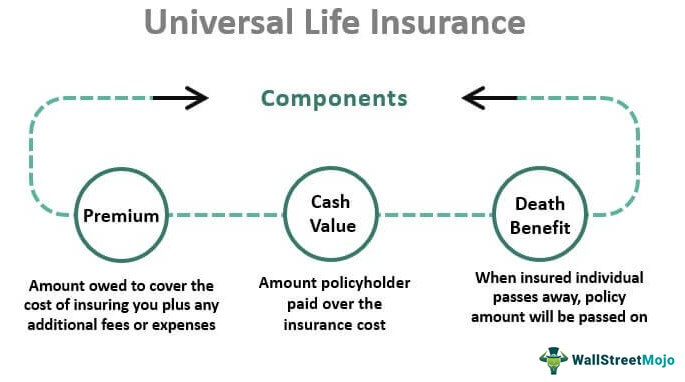

Universal life insurance is a versatile financial tool that combines life coverage with a cash value component, offering policyholders the unique advantage of premium flexibility. Unlike traditional policies, a universal life policy allows individuals to adjust their premium payments and death benefits according to their changing financial circumstances. This adaptability often leads to misunderstandings and life insurance misconceptions, as many people mistakenly believe that these policies are inherently risky or unmanageable. Indexed universal life insurance, a specific type of universal life insurance, further enhances this flexibility by linking cash value growth to a stock market index, ensuring a potential for greater returns. By understanding the benefits and functionalities of universal life insurance, individuals can make informed decisions about their long-term financial planning and security.

When exploring options for life coverage, one might come across terms like flexible life insurance products or adjustable life policies, which refer to the same concepts embodied in universal life insurance. These alternative terms capture the essence of a life insurance policy that not only provides a death benefit but also allows for strategic adjustments in premiums and benefits over time. The ability to modify payments makes these policies appealing to those who value adaptability in their financial planning. Indexed life insurance, a subset of this category, integrates stock market performance into its growth strategy, presenting an opportunity for policyholders to increase their cash value significantly. Understanding how these various life insurance options work can help dispel the myths surrounding them and empower consumers to leverage their features effectively.

Understanding Universal Life Insurance: Myths and Realities

Universal life insurance (ULI) is often surrounded by misconceptions that can deter potential policyholders from exploring its benefits. Many people believe that ULI is a cheap alternative to whole life insurance, leading to unrealistic expectations about cost and coverage. This misconception stems from anecdotal tales of negative experiences, where individuals encountered unexpected costs or premium increases later in life. However, these stories often fail to acknowledge the policyholder’s role in managing their insurance effectively. When designed and funded correctly, universal life insurance can be a powerful tool for financial planning, offering flexibility that traditional life insurance policies may lack.

The flexibility inherent in a universal life policy allows the policyholder to adjust their premiums and death benefits as circumstances change. This adaptability is crucial, especially in times of financial uncertainty. For instance, if a policyholder experiences a temporary loss of income, they can reduce their premium payments without losing their coverage. Conversely, should their financial situation improve, they can make substantial contributions to their policy, enhancing both the cash value and death benefit. Understanding these dynamics is essential to dispelling fears associated with universal life insurance, positioning it as a viable option for long-term financial security.

Frequently Asked Questions

What is Universal Life Insurance and how does it differ from other life insurance policies?

Universal Life Insurance (UL) is a flexible premium, adjustable benefit type of life insurance policy that combines life coverage with an investment savings element. Unlike whole life insurance, which has fixed premiums and benefits, UL allows policyholders to adjust their premium payments and death benefits, providing greater financial flexibility. This adaptability makes UL suitable for individuals seeking both insurance protection and savings accumulation.

What are the advantages of Indexed Universal Life Insurance compared to traditional Universal Life Insurance?

Indexed Universal Life Insurance (IUL) offers the benefits of universal life insurance with the added potential for higher returns based on a stock market index. Policyholders can participate in market gains while maintaining a floor to protect against losses. This means that even in volatile markets, IUL provides a safety net, making it an attractive option for those looking for growth opportunities alongside life insurance coverage.

Are there common misconceptions about Universal Life Insurance that potential buyers should be aware of?

Yes, there are several misconceptions about Universal Life Insurance. One common myth is that UL policies are inherently risky or always result in financial loss. In reality, when executed properly, UL policies offer significant flexibility and can perform well over time. Additionally, some people believe that UL is a cheap alternative to whole life insurance, but it is important to understand that both products serve different purposes and pricing can vary widely based on features.

How does premium flexibility work with Universal Life Insurance policies?

Premium flexibility in Universal Life Insurance allows policyholders to adjust their premium payments according to their financial situation. This means that you can pay more in profitable years and less when cash flow is tight, unlike traditional life insurance policies that require fixed payments. This flexibility helps ensure that coverage remains in force while accommodating changing financial circumstances.

What happens if I stop making premium payments on my Universal Life Insurance policy?

If you stop making premium payments on your Universal Life Insurance policy, the policy may enter a grace period during which you can reinstate it by making overdue payments. After this period, if there is sufficient cash value, the policy may continue to provide a death benefit, but it will deplete over time if no further premiums are paid. It’s crucial to understand the terms of your policy to avoid losing coverage.

Can I increase the death benefit on my Universal Life Insurance policy?

Yes, many Universal Life Insurance policies allow for an increase in the death benefit. However, this typically requires an increase in premium payments and possibly medical underwriting. Increasing the death benefit can provide additional financial security for your beneficiaries, but it’s important to assess how it aligns with your overall financial strategy.

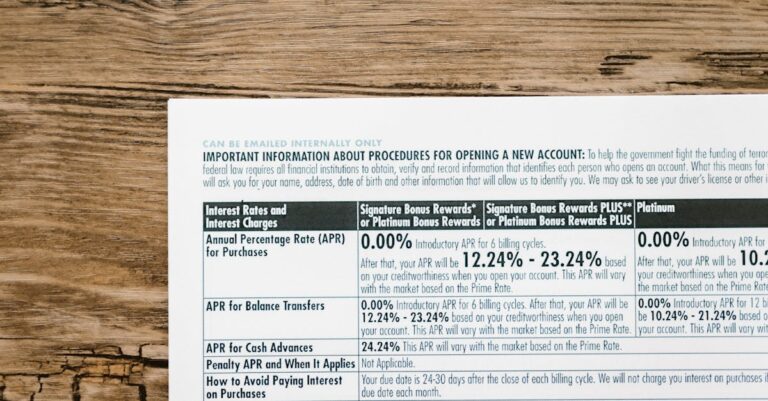

What are the fees associated with Universal Life Insurance and how do they impact policy performance?

Universal Life Insurance policies come with various fees, including cost of insurance, administrative fees, and potentially investment management fees. These costs can impact the performance of the policy, particularly if the cash value growth does not keep pace with these expenses. Understanding these fees is essential for effective policy management and ensuring that the insurance remains beneficial over the long term.

How can I ensure that my Indexed Universal Life Insurance policy remains in good standing?

To maintain your Indexed Universal Life Insurance policy in good standing, it’s important to regularly review and adjust your premium payments based on your financial situation and policy performance. Additionally, staying informed about any changes to market indices and the policy’s guaranteed features will help you make better decisions. Consulting with a financial advisor can also guide you in optimizing your policy for long-term success.

What options do I have if my Universal Life Insurance policy is underfunded?

If your Universal Life Insurance policy is underfunded, you have several options. You can catch up on missed premium payments to restore the policy’s cash value and death benefit. Alternatively, you may consider reducing the death benefit to lower expenses and enhance cash value growth. Regularly reviewing your policy and consulting with your insurance agent can provide tailored solutions to address underfunding.

Is Universal Life Insurance suitable for everyone, or are there specific circumstances where it excels?

Universal Life Insurance is particularly suitable for individuals who value flexibility in premium payments and death benefits. It excels for those with varying income levels or who anticipate changes in their financial situation. Additionally, those interested in a combination of insurance protection and cash value accumulation will find UL policies beneficial. However, it may not be the best choice for individuals seeking straightforward, fixed-benefit life insurance.

| Key Aspects | Details |

|---|---|

| Misconceptions | Many negative views on universal life insurance stem from anecdotal evidence and misunderstandings about how the product works. |

| Design Flexibility | Universal life insurance offers significant flexibility in premium payments and death benefits, allowing owners to adapt their policies as needed. |

| Cost Comparison | It is not inherently cheaper than whole life insurance; comparable coverage should reflect similar costs. |

| Real Case Example | A historical indexed universal life policy shows that even with underfunding, the policy can still perform well. |

| Fee Structure | Annual expenses have been manageable, with the policy still yielding positive returns even in a down market. |

| Future Adjustments | Policyholders have options to reduce death benefits or make catch-up contributions to manage expenses. |

Summary

Universal Life Insurance is a flexible and adaptable financial tool that allows policyholders to manage their premiums and death benefits effectively. Misconceptions surrounding this product often arise from anecdotal experiences rather than factual evidence. By understanding its design and benefits, individuals can leverage Universal Life Insurance to meet their long-term financial goals while mitigating risks associated with rising expenses.

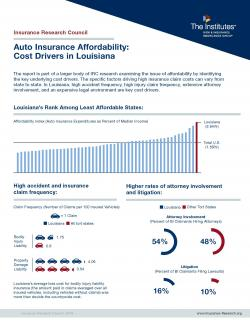

If you’re a senior vehicle driver, you could be qualified for rebates on your Auto Insurance in Las Vegas Nevada.

Several carriers supply lesser prices for elders that preserve a well-maintained driving report with their Auto Insurance in Las Vegas Nevada plans.

Also, accomplishing a senior chauffeur security program can result in further financial savings on Auto

Insurance in Las Vegas Nevada. Get in touch with your carrier

to find what price cuts are actually on call for elderly chauffeurs under Auto Insurance

in Las Vegas Nevada.

Wow! Thank you! I always needed to write on my

site something like that. Can I include a portion of your post to my blog?