Understanding Insurance Terminology: Key Terms Explained

Understanding insurance terminology is essential for anyone looking to navigate the complex world of insurance. Terms like “underwriting,” “premiums,” and “contestability period” can often feel overwhelming, yet they are pivotal in shaping your insurance experience. By familiarizing yourself with these insurance definitions, you can make informed decisions about your life insurance terms and policy terms. This knowledge not only boosts your financial literacy regarding insurance but also empowers you as a consumer. Join us as we explore and clarify some commonly misunderstood insurance terms, ensuring you gain the confidence needed to manage your insurance needs effectively.

Grasping the language of insurance can significantly enhance your ability to make sound financial decisions. Familiar concepts such as premium payments, policy features, and underwriting practices are critical in the insurance landscape. By decoding these terms and phrases, you can better understand your coverage options and the implications of various insurance products. Whether you’re exploring life insurance options or assessing your financial literacy in insurance, delving into these definitions will equip you with the necessary knowledge to navigate your insurance journey. Let’s dive into the nuances of these essential insurance terms to demystify the insurance process.

Understanding Insurance Terminology: A Guide

Insurance terminology can often seem daunting, especially for those who are new to the world of financial products. Terms like underwriting, premiums, and contestability periods create a barrier to understanding that can leave individuals feeling lost. This guide aims to demystify these terms, providing clear definitions and examples to enhance your financial literacy in insurance matters. By understanding these key insurance definitions, you can make more informed decisions regarding your policies and coverage.

Moreover, understanding insurance terminology is crucial not only for securing the right policies but also for managing them effectively. Knowing terms like accelerated death benefit and long-term care insurance can empower you to utilize your policies fully. As you navigate your insurance journey, remember that a good insurance professional can be a vital resource in explaining these terms and ensuring that you comprehend the implications of your choices.

Key Insurance Definitions for Better Financial Literacy

Financial literacy in insurance involves grasping essential insurance definitions that impact your financial decisions. For instance, understanding what a premium is—the amount you pay for your insurance coverage—can help you budget accordingly. It’s also important to know how premiums can vary based on factors like age, health, and lifestyle choices, which can directly affect your financial planning.

In addition to premiums, comprehending terms like death benefit and disability can significantly influence your approach to insurance policies. The death benefit is what your beneficiaries will receive upon your passing, while disability coverage ensures you have financial protection in the event of an unexpected illness or injury. By mastering these terms, you not only enhance your financial literacy but also become a more informed consumer in the insurance market.

The Importance of Premiums in Insurance Policies

Premiums are a fundamental aspect of any insurance policy, representing the cost of maintaining your coverage. Understanding how these payments work can help you choose the right policy for your financial situation. Insurance companies typically offer various payment options, such as monthly, quarterly, or annual premiums, allowing you to select a frequency that best suits your budgeting needs.

Moreover, it’s crucial to recognize that the premium amount can fluctuate based on several factors, including your health history and lifestyle choices. For instance, individuals who lead healthier lifestyles may qualify for lower premiums. By staying informed about how premiums are calculated and what influences their rates, you can make smarter choices that align with your financial goals.

Exploring the Contestability Period in Life Insurance

The contestability period is a critical timeframe in life insurance that often goes overlooked by policyholders. Typically lasting one to two years from the policy’s issue date, this period allows insurance companies to review the information provided in your application. Should any discrepancies arise during this time, insurers retain the right to contest claims, which can significantly impact beneficiaries.

Understanding the implications of the contestability period is essential for both policyholders and beneficiaries. It serves as a safeguard for insurance companies against fraud, ensuring that claims are valid. By being aware of this term, you can ensure your application is accurate and complete, thereby avoiding potential complications in the future.

The Role of Underwriting in Insurance Policies

Underwriting is the backbone of the insurance approval process, determining both eligibility and premium rates for applicants. During this phase, an underwriter assesses various factors such as health history, lifestyle habits, and age to evaluate the risk associated with insuring an individual. This process is critical in ensuring that insurance companies can offer fair rates based on the level of risk presented.

Understanding underwriting can provide insights into how insurance companies make decisions regarding policy issuance. For example, if you have a pre-existing condition or engage in risky activities, this may lead to higher premiums or even denial of coverage. Being informed about underwriting criteria can empower you to present your application more effectively and explore options that may be available to you.

Decoding Riders and Their Benefits

Riders are additional provisions that can be attached to a base insurance policy, offering expanded coverage and benefits tailored to specific needs. For instance, an accelerated death benefit rider allows policyholders to access a portion of their death benefit while still alive if diagnosed with a terminal illness. This flexibility can provide critical financial support during challenging times.

Understanding the various types of riders available can enhance your insurance portfolio significantly. Riders can address specific circumstances such as long-term care needs or accidental death. By discussing potential riders with an insurance professional, you can customize your policy to ensure it meets your unique financial situation and goals.

The Significance of Insurable Interest in Insurance Policies

Insurable interest is a vital concept in the realm of life insurance, ensuring that the insured individual has a legitimate interest in the life of the person covered by the policy. This means that the policyholder would suffer a financial loss in the event of the insured’s death. The requirement for insurable interest protects insurance companies from fraudulent claims and ensures the integrity of the insurance system.

Understanding insurable interest is crucial when considering whom to insure under your life policy. Common examples include family members, business partners, or dependents. By ensuring you have an insurable interest in the individuals you cover, you can avoid potential legal issues and ensure that your insurance coverage remains valid.

Navigating the Complexities of Long-Term Care Insurance

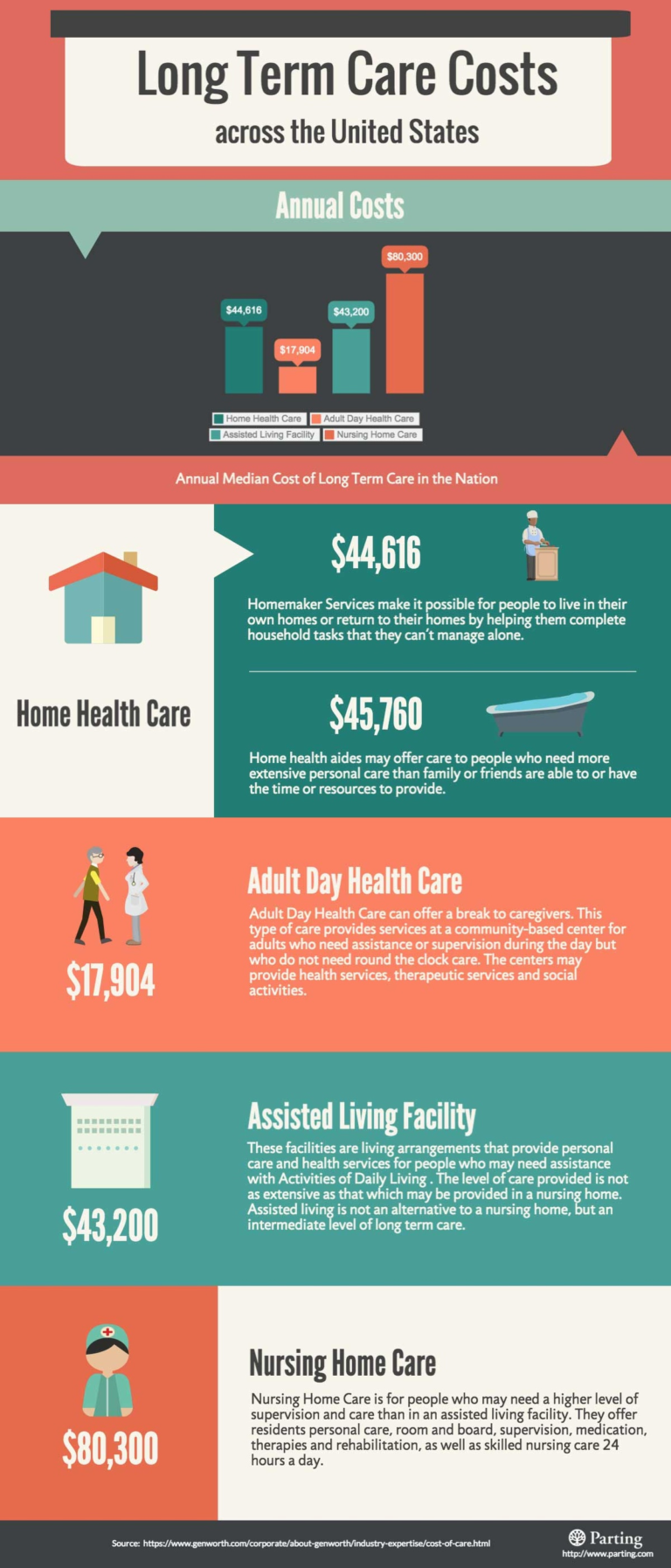

Long-term care insurance is an essential financial product that provides coverage for individuals who may need assistance with daily living activities due to chronic illness or disability. Understanding this type of insurance is crucial, as it can help protect your savings and ensure access to necessary care without financial strain.

When considering long-term care insurance, it’s important to evaluate the different policy options available. These policies can cover a variety of services, including in-home care, nursing home stays, and even adult day care. By comprehensively understanding your options, you can choose a policy that best aligns with your financial needs and future care requirements.

Maximizing Benefits with Living Benefits in Insurance

Living benefits are a unique feature of some life insurance policies, allowing policyholders to access certain benefits while still alive. These benefits can include accelerated death benefits and long-term care riders, providing financial flexibility during critical times. Understanding how living benefits work can help you make the most of your life insurance policy.

For many, the ability to access funds for medical expenses or long-term care needs can significantly alleviate financial burdens. By being aware of the living benefits included in your policy, you can ensure that you have the necessary financial resources when facing health challenges. This proactive approach to using your life insurance can enhance your overall financial strategy and security.

Understanding Annuities and Their Role in Financial Planning

Annuities are financial products that can play a crucial role in retirement planning and long-term financial stability. These contracts with insurance companies allow you to invest a sum of money upfront in exchange for regular payments over time, either for a fixed period or for the rest of your life. Understanding how annuities work can help you make informed decisions about your retirement income.

Choosing the right type of annuity involves understanding the various options available, such as fixed, variable, or indexed annuities. Each type has its own benefits and risks, making it essential to assess your financial goals and risk tolerance. By grasping the nuances of annuities, you can better integrate them into your overall financial plan, ensuring a steady income stream during retirement.

Frequently Asked Questions

What are common insurance definitions that I should know?

Understanding insurance terminology is essential for making informed decisions. Common insurance definitions include ‘premium,’ which is the payment to keep your policy active; ‘underwriting,’ the process insurers use to assess risk; and ‘death benefit,’ the amount paid to beneficiaries upon the insured’s death. Familiarizing yourself with these terms can enhance your financial literacy regarding insurance.

What is the significance of the contestability period in insurance policy terms?

The contestability period is a crucial insurance policy term, typically lasting one to two years after issuing a life insurance policy. During this time, the insurer can investigate any misrepresentation in the application. Understanding this term helps you grasp how insurance companies protect themselves from fraud while ensuring fair treatment for policyholders.

How do accelerated death benefits work in life insurance terms?

Accelerated death benefits are provisions in some life insurance policies that allow you to access part of the death benefit while still alive, particularly if diagnosed with a terminal illness. This understanding of life insurance terms can be beneficial for managing expenses during critical times, allowing policyholders to cover debts or special experiences with loved ones.

What is the importance of insurable interest in understanding insurance terminology?

Insurable interest is a key concept in insurance definitions, requiring that the policyholder has a financial stake in the insured’s life. This ensures that the policyholder would suffer a financial loss upon the insured’s death, which is a fundamental principle protecting against insurance fraud.

What are living benefits in the context of insurance definitions?

Living benefits refer to the features of some life insurance policies that allow access to benefits while the policyholder is still alive. Common examples include accelerated death benefits and long-term care benefits. Understanding living benefits is vital for comprehensive financial literacy regarding insurance, as they provide additional financial support during critical life stages.

What does underwriting mean in insurance terminology?

Underwriting is the process by which insurance companies evaluate the risk of insuring an applicant. It involves assessing factors like health history, lifestyle, and age to determine policy eligibility and premium rates. A solid understanding of underwriting can help individuals navigate the complexities of insurance applications.

What is the difference between term life insurance and permanent life insurance terms?

Term life insurance provides coverage for a specific period (typically 10, 20, or 30 years) and pays a death benefit if the insured dies during that term. In contrast, permanent life insurance offers lifelong coverage and builds cash value over time. Grasping these differences is vital for making informed choices about life insurance options.

How do riders enhance insurance policy terms?

Riders are optional additions to an insurance policy that provide extra coverage tailored to specific needs. For example, a long-term care rider can be added to a life insurance policy for additional benefits. Knowing how riders work can help you customize your policy for better protection.

What are preferred rates in the context of insurance terms?

Preferred rates are lower premiums offered to individuals deemed lower risk by insurers based on health, lifestyle, and other factors. Understanding how preferred rates work can help you find the best financial options in your insurance coverage.

How can understanding financial literacy insurance improve my insurance decisions?

Improving your financial literacy regarding insurance helps you understand key terms and concepts, enabling you to make informed decisions about coverage, premiums, and benefits. This knowledge can lead to better financial planning and protection for you and your family.

| Term | Definition |

|---|---|

| Accelerated death benefit | Allows access to some life insurance death benefits if terminally ill, useful for paying debts or expenses. |

| Annuity | Financial products that provide tax-advantaged savings and lifelong income, popular with retirees. |

| Contestability period | Duration for reviewing applications to prevent fraud, typically lasts one to two years post-policy issuance. |

| Conversion right | Allows conversion from term to permanent life insurance, helping maintain coverage and build wealth. |

| Death benefit | Amount paid to beneficiaries upon death, generally tax-free. |

| Disability | Covers various conditions beyond illness or injury, including maternity and mental health issues. |

| Grace period | Time frame allowing policy to remain active after missed premium payment, usually about one month. |

| Insurable interest | Requirement that policyholder would face financial loss if the insured person dies. |

| Living benefits | Benefits available while insured is alive, such as long-term care or accelerated death benefits. |

| Long-term care insurance | Insurance providing support for extended care needs, covering nursing homes and home health care. |

| Permanent life insurance | Provides lifelong coverage and builds cash value, unlike term life insurance. |

| Preferred rates | Lower rates for applicants considered at lower risk based on health and lifestyle factors. |

| Premium | Payment required to keep an insurance policy active, can be made at various intervals. |

| Rider | Additional coverage added to a policy, tailored to specific needs such as long-term care. |

| Term life insurance | Affordable life insurance providing coverage for a specific period, usually with a death benefit. |

| Underwriting | Process used by insurers to evaluate risk and determine policy eligibility and rates. |

Summary

Understanding insurance terminology can feel daunting, but with the right guidance, you can easily navigate through it. This overview of commonly misunderstood insurance terms provides clarity on essential concepts that are vital for making informed decisions regarding your insurance needs. Whether you’re exploring options for life insurance, disability coverage, or understanding the nuances of premium payments, becoming familiar with these terms is the first step towards financial literacy in the realm of insurance. Don’t hesitate to seek help from professionals who can further assist you in your insurance journey.