Snow Removal Business Insurance: Essential Policies Explained

Snow removal business insurance is an essential aspect of running a successful snow removal operation. As winter sets in and snow begins to blanket roads and sidewalks, the demand for snow removal services increases dramatically. However, with this increased demand comes a range of risks, from potential property damage to employee injuries and equipment breakdowns. To safeguard your business, it’s crucial to invest in comprehensive coverage, including liability insurance for snow removal, workers compensation for snow removal, and equipment insurance for snow removal. With the right insurance policies in place, you can focus on providing excellent service while being confident that your business is protected from unforeseen events.

When operating a snow clearing service, having adequate insurance coverage is vital for mitigating risks associated with winter operations. This coverage encompasses various policies designed specifically for businesses in the snow removal industry, including protection against liability claims, employee injuries, and damage to essential equipment. Terms such as insurance for snow removal services and commercial auto insurance are integral to ensuring that your vehicles and machinery remain operational in hazardous conditions. Additionally, understanding the importance of workers compensation for snow removal can help protect your workforce while enhancing your company’s reputation. By securing the right insurance policies, you can navigate the challenges of winter weather with confidence and peace of mind.

The Importance of Snow Removal Business Insurance

Running a snow removal business can be rewarding, but it comes with a unique set of risks that necessitate comprehensive insurance coverage. Snow removal business insurance is not just a regulatory requirement; it is a strategic investment that protects your assets, reputation, and financial stability. This type of insurance encompasses various policies tailored to meet the specific needs of snow removal operations, ensuring that you are prepared for any unforeseen incidents that may arise during the winter season.

Without adequate snow removal business insurance, you expose yourself to significant financial risks. For instance, if a slip-and-fall incident occurs on a freshly cleared driveway, the financial burden can be overwhelming. This is where general liability insurance becomes crucial, covering expenses related to injuries or property damage claims. Additionally, having workers’ compensation for snow removal ensures that your employees are protected in case of workplace injuries, safeguarding both them and your business from potential lawsuits.

Frequently Asked Questions

What types of insurance for snow removal services do I need to protect my business?

To adequately protect your snow removal business, you should consider essential insurance policies including general liability insurance, commercial auto insurance, workers compensation for snow removal, professional liability insurance, and equipment insurance for snow removal. Each of these policies addresses specific risks associated with your operations.

How does general liability insurance for snow removal protect my business?

General liability insurance for snow removal safeguards your business from financial losses resulting from third-party bodily injury or property damage claims. For instance, if a customer slips on ice you’ve cleared, this insurance covers their medical expenses and any legal claims.

Why is workers compensation for snow removal essential for my employees?

Workers compensation for snow removal is crucial as it provides financial and medical support to employees injured on the job. Given the physical demands and risks associated with snow removal, this insurance protects both your employees’ well-being and your business from potential lawsuits.

What does commercial auto insurance cover for snow removal businesses?

Commercial auto insurance for snow removal businesses covers damages and injuries related to your operational vehicles. It includes accident liability, vehicle damage from accidents, theft, and comprehensive coverage for your snow removal fleet, ensuring you remain operational after incidents.

What is equipment insurance for snow removal, and why do I need it?

Equipment insurance for snow removal protects your critical tools and machinery from theft, damage, or breakdowns. This specialized coverage is vital because snow removal equipment is often expensive and essential for daily operations, ensuring financial stability in case of unforeseen issues.

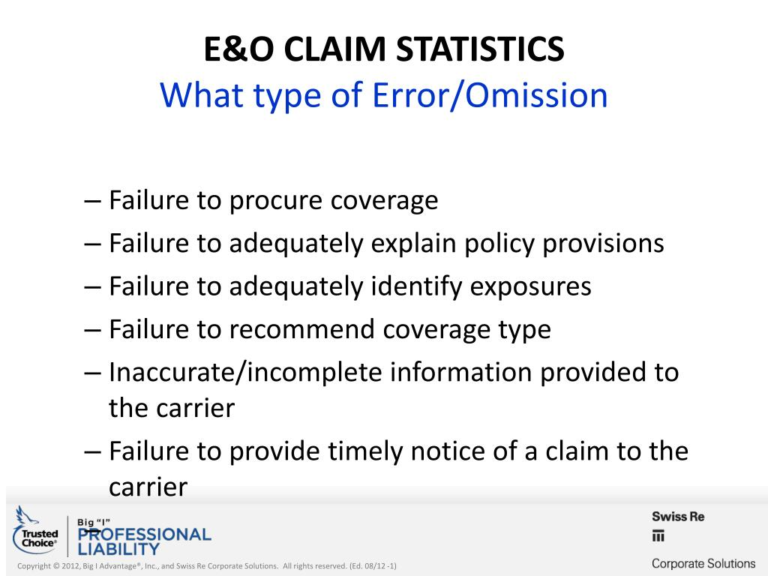

How can professional liability insurance for snow removal benefit my business?

Professional liability insurance for snow removal is beneficial as it covers claims related to mistakes or oversights in your services. If a client claims that your work created hazards, this insurance helps manage legal costs and potential settlements, protecting your business reputation.

What are the risks of not having insurance for my snow removal business?

Not having insurance for your snow removal business can expose you to significant financial risks. Without proper coverage, you may face crippling costs from lawsuits stemming from property damage, bodily injury claims, employee injuries, or equipment loss, potentially jeopardizing your business’s future.

What factors should I consider when choosing insurance for snow removal services?

When choosing insurance for snow removal services, consider coverage options tailored to your business needs, the types of risks you face, the financial implications of potential claims, and the reputation of the insurance provider in handling claims related to snow removal operations.

Is equipment insurance for snow removal different from general property insurance?

Yes, equipment insurance for snow removal is specific to movable tools and machinery used in operations, often referred to as inland marine insurance, while general property insurance covers fixed locations and assets. Both are important for comprehensive coverage.

How can I lower my insurance premiums for snow removal business insurance?

To lower your insurance premiums for snow removal business insurance, consider implementing safety protocols, regular vehicle maintenance, bundling insurance policies, and maintaining a good claims history. These measures can demonstrate risk management to your insurer.

| Insurance Policy | Coverage Details | Importance |

|---|---|---|

| General Liability Insurance | Covers bodily injury, property damage, and personal injury claims. | Protects against legal fees and claims from accidents on cleared properties. |

| Commercial Auto Insurance | Covers accident liability, vehicle damage, and comprehensive risks for business vehicles. | Essential for protecting the business’s fleet of snow removal vehicles. |

| Professional Liability Insurance | Covers negligence claims, missed deadlines, and professional errors. | Safeguards reputation and finances from client disputes. |

| Worker’s Compensation Insurance | Covers medical expenses and lost wages for injured employees. | Crucial for protecting workers and avoiding lawsuits related to injuries. |

| Equipment Insurance | Covers theft, damage, and breakdowns of essential equipment. | Vital for replacing or repairing tools crucial to operations. |

Summary

Snow removal business insurance is essential for protecting your livelihood against the risks inherent in this demanding industry. From safeguarding your equipment to ensuring your employees are covered in case of accidents, the right insurance policies allow you to focus on providing critical services to your community. By investing in comprehensive coverage such as general liability, commercial auto, professional liability, worker’s compensation, and equipment insurance, you can mitigate potential financial losses and ensure the continuity of your business during the harsh winter months.