Personal Insurance: Understanding Your Coverage Needs

In today’s unpredictable world, securing personal insurance is essential for protecting your assets and peace of mind. From comprehensive insurance policies to specialized coverage, understanding the various types of personal insurance, including homeowners insurance and auto insurance in New Jersey, can be a game changer. Particularly for those living in coastal areas, flood insurance should be a top priority, as it is often not included in standard homeowners policies. With someone like Anderson Insurance Agency by your side, navigating these options becomes simpler, ensuring you have the adequate protection against life’s uncertainties. So, let’s explore the crucial aspects of personal insurance that can keep you and your possessions safe.

When we discuss individual coverage options, many may refer to personal insurance under terms like private coverage or family protection plans. This encompasses a wide array of offerings designed to shield your assets, such as home and auto coverage, particularly important for residents of New Jersey aware of local risks. Additionally, securing proper flood insurance and understanding comprehensive insurance policies can provide a holistic safety net for homeowners. With a plethora of options available, finding the right insurance solution tailored to your lifestyle is imperative. Let’s delve deeper into the vital layers of protection available to safeguard your home, vehicle, and personal well-being.

Understanding Personal Insurance Needs

Navigating the world of personal insurance can be daunting, especially with the myriad options available to consumers today. Personal insurance is designed to protect individuals and their assets from unforeseen events that could lead to financial loss. Whether it’s homeowners insurance, auto coverage, or specialized policies like flood insurance, each type serves a specific purpose. By understanding your personal risks and lifestyle, you can choose the right combination of insurance products that provide you peace of mind.

In New Jersey, where extreme weather conditions can unexpectedly impact your quality of life, having adequate coverage becomes even more crucial. Recognizing the various types of personal insurance—such as comprehensive insurance policies that might bundle homeowners and auto coverage—ensures that you’re not left vulnerable. Start by assessing what assets you need to protect and consult with a knowledgeable insurance agent to tailor a policy that meets your individual requirements.

Homeowners Insurance: A Necessary Investment

For homeowners in New Jersey, having a robust homeowners insurance policy is not just advisable; it’s essential. Given the state’s susceptibility to hurricanes, as demonstrated by Hurricane Sandy, homeowners need protection that covers structural damages and personal belongings. While many people believe that their home will be safe, the truth is that unexpected events can lead to significant financial loss without adequate coverage in place.

Moreover, homeowners insurance often extends beyond just covering damages from natural disasters. It can include liability protection in case someone is injured on your property and coverage for additional living expenses if you are temporarily unable to live in your home due to damage. Therefore, understanding the nuances of your homeowners insurance policy can ensure that you are fully protected against a variety of risks.

Auto Insurance in New Jersey: Key Considerations

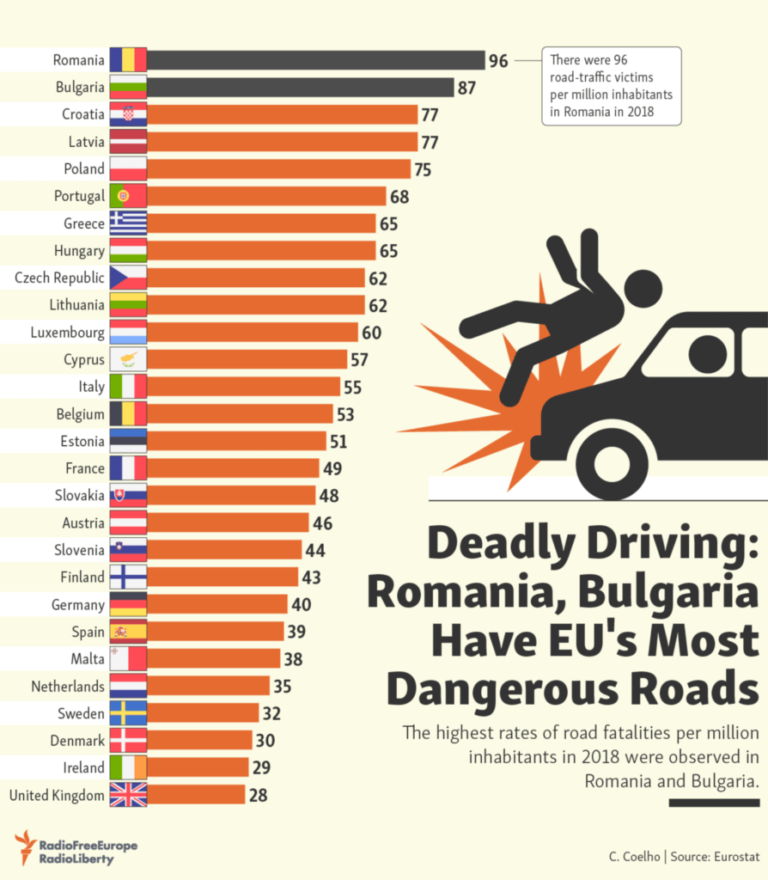

Car ownership comes with a host of responsibilities, especially in New Jersey, where the law mandates that drivers maintain sufficient auto insurance. This insurance not only protects you in case of accidents but also covers potential damages resulting from uninsured drivers, which can protect your financial wellbeing. Understanding the minimum coverage requirements is crucial, but evaluating your specific needs can often lead to more comprehensive protection.

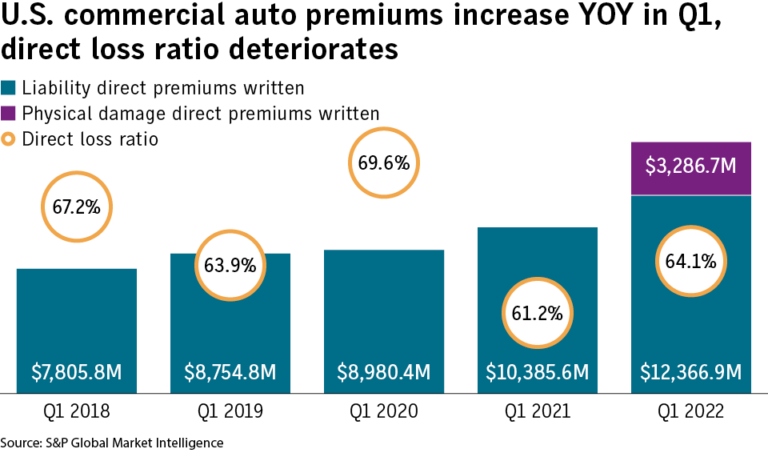

Choosing an experienced local insurance agent can make the difference when it comes to finding the best auto insurance rates. A knowledgeable agent can help identify the necessary coverage options based on your driving habits and vehicle value while looking for discounts that may apply. Moreover, don’t overlook the possibility of bundling your auto insurance with homeowners insurance to save on premiums—this could be a smart financial move.

The Importance of Flood Insurance

Flooding can occur in many unexpected situations, which is why having flood insurance is a crucial part of a homeowner’s risk management strategy. Standalone flood insurance policies provide coverage that standard homeowners insurance policies typically exclude. In areas like New Jersey, where storm surges and heavy rainfall are common, investing in this type of coverage can safeguard your home and assets against devastating water damages.

Understanding the specifics of your flood insurance policy is vital, as coverage can vary significantly between providers. It’s essential to verify what damages are included and the process for filing claims post-flood. With climate change leading to more intense storms, homeowners should make flood insurance a priority in their overall personal insurance planning.

Comprehensive Insurance Policies: The All-in-One Solution

When considering personal insurance, many people wonder if there is an option that encompasses all their needs. Comprehensive insurance policies are designed to combine various types of coverage into a single manageable plan. This can include homeowners, auto, and even liability insurance, all under one overall policy, creating a simplified approach to managing personal insurance.

While comprehensive policies might come with a higher upfront cost, they often provide greater peace of mind by reducing complexity and ensuring that all aspects of your personal insurance needs are covered. A trusted insurance agent can help you navigate these options, ensuring you find a comprehensive policy that balances your risk profile with your budget.

Exploring Various Types of Personal Insurance

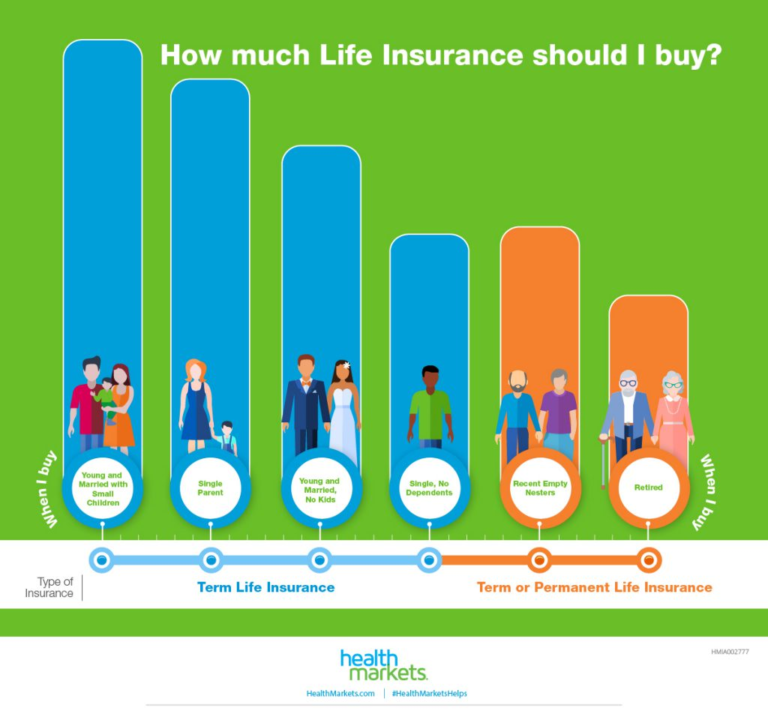

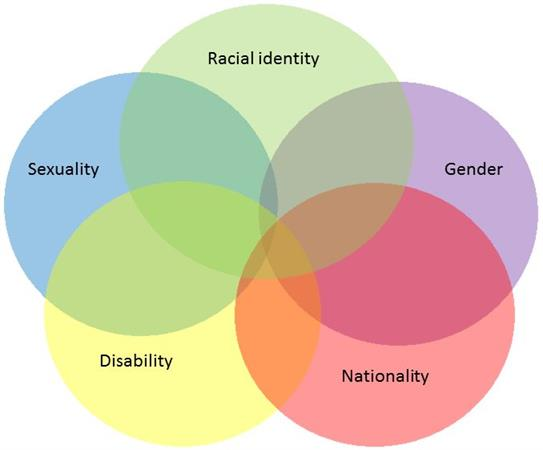

Personal insurance is not a one-size-fits-all solution, and understanding the different types available is key to making informed choices. Different personal insurance types—such as health, life, renters, and personal liability insurance—offer a wide array of protection depending on individual lifestyles and needs. Exploring options like umbrella insurance can provide additional coverage that kicks in when your primary policy limits are exceeded.

Additionally, specialized insurances can also protect unique assets. For example, if you own valuable items or engage in high-risk activities, specific policies can cover those elements where standard personal insurance may fall short. Knowing your options and taking informed steps can lead to a comprehensive risk management strategy.

How to Choose the Right Insurance Agent

Selecting the right insurance agent can significantly impact your experience with personal insurance. A knowledgeable and trustworthy agent can guide you through the myriad options available, ensuring you find the right coverage for your specific needs. Look for someone who specializes in personal insurance and is familiar with the local market, especially if you reside in areas prone to natural hazards.

An effective agent won’t only sell policies; they will also be a valuable resource for understanding the complexities of insurance products. Regular check-ins can provide updated information about your coverage and any new risks that could arise. The right insurance agent becomes a partner, helping you navigate insurance challenges and ensuring you are adequately protected over time.

Common Misconceptions About Personal Insurance

A common misconception about personal insurance is that once you purchase it, you can forget about it. Many people assume that their coverage will always meet their needs without any adjustments. However, life changes can demand adjustments in your insurance coverage, whether due to marriage, home purchases, or new driving habits. Regular reviews of your insurance policies can help adapt to these changes.

Another myth is that all insurance is extravagant or unnecessary. While some policies, like high-end umbrella insurance, can be considered extra, many forms of personal insurance, such as homeowners and auto insurance, are critical for protecting financial stability. Debunking these myths can lead to a better-informed public that understands the necessity of safeguarding their assets.

Mitigating Risks with Personal Insurance

Personal insurance plays a pivotal role in risk mitigation. By understanding the different risks associated with various aspects of life—such as property ownership, vehicle operation, and personal liability—individuals can take proactive steps to diminish potential financial losses. Insurance minimizes the impact of accidents, injuries, and other unexpected events that can derail personal finances.

In addition to standard insurance products, individuals can also invest in risk management strategies, such as installing home security systems or employing safe driving techniques, which can lower premium costs and enhance overall protection. Evaluating your risk landscape holistically ensures that you are adequately prepared for whatever life throws your way.

The Role of Customer Service in Personal Insurance

Customer service is a critical aspect of personal insurance that is often undervalued. The relationship you build with your insurance provider can significantly influence your experience, especially when it comes time to filing claims or adjusting your coverage. A great insurance agent will prioritize customer service, providing timely assistance and personalized support, crucial in stressful situations.

Good customer service includes clear communication about policy details, support during claim processes, and proactive guidance on adjusting coverage as life circumstances change. Being able to trust your insurance provider fosters a reliable partnership that allows individuals to navigate the complexities of personal insurance more confidently.

Frequently Asked Questions

What types of personal insurance are essential for homeowners in New Jersey?

In New Jersey, essential types of personal insurance for homeowners include homeowners insurance, which protects your home against various risks, and flood insurance, which is critical due to the state’s vulnerability to hurricanes and storm surges. Additionally, if you own rental properties, you should consider having rental property insurance to ensure comprehensive coverage.

How does auto insurance in New Jersey differ from other states?

Auto insurance in New Jersey is unique due to its mandatory coverage requirements and its high number of uninsured motorists. This makes it crucial for drivers to have sufficient personal auto insurance that covers not only accidents but also protects against damages caused by uninsured drivers.

Do I need flood insurance if I have homeowners insurance in New Jersey?

Yes, you need flood insurance even if you have homeowners insurance, as standard homeowners policies do not cover flood damage. Given New Jersey’s coastal location and the potential risks from hurricanes, purchasing a separate flood insurance policy is highly recommended to protect your property.

What is comprehensive insurance for personal assets?

Comprehensive insurance for personal assets refers to policies that cover a wide range of risks for various possessions, including your home, vehicle, and personal liabilities. This type of insurance may combine multiple coverage types into one plan, offering peace of mind and streamlined management of your personal insurance needs.

How can I find competitive rates for personal insurance in New Jersey?

To find competitive rates for personal insurance in New Jersey, it is advisable to consult a local insurance agent, like those at Anderson Insurance Agency. They can provide personalized assistance in navigating the various types of personal insurance, ensure you get the best rates, and help you understand the specific coverage you need.

Is there a personal insurance policy that covers all my needs?

Yes, there are comprehensive insurance policies available that can cover all your personal insurance needs, including homeowners, auto, and liability insurance. These bundled policies, offered by premier providers like Anderson Insurance Agency, can simplify management and often provide better rates than purchasing individual policies.

What are the benefits of having boat insurance alongside my homeowners insurance?

Having separate boat insurance, in addition to what is covered under your homeowners insurance, is crucial as it provides specialized coverage for potential damages and liabilities specific to boating. Homeowners insurance often only covers minor incidents, while a dedicated boat insurance policy addresses risks like accidents or damage due to storms.

| Type of Insurance | Importance | Key Considerations |

|---|---|---|

| Homeowners Insurance | Protects your home, especially in hurricane-prone areas. | Consider coverage for secondary homes and rental properties. |

| Auto Insurance | Covers expenses from accidents, including those with uninsured motorists. | Find a local agent for the best rates and suitable coverage. |

| Boat Insurance | Essential for protecting against boating accidents and damage. | Home insurance often offers limited boat coverage—consider a separate policy. |

| Flood Insurance | Required as it is not standard in homeowners policies and essential for coastal areas. | Different policies cover different risks; research is vital. |

| Personal Liability Insurance | Covers a wide range of risks beyond standard policies. | Consider umbrella insurance for extensive coverage. |

Summary

Personal insurance plays a crucial role in securing your financial future and peace of mind. Understanding the various types of personal insurance, such as homeowners, auto, and liability insurance is essential for anyone looking to protect their assets and loved ones. Investing the time to navigate through different policies and working with an experienced insurance agent can help ensure that you have the right coverage tailored to your needs. Don’t leave yourself underinsured; take the initiative to explore the options available and consider bundling your personal insurance for comprehensive protection.