Personal Cyber Insurance: Protect Against Evolving Threats

In today’s digital age, personal cyber insurance has emerged as a crucial safeguard against the rising tide of cybersecurity threats. With alarming statistics highlighting a surge in identity theft and elder fraud, particularly among those over 60, this insurance provides essential online fraud protection. As technology advances, so do the tactics of cybercriminals, with increasingly sophisticated schemes like deepfake scams targeting vulnerable populations. Personal cyber insurance not only covers losses from identity theft but also offers protection against a broad spectrum of cyber risks, ensuring peace of mind for policyholders. As our lives become more intertwined with technology, investing in personal cyber insurance is not just wise; it’s essential for protecting personal assets and information.

As the world becomes more reliant on digital platforms, individuals are facing a new array of risks that necessitate innovative protection solutions. Terms like digital asset protection or personal data insurance capture the essence of personal cyber insurance, which is designed to shield consumers from various cyber-related threats. With the increase in online fraud and deceptive practices, many are recognizing the need for comprehensive coverage that goes beyond traditional identity theft safeguards. This type of insurance not only addresses financial losses incurred through cyber scams but also offers support for recovering compromised devices. By understanding the importance of this coverage, individuals can better equip themselves to navigate the complexities of the digital landscape.

Understanding the Rise of Cyber Fraud Among the Elderly

The increase in cyber fraud targeting the elderly is alarming and reflects a growing trend that many stakeholders, including families and financial institutions, must take seriously. In recent years, the number of reported cyber fraud cases among individuals aged 60 and above has surged, with losses exceeding $3.4 billion in 2023 alone. This demographic is particularly vulnerable due to a combination of factors, including a lack of familiarity with technology, trust in traditional support systems, and the significant assets they possess, making them prime targets for cybercriminals. Common scams such as tech support fraud, romance scams, and investment scams have become more prevalent, exploiting the inherent trust that older adults often place in others, especially in digital interactions.

Moreover, the rise of sophisticated scams, including deepfake technology, has heightened the risks faced by older adults. Cybercriminals are not just using traditional phishing techniques; they are employing advanced tools that create realistic impersonations of trusted individuals. This evolution in scam tactics has made it even more challenging for older adults to discern legitimate communications from malicious ones, leading to devastating financial losses.

The statistics are sobering: the Internet Crime Complaint Center (IC3) reported that individuals over 60 accounted for 40% of all call center and tech support scam incidents, with losses amounting to approximately $770 million. These figures highlight a crucial need for better education and preventive measures tailored specifically for this age group. Financial institutions, tech companies, and community organizations must collaborate to develop resources that empower older adults to recognize and respond to cyber threats effectively. Awareness programs that focus on identifying red flags in communications and understanding the tools available for online fraud protection are essential in safeguarding this vulnerable population.

The Importance of Personal Cyber Insurance

Personal cyber insurance has emerged as a critical tool in the fight against the rising tide of cyber threats, particularly for high-risk demographics like the elderly. Unlike traditional identity theft protection plans, which focus primarily on recovering from identity theft incidents, personal cyber insurance offers a broader spectrum of coverage. This includes protection against cyber extortion, online fraud, and various social engineering scams that may not directly involve identity theft but can have equally devastating financial impacts. As cybercriminals evolve their tactics, having comprehensive coverage becomes essential for individuals to mitigate potential losses effectively.

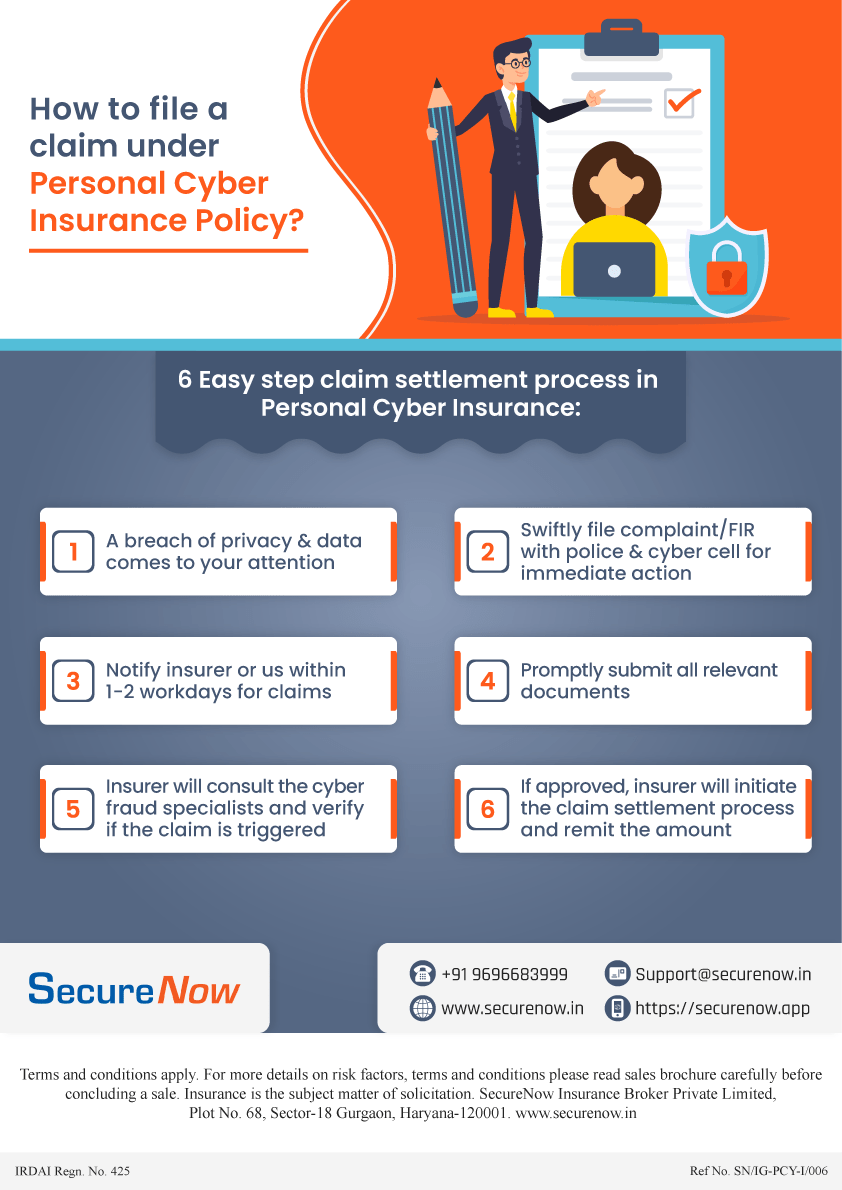

Moreover, personal cyber insurance not only provides financial reimbursement for direct losses but also offers assistance in managing the aftermath of a cyber incident. For instance, if a policyholder falls victim to a scam that results in a financial loss, the insurance can help cover the costs of forensic investigations or professional services needed to recover from the breach. This holistic approach to cyber risk management is crucial in today’s digital landscape, where threats are becoming more sophisticated and pervasive.

As we see the landscape of cyber threats evolve, the need for personal cyber insurance becomes increasingly apparent. This coverage can be a lifesaver, especially for the elderly, who may struggle to navigate the complexities of modern technology and online interactions. Cyber insurance is not just about financial protection; it also provides peace of mind, knowing that there is support available in the event of a cyber incident. Companies like Hartford Steam Boiler (HSB) have recognized this need and have tailored their policies to cover a wide range of cyber risks, ensuring that policyholders are not left to face these challenges alone. In an increasingly interconnected world, personal cyber insurance is an essential component of any comprehensive financial strategy.

The Evolution of Cybersecurity Threats

Cybersecurity threats have evolved dramatically over the past few years, driven by advancements in technology and the increasing sophistication of cybercriminals. The proliferation of smart devices and the Internet of Things (IoT) has opened new avenues for cyber attacks, making it imperative for individuals and organizations to stay informed about the latest threats. For instance, deepfake technology, which can create realistic but fabricated content, poses significant risks as it can be used to manipulate individuals into divulging sensitive information or transferring money under false pretenses. This shift in the threat landscape underscores the importance of not only having robust cybersecurity measures in place but also understanding the tools that cybercriminals are utilizing to exploit vulnerabilities.

Additionally, the rise of remote work has transformed how cyber threats are executed. Cybercriminals are increasingly targeting home networks and personal devices, which may lack the security protocols typically found in corporate environments. This shift has made individuals, especially the elderly, more vulnerable to online fraud and scams. Awareness and education about these evolving threats are crucial for effective prevention. Regular training and updates on best cybersecurity practices can empower individuals to protect themselves against these sophisticated attacks.

As the landscape of cyber threats continues to evolve, so too must our approaches to cybersecurity. Traditional methods of protection may no longer suffice against the new wave of cybercriminal tactics. Individuals must adopt a proactive stance, utilizing tools like personal cyber insurance and identity theft protection to shield themselves from potential losses. Furthermore, understanding the nature of these threats—be it phishing scams, deepfakes, or sophisticated social engineering techniques—will help individuals recognize when they are being targeted. It is essential that we foster a culture of cybersecurity awareness, where individuals are not only informed about the risks but are also equipped with the knowledge and resources needed to defend against them.

The Role of Identity Theft Protection in Cybersecurity

Identity theft protection plays a crucial role in the broader context of cybersecurity, serving as a frontline defense against one of the most prevalent forms of cybercrime. Given the staggering statistics of identity theft incidents, especially among vulnerable populations like the elderly, understanding how these protection plans work is essential. Identity theft protection services typically monitor personal information, alerting individuals to potential unauthorized use of their credentials. This monitoring can significantly reduce the risk of financial loss and identity compromise, providing individuals with a sense of security in an increasingly digital world.

However, identity theft protection is just one piece of the puzzle. While it focuses on protecting personal information from being stolen or misused, it does not cover the vast array of other cyber risks individuals may encounter. For instance, it may not provide financial reimbursement for losses incurred through cyber extortion or online scams that do not involve direct identity theft. Therefore, it is crucial for individuals to understand that while identity theft protection is important, it should be part of a comprehensive strategy that includes personal cyber insurance to cover a wider spectrum of cyber-related risks.

The interplay between identity theft protection and personal cyber insurance highlights the need for individuals to adopt a holistic approach to their cybersecurity strategies. A robust identity theft protection plan can act as a deterrent against unauthorized access to personal information, while personal cyber insurance can provide financial support in the event that an individual falls victim to a cyber scam. As cyber threats continue to evolve, it is imperative that consumers educate themselves about these options and consider integrating both types of protection into their overall risk management plans. By doing so, they can better safeguard their financial health and personal information against the myriad of cyber threats facing them today.

Navigating Online Fraud Protection Strategies

Navigating online fraud protection requires a multifaceted approach that combines education, awareness, and the use of technology. As cyber threats evolve, individuals must equip themselves with the knowledge to recognize potential scams and fraudulent activities. This includes understanding common tactics used by cybercriminals, such as phishing emails, fake websites, and social engineering techniques. Regular training sessions and workshops can empower individuals, particularly the elderly, to recognize these threats and respond appropriately. Furthermore, using advanced security measures like two-factor authentication and strong, unique passwords can provide an additional layer of protection against unauthorized access to personal accounts.

In addition to proactive education, leveraging online fraud protection services can significantly enhance individual security. Many banks and financial institutions now offer fraud detection services that monitor transactions for unusual activity, alerting customers to potential fraud in real time. By utilizing these services alongside personal cyber insurance, individuals can create a robust defense against online fraud, ensuring that they are covered financially and have the support needed to recover from any incidents that occur.

Moreover, staying informed about the latest trends in cyber fraud is essential for effective online protection. As fraud tactics become more sophisticated, consumers must remain vigilant and adaptable. Following reputable cybersecurity blogs, attending webinars, and participating in community discussions can help individuals stay ahead of emerging threats. Additionally, reporting any suspicious activity to the appropriate authorities can contribute to broader efforts to combat cybercrime. By fostering a community of awareness and proactive engagement, individuals can not only protect themselves but also contribute to a safer online environment for everyone.

The Impact of Deepfake Scams on Cybersecurity

Deepfake scams represent one of the most concerning advancements in cybercriminal tactics, leveraging artificial intelligence to create realistic and often convincing fake content. These scams can take various forms, including video and audio impersonations that can deceive individuals into believing they are interacting with a trusted person. The implications of deepfake technology for cybersecurity are profound, as it can be used to bypass traditional security measures and manipulate victims into divulging sensitive information or making financial transactions. As such, understanding and recognizing the signs of deepfake scams is crucial for everyone, particularly for high-risk populations like the elderly, who may be less familiar with such technology.

Education and awareness are vital in combating the threat posed by deepfakes. Individuals must be trained to critically evaluate the authenticity of the content they encounter online, particularly in communications that involve requests for sensitive information or financial transactions. Implementing strong verification procedures, such as multiple channels of communication, can help mitigate the risks associated with deepfake scams. Additionally, personal cyber insurance can provide a safety net for individuals who fall victim to these sophisticated scams, covering losses and offering assistance in recovery efforts.

Moreover, as deepfake technology continues to evolve and become more accessible, the risks associated with it will likely increase. Cybercriminals are constantly finding new ways to exploit technological advancements for their gain, making it essential for individuals and organizations to stay ahead of these trends. Collaboration among technology companies, law enforcement, and cybersecurity experts is crucial in developing effective strategies to combat deepfake scams. By fostering a comprehensive approach that includes education, technological solutions, and insurance coverage, we can better protect ourselves and our communities from the growing threat of deepfake scams.

The Future of Cybersecurity for Seniors

As the digital landscape continues to evolve, the future of cybersecurity for seniors is a pressing concern that requires immediate attention and action. With older adults projected to make up a significant portion of the population, it is essential to develop targeted strategies that address their unique vulnerabilities in the face of increasing cyber threats. This demographic often faces challenges such as limited technological proficiency and a higher likelihood of being targeted by fraudsters. Therefore, tailored educational programs that enhance digital literacy and raise awareness about emerging threats are crucial in empowering seniors to navigate the online world safely.

In addition to education, the integration of user-friendly technology designed with seniors in mind can significantly improve their cybersecurity posture. Tools that simplify security settings, provide clear alerts about potential threats, and offer easy-to-understand resources for reporting fraud can help mitigate risks. Furthermore, the importance of personal cyber insurance cannot be overstated; as seniors become more active online, having comprehensive coverage to protect against cyber-related losses becomes essential. Insurance companies must adapt their offerings to meet the needs of this growing demographic, ensuring they are equipped to handle the unique challenges posed by the evolving cyber landscape.

Looking ahead, the collaboration between technology providers, healthcare organizations, and financial institutions will be vital in creating a safer online environment for seniors. By sharing information about common threats and best practices, these entities can work together to develop preventative solutions that cater specifically to the needs of older adults. Additionally, advocacy for stronger regulatory measures to protect vulnerable populations from cyber threats will be essential in fostering a safer digital ecosystem. As we navigate the complexities of cybersecurity, it is imperative to prioritize the protection of seniors, ensuring they can engage confidently and securely in the digital age.

Collaborative Efforts in Cybersecurity Education

Collaborative efforts in cybersecurity education are essential to create a robust defense against the rising tide of cyber threats, particularly for vulnerable populations such as the elderly. Partnerships between schools, community organizations, cybersecurity firms, and government agencies can foster awareness and equip individuals with the necessary skills to navigate the complexities of the digital world. By developing tailored educational programs that focus on recognizing cyber threats, understanding online safety practices, and utilizing protective tools, we can empower communities to take proactive measures against cybercrime.

Moreover, leveraging technology to facilitate learning can enhance the effectiveness of these educational initiatives. Online courses, webinars, and workshops can reach a wider audience, providing valuable resources for individuals of all ages. Incorporating real-life examples of cyber threats, including identity theft and online fraud, can help participants understand the potential risks they face. Additionally, engaging with local law enforcement to provide insight into current scams and safety measures can further enrich these educational programs, fostering a culture of awareness and vigilance.

Beyond individual education, collaborative efforts can also extend to advocacy for stronger cybersecurity policies and regulations. By uniting stakeholders from various sectors, we can address the systemic issues that contribute to the vulnerability of certain populations, including the elderly. This may involve lobbying for improved cybersecurity standards in technology products, increased funding for cybersecurity education programs, and the establishment of support networks for victims of cybercrime. Through these collaborative efforts, we can create a safer digital environment where individuals can thrive without the fear of falling victim to cyber threats.

Frequently Asked Questions

What is personal cyber insurance and how does it protect against cybersecurity threats?

Personal cyber insurance (PCI) is a type of coverage designed to protect individuals from various cybersecurity threats, including identity theft, online fraud, and cyber extortion. It provides financial reimbursement for losses incurred from cyber incidents, helping policyholders manage the financial impact of scams and data breaches.

How does personal cyber insurance differ from identity theft protection?

While identity theft protection (ITP) focuses specifically on safeguarding against identity theft risks, personal cyber insurance covers a broader range of cyber-related losses. PCI includes coverage for online fraud, cyber extortion, and deceptive transfers, providing more comprehensive protection than ITP alone.

What types of scams does personal cyber insurance cover?

Personal cyber insurance can cover various scams such as call center scams, romance scams, deepfake scams, and investment fraud. It also addresses financial losses from cyber extortion and online fraud, ensuring that policyholders are financially supported in the event of a cyber incident.

Is personal cyber insurance beneficial for the elderly in protecting against online fraud?

Yes, personal cyber insurance is particularly beneficial for the elderly, who are increasingly targeted by online fraud and scams. Given the rising financial losses reported by individuals aged 60 and over, PCI provides essential coverage that helps mitigate the risks associated with cybersecurity threats targeting this demographic.

How can personal cyber insurance assist individuals who have been victims of cyber scams?

Personal cyber insurance assists victims of cyber scams by offering financial reimbursement for losses and covering costs associated with recovery efforts, such as hiring professionals to restore compromised devices or manage the fallout from scams. This support is crucial for individuals seeking to regain their security after a cyber incident.

What should I look for when choosing personal cyber insurance?

When choosing personal cyber insurance, look for comprehensive coverage that includes protection against identity theft, online fraud, cyber extortion, and deepfake scams. Additionally, consider policies that offer assistance services, financial reimbursement for recovery costs, and the ability to easily add it to existing homeowners or renters insurance.

How prevalent are cybersecurity threats affecting personal finances today?

Cybersecurity threats are increasingly prevalent, with millions of individuals reporting losses due to online fraud and scams. In 2023, losses reported by individuals aged 60 and over alone surpassed $3.4 billion, underscoring the urgent need for personal cyber insurance to help mitigate these financial risks.

Can personal cyber insurance cover losses from deepfake scams?

Yes, personal cyber insurance can cover losses resulting from deepfake scams, a growing concern as these sophisticated scams can trick individuals into revealing sensitive information or transferring money. This type of coverage is crucial for protecting against evolving cyber threats.

What are the financial implications of not having personal cyber insurance?

Without personal cyber insurance, individuals risk facing significant financial losses due to cyber incidents such as identity theft, online fraud, and cyber extortion. The rising costs associated with recovering from these incidents can be overwhelming, making insurance a vital safeguard against potential financial devastation.

How can I enhance my personal cybersecurity along with having insurance?

Enhancing personal cybersecurity involves adopting best practices such as using strong, unique passwords, enabling two-factor authentication, regularly updating software, and being cautious of phishing attempts. Combining these practices with personal cyber insurance creates a robust defense against cybersecurity threats.

| Key Points | Details |

|---|---|

| Increase in Fraud Targeting Older Adults | In 2023, individuals aged 60 and over reported losses exceeding $3.4 billion, an 11% increase from 2022. |

| Common Cyber Fraud Activities | The most reported scams include Call Center/Tech Support Scams, Confidence/Romance Scams, Cryptocurrency Scams, and Investment Scams. |

| Impact of Digital Living | The rise of digital technology increases vulnerabilities, with older adults particularly targeted by scams like phishing. |

| Deepfake Technology Risks | Deepfakes can deceive individuals and pose serious risks for personal security, including identity theft and financial loss. |

| Managing Personal Cyber Risk | Personal Cyber Insurance (PCI) offers broader protection against losses not covered by Identity Theft Protection (ITP), including cyber extortion and online fraud. |

| Market Trends and Availability | Insurance carriers are adapting coverage options for personal cyber insurance to meet the evolving landscape of cyber threats. |

| Importance of Personal Cyber Insurance | PCI provides financial reimbursement for cyber scams and related risks, helping individuals safeguard against financial repercussions of cyber incidents. |

Summary

Personal cyber insurance is becoming increasingly vital in today’s digital world, especially given the alarming rise in cyber fraud targeting older adults. As technology continues to advance and integrate into our daily lives, the risks associated with cyber crimes also escalate. Personal cyber insurance not only offers coverage against identity theft but also protects individuals against a broader range of cyber threats, including online fraud and cyber extortion. With significant financial losses reported, having personal cyber insurance can provide peace of mind and essential support for individuals navigating the complexities of the digital landscape.