Parametric Insurance: A New Approach to Flood Risk

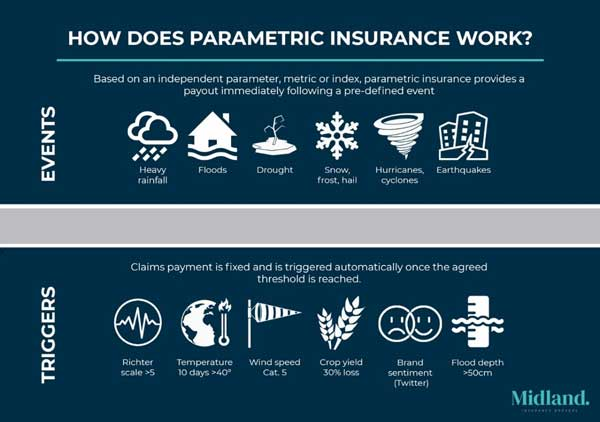

Parametric insurance is emerging as a groundbreaking solution for communities grappling with the increasing frequency of natural disasters, particularly in the realm of flood insurance. Unlike traditional indemnity policies that require damage assessment post-event, parametric insurance offers rapid payouts based on predetermined conditions, such as rainfall levels or wind speeds. This innovative approach not only expedites disaster recovery but also addresses significant protection gaps that many residents face when climate risks strike. As the United States continues to face mounting challenges from climate-related disasters, the integration of parametric structures into insurance regulations becomes essential for effective risk mitigation. By streamlining the claims process, parametric insurance is poised to transform how communities prepare for, respond to, and recover from catastrophic events.

Also referred to as index-based insurance, parametric insurance represents a shift in the traditional insurance paradigm, providing unique solutions for managing climate-related risks. It functions by delivering automatic payouts when specific environmental thresholds are met, thus enhancing the efficiency of disaster recovery efforts. This form of coverage is increasingly recognized as vital for communities vulnerable to severe weather events, often filling the gaps left by conventional flood insurance. As businesses and individuals alike seek innovative ways to mitigate the impacts of climate change, the appeal of parametric solutions continues to grow. With a focus on resilience and rapid response, this approach not only addresses immediate financial needs but also fosters long-term community recovery in the face of escalating climate challenges.

The Rise of Parametric Insurance in Disaster Recovery

As climate-related disasters continue to escalate, the demand for innovative insurance solutions has surged. Parametric insurance is emerging as a key player in disaster recovery, particularly in flood-prone areas. Unlike traditional indemnity insurance, which requires extensive damage assessments and can delay payouts, parametric insurance offers rapid compensation based on predetermined triggers. For instance, if a storm’s wind speed exceeds a certain threshold, policyholders receive a payment without waiting for an adjuster to evaluate the damage, thus enabling quicker recovery for affected communities.

This shift towards parametric insurance reflects a broader trend in the insurance industry, where companies are increasingly recognizing the limitations of traditional models. With the global parametric insurance market valued at $18 billion in 2023, insurers like FloodFlash and Ric are innovating to meet the needs of vulnerable communities. These companies are expanding their offerings, providing coverage that goes beyond the limits of conventional flood insurance, and helping to fill crucial protection gaps that many residents encounter during disasters.

Flood Insurance: Bridging the Protection Gap

The recent focus on flood insurance, particularly in light of severe storms and flooding, underscores the urgent need to bridge the existing protection gap. Many residents affected by disasters often lack adequate flood coverage, which can leave them reliant on federal relief funds for recovery. This gap highlights the importance of initiatives like the Mississippi River Cities and Towns Initiative’s pilot program, which utilizes parametric insurance to provide timely financial support to those impacted by flooding. By streamlining the claims process, parametric insurance can help communities bounce back more quickly.

Moreover, as climate risk continues to grow, the importance of comprehensive flood insurance cannot be overstated. The implementation of parametric insurance programs in cities like New York and small towns like Isleton, California, demonstrates a proactive approach to risk mitigation. These programs not only enhance resilience for low- and moderate-income neighborhoods but also serve as a model for other regions grappling with similar challenges. By increasing awareness and access to flood insurance options, communities can better prepare for the financial impacts of future disasters.

Navigating Insurance Regulations for Parametric Solutions

As parametric insurance gains popularity, navigating the complex landscape of insurance regulations becomes increasingly critical. Many jurisdictions are still adapting their legal frameworks to accommodate these innovative products, which can create uncertainty for insurers and policyholders alike. For example, the absence of clear guidelines on how parametric payouts should be structured can lead to confusion regarding the coverage provided. Recent legislative advancements in states like New York and Vermont are promising steps toward clarifying the role of parametric insurance within the broader insurance market.

However, challenges remain as regulators work to create a balanced approach that allows for the flexibility of parametric contracts while ensuring consumer protection. The backlash following the non-payout of the $150 million parametric catastrophe bond after Hurricane Beryl exemplifies the need for clear thresholds and definitions in parametric insurance policies. As the industry continues to evolve, collaboration between insurers, regulators, and community stakeholders will be essential in fostering an environment where parametric solutions can thrive alongside traditional indemnity coverage.

Climate Risk and the Future of Insurance

The increasing severity of climate risk is reshaping the insurance landscape, necessitating new strategies to address the challenges posed by natural disasters. Insurers are now tasked with developing products that can effectively respond to the unpredictable nature of climate events. Parametric insurance has emerged as a viable solution, providing rapid payouts based on measurable criteria rather than actual losses. This shift not only benefits policyholders but also allows insurers to manage their risk exposure more effectively, creating a more sustainable insurance model in the face of climate change.

As the insurance industry adapts to these new realities, it is crucial for companies to incorporate climate risk assessments into their underwriting processes. Enhanced data analytics and modeling can help insurers better understand potential exposures and tailor parametric policies accordingly. By prioritizing climate risk in their operations, insurers can position themselves as leaders in the market, offering innovative solutions that meet the evolving needs of consumers while contributing to broader efforts in risk mitigation and disaster preparedness.

Innovative Solutions for Vulnerable Communities

Parametric insurance is proving to be a game-changer for vulnerable communities that have historically struggled to secure adequate coverage against natural disasters. Programs like the MRCTI’s flood insurance pilot highlight how targeted initiatives can leverage parametric structures to provide immediate financial relief to those most in need. By focusing on specific communities and their unique challenges, these programs are not only enhancing resilience but also empowering residents to take an active role in their disaster recovery efforts.

In addition to addressing the immediate needs of flood-prone areas, these innovative solutions can also serve as a catalyst for broader community engagement. By educating residents about the benefits of parametric insurance and encouraging them to explore coverage options, stakeholders can foster a culture of preparedness. As more communities adopt these forward-thinking insurance models, the potential for reducing the long-term impacts of climate-related disasters becomes increasingly attainable.

The Intersection of Technology and Insurance

The role of technology in the evolution of parametric insurance cannot be overlooked. Advances in data analytics, modeling, and digital platforms are enabling insurers to design more precise and effective parametric products. By harnessing real-time weather data and predictive analytics, insurers can set accurate parameters for payouts, ensuring that coverage is both relevant and responsive to the changing climate landscape. This technological integration not only streamlines the underwriting process but also enhances the overall customer experience.

Moreover, technology facilitates greater access to parametric insurance products, allowing insurers to reach underserved markets that may have previously been overlooked. Startups like Ric are leveraging technology to offer micro-policies that cater to individuals and families with limited financial resources. By integrating insurance offerings into employee benefits programs, these innovative approaches are broadening the reach of parametric insurance, making it more accessible to those who need it most.

Community Resilience and Risk Mitigation Strategies

The importance of community resilience and effective risk mitigation strategies cannot be overstated in the context of climate change and natural disasters. Parametric insurance plays a crucial role in enhancing community resilience by providing timely financial support that enables rapid recovery. However, it must be part of a broader strategy that includes infrastructure improvements, public awareness campaigns, and collaborative planning efforts among stakeholders. By adopting a holistic approach to disaster preparedness, communities can better equip themselves to face the challenges posed by climate risks.

Incorporating risk mitigation strategies into community planning can significantly reduce vulnerability to future disasters. This includes investing in infrastructure that can withstand extreme weather events, as well as implementing policies that promote sustainable land use and development. By fostering a culture of resilience, communities can not only protect their residents from the immediate impacts of disasters but also build a foundation for long-term recovery and sustainability.

Consumer Awareness and Education in Insurance

Consumer awareness and education are vital components in the successful adoption of parametric insurance products. Many residents remain unaware of the benefits and functionalities of these innovative solutions, which can hinder their ability to secure adequate coverage against climate risks. Insurance providers and community organizations must prioritize educational initiatives that inform consumers about the advantages of parametric insurance, including its speed of payout and reduced administrative burden compared to traditional policies.

By fostering a better understanding of insurance options, stakeholders can empower individuals and communities to make informed decisions about their coverage needs. Workshops, informational campaigns, and accessible online resources can play a significant role in raising awareness and encouraging proactive engagement with insurance products. Ultimately, an informed consumer base is essential for driving the growth of parametric insurance and ensuring that more residents are adequately protected against the impacts of natural disasters.

The Future of Parametric Insurance: Challenges and Opportunities

As the parametric insurance market continues to develop, several challenges and opportunities lie ahead. On one hand, the growing recognition of the effectiveness of parametric models presents a unique opportunity for insurers to expand their offerings and reach new markets. However, the potential for regulatory hurdles, coupled with the need for consumer education, poses significant challenges that must be addressed to ensure the long-term success of parametric products.

Additionally, as climate change continues to exacerbate natural disasters, the urgency for innovative insurance solutions will only increase. Insurers must navigate the balance between profitability and social responsibility, ensuring that their products remain accessible to those who need them most. By collaborating across the industry—between insurers, regulators, and community stakeholders—there is a significant opportunity to refine parametric insurance models, making them not only effective but also equitable in addressing the risks posed by our changing climate.

Frequently Asked Questions

What is parametric insurance and how does it differ from traditional flood insurance?

Parametric insurance is a type of coverage that pays out predetermined amounts based on specific triggers, such as rainfall levels or wind speeds, rather than assessing individual damages like traditional flood insurance. This method allows for quicker payouts and reduces administrative costs, making it an attractive option for disaster recovery, especially in the context of increasing climate risks.

How can parametric insurance aid in disaster recovery for flood-prone areas?

Parametric insurance can significantly enhance disaster recovery efforts in flood-prone areas by providing rapid payouts once specific weather conditions are met. This quick access to funds can help affected communities rebuild and recover more efficiently, reducing reliance on slower federal relief processes, especially in high-risk zones where traditional flood insurance coverage may be inadequate.

What are the advantages of using parametric insurance for climate risk management?

The advantages of parametric insurance for climate risk management include faster claim payments, lower administrative costs, and the ability to cover losses that traditional indemnity insurance may not address effectively. As climate risks become more severe and unpredictable, parametric solutions provide a flexible and responsive insurance option for both individuals and communities.

Are there any regulatory challenges associated with parametric insurance?

Yes, regulatory challenges exist for parametric insurance due to the lack of specific insurance laws governing such products in many jurisdictions. As parametric insurance gains popularity, states are beginning to adopt regulations to clarify coverage terms and ensure transparency, but ambiguity still remains around payout criteria and compliance with traditional insurance frameworks.

How is the market for parametric flood insurance evolving in the United States?

The market for parametric flood insurance in the United States is rapidly evolving, with an increasing number of insurers offering innovative products tailored to meet the needs of flood-prone communities. Partnerships between initiatives like the Mississippi River Cities and Towns Initiative and firms like Munich Re are paving the way for more accessible parametric solutions, reflecting a growing recognition of their importance in managing climate risks.

Can parametric insurance replace traditional flood insurance?

While parametric insurance offers unique benefits, it is not intended to replace traditional flood insurance. Instead, it can complement existing policies, providing additional coverage for specific climate risks while traditional indemnity insurance addresses comprehensive property damage. Understanding how to effectively combine both types of insurance is crucial for optimal risk management.

What impact does parametric insurance have on risk mitigation efforts?

Parametric insurance enhances risk mitigation efforts by providing timely financial support that empowers communities to implement preventive measures and rebuild resilience. By offering quick payouts after triggering events, it encourages proactive investments in disaster preparedness and infrastructure improvements, ultimately reducing long-term vulnerability to climate risks.

What role do startups play in expanding access to parametric insurance?

Startups are playing a pivotal role in expanding access to parametric insurance by introducing innovative products and utilizing technology to reach underserved markets. Companies like Ric and FloodFlash are broadening the scope of parametric coverage, making it more accessible and affordable, particularly for low-income communities and those previously excluded from traditional insurance markets.

How do community initiatives utilize parametric insurance for flood protection?

Community initiatives are utilizing parametric insurance as a strategic tool for flood protection by implementing pilot programs that provide immediate financial assistance based on specific weather triggers. These initiatives aim to fill coverage gaps in vulnerable neighborhoods, enhance resilience, and ensure that communities are better prepared for the impacts of climate change.

What should consumers know about parametric insurance before purchasing?

Consumers should understand that parametric insurance operates differently than traditional forms of coverage. It is essential to review the specific triggers, payout structures, and limitations of parametric policies. Additionally, consumers should consider how these policies fit into their overall insurance strategy, especially in conjunction with traditional flood insurance for comprehensive protection.

| Key Point | Details |

|---|---|

| Natural Disaster Impact | In 2022, the U.S. faced $27 billion in damages due to natural disasters, primarily from storms and flooding. |

| Protection Gap | Many affected residents lacked flood insurance and relied on federal aid, indicating a significant protection gap. |

| Parametric Insurance Pilot Program | MRCTI, in collaboration with Munich Re, launched a parametric insurance pilot to aid flood recovery. |

| How Parametric Insurance Works | Parametric insurance pays out based on predefined conditions (like rainfall levels) rather than damage assessments. |

| Efficiency in Payouts | Parametric insurance allows for rapid payouts, reducing administrative burdens, as seen after Hurricane Milton. |

| Coastal Programs | New York City’s parametric flood program was established post-Superstorm Sandy to support vulnerable communities. |

| Emerging Market | The global parametric insurance market reached $18 billion in 2023, indicating rising interest and offerings. |

| Regulatory Developments | Only a few states have parametric insurance laws, but movement towards regulation is evident. |

| Future of Parametric Insurance | Parametric insurance, alongside traditional methods, is essential for addressing climate-related risks. |

Summary

Parametric insurance is emerging as a crucial tool in disaster recovery, especially as communities face increasing risks from climate change. As evidenced by recent pilot programs and regulatory advancements, the adoption of parametric insurance is gaining momentum across the United States. This innovative insurance model not only provides timely financial support to affected areas but also addresses significant protection gaps left by traditional insurance methods. As more communities recognize the benefits of parametric insurance, its role in enhancing resilience against natural disasters will continue to grow, ultimately shaping the future of risk management.