Natural Disaster Risk Mitigation: Insights from Experts

Natural disaster risk mitigation is a crucial aspect of modern society, especially as we face the increasing frequency and severity of events like severe convective storms and hurricanes. With climate change impacting weather patterns, understanding and preparing for these disasters has never been more essential. For instance, accurate hailstorm data collection is vital for developing effective insurance industry strategies that can help communities recover faster and more efficiently. As experts predict an active hurricane forecast for future seasons, leveraging innovative data-driven approaches will play a key role in safeguarding lives and property. By focusing on risk mitigation, we can build resilience against the devastating effects of natural disasters.

The proactive management of risks associated with natural calamities is fundamental to protecting our communities and infrastructure. This involves developing comprehensive strategies to foresee and respond to threats like thunderstorms, hurricanes, and other extreme weather phenomena. As we delve into the implications of shifting climate dynamics, it becomes clear that a robust framework for disaster preparedness is essential. By utilizing advanced data analytics and collaborative research efforts, stakeholders—including the insurance sector—can enhance their response to unpredictable weather events. Ultimately, prioritizing disaster readiness not only saves lives but also mitigates economic losses, paving the way for a safer future.

Understanding Natural Disaster Risk Mitigation Strategies

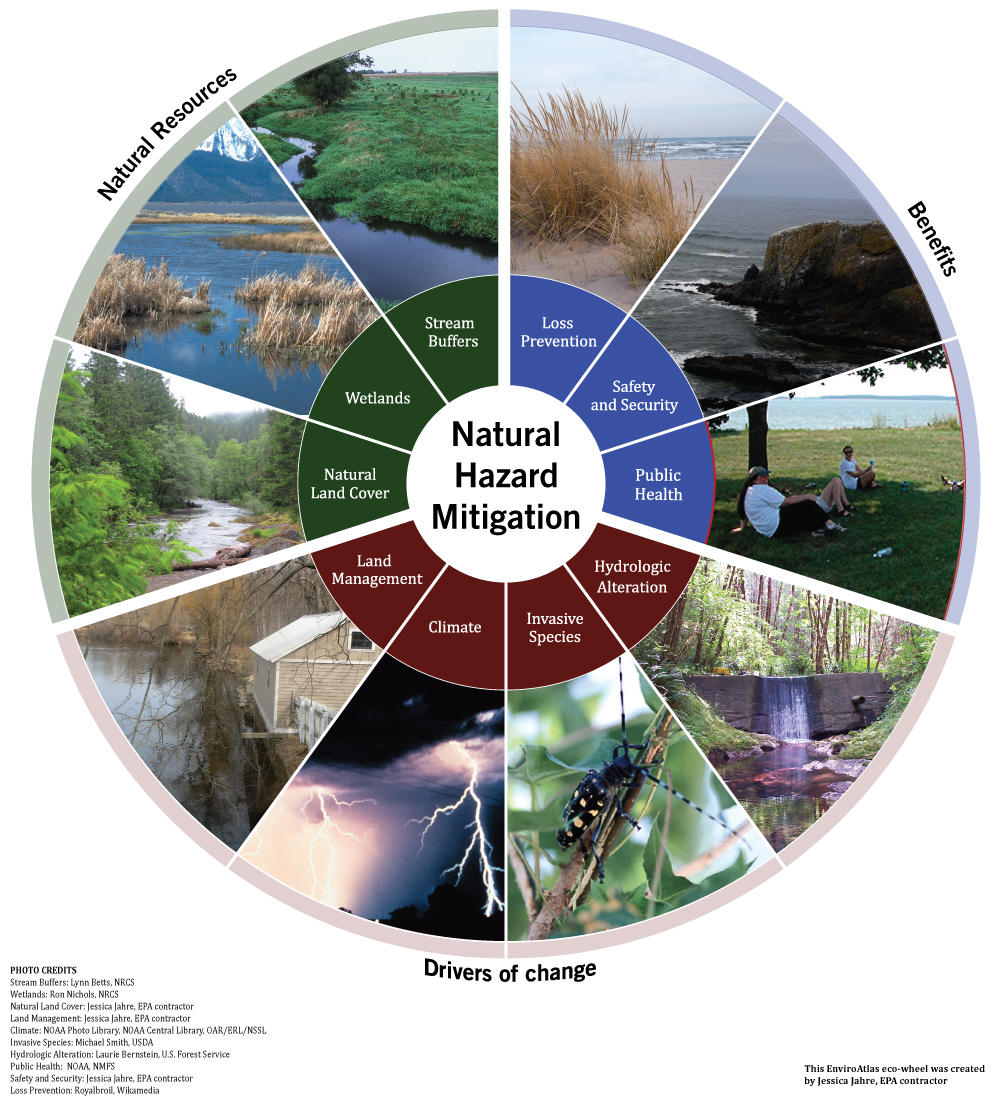

Natural disaster risk mitigation involves a range of strategies designed to minimize the impact of severe weather events on communities and ecosystems. As climate change intensifies the frequency and severity of natural disasters, innovative approaches are becoming increasingly vital. These strategies include improving infrastructure resilience, implementing early warning systems, and enhancing community preparedness through education and resources. By adopting these measures, societies can significantly reduce the economic and human toll that disasters, such as hurricanes and severe convective storms, can inflict.

Moreover, integrating advanced data collection and analysis plays a crucial role in effective risk mitigation. As highlighted by the recent Triple-I webinar, initiatives like the In-situ Collaborative Experiment for the Collection of Hail in the Plains (ICECHIP) aim to gather critical hailstorm data that can inform future forecasting models. This research not only helps in understanding the dynamics of severe weather events but also aids insurance companies in developing more effective strategies to manage risk and ensure financial stability during catastrophic events.

The Impact of Severe Convective Storms on Insurance Losses

Severe convective storms (SCS) are among the leading causes of insured losses globally, accounting for a staggering 70% of such losses in the first half of 2024 alone. The growing severity of these storms, including tornadoes and hailstorms, has led to unprecedented financial impacts, with U.S. insured losses exceeding $50 billion in 2023. This trend highlights the urgent need for better data collection and predictive modeling to inform the insurance industry about potential risks and to guide policy adjustments accordingly.

As meteorological experts like Phil Klotzbach have indicated, the patterns of severe convective storms are becoming increasingly unpredictable due to climate change. This shift necessitates that the insurance industry not only recalibrates its risk models but also invests in technology and research that can enhance the accuracy of their forecasts. With initiatives like the proposed Center for Interdisciplinary Research on Convective Storms (CIRCS), the collaboration between academia and the insurance sector aims to develop comprehensive strategies that can mitigate losses and improve overall resilience.

Innovative Data Collection for Improved Weather Forecasting

The role of data collection in improving weather forecasting cannot be overstated, especially in the context of severe weather events. Recent advancements, such as the ICECHIP program, aim to enrich our understanding of hailstorm dynamics by sending teams of scientists into affected areas for firsthand data collection. This initiative is crucial, as it seeks to fill long-standing gaps in our knowledge base regarding hailstorms, which are often overlooked in favor of larger, more destructive disasters like hurricanes.

Furthermore, the insurance industry is experiencing a ‘data arms race’ as companies strive to harness publicly available information for risk assessment and forecasting. By analyzing climate data, insurance carriers can develop more accurate models that predict the likelihood of severe weather events, thereby enhancing their underwriting processes and claims management. This data-driven approach not only aids in minimizing financial losses but also contributes to developing more resilient communities through better preparedness and response strategies.

Climate Change and Its Effects on Weather Patterns

Climate change has a profound impact on weather patterns, leading to increased severity and unpredictability of natural disasters. As highlighted by the panel discussion during the Triple-I webinar, the 2024 Atlantic hurricane season exemplified this phenomenon, showcasing an unusual pattern of activity that included both intense storms and periods of quiet. This inconsistency poses significant challenges for meteorologists and the insurance industry, requiring adaptive strategies to address the evolving landscape of climate-related risks.

Moreover, the correlation between climate change and severe convective storms cannot be ignored. As the frequency of these storms rises, so do the associated costs, with insured losses from such events reaching record highs. Understanding this relationship is critical for developing effective risk mitigation strategies that not only address immediate threats but also consider long-term climate trends. This requires a collaborative effort among scientists, policymakers, and the insurance industry to foster resilience and prepare communities for future challenges.

The Role of Insurance in Risk Mitigation

Insurance plays a pivotal role in natural disaster risk mitigation by providing financial protection to individuals and businesses affected by severe weather events. The industry is increasingly recognizing the need for innovative strategies that go beyond traditional coverage, focusing on proactive measures to reduce the impact of disasters. This includes developing policies that incentivize resilience-building activities, such as retrofitting buildings to withstand severe convective storms and offering discounts for properties with enhanced safety features.

Additionally, the insurance sector is leveraging technology to improve its response to natural disasters. By utilizing open-source intelligence (OSINT) and advanced data analytics, insurers can better assess risks and make informed decisions regarding coverage and premium rates. This shift towards a more data-driven approach not only enhances the accuracy of risk assessments but also fosters a culture of preparedness within communities, ultimately reducing the overall economic burden of natural disasters.

Enhancing Community Preparedness for Severe Weather Events

Community preparedness is essential in mitigating the impacts of severe weather events. Educational programs and resource distribution can empower individuals and local organizations to take proactive steps in safeguarding their homes and livelihoods. Initiatives that focus on creating emergency response plans and conducting drills can dramatically improve a community’s ability to respond effectively to severe convective storms and hurricanes.

Moreover, collaboration between local governments, NGOs, and the insurance industry can facilitate the development of comprehensive disaster response strategies. By sharing resources and information, these partnerships can enhance community resilience and ensure that residents are equipped with the knowledge and tools necessary to weather severe storms. Engaging community members in the planning process also fosters a sense of ownership and responsibility, which is crucial for effective disaster management.

The Importance of Multidisciplinary Research in Weather Forecasting

Multidisciplinary research is vital in advancing our understanding of weather phenomena and their impacts. Collaborations between atmospheric scientists, social scientists, and industry leaders can lead to innovative solutions that address the complexities of severe weather forecasting and risk mitigation. The proposed Center for Interdisciplinary Research on Convective Storms (CIRCS) exemplifies this approach, aiming to bring together diverse expertise to tackle the multifaceted challenges posed by severe convective storms.

The integration of various disciplines allows for a more holistic understanding of how severe weather events affect communities and economies. By combining meteorological data with social science research, we can better assess the vulnerabilities of different populations and develop targeted strategies that enhance resilience. This collaborative framework not only improves weather forecasting accuracy but also ensures that the insurance industry can adapt its strategies to meet the evolving needs of a changing climate.

Utilizing Technology for Effective Risk Management

Technology is reshaping the landscape of risk management, particularly in the insurance industry. As highlighted by the discussions at the Triple-I webinar, the use of data analytics and artificial intelligence is becoming increasingly important for understanding and predicting severe weather events. By harnessing large datasets, insurers can refine their models to better anticipate the impacts of storms and adjust their policies accordingly.

Moreover, technology enables real-time monitoring of weather patterns, providing critical information for both insurers and communities. This capability allows for timely alerts and proactive measures that can significantly reduce the damage caused by severe convective storms and hurricanes. By investing in technology-driven solutions, the insurance industry can not only enhance its operational efficiency but also contribute to broader efforts in climate resilience and disaster preparedness.

Future Directions in Natural Disaster Research and Insurance Strategies

As the frequency and severity of natural disasters continue to escalate, future research in this field must focus on developing adaptive strategies that address the challenges posed by climate change. This includes exploring new methodologies for data collection and analysis, as well as fostering collaborations between researchers, insurers, and policymakers. By taking a proactive approach to understanding the implications of severe weather events, stakeholders can better prepare for the future.

Furthermore, the insurance industry must evolve its strategies to align with the changing climate landscape. This means not only improving risk assessment models but also creating policies that encourage resilience in communities. By investing in ongoing research and data-driven solutions, the industry can enhance its capacity to mitigate risks associated with severe convective storms and other natural disasters, ultimately leading to a more sustainable and resilient future.

Frequently Asked Questions

How does natural disaster risk mitigation relate to severe convective storms?

Natural disaster risk mitigation is crucial for addressing the increasing frequency and severity of severe convective storms, such as tornadoes and hailstorms. By implementing effective risk mitigation strategies, communities can enhance their preparedness, response, and recovery efforts, ultimately reducing insured losses and protecting lives.

What role does hurricane forecasting play in natural disaster risk mitigation?

Hurricane forecasting is a vital component of natural disaster risk mitigation, as accurate predictions allow for timely warnings and preparedness measures. Improved forecasting techniques help communities understand potential threats and implement strategies to minimize damage and enhance resilience against hurricanes.

How can hailstorm data collection improve natural disaster risk mitigation strategies?

Hailstorm data collection enhances natural disaster risk mitigation by providing critical information that can improve forecasting and understanding of hail events. Initiatives like the ICECHIP project aim to gather detailed data on hailstorms, which can lead to better predictive models and ultimately reduce the risk and impact of hail damage.

What is the impact of climate change on natural disaster risk mitigation efforts?

Climate change significantly impacts natural disaster risk mitigation by altering weather patterns, increasing the frequency and intensity of extreme events. Understanding these changes is crucial for developing effective mitigation strategies that can adapt to new risks and enhance community resilience against disasters.

How are insurance industry strategies evolving in response to natural disaster risk mitigation needs?

Insurance industry strategies are evolving to focus more on data-driven solutions for natural disaster risk mitigation. By utilizing open-source intelligence and improving data collection methods, the insurance industry aims to better assess risks and enhance their underwriting processes, ultimately reducing losses from disasters.

| Key Points | Details |

|---|---|

| Webinar Series Launch | Triple-I launched a new webinar featuring its Non-Resident Scholars discussing natural disaster risks. |

| Panelists | Included experts like Phil Klotzbach, Victor Gensini, Seth Rachlin, and Colby Fisher. |

| Hurricane Season Overview | 2024 Atlantic hurricane season described as the ‘wild and crazy’ season with notable storms like Helene and Milton. |

| Severe Convective Storms (SCS) | SCS accounted for 70% of insured losses globally in H1 2024, with over $50 billion in losses in 2023. |

| Hailstorm Research Initiatives | ICECHIP is set to collect detailed data on hailstorms to improve forecasting and minimize damage. |

| Data-Driven Solutions | Rachlin and Fisher highlighted the need for better data utilization in the insurance industry to enhance risk mitigation strategies. |

Summary

Natural disaster risk mitigation is crucial in today’s rapidly changing climate. Recent discussions highlighted the escalating severity of natural disasters and the innovative approaches being taken to address these challenges. With experts emphasizing the importance of data collection and analysis, the insurance industry must adapt and improve its strategies to effectively mitigate risks associated with severe weather events. As we invest in better data and research, we can enhance resilience and reduce the impact of future natural disasters.

Auto insurance in Chicago could be expensive, but there are

actually rebates as well as options that may aid decrease your premium.

Bring in certain you discover all your choices for auto insurance coverage in Chicago to get the absolute

most value for your loan.

This is a really good read for me, Must admit that you are one of the best

bloggers I ever saw.Thanks for posting this informative article.

Those on a pay-as-you-go mobile phone contract in the UK can also use

the pay-by-phone bill option.

This web site definitely has all of the info I wanted about this subject and didn’t know who to ask.