Multiple Life Insurance Policies: Tailoring Your Coverage

Multiple life insurance policies can be an effective way to enhance your financial security, catering specifically to the diverse needs of individuals and families alike. While many may opt for a single policy, exploring the benefits of multiple life insurance can provide tailored coverage that addresses various life stages and financial responsibilities. Whether you’re looking for life insurance for families, or considering how to get life insurance that fits your needs, multiple policies open doors to greater flexibility and comprehensive protection. From affordable life insurance plans to strategic estate planning, understanding how these policies work together can help you create a robust safety net for your loved ones. Dive into the world of life insurance strategies and discover how having multiple policies can bolster your financial planning efforts.

When it comes to securing your family’s future, utilizing several insurance contracts can prove advantageous. This approach allows individuals to customize their protection by combining different types of policies, such as term and whole life, thereby ensuring a greater range of coverage tailored to their unique circumstances. The notion of leveraging multiple insurance agreements not only increases financial security but also caters to evolving life situations—like marriage or new parenthood. By understanding the nuances of this diversified insurance strategy, you can better prepare for unexpected events and optimize your family’s financial well-being. Ultimately, exploring various coverage options can lead to effective planning and peace of mind.

The Importance of Multiple Life Insurance Policies

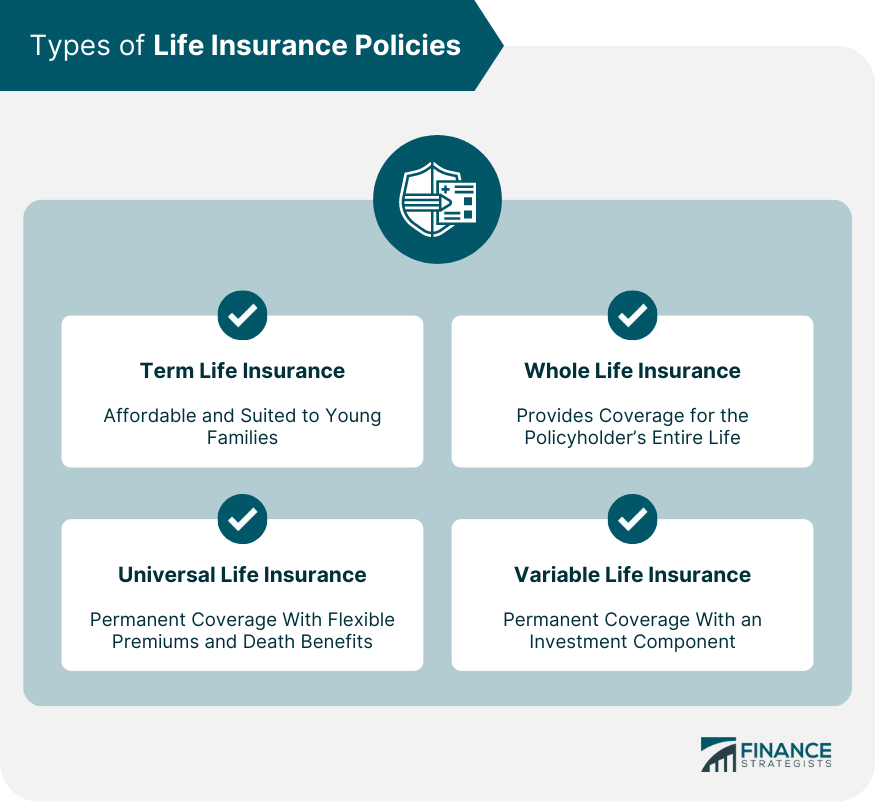

Having multiple life insurance policies can significantly enhance your financial security and flexibility. One of the primary benefits is coverage flexibility; different types of insurance serve unique needs. For instance, a term life policy can be an excellent choice for short-term obligations like paying off a mortgage, while a permanent policy can provide lifelong coverage and build cash value. This diversification allows individuals to strategically manage their risk and tailor their insurance portfolio to fit their evolving financial landscape.

Moreover, multiple policies enable individuals to address various life stages and responsibilities. As families grow or financial situations change, having access to additional coverage can provide peace of mind. For example, new parents may find that their insurance needs increase, and having a supplemental policy can ensure that their child’s future is protected. This adaptability highlights the crucial role that multiple life insurance policies can play in an effective financial planning strategy.

Benefits of Multiple Life Insurance Policies

One of the most significant benefits of holding multiple life insurance policies is the ability to diversify risk. Different insurers may offer varying terms, premiums, and conditions, and relying on a single policy can expose individuals to financial risks. In contrast, multiple policies can serve as a safety net against unforeseen circumstances, such as a sudden change in an insurer’s financial stability. This strategy ensures that you maintain coverage even if one policy becomes nonviable due to market fluctuations.

Additionally, having multiple policies can facilitate more comprehensive estate planning strategies. For instance, policyholders can tailor their insurance to cover estate taxes and provide liquidity for settling estate expenses. This strategic approach minimizes tax liabilities and ensures that heirs receive their intended inheritance without significant delays. The benefits of multiple life insurance policies extend beyond mere coverage, allowing individuals to create a robust financial safety net for their loved ones.

How to Get Life Insurance: Exploring Your Options

Getting life insurance involves a few essential steps. The first is to assess your personal and financial needs to determine the right type of coverage. Whether you need term or permanent life insurance depends on your financial obligations and goals. Once you have a clear understanding of your needs, researching different policies and comparing quotes from various providers will help you find the most affordable life insurance plans that suit your requirements.

It’s also crucial to consider the underwriting requirements when applying for multiple policies. Each insurer will evaluate your health, lifestyle, and potential risks, which can affect your premiums significantly. Understanding these processes can help you navigate the application more efficiently and ensure you secure the best rates across all policies.

Affordable Life Insurance Plans for Families

Finding affordable life insurance plans is a priority for many families. Policies should provide sufficient coverage without straining the family budget. Options such as term life insurance can be a cost-effective solution, offering substantial coverage at lower premiums for a specified period. Families can also explore group insurance plans through employers, which often provide lower rates and easier access to coverage.

Moreover, when considering multiple life insurance policies, families can strategically combine different types of products to balance affordability and coverage. For example, a family might opt for a term policy for immediate needs and a whole life policy for long-term financial security. This approach allows families to protect their loved ones while ensuring that their financial commitments remain manageable.

Life Insurance Strategies for Long-Term Security

Implementing effective life insurance strategies is essential for long-term financial security. Individuals should evaluate their current and future financial obligations, including debts, education costs, and retirement planning. This comprehensive assessment allows for the creation of a tailored life insurance portfolio, possibly including multiple policies to address various life stages and financial goals.

Incorporating multiple life insurance policies can also aid in managing tax implications and ensuring that beneficiaries receive the intended benefits. By strategically planning the ownership and beneficiary designations of these policies, individuals can minimize tax burdens and facilitate a smoother claims process for their heirs. This proactive approach can significantly impact the financial legacy left behind.

Navigating the Complexities of Life Insurance

Navigating the complexities of life insurance can be daunting, especially when considering multiple policies. It’s crucial to seek professional guidance to understand the various products available and how they can work together to meet your needs. Insurance agents and financial advisors can provide valuable insights and help you make informed decisions about which policies to pursue and how to structure them.

Additionally, understanding the terms and conditions of each policy is vital to avoid potential pitfalls. Policyholders should be diligent in reading the fine print, including exclusions, limitations, and the process for making claims. By being well-informed, individuals can ensure they maximize the benefits of their life insurance coverage and protect their loved ones effectively.

Key Considerations for Multiple Life Insurance Policies

While multiple life insurance policies can offer significant advantages, there are key considerations to keep in mind. Affordability is paramount; individuals must assess their financial situation to ensure they can maintain premiums for multiple policies without stretching their budget. A thorough financial analysis can help identify the optimal number of policies and coverage amounts needed to provide adequate protection.

Another crucial factor is the coordination of benefits across multiple policies. Policyholders should ensure that there is no overlap in coverage, which can lead to confusion during claims processing. Keeping beneficiaries informed about all policies in place is essential for a seamless experience, especially in times of crisis when claims need to be filed swiftly.

The Role of Professional Guidance in Life Insurance

Engaging with a professional insurance agent can greatly enhance your life insurance strategy, especially when considering multiple policies. These experts can help you assess your needs, compare different options, and navigate the underwriting process. Their insights can lead to better decisions regarding which policies to pursue and how to structure them for optimal coverage and affordability.

Professional guidance can also help you understand the long-term implications of your life insurance choices, including how they fit into your overall financial plan. By collaborating with an expert, you can ensure that your life insurance strategy aligns with your financial goals, providing the necessary protection for your family while also considering future financial needs.

Designing a Comprehensive Life Insurance Strategy

Designing a comprehensive life insurance strategy involves a thorough assessment of your current financial situation and future obligations. By evaluating your needs, you can determine how many policies you require and what type of coverage will be most beneficial. This process often includes considering both term and permanent life insurance options to create a balanced portfolio that addresses your short-term and long-term goals.

Additionally, working with a trusted insurance provider, such as Abbate Insurance Associates Inc., can streamline this process. Professionals can assist in tailoring your coverage to your specific circumstances, ensuring that you receive the protection you need while optimizing your financial resources. A well-structured life insurance strategy not only protects your family but also contributes to your overall financial stability.

Frequently Asked Questions

What are the benefits of having multiple life insurance policies?

Having multiple life insurance policies can offer significant benefits including coverage flexibility, allowing you to tailor policies for different financial needs like mortgage protection or long-term savings. It also diversifies risk, ensuring that you have continued coverage despite market changes or insurer fluctuations. Additionally, multiple policies can provide supplemental coverage as life circumstances evolve, such as marriage or the birth of a child, and serve as an effective strategy in estate planning to minimize tax liabilities and aid in asset distribution.

How can I get affordable life insurance plans with multiple policies?

To secure affordable life insurance plans while holding multiple policies, start by assessing your financial needs and budget. Compare quotes from different insurers and consider a mix of term and permanent life insurance to optimize costs. Additionally, working with an insurance agent can help you identify discounts for bundling policies or finding special programs that cater to families, which can lower overall expenses.

What strategies should I consider when managing multiple life insurance policies?

When managing multiple life insurance policies, consider strategies such as coordinating benefits to avoid overlapping coverage and ensuring all beneficiaries are informed of the policies. Regularly review your policies to adjust coverage according to changing life circumstances, like a new job or family expansion. It’s also wise to consult with a financial advisor to align your life insurance strategy with your long-term financial goals.

Can multiple life insurance policies help with estate planning?

Yes, multiple life insurance policies can significantly aid in estate planning. They can provide liquidity for estate settlement expenses, minimize tax liabilities, and ensure a smoother distribution of assets among heirs. By incorporating various policies into your estate plan, you can tailor protection that meets your family’s needs and financial goals while ensuring that your wishes are honored.

What should I know about the underwriting requirements for multiple life insurance policies?

Underwriting requirements can vary for each life insurance policy you apply for. Each policy typically involves a separate underwriting process, assessing your health and lifestyle. This can be time-consuming and might lead to higher premiums if any health issues are identified. It’s essential to be prepared for this process and possibly consult with an insurance professional to navigate multiple applications effectively.

How do I coordinate benefits between multiple life insurance policies?

Coordinating benefits between multiple life insurance policies involves keeping detailed records of each policy, including coverage amounts and beneficiary designations. Regularly review policies to prevent overlaps or gaps in coverage. Communicate with all beneficiaries about each policy to ensure they understand the claims process. Consulting with an insurance agent can also provide guidance on how best to manage and coordinate these benefits.

What are the potential pitfalls of having multiple life insurance policies?

The potential pitfalls of having multiple life insurance policies include the complexity of managing several policies, which can lead to confusion regarding coverage and beneficiaries. Additionally, the cumulative cost of premiums can strain your budget. There may also be challenges during the claims process if policies overlap or have conflicting beneficiary designations. It’s crucial to maintain organization and clarity to avoid these issues.

| Key Points | Description |

|---|---|

| Coverage Flexibility | Different policies cater to different financial needs, allowing for tailored protection. |

| Diversification of Risk | Multiple policies help mitigate risk and ensure continued coverage amid market changes. |

| Supplemental Coverage | Additional policies can address changes in personal circumstances and provide extra protection. |

| Estate Planning Strategies | Multiple policies can aid in minimizing tax liabilities and facilitating asset distribution. |

| Affordability | Maintaining multiple policies can be costly; careful budget assessment is crucial. |

| Underwriting Requirements | Each policy may require separate underwriting, which can be time-consuming and costly. |

| Coordination of Benefits | Overlapping coverage and beneficiary designations must be carefully managed. |

| Policy Ownership and Tax Implications | Ownership designations must be planned to avoid unintended tax consequences. |

Summary

Multiple life insurance policies can be a valuable strategy for individuals looking to enhance their financial security and tailor their coverage to meet diverse needs. By opting for multiple policies, one can achieve greater flexibility, diversify risk, and ensure adequate protection during life changes. However, it is essential to consider the affordability and complexities involved in managing multiple policies, such as underwriting and coordination of benefits. Partnering with professionals like Abbate Insurance Associates Inc. can help navigate these challenges and create a comprehensive life insurance strategy that aligns with your financial goals.