Louisiana Auto Insurance Affordability: Latest Insights 2023

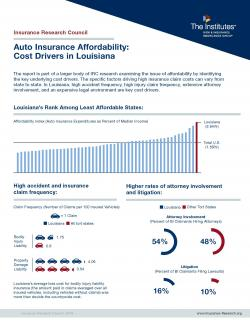

Louisiana auto insurance affordability has recently seen a slight improvement, dropping to 2.67 percent of the median household income in 2022 from 2.93 percent in 2020. Despite this positive shift, Louisiana still holds the unfortunate distinction of being the least affordable state for auto insurance, according to experts from the Insurance Research Council. The state’s auto insurance costs are burdened by various factors, including a higher frequency of accidents and severe repair costs, which significantly exceed the national average. Additionally, the affordability of car insurance is further impacted by the alarming rate of auto insurance claims and the involvement of attorneys in litigation, which is more prevalent in Louisiana than in most states. As policymakers and industry leaders look for solutions, understanding the underlying issues surrounding Louisiana insurance rates is crucial for enhancing affordability for residents.

The landscape of car insurance expenses in Louisiana presents a daunting challenge for many drivers, as the state consistently ranks among the most expensive for coverage. With a myriad of factors contributing to the elevated costs, including a higher incidence of accidents and medical claims, residents often find themselves grappling with the financial burden of maintaining adequate coverage. The pressing issues of insurance affordability in Louisiana are compounded by the prevalence of underinsured motorists and the high rate of claims litigation. As stakeholders seek to address these Louisiana insurance concerns, it becomes increasingly vital to explore effective legislative measures that can alleviate the strain on consumers. By tackling the root causes of these elevated insurance rates, there is hope for a more manageable and equitable insurance environment in the Bayou State.

Understanding Louisiana Auto Insurance Affordability

In recent years, Louisiana has been recognized as one of the least affordable states for auto insurance, with personal auto insurance affordability improving to 2.67 percent of the median household income in 2022, down from 2.93 percent in 2020. Despite this slight improvement, Louisiana still grapples with high auto insurance costs that significantly exceed the national average. Factors such as accident frequency and repair costs contribute heavily to the inflated insurance rates, creating financial strain for residents. The affordability of car insurance remains a critical issue, particularly for low- and middle-income families in the state.

To address the pressing issue of Louisiana auto insurance affordability, experts like Dale Porfilio suggest that reducing overall expected losses is crucial. This can be achieved through legislative efforts aimed at lowering key cost drivers that inflate insurance rates. For example, Louisiana’s accident frequency is 16 percent higher than the national average, while the relative frequency of injury claims is alarmingly high. Such statistics underscore the need for comprehensive reforms in the state’s insurance practices, which could lead to more competitive insurance rates for consumers.

The Impact of Louisiana’s Unique Insurance Challenges

Louisiana’s insurance landscape is shaped by unique challenges that significantly affect affordability and availability. The state faces high repair costs and a frequency of bodily injury claims that are more than twice the national average. These factors not only drive up auto insurance costs but also create a challenging environment for insurers, who must navigate the complexities of frequent claims and high litigation rates. The combination of these issues contributes to the overall insurance problems Louisiana residents face, making it imperative for policymakers to consider targeted solutions.

Furthermore, the aftermath of natural disasters, such as hurricanes, compounds Louisiana’s insurance woes, leading to dramatic increases in homeowners’ insurance costs that indirectly affect auto insurance rates. The substantial payouts related to disasters like Hurricane Laura and Hurricane Ida have placed additional financial burdens on insurers, leading to a more cautious approach to underwriting in the state. This cautiousness can result in higher premiums for consumers, thereby exacerbating the affordability crisis in Louisiana’s auto insurance market.

Legislative Efforts to Improve Insurance Affordability in Louisiana

In response to the growing affordability crisis, Louisiana lawmakers have begun to explore legislative measures aimed at alleviating the financial burden on residents. The establishment of a $45 million fund to encourage insurers to write property insurance in Louisiana is one such initiative that seeks to stabilize the insurance market. However, insurance commissioner Jim Donelon warns that this fund is just the beginning of what will be needed to effectively reduce homeowners’ and auto insurance rates. More comprehensive reforms are essential to tackle the underlying cost drivers that inflate insurance costs across the board.

Additionally, targeted legislation could address specific issues such as the high frequency of claims litigation, which is currently more than twice the national average in Louisiana. By focusing on reducing legal disputes surrounding auto insurance claims, the state could create a more favorable environment for insurers and potentially lower costs for consumers. Overall, sustained legislative efforts will be crucial in addressing Louisiana’s insurance challenges and improving affordability for its residents.

The Role of Market Competition in Louisiana Insurance Rates

Market competition plays a vital role in determining auto insurance rates in Louisiana. With many insurers hesitant to operate in a state marked by high claims frequency and extensive litigation, competition becomes limited. This lack of competition can lead to higher prices and fewer choices for consumers. To foster a more competitive insurance landscape, it is crucial for state policymakers to create an environment that encourages insurers to enter the market with confidence, ultimately benefiting consumers through better rates and services.

Moreover, initiatives that aim to simplify the regulatory landscape can also enhance market competition. Streamlined processes for claims and underwriting can reduce operational costs for insurers, allowing them to pass those savings onto consumers. By promoting a competitive market environment, Louisiana can work towards alleviating the affordability crisis and ensuring that residents have access to reasonably priced auto insurance.

The Importance of Consumer Education in Navigating Insurance Costs

Consumer education is paramount in helping Louisiana residents navigate the complexities of auto insurance costs. Many drivers may not fully understand the factors that contribute to their premiums, such as claims history, vehicle type, and coverage levels. By providing educational resources and guidance, consumers can make informed decisions about their insurance options, potentially leading to lower costs and better coverage. Understanding the nuances of auto insurance can empower residents to seek competitive quotes and choose policies that align with their financial needs.

Additionally, promoting awareness about available discounts and cost-saving measures can further enhance consumer outcomes. Many insurers offer discounts for safe driving records, bundling policies, or opting for higher deductibles. By equipping consumers with this knowledge, Louisiana can foster a more proactive approach to managing auto insurance expenses, ultimately aiding in the quest for greater affordability in the state’s insurance market.

Strategies for Reducing Auto Insurance Premiums in Louisiana

Reducing auto insurance premiums in Louisiana requires a multifaceted approach that addresses the root causes of high costs. One effective strategy is the implementation of targeted reforms aimed at reducing accident frequency and severity. For instance, enhancing road safety measures and promoting driver education programs can lead to fewer accidents and, subsequently, lower insurance costs. Additionally, encouraging the use of technology, such as telematics, can help insurers assess risk more accurately, potentially resulting in lower premiums for safe drivers.

Moreover, advocating for reforms in the legal framework surrounding auto insurance claims can significantly impact premium rates. By streamlining the claims process and reducing litigation costs, insurers can operate more efficiently, ultimately leading to lower prices for consumers. Collaborative efforts between lawmakers, insurance companies, and consumer advocacy groups can pave the way for meaningful changes that benefit all parties involved in the Louisiana auto insurance market.

The Future of Auto Insurance in Louisiana

As Louisiana continues to grapple with the challenges of auto insurance affordability, the future of the state’s insurance market remains uncertain. However, with ongoing legislative efforts and a focus on fostering competition, there is potential for positive change. Policymakers are increasingly recognizing the need for comprehensive reforms that address the unique factors driving up insurance costs, including accident frequency, repair costs, and claims litigation.

Additionally, advancements in technology and data analytics may play a pivotal role in shaping the future of auto insurance in Louisiana. Insurers can leverage these tools to better assess risk and create more personalized pricing models. As the landscape evolves, both consumers and insurers must adapt to the changing dynamics of the market, working together to achieve a more affordable and sustainable future for auto insurance in Louisiana.

Navigating Claims: Understanding the Process in Louisiana

Navigating the claims process in Louisiana can be daunting for many drivers, especially given the state’s high frequency of claims litigation. Understanding the steps involved in filing a claim and what to expect can empower consumers to handle the process more effectively. It is essential for policyholders to familiarize themselves with their policy’s coverage limits and exclusions, as well as the documentation required to support their claims.

Furthermore, being proactive in communication with insurers during the claims process can lead to a smoother experience. Louisiana consumers should document all interactions with their insurance companies and maintain thorough records of their claims. By staying organized and informed, drivers can mitigate some of the stress associated with claims and ensure they receive the compensation they are entitled to.

The Financial Burden of High Insurance Costs on Louisiana Families

The high costs of auto insurance in Louisiana place a significant financial burden on families, particularly those with limited incomes. With the state’s median household income being relatively low compared to the national average, many residents find it challenging to afford necessary insurance coverage. This financial strain can lead to difficult choices, such as forgoing adequate coverage or risking driving without insurance entirely.

To alleviate this burden, it is crucial for both state officials and insurance providers to explore solutions that prioritize affordability. Implementing programs aimed at helping low-income families access affordable auto insurance could make a considerable difference. By fostering a more supportive environment for financially vulnerable families, Louisiana can work towards creating a more equitable insurance landscape.

Frequently Asked Questions

What is the current state of Louisiana auto insurance affordability?

As of 2022, Louisiana’s auto insurance affordability stands at 2.67 percent of the median household income, a decrease from 2.93 percent in 2020. Despite this improvement, Louisiana remains the least affordable state for auto insurance in the U.S.

What factors contribute to the affordability of car insurance in Louisiana?

The affordability of car insurance in Louisiana is affected by several factors including high accident frequency, elevated repair costs, increased injury claim rates, and significant attorney involvement. These issues lead to overall insurance costs that are significantly above the national average.

How do Louisiana insurance rates compare to the national average?

Louisiana insurance rates are notably higher than the national average across various metrics. For instance, accident frequency is 16 percent above the national average, while injury claim relative frequency is nearly double, contributing to the overall high costs of auto insurance in the state.

What legislative measures could improve the affordability of car insurance in Louisiana?

To enhance the affordability of car insurance in Louisiana, legislation aimed at reducing key cost drivers such as accident frequency, repair costs, and claims litigation would be beneficial. Addressing these issues could help lower the expenses for consumers.

What role do underinsured motorists play in Louisiana’s auto insurance costs?

Underinsured motorists significantly impact Louisiana’s auto insurance costs, with over 35 percent of multi-car accidents involving at-fault drivers lacking adequate liability insurance. This rate is more than double the national average of 16 percent, contributing to higher claims and costs.

How do natural disasters affect Louisiana auto insurance affordability?

Natural disasters such as hurricanes can exacerbate Louisiana’s auto insurance affordability issues by raising overall insurance costs. The high costs of reinsurance and payouts from significant events, like Hurricanes Laura and Ida, contribute to the financial strain on insurers, which is ultimately passed on to consumers.

What is being done to address Louisiana insurance issues and improve affordability?

Efforts to address Louisiana insurance issues include the establishment of a $45 million fund to encourage insurers to write property insurance in the state. However, experts like Jim Donelon emphasize that this is just the first step, and more comprehensive measures are needed to effectively lower insurance rates.

How does Louisiana’s claims litigation rate affect auto insurance affordability?

Louisiana has a claims litigation rate that is more than twice the national average, which significantly raises the costs associated with auto insurance. This high level of litigation leads to increased legal fees and settlements, ultimately impacting the affordability of car insurance for residents.

| Key Points |

|---|

| Louisiana’s auto insurance affordability improved to 2.67% of median household income in 2022, down from 2.93% in 2020. |

| Despite improvements, Louisiana remains the least affordable state for auto insurance as per Triple-I’s chief insurance officer. |

| Accident frequency in Louisiana is 16% higher than the national average, increasing insurance costs. |

| Repair cost severity is 9% higher in Louisiana, contributing to rising insurance premiums. |

| Injury claims are significantly more common, with 49% of property damage claims resulting in bodily injury, compared to the national average of 25%. |

| Medical utilization is 47% higher than the national average, increasing overall costs. |

| Attorney involvement in claims is 24% higher in Louisiana, further driving up costs. |

| Over 35% of at-fault drivers in Louisiana have inadequate liability insurance, more than double the national average of 16%. |

| Claims litigation in Louisiana is more than twice the national average, second only to Florida. |

| Legislation aimed at reducing key cost drivers is essential for improving auto insurance affordability. |

| High insurance costs combined with low median income make affordability a significant challenge in Louisiana. |

| Natural disasters and the high cost of reinsurance further complicate the insurance landscape in Louisiana. |

| Efforts such as the $45 million fund approved in February 2023 aim to stabilize the property insurance market in Louisiana. |

Summary

Louisiana auto insurance affordability has seen slight improvements, with the percentage of median household income spent on auto insurance decreasing to 2.67% in 2022. However, the state still faces significant challenges that maintain its status as the least affordable in the United States. High accident rates, severe repair costs, and a large percentage of underinsured motorists contribute to this ongoing issue. To enhance affordability, targeted legislative measures addressing the key cost drivers are critical. Without further action, Louisiana’s auto insurance market will continue to struggle with high costs relative to household incomes.