Louisiana Auto Insurance Affordability Challenges Revealed

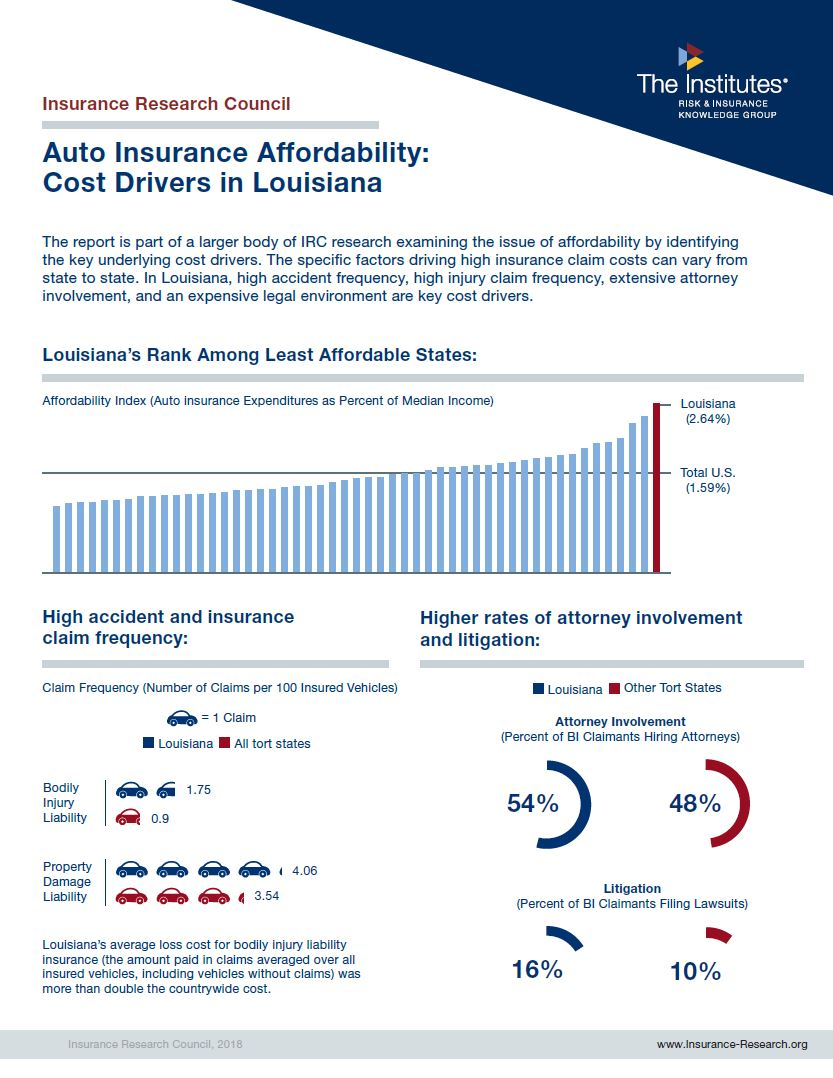

Louisiana auto insurance affordability is a pressing concern for many residents, as the state consistently ranks as the least affordable among its Southern counterparts and across the United States. In 2022, the average annual premium for auto insurance in Louisiana soared to $1,588, a staggering 40% above the national average, making it difficult for families to manage their insurance costs. This high expenditure accounts for approximately 2.67% of the Louisiana median household income, further complicating financial stability for many drivers. Factors contributing to these elevated insurance rates include a high frequency of injury claims, a significant number of underinsured motorists, and an active litigation environment. As Louisiana drivers seek affordable auto insurance, understanding these dynamics is essential for navigating the complex landscape of Louisiana insurance costs and optimizing their coverage options.

The affordability of car insurance in Louisiana poses significant challenges for drivers, particularly in light of rising costs that impact their financial well-being. With Louisiana auto insurance premiums reaching unprecedented heights, residents are increasingly seeking ways to compare auto insurance rates and find more budget-friendly options. The state’s economic factors, including low median household income and a high incidence of claims, further exacerbate the situation, making it crucial for consumers to explore alternatives. In this context, evaluating the landscape of affordable auto insurance becomes vital for Louisiana families aiming to secure adequate coverage without straining their finances. By delving into the key drivers of insurance costs and identifying potential savings, drivers can better navigate the complexities of Louisiana’s insurance market.

Understanding Auto Insurance Affordability in Louisiana

Auto insurance affordability in Louisiana is a pressing concern for many residents, as the state consistently ranks among the least affordable in the nation. Despite a noticeable increase in personal income levels, the average annual premium expenditure for auto insurance in Louisiana reached $1,588 in 2022. This figure is approximately 40 percent higher than the national average, indicating that while incomes may be rising, the costs associated with securing adequate coverage remain disproportionately high. The significant difference in auto insurance rates can make it challenging for individuals and families to budget effectively, leaving many drivers vulnerable to being underinsured.

Factors contributing to this affordability crisis include a higher frequency of injury claims following accidents, a notable number of underinsured motorists, and escalating legal costs related to claim litigation. The state’s challenging legal environment has been highlighted in various studies, pointing to a culture of higher attorney involvement in auto injury claims. These issues are exacerbated by Louisiana’s low median household income, which stands below the national average, further straining residents’ ability to afford essential auto insurance coverage.

A Comparison of Auto Insurance Rates in Southern States

When comparing auto insurance rates across Southern states, Louisiana emerges as an outlier with its significantly higher average premiums. For example, in neighboring North Carolina, the average annual premium is only $840, nearly half of what Louisiana residents pay. This disparity raises questions about the factors driving these costs, including the state’s legal landscape and the prevalence of claims. Furthermore, while Florida’s rates are slightly higher than Louisiana’s at $1,625, its higher median household income allows for a lower expenditure relative to income, illustrating how economic conditions can influence insurance affordability.

The IRC report highlights these variations, showing that all Southern states struggle with median household incomes that are below the overall U.S. average. This financial strain makes it difficult for residents to absorb the costs of auto insurance, especially as the legal challenges continue to contribute to rising rates. As insurance rates continue to climb, consumers in Louisiana must weigh their options carefully to find affordable auto insurance solutions that fit within their financial constraints.

Factors Influencing Louisiana’s Rising Auto Insurance Costs

Several key factors contribute to the rising auto insurance costs in Louisiana, making it a challenging environment for drivers seeking affordable coverage. Primarily, the state’s high rate of claim litigation plays a significant role in inflating premiums. Louisiana has been highlighted for its high incidence of attorney involvement in auto injury claims, which drives up legal costs and, in turn, insurance premiums. This is compounded by data indicating a higher tendency for residents to file injury claims, further straining the insurance market and contributing to the perception of Louisiana as a high-risk state for insurers.

Additionally, the prevalence of underinsured motorists in Louisiana exacerbates the challenges faced by consumers. With many drivers lacking adequate insurance coverage, those involved in accidents may find themselves facing substantial financial liabilities. This situation not only impacts individual drivers but also creates a ripple effect throughout the insurance system, leading to increased rates for all policyholders. As Louisiana continues to grapple with these issues, understanding the underlying causes of rising insurance costs becomes vital for residents seeking to navigate this complex landscape.

The Impact of Median Household Income on Insurance Affordability

The relationship between median household income and auto insurance affordability in Louisiana is significant. With the average household income in the state falling below the national average, many families find it increasingly difficult to allocate funds for necessary insurance coverage. In 2022, auto insurance expenditure accounted for approximately 2.67 percent of the median household income, a figure that highlights the financial burden placed on Louisiana residents. This situation is further complicated by the fact that high insurance costs can lead to an increased number of uninsured drivers, which only intensifies the risk for those who do comply with insurance requirements.

In comparison to neighboring states, Louisiana’s economic conditions create a challenging environment for securing affordable auto insurance. For example, while Florida’s median income allows for a lower percentage of income spent on insurance, Louisiana’s economic realities result in a higher financial strain. This disparity underscores the importance of addressing not only insurance costs but also the broader economic factors affecting residents’ ability to secure and maintain adequate coverage. As discussions around insurance reform continue, understanding the impact of income levels on insurance affordability will be crucial for developing effective solutions.

Legal Challenges Affecting Insurance Rates in Louisiana

Louisiana’s legal environment plays a critical role in shaping auto insurance rates, often leading to higher costs for consumers. The state has been criticized for its complex litigation landscape, which has consistently ranked among the least favorable in the United States. High rates of claim litigation and attorney involvement in auto injury claims contribute significantly to rising premiums, as insurers pass on the costs associated with legal defenses and settlements to policyholders. This situation creates a cycle where high insurance costs lead to increased financial pressure on drivers, pushing some individuals to opt for lower coverage or none at all.

Furthermore, Louisiana’s status as a perennial member of the ‘Judicial Hellholes’ list showcases the ongoing concerns regarding the fairness and efficiency of the state’s legal processes. These challenges discourage competition among insurers, leading to fewer options and higher rates for consumers. As residents seek ways to navigate the complexities of insurance costs, addressing these legal challenges will be essential for creating a more equitable environment for auto insurance in Louisiana.

Strategies for Finding Affordable Auto Insurance in Louisiana

In light of the ongoing challenges related to auto insurance affordability in Louisiana, residents are encouraged to explore various strategies to secure more affordable coverage. Shopping around for different insurance quotes is a crucial first step. By comparing rates from multiple providers, consumers can identify options that fit their budget while still offering adequate coverage. Utilizing online comparison tools can streamline this process, allowing individuals to assess their options quickly and efficiently.

Additionally, considering factors such as deductible amounts and coverage limits can significantly impact overall premiums. For instance, opting for a higher deductible may reduce monthly premiums, although it requires a greater out-of-pocket expense in the event of a claim. Furthermore, taking advantage of discounts for safe driving records or bundling multiple insurance policies can also provide cost savings. By being proactive and informed, Louisiana residents can better navigate the insurance landscape and find affordable auto insurance solutions tailored to their needs.

The Role of State Regulations in Auto Insurance Rates

State regulations play a pivotal role in determining auto insurance rates, influencing how insurers price their products and the types of coverage available. In Louisiana, the regulatory environment has been under scrutiny due to its implications for affordability. Regulations designed to protect consumers can sometimes inadvertently contribute to higher costs, as insurers adjust their pricing strategies to accommodate these requirements. Understanding the nuances of state regulations is essential for consumers looking to navigate the complex auto insurance market effectively.

Moreover, ongoing discussions about potential reforms highlight the need for a balanced approach that protects consumers without compromising affordability. As stakeholders engage in conversations about regulatory changes, it is crucial for residents to stay informed about how these developments may impact their insurance rates. By advocating for transparency and fairness in the regulatory process, Louisiana drivers can work towards a more sustainable and affordable auto insurance landscape.

Exploring Alternative Insurance Solutions in Louisiana

As Louisiana continues to grapple with high auto insurance rates, exploring alternative insurance solutions may provide residents with viable options for affordable coverage. One potential avenue is the use of non-traditional insurance models, such as usage-based insurance (UBI), which allows drivers to pay premiums based on their actual driving behavior rather than standard rates. This approach can be particularly beneficial for safe drivers, offering them the opportunity to reduce their overall insurance costs by demonstrating responsible driving habits.

Additionally, Louisiana residents may also consider group insurance policies, which can provide lower rates through collective bargaining. Joining organizations or associations that offer discounted insurance plans can be an effective strategy for individuals seeking to mitigate the financial burden of auto insurance. By considering these alternative solutions, residents can take proactive steps towards securing affordable auto insurance while addressing the unique challenges posed by the state’s insurance landscape.

Future Trends in Louisiana Auto Insurance Market

Looking ahead, several trends may shape the future of the auto insurance market in Louisiana. As technology continues to evolve, innovations such as telematics and artificial intelligence are likely to play an increasingly significant role in how premiums are assessed and managed. Insurers may leverage data analytics to better understand risk profiles and create more personalized insurance products that cater to individual drivers’ needs. This shift towards data-driven decision-making could lead to more competitive pricing and improved affordability for consumers.

Furthermore, as public awareness around the importance of insurance coverage grows, there may be an increased push for legislative reforms aimed at improving affordability and accessibility. Stakeholders, including consumer advocacy groups and insurance providers, will likely engage in discussions to address the underlying factors contributing to high insurance costs in Louisiana. By fostering a collaborative environment focused on innovative solutions, Louisiana may see positive changes in its auto insurance landscape in the coming years.

Frequently Asked Questions

What factors contribute to Louisiana auto insurance affordability?

Louisiana auto insurance affordability is influenced by several factors, including the high rate of injury claims, a significant number of underinsured motorists, and an elevated claim litigation rate. These issues contribute to higher auto insurance rates in Louisiana compared to other states.

How do Louisiana auto insurance rates compare to neighboring states?

Louisiana has the highest auto insurance rates among its Southern neighbors. The average annual premium in Louisiana is $1,588, nearly 40% above the national average and significantly higher than North Carolina, which has the lowest rates in the South at $840.

What is the average annual expenditure for auto insurance in Louisiana?

In 2022, the average annual expenditure for auto insurance in Louisiana was $1,588 per vehicle, which represents 2.67% of the state’s median household income.

How does Louisiana’s median household income affect auto insurance affordability?

Louisiana’s median household income impacts auto insurance affordability, as the state’s lower income levels lead to higher percentages of income spent on auto insurance compared to states with higher median incomes, like Florida.

Why is Louisiana considered the least affordable state for auto insurance?

Louisiana is deemed the least affordable state for auto insurance due to its high average premiums, the prevalence of costly legal claims, and the relatively low median household income, which results in a higher expenditure percentage on insurance.

What are the challenges of finding affordable auto insurance in Louisiana?

Challenges include navigating high auto insurance rates, a high rate of claims litigation, and dealing with the implications of living in a state known for its complex legal environment, all of which drive up costs.

Are there any recent developments regarding auto insurance affordability in Louisiana?

Despite some improvements in personal income growth, auto insurance affordability in Louisiana remains a significant issue, as evidenced by recent reports highlighting its status as the least affordable in the U.S.

How does Louisiana’s auto insurance affordability compare to Florida?

Although Florida’s average annual auto insurance premium is slightly higher at $1,625, Louisiana’s lower median income results in a larger proportion of income spent on insurance, making it less affordable overall.

What role does litigation play in Louisiana’s auto insurance costs?

Litigation plays a crucial role in Louisiana’s auto insurance costs, with high rates of attorney involvement in claims and a reputation for being a ‘Judicial Hellhole,’ which contributes to rising insurance rates.

How can residents find affordable auto insurance in Louisiana?

Residents can find affordable auto insurance in Louisiana by comparing rates from different insurers, considering coverage options, and exploring discounts that may lower their overall premium costs.

| Key Point | Details |

|---|---|

| Income Growth | Strong income growth has improved personal auto insurance affordability in Louisiana. |

| Average Premiums | In 2022, the average annual premium in Louisiana was $1,588, nearly 40% above the national average. |

| Comparison with Other States | Louisiana has the highest auto insurance costs in the South, almost double North Carolina’s $840 average. |

| Household Income Impact | Auto insurance costs accounted for 2.67% of median household income in Louisiana. |

| Claims and Litigation | Higher rates of injury claims, underinsured motorists, and litigation contribute to costs. |

| Judicial Environment | Louisiana ranks poorly in litigation fairness and is often listed as a ‘Judicial Hellhole’. |

Summary

Louisiana auto insurance affordability remains a significant concern despite recent improvements in income levels. The state continues to struggle with high auto insurance premiums that far exceed the national average, making it the least affordable state for auto insurance in the region. Factors such as higher claim rates, a high percentage of underinsured drivers, and a challenging litigation environment exacerbate the issue, placing a substantial financial burden on Louisiana residents.