Long-Term Care Insurance: A Comprehensive Checklist

Long-term care insurance (LTCI) has become an essential consideration for many as we navigate the complexities of aging. With 69% of individuals likely to require long-term care services, planning ahead is crucial for securing your financial future and safeguarding your loved ones’ peace of mind. The landscape of long-term care options is vast, and understanding the insurance policy features available can empower you to make informed decisions. Utilizing an LTCI checklist can streamline your evaluation process and help you identify the right coverage to meet your needs. By proactively engaging in long-term care planning, you can ensure financial stability during life’s unexpected turns.

As individuals approach their later years, the topic of extended healthcare coverage often arises, commonly referred to as long-term care insurance or simply LTC coverage. This insurance is designed to assist with the costs associated with various types of care, such as nursing facilities and in-home assistance. In the realm of elder care, exploring different policies and understanding their features can significantly impact one’s financial wellbeing. It’s important to consider options that provide comprehensive benefits while also factoring in potential costs and provider reliability. Engaging in thorough long-term care planning is not just a practical step; it’s a proactive measure to secure a stable future.

Understanding Long-Term Care and Its Importance

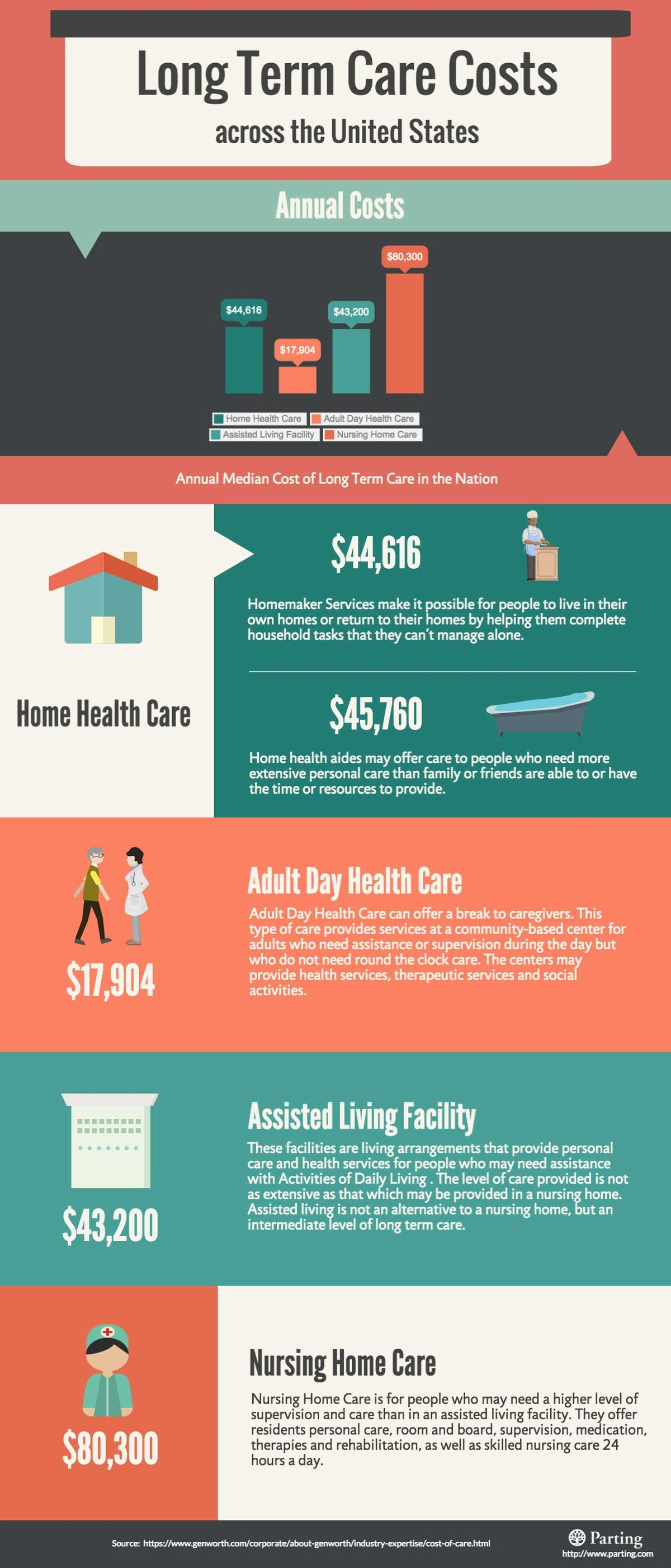

Long-term care (LTC) encompasses various types of assistance, including nursing home care, home health care, and assisted living services. As individuals age, the likelihood of needing such support increases, making it crucial to understand what options are available. By familiarizing yourself with the types of care, you can assess your potential needs and those of your loved ones. It’s important to note that long-term care insurance (LTCI) may not cover certain types of care, such as that provided by family members or specific medical expenses, so comprehensive knowledge is vital.

Planning for long-term care early can significantly enhance your financial preparedness. The earlier you begin exploring LTCI options, the more choices you will have available, allowing you to secure a policy that suits your needs and budget. Moreover, early planning can prevent emotional stress on your family during difficult times, as they will have a clearly defined plan in place. By taking proactive steps now, you can ensure that you are ready for whatever the future holds.

Exploring Long-Term Care Insurance Options and Policy Features

When considering long-term care insurance, it’s essential to explore the various options available to you. Traditional long-term care insurance, often referred to as standalone policies, primarily covers nursing home, home health, and assisted living costs. In contrast, hybrid policies combine life insurance or annuity benefits with long-term care coverage, offering more flexibility. Understanding the differences between these policies will help you make an informed decision, ensuring that your coverage aligns with your anticipated needs.

In addition to understanding the types of policies, it’s crucial to investigate specific policy features. Look into daily or monthly benefit amounts, the length of benefit periods, and elimination periods to determine what will best suit your financial situation. Inflation protection is another important feature to consider, as it ensures your benefits will keep up with rising care costs. By thoroughly evaluating these policy attributes, you can select a long-term care insurance plan that provides the best protection for you and your family.

Understanding Costs and Premiums of Long-Term Care Insurance

When it comes to long-term care insurance, understanding the costs associated with premiums is vital for effective financial planning. Premiums can vary widely based on the type of policy, your age, health status, and the coverage amount you select. It’s important to assess whether these costs fit comfortably within your budget. Additionally, inquire about the potential for future premium increases and the conditions under which they might occur, as this can significantly impact your long-term financial stability.

Another critical aspect to explore is the specifics of what services are covered under your policy. Familiarizing yourself with the details—such as covered services, exclusions, and any applicable restrictions—will prevent unpleasant surprises down the line. This knowledge will empower you to make informed decisions about your long-term care coverage, ensuring that you have the necessary financial resources in place when you need them most.

Evaluating Provider Reputation and Financial Stability

Choosing the right insurance provider is a crucial step in securing long-term care insurance. It’s essential to select companies that have a strong reputation for delivering on their promises and effectively servicing their long-term care policies. Researching customer reviews and ratings from independent agencies can help you gauge a provider’s reliability. Additionally, understanding the financial strength ratings of the insurance company will give you confidence in their ability to fulfill claims in the future.

Consulting with legal and financial experts who specialize in long-term care planning can provide valuable insights into the implications of your insurance choices. These professionals can help you navigate the complexities of insurance policies and ensure that you select an option that aligns with your financial goals. By incorporating expert advice, you can make more informed decisions that enhance your overall financial stability.

The Importance of Family Discussions in Long-Term Care Planning

Engaging in open discussions with family members about long-term care planning is essential for ensuring that everyone is on the same page. By involving loved ones in these conversations, you can collectively address concerns and preferences regarding future care needs. Long-term care insurance (LTCI) serves not only as a financial tool but also as a means to alleviate the emotional burden on your family, providing them with the resources they need to make informed decisions.

Moreover, it’s important to recognize that long-term care needs can change over time. Periodically reviewing and updating your policy, especially after significant life events such as retirement or health changes, will help ensure that your coverage remains adequate. Establishing a routine for these discussions can foster a supportive environment and make future transitions smoother for everyone involved.

Frequently Asked Questions

What is long-term care insurance (LTCI) and why is it important?

Long-term care insurance (LTCI) is a type of insurance designed to cover the costs associated with long-term care services, such as nursing homes, assisted living, and home health care. It’s important because it helps protect your financial stability as you age, ensuring that you have access to necessary care without depleting your savings.

What should I include in my LTCI checklist when planning for long-term care?

When creating your LTCI checklist, include the types of long-term care services you may need, the types of insurance options available (traditional vs. hybrid), policy features such as daily benefit amounts and coverage details, provider reputation, and the importance of early planning for financial stability.

How do I choose the right long-term care insurance policy features?

Choosing the right LTCI policy features involves assessing daily benefit amounts, the length of benefit periods, elimination periods, and whether to include inflation protection. Evaluating these factors will help you find a policy that meets your long-term care needs.

What are the costs associated with long-term care insurance premiums?

Long-term care insurance premiums can vary significantly based on factors like age, health, and the amount of coverage chosen. It’s essential to understand these costs, check if they fit your budget, and be aware of any potential future increases.

How can I ensure the financial stability of my long-term care insurance provider?

To ensure the financial stability of your LTCI provider, research their financial strength ratings and reputation in the industry. Choose a company known for effectively servicing long-term care policies to avoid complications later.

Why is family discussion important in long-term care planning?

Family discussion is crucial in long-term care planning as it ensures everyone is informed and on the same page regarding care needs and financial responsibilities. Involving family members can help alleviate burdens and foster understanding about how LTCI can support care decisions.

How often should I evaluate my long-term care insurance policy?

It’s advisable to evaluate your long-term care insurance policy annually or after significant life changes to ensure it continues to meet your evolving needs. Continuous evaluation helps you stay prepared for potential long-term care requirements.

What types of long-term care options does LTCI cover?

Long-term care insurance typically covers a variety of services, including nursing home care, assisted living, and home health care. However, it’s important to know what services are not covered, such as care provided by family members or certain medical expenses.

When is the best time to start planning for long-term care insurance?

The best time to start planning for long-term care insurance is early, ideally in your 50s or 60s. Early planning allows for better financial preparation and a broader range of policy options, ensuring you secure the best coverage for your future needs.

What should I do if I have questions about my long-term care insurance options?

If you have questions about your long-term care insurance options, consult with a licensed insurance agent or financial advisor who specializes in long-term care planning. They can provide personalized guidance and help you navigate your choices.

| Key Point | Details |

|---|---|

| Understanding Long-Term Care and Early Planning | Familiarize with types of care and plan early for better options and financial preparation. |

| Exploration of Insurance Options and Policy Features | Differentiate between traditional and hybrid policies, and assess policy features like benefits and inflation protection. |

| Costs, Premiums, and Coverage Specifics | Understand premium costs, potential increases, and familiarization with covered services and limitations. |

| Provider Reputation, Financial Stability, and Legal Consultation | Choose reputable insurance providers and consult legal/financial experts for informed decision-making. |

| Family Discussion and Continuous Evaluation | Engage family in discussions about long-term care planning and review policies regularly as needs change. |

Summary

Long-term care insurance is essential for preparing for the uncertainties of aging, as many individuals will require such services at some point in their lives. By understanding various care types, exploring insurance options, evaluating costs, and consulting with professionals, you can make informed decisions that provide security for yourself and your family. Engaging in discussions with loved ones and regularly reviewing your policy ensures that your long-term care needs are met effectively, securing peace of mind for the future.