Life Insurance Misconceptions Addressed by Delvin Joyce

When it comes to life insurance misconceptions, many people, particularly in the Black community, hold onto outdated beliefs that can hinder their financial security. Financial planner Delvin Joyce has dedicated his career to educating clients about the true benefits of life insurance, which extend far beyond just final expenses. He emphasizes that life insurance can play a crucial role in wealth building, provide income replacement, and protect against debt, making it a vital part of any comprehensive financial plan. Moreover, many individuals mistakenly think that their employer-provided insurance coverage is sufficient, but this is rarely the case. By addressing these misconceptions, Delvin helps clients understand the importance of adequate insurance coverage for their family’s future.

Exploring the topic of life insurance misconceptions reveals a myriad of misunderstandings that can impact financial well-being. Often referred to as life coverage or death benefits, many people mistakenly believe that insurance is solely for posthumous expenses, neglecting its potential to support ongoing financial goals. This perception can be particularly prevalent in underserved communities, where the importance of comprehensive financial planning is overlooked. By dispelling these myths and highlighting the various ways insurance can contribute to financial stability and wealth accumulation, we open the door to informed discussions that promote overall economic empowerment. Understanding the multifaceted nature of life insurance is essential for anyone looking to secure their family’s financial future.

Understanding Life Insurance Benefits Beyond Final Expenses

Life insurance is often misconceived as merely a product designed to cover final expenses like burial costs. However, financial planner Delvin Joyce emphasizes that its benefits extend far beyond this narrow perspective. Life insurance can serve as a powerful financial tool that provides income replacement in case of untimely death, allowing families to maintain their standard of living. Furthermore, it can help cover debts, ensuring that loved ones are not burdened with financial liabilities in a difficult time.

In addition to immediate financial protection, life insurance can also contribute significantly to long-term wealth building. Many policies, especially permanent life insurance, accumulate cash value over time, which can be accessed for various financial needs. This means that individuals can leverage their life insurance not just for protection but as a strategic asset in their overall financial planning. Understanding these multifaceted benefits can help dispel the myth that life insurance is only about covering funeral costs.

Life Insurance Misconceptions in the Black Community

Delvin Joyce has observed that many misconceptions about life insurance are prevalent in the Black community, primarily due to historical financial disparities and a lack of education on the subject. One common belief is that life insurance will create a sense of entitlement among heirs, potentially leading to laziness or lack of motivation. Delvin addresses these concerns by promoting the importance of estate planning and the creation of living trusts, which enable families to pass on wealth while instilling the values of hard work and determination.

Moreover, these misconceptions can deter individuals from securing adequate coverage that could ultimately benefit future generations. By actively engaging in conversations about the true purpose of life insurance, Delvin aims to reshape the narrative and encourage families to view it as a means of protection and wealth accumulation rather than a source of complacency. This shift in mindset can empower the Black community to leverage life insurance as a tool for financial stability.

The Limitations of Employer-Sponsored Life Insurance

Many people believe that the life insurance provided by their employer is sufficient for their needs. However, Delvin Joyce warns that this coverage often falls short of what individuals truly require. Employer-sponsored policies typically offer a limited amount of coverage that may not adequately protect a family’s financial future. Additionally, if an individual changes jobs or faces unemployment, they risk losing this crucial benefit, leaving their family vulnerable.

To ensure comprehensive protection, it is advisable to supplement employer-provided coverage with a personal life insurance policy. This approach not only guarantees continued coverage regardless of employment status but also allows individuals to customize their policies to better fit their unique financial responsibilities and goals. Understanding these limitations is essential for anyone looking to secure their family’s future.

The Living Benefits of Life Insurance

A significant misconception surrounding life insurance is the belief that it only serves a purpose after death. Delvin Joyce points out that many policies come with living benefits that can provide financial assistance while the policyholder is still alive. Features like chronic illness riders and cash value accumulation can be utilized for various needs, such as covering medical expenses or funding education.

By highlighting these living benefits, Delvin helps clients recognize life insurance as a versatile financial instrument that supports a range of goals throughout their lifetime. This understanding is particularly vital in light of the pressing need to address the wealth gap faced by the Black community. Utilizing life insurance not only for protection but also as a means of financial empowerment can lead to greater overall financial health.

The Importance of Adequate Life Insurance Coverage

Many individuals, especially in the Black community, underestimate the amount of life insurance coverage needed to ensure their family’s financial security. Delvin frequently encounters clients who believe that a lower coverage amount, such as $1 million, is unnecessary. However, he emphasizes that when considering expenses like mortgages, car payments, and future college tuition, the required coverage can quickly exceed initial estimates.

Delvin also highlights that life insurance is often more affordable than many assume, particularly term life insurance. By educating clients about the actual costs and benefits, he helps dispel the notion that adequate coverage is financially out of reach. Ensuring sufficient coverage is a critical step in safeguarding loved ones against unforeseen financial burdens.

Choosing the Right Insurance Professional

Navigating the complexities of life insurance can be daunting, which is why working with a qualified insurance professional is crucial. Delvin Joyce recommends that individuals seek out knowledgeable agents who can provide personalized advice and guidance tailored to their unique financial situations. A qualified insurance professional can help identify misconceptions and ensure clients understand the full spectrum of life insurance benefits available to them.

Using resources like an Agent Locator can simplify the process of finding a reputable insurance professional in your area. Engaging with an expert not only clarifies the intricacies of various policies but also empowers individuals to make informed decisions regarding their insurance coverage. This proactive approach contributes to better financial planning and ultimately enhances the financial security of families.

Empowering the Black Community Through Life Insurance Education

Education plays a pivotal role in transforming the perspectives of the Black community regarding life insurance. By organizing workshops and informational sessions, financial planners like Delvin Joyce aim to raise awareness about the benefits of life insurance and dispel common myths. Educating individuals about how life insurance can be a tool for wealth building rather than just a safety net encourages proactive financial planning.

Furthermore, addressing the historical context of financial literacy within the Black community is essential to fostering a more informed approach to life insurance. By dismantling barriers and promoting understanding, community leaders can empower individuals to leverage life insurance as part of their overall wealth-building strategies, ultimately contributing to greater financial resilience.

The Role of Life Insurance in Wealth Building

Life insurance is not only a protective measure but also a vital component in the wealth-building process. Delvin Joyce advocates for the integration of life insurance into broader financial planning strategies, emphasizing its potential to create a legacy for future generations. The cash value accumulation in permanent life insurance policies can serve as a strategic asset, enhancing an individual’s overall financial portfolio.

Moreover, life insurance can provide liquidity that aids in investment opportunities, business ventures, or even retirement planning. By incorporating life insurance into wealth-building discussions, individuals can better appreciate its role in achieving long-term financial goals. This comprehensive understanding is particularly important for the Black community, where building wealth has historically been more challenging.

Overcoming Financial Barriers with Life Insurance

For many in the Black community, financial barriers can hinder access to adequate life insurance coverage. Delvin Joyce stresses the importance of addressing these challenges head-on, whether through advocacy for better financial products or community support initiatives. By fostering an environment that encourages financial literacy and access to resources, individuals can overcome these barriers and secure the coverage they need.

Additionally, by collaborating with financial planners and insurance professionals, individuals can explore various options that align with their financial capabilities. This collaborative approach not only enhances understanding but also empowers families to make informed decisions about their life insurance needs, ultimately leading to improved financial security.

Frequently Asked Questions

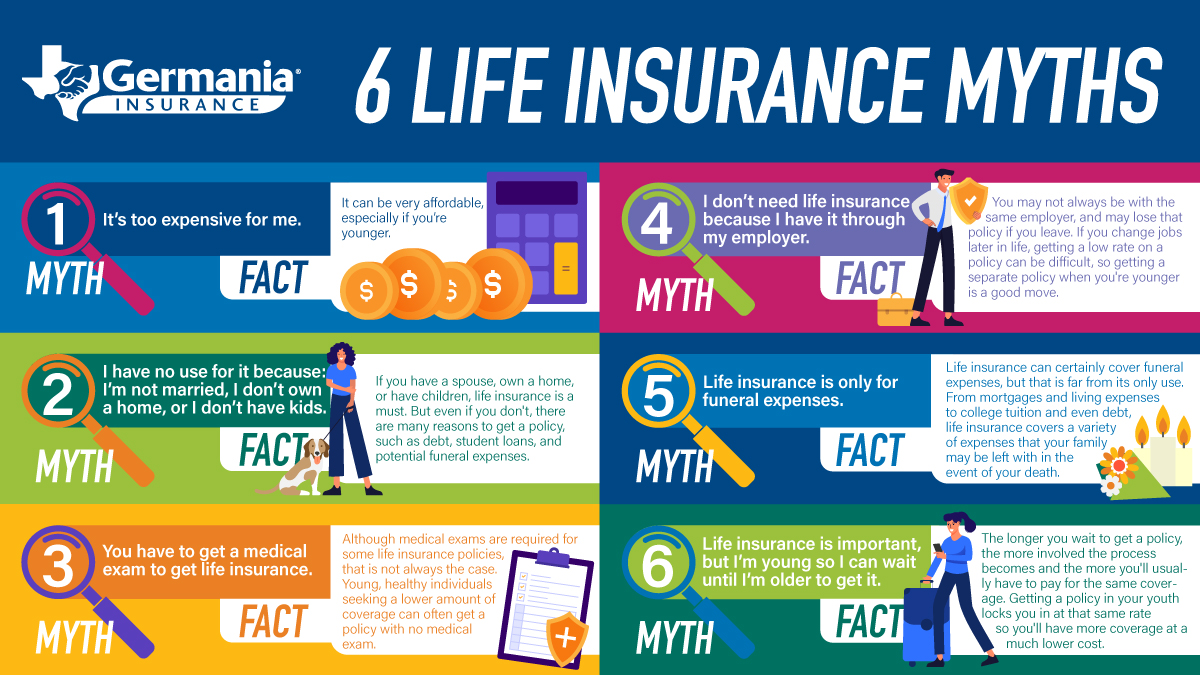

What are the common life insurance misconceptions regarding its benefits in wealth building?

Many people mistakenly believe that life insurance is solely for final expenses, such as funeral costs. However, life insurance can also serve as a powerful tool for wealth building. It offers income replacement, debt protection, and can fund future needs like children’s college education. Understanding these broader life insurance benefits is essential for effective financial planning.

How can life insurance misconceptions affect financial planning in the Black community?

Misconceptions about life insurance often lead to inadequate financial planning in the Black community. Many individuals see life insurance only as burial insurance, which limits their understanding of its potential for wealth building and financial security. Educating clients about the comprehensive benefits of life insurance can empower them to make informed decisions for their family’s financial future.

Is it true that life insurance only benefits me after I die?

This is a common life insurance misconception. In reality, many policies offer living benefits such as cash value accumulation and chronic illness riders that can provide financial support while you are alive. Understanding these features can help individuals leverage life insurance for their ongoing financial goals.

Do I really need more life insurance than what my job provides?

Relying solely on employer-provided life insurance is a significant misconception. This coverage may not be sufficient and can be lost if you change jobs or retire. Supplementing your job’s insurance with additional coverage is crucial to ensure your family’s financial security.

Why do some believe that having $1 million in life insurance coverage is unnecessary?

Many individuals underestimate their family’s actual financial needs, leading to the misconception that they don’t require significant life insurance coverage. Expenses like mortgages, car payments, and college tuition can add up quickly. It’s important to evaluate your family’s financial obligations and recognize that life insurance is often more affordable than perceived, ensuring adequate protection.

| Misconception | Explanation |

|---|---|

| Life insurance is only for final expenses. | Many believe it only covers funeral costs, but it can provide income replacement, debt protection, and support children’s education. |

| Life insurance will leave my kids on Easy Street. | Concerns about children becoming unmotivated can be addressed with estate planning and living trusts. |

| I have enough life insurance through my job. | Employer coverage is often inadequate and can be lost if you change jobs or retire. |

| Life insurance only benefits me if I die. | There are living benefits, such as chronic illness riders and cash value accumulation. |

| I don’t need something like $1 million of coverage. | Clients often underestimate their coverage needs due to accumulating expenses; term life insurance is often more affordable than assumed. |

Summary

Life insurance misconceptions can significantly impact financial planning, especially in communities where these myths are prevalent. Understanding that life insurance is not just for final expenses, but also a vital tool for income replacement, debt protection, and wealth building, is crucial. By addressing these misconceptions, individuals can secure their families’ financial futures and make informed decisions about their insurance needs.