Life Insurance for AAPI Community: Breaking Misconceptions

Life insurance for the AAPI community is an essential topic that deserves attention, especially given the unique financial challenges faced by Asian Americans and Pacific Islanders. Despite representing the smallest life insurance need gap among racial and ethnic groups, there are still approximately 5 million individuals within this community lacking adequate coverage. Many misconceptions, such as the belief that life insurance is unaffordable, often deter potential policyholders from exploring their options. In reality, life insurance can be more economical than perceived, with substantial benefits that can greatly improve financial security. By fostering AAPI financial literacy, we can help demystify these commonly held beliefs and encourage individuals to secure life insurance that fits their needs and budgets.

When discussing AAPI life insurance, it is crucial to address the specific financial concerns and misconceptions that affect this community. Often, individuals may think that having insurance through their employer is sufficient, yet this coverage may fall short when considering family needs. Moreover, many believe that life insurance only serves its purpose after death, overlooking the array of living benefits that policies can offer while insured individuals are still alive. Addressing these myths is vital to enhancing life insurance affordability and ensuring that members of the AAPI community can access the benefits they deserve. By promoting awareness and knowledge around these topics, we pave the way for healthier financial futures for families across the AAPI spectrum.

Understanding Life Insurance Affordability in the AAPI Community

One of the primary reasons many individuals in the AAPI community hesitate to purchase life insurance is the misconception that it is unaffordable. According to the 2023 Insurance Barometer Study, 37 percent of Asian Americans believe that the costs associated with life insurance are prohibitive. This viewpoint often stems from a lack of understanding about the actual costs involved. In truth, life insurance can be much more affordable than many people assume. For example, a healthy young adult can secure a substantial policy for less than the cost of a monthly coffee habit. By consulting with a professional, individuals can find tailored policies that fit their budget, debunking the myth that life insurance is out of reach for most families.

Moreover, when considering life insurance affordability, it’s essential to look beyond mere monthly premiums. Many policies offer flexible payment options and can be adjusted to meet the policyholder’s financial capabilities. Jordan Mangaliman emphasizes that individuals should not overlook the potential benefits and peace of mind that come with securing life insurance. It is a small investment that can provide significant financial protection for loved ones in the event of an unexpected tragedy. By engaging with an insurance professional, AAPI community members can discover the various options available, ensuring they find a plan that suits their financial situation.

Debunking Common Insurance Misconceptions

Misconceptions about life insurance abound, particularly within the AAPI community. One prevalent belief is that having life insurance through one’s employer is sufficient coverage. While employer-provided plans are beneficial, they typically offer limited coverage and may not be portable, meaning they vanish if the individual changes jobs. This scenario can leave families vulnerable to financial strain in the event of a premature death. Jordan points out that many individuals do not factor in their family’s long-term financial needs when relying solely on workplace insurance. To ensure adequate protection, it’s vital to assess personal circumstances and consider a standalone life insurance policy that guarantees coverage regardless of employment status.

Another common misconception is the idea that life insurance is only beneficial after death. Many people, including those within the AAPI community, are unaware of the living benefits that certain policies offer. Today’s life insurance products have evolved to provide financial advantages while the policyholder is still alive, such as access to cash value for emergencies or even funding for a child’s education. Jordan educates his clients on the concept of living benefits, which can serve as a financial safety net during challenging times. By understanding these features, individuals can appreciate the broader scope of life insurance, seeing it as a versatile financial tool rather than just a safety net for their beneficiaries.

The Importance of Life Insurance Benefits

Life insurance serves as a critical financial tool that provides significant benefits to families, especially in the AAPI community where financial literacy may vary. The primary purpose of life insurance is to ensure that loved ones are not left in financial distress in the event of an untimely death. Jordan highlights that life insurance can cover various expenses, including mortgages, educational costs, and everyday living expenses, allowing families to maintain their quality of life. The financial cushion that life insurance provides is essential for safeguarding the future of dependents, ensuring that they can continue pursuing their dreams without the burden of unexpected financial hardship.

Additionally, life insurance can play a vital role in wealth accumulation and generational wealth transfer. Many AAPI families prioritize saving and investing; however, without life insurance, the financial legacy they wish to leave behind can be jeopardized. Jordan explains that by having a life insurance policy, families can create a financial legacy that supports future generations. Furthermore, certain types of life insurance, such as whole life or universal life policies, can accumulate cash value over time, which can be accessed for various purposes, including retirement funding or emergency expenses. This dual benefit reinforces the importance of life insurance not just as a safety net, but as a strategic component of a comprehensive financial plan.

Enhancing AAPI Financial Literacy Through Life Insurance Education

Financial literacy plays a crucial role in the AAPI community’s understanding of life insurance and its benefits. Many individuals may not fully grasp the intricacies of life insurance policies, often leading to misconceptions that prevent them from securing adequate coverage. Jordan Mangaliman actively works to enhance financial literacy by providing educational resources and workshops tailored to the AAPI community. By demystifying life insurance and addressing common myths, he aims to empower individuals to make informed financial decisions that can secure their family’s future.

Increasing financial literacy also involves understanding the various products available and how they can be utilized effectively. Jordan emphasizes that the more knowledge individuals gain about life insurance, the better equipped they are to navigate their options. This understanding allows them to appreciate the nuances of different policies, including term life, whole life, and universal life insurance. By fostering an environment of learning and open discussion, the AAPI community can significantly improve its engagement with financial products, leading to better outcomes in securing life insurance and addressing the community’s unique financial needs.

The Consequences of Relying Solely on Savings

Many members of the AAPI community believe that having substantial savings is a sufficient safeguard for their families’ financial futures. While savings are undeniably important, relying solely on them can be risky. In the event of an unforeseen tragedy, such as a death or disability, the savings that individuals have worked hard to accumulate may be quickly depleted to cover immediate expenses. Jordan reminds his clients that life insurance is designed to provide a financial safety net that can prevent the erosion of their savings during difficult times. This approach ensures that family members can maintain their standard of living without the stress of financial insecurity.

Moreover, life insurance can complement savings by offering a structured approach to financial planning. It can provide funds that can be used for specific goals, such as funding children’s education or paying off debts. By integrating both savings and life insurance into a comprehensive financial strategy, families can create a robust safety net that not only protects them in times of crisis but also supports long-term financial goals. Jordan encourages individuals to view life insurance as an essential part of their overall financial health, allowing them to build a legacy that transcends mere savings.

Securing Life Insurance at a Young Age

One of the most significant misconceptions about life insurance is the belief that young individuals do not need it or that it is too early to consider purchasing a policy. In reality, securing life insurance at a young age can be highly advantageous. Premium rates are typically lower for younger, healthier individuals, meaning that the longer one waits to purchase a policy, the higher the premiums may become. Jordan advocates for the importance of locking in a policy while still young to maximize the benefits and minimize costs. This proactive approach ensures that individuals are protected against potential future health issues that could impede their ability to obtain coverage later on.

Additionally, acquiring life insurance early provides a unique opportunity for young individuals to start building a financial foundation. Many life insurance policies offer cash value accumulation, which can serve as a savings tool over time. These funds can be utilized for various needs, such as starting a business or funding a home purchase. Jordan emphasizes that by investing in life insurance at a young age, individuals can set themselves up for financial success in the future, reinforcing the message that life insurance is not just a product for the elderly but a critical financial resource for all ages.

Frequently Asked Questions

What are the common misconceptions about life insurance for the AAPI community?

Common misconceptions about life insurance for the AAPI community include beliefs that life insurance is unaffordable, that employer-provided insurance is sufficient, and that life insurance can only be used after death. Additionally, many believe they don’t need life insurance if they have savings, or that they are too young to purchase a policy. Educating the AAPI community about these misconceptions is crucial for ensuring they obtain the coverage they need.

Is life insurance for the AAPI community really affordable?

Many in the AAPI community perceive life insurance as unaffordable, but this is often a misconception. In reality, life insurance can be more affordable than expected. By working with an insurance professional, individuals can find coverage options that fit their budget, debunking the myth that life insurance is out of reach.

How does life insurance benefit the AAPI community while they are still alive?

Life insurance for the AAPI community offers more than just a death benefit. Many modern policies include living benefits, allowing policyholders to access funds in cases of illness or injury. This can be instrumental in managing financial challenges during difficult times, making life insurance a valuable asset while still alive.

Why isn’t employer-provided life insurance enough for AAPI community members?

While employer-provided life insurance is a benefit, it often offers limited coverage, typically one to two times the employee’s salary. For many in the AAPI community, this may not be sufficient to cover all family expenses after a loss. Seeking an individual life insurance policy can ensure adequate coverage regardless of employment changes.

Why do AAPI individuals think they don’t need life insurance if they have savings?

Many in the AAPI community prioritize saving; however, relying solely on savings can be risky. Life insurance provides a safety net that preserves savings for other goals, such as retirement or education. It ensures that families are not financially burdened with expenses after a loss, allowing them to maintain their savings.

What is the best age to purchase life insurance for the AAPI community?

Purchasing life insurance while young is generally more cost-effective, as premiums are based on age and health. Delaying the purchase can lead to higher costs later due to increased risks. It is advisable for AAPI individuals to consider securing life insurance early to lock in lower rates and ensure financial protection.

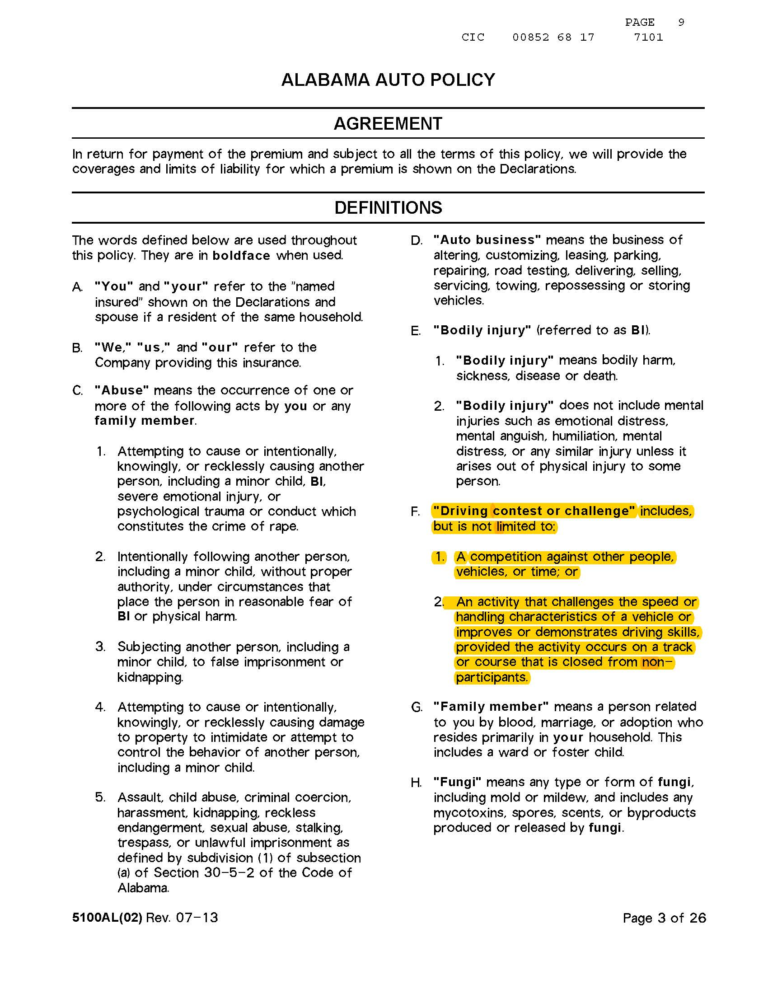

| Key Point | Details |

|---|---|

| Misconception 1: Life insurance is unaffordable. | Many AAPI community members overestimate life insurance costs. In reality, it is often more affordable than perceived, and working with an insurance professional can help find suitable options. |

| Misconception 2: I have enough life insurance at work. | Work-provided life insurance often offers insufficient coverage. Individual policies can provide better financial support for families after one’s death. |

| Misconception 3: I have to die to use a life insurance policy. | Life insurance can provide benefits while still alive, such as living benefits for illness or injury, and cash value for various expenses. |

| Misconception 4: I have savings, so I don’t need life insurance. | Relying on savings alone may not cover all expenses after death. Life insurance ensures financial stability for loved ones during emergencies. |

| Misconception 5: I’m too young for life insurance. | Life insurance premiums are cheaper when younger and healthier. Delaying can lead to higher costs later. |

Summary

Life insurance for the AAPI community is crucial for ensuring financial security for loved ones. Despite having the smallest life insurance need gap, approximately 5 million individuals within the AAPI community still require additional coverage. By addressing common misconceptions about affordability, workplace coverage adequacy, the benefits of living benefits, the importance of life insurance alongside savings, and the advantages of obtaining insurance at a young age, the AAPI community can be better educated about the importance of life insurance. Engaging with knowledgeable insurance professionals like Jordan Mangaliman can empower community members to make informed decisions that protect their families’ financial futures.