Life Insurance During Pregnancy: What You Need to Know

Life insurance during pregnancy is an essential consideration for expectant parents looking to secure their family’s financial future. As pregnancy is a transformative life event, it often prompts individuals to evaluate their insurance options for pregnant women to ensure adequate protection. By applying for life insurance early in your pregnancy, you can benefit from potentially lower premiums and more favorable terms, as insurers typically assess applicants based on overall health and medical history. This proactive step not only provides peace of mind but also guarantees financial security during pregnancy, covering unexpected expenses related to childcare and education. Understanding the life insurance benefits for families can empower you to make informed decisions that safeguard your loved ones in the years to come.

Navigating the world of insurance while preparing for a new addition to your family can be overwhelming, but it’s crucial to explore protective measures such as maternity coverage. Expectant mothers often face unique challenges, making it important to assess various insurance products tailored for their specific needs. Seeking pregnant life insurance not only ensures that your family is financially stable but also allows you to focus on the joys of motherhood without the burden of financial uncertainty. Engaging with an insurance professional can help you identify the best policy options and clarify the application process, ensuring that both you and your baby are well-protected. Ultimately, planning for your family’s future during this critical time can lead to lasting security and peace of mind.

Understanding Life Insurance Options for Pregnant Women

When considering life insurance during pregnancy, it’s essential to explore the various options available to expectant mothers. Many insurance companies offer specialized policies designed to meet the unique needs of pregnant women. These options can range from term life insurance, which provides coverage for a specified period, to whole life insurance, which offers lifelong protection and can accumulate cash value. By understanding these different types of policies, pregnant women can make informed decisions that align with their financial goals and family planning.

In addition to the different types of life insurance available, it’s crucial to understand the specific features that may benefit pregnant women. Some policies may offer added riders, such as child term riders, which provide additional coverage for children. Others may include options for premium waivers in the event of the policyholder’s death, ensuring that the family remains financially secure without the burden of premium payments. By assessing these features, expectant parents can choose a policy that provides comprehensive protection for their growing family.

The Importance of Applying for Life Insurance Early

Applying for life insurance early during pregnancy is a strategic move that can significantly enhance your chances of approval and secure lower premiums. Insurers often view early-stage pregnancies as lower risk, provided there are no complicating health issues. By initiating the application process early, pregnant women can avoid potential delays caused by the underwriting evaluations that may arise later in pregnancy due to health changes or complications.

Moreover, early application allows expectant parents to lock in coverage before any pregnancy-related conditions potentially impact their health status. This proactive approach not only provides peace of mind but also ensures that families have the financial protection they need as they prepare for the arrival of their baby. Understanding the timing of your application can be a crucial factor in securing the best possible insurance options.

Navigating Health Considerations in Life Insurance Applications

When applying for life insurance during pregnancy, health and medical history play a pivotal role in the approval process. Insurers typically assess overall health, lifestyle habits, and any pregnancy-related changes that may influence their decision. Expectant mothers should be prepared to provide detailed information about their prenatal care, any complications experienced in previous pregnancies, and their current health status. This transparency is essential for obtaining the best rates and coverage.

Additionally, pregnant women should be aware that certain conditions, such as gestational diabetes or high blood pressure, may require further evaluation by the insurer. It’s advisable to work closely with a knowledgeable insurance agent who can help navigate these complexities and advocate for your best interests. Understanding how health considerations affect life insurance applications can empower expectant mothers to secure the coverage they need.

Key Benefits of Life Insurance for Expectant Parents

Securing life insurance during pregnancy is not just about peace of mind; it also offers critical financial protection for families. In the unfortunate event of a policyholder’s death, life insurance can cover childcare costs, educational expenses, and other household obligations, ensuring that the family can maintain their quality of life. This financial security is especially vital for new parents who are often faced with increased expenses and responsibilities.

Moreover, life insurance provides an opportunity for long-term stability. Expectant parents can align their life insurance policies with their broader financial goals, allowing them to plan for their child’s future with confidence. By understanding the benefits of life insurance, families can make informed decisions that safeguard their loved ones’ financial well-being.

Timing Your Life Insurance Application During Pregnancy

The timing of your life insurance application is crucial, especially during pregnancy. Applying early—preferably in the first trimester—can significantly reduce the risk of delays caused by health evaluations. Insurers are generally more accommodating to applicants in the early stages of pregnancy, making it an ideal time to secure coverage.

On the other hand, applying late in pregnancy, particularly in the third trimester, may pose challenges. Health conditions that arise as the pregnancy progresses can complicate the underwriting process, potentially leading to higher premiums or even denial of coverage. Therefore, careful planning and consideration of when to apply can ensure a smoother experience and provide essential protection for your family.

The Role of Professional Guidance in Securing Life Insurance

Navigating the world of life insurance can be complex, especially for pregnant women. Seeking professional guidance from an experienced insurance agent can be invaluable in understanding the various options available and the nuances of the application process. An agent can provide insights into the best policies for your specific needs, helping you weigh the benefits and costs associated with each option.

Additionally, working with a professional can help you prepare the necessary documentation and information required by insurers. This support is crucial in ensuring that your application is complete and accurate, which can enhance your chances of approval. By partnering with an insurance expert, expectant parents can feel more confident in their choices and secure the financial protection their growing family deserves.

Financial Security for Families with Life Insurance

Life insurance serves as a crucial component of financial security for families, particularly during the transformative period of pregnancy. It ensures that loved ones are financially protected in the face of unforeseen circumstances. For new parents, this added layer of security can alleviate stress and allow them to focus on welcoming their new baby into the world.

Moreover, having life insurance can help families maintain their standard of living, covering expenses such as mortgage payments, childcare, and education costs. This financial planning is essential as parents prepare for the future, allowing them to invest in their child’s upbringing without the added worry of financial strain. Life insurance transforms from a mere policy into a lifeline for families planning for the unexpected.

Reassessing Existing Life Insurance Policies During Pregnancy

If you already have a life insurance policy, pregnancy is an excellent time to reassess your coverage to ensure it meets the evolving needs of your family. As your family grows, so do your financial responsibilities and goals. Reviewing your existing policy can help you determine whether it provides adequate coverage or if adjustments are necessary to account for new family members.

Additionally, changes in your life circumstances, such as the birth of a child, may require you to increase your coverage or explore additional riders for enhanced protection. By taking the time to evaluate your life insurance during pregnancy, you can ensure that you are adequately prepared for the future and that your family’s financial security is prioritized.

Choosing the Right Life Insurance Policy for Your Family

Selecting the right life insurance policy is a critical decision for expectant parents. Factors to consider include the type of policy, coverage amount, and cost of premiums. It’s essential to balance the need for comprehensive coverage with your family’s budget to ensure financial feasibility. Understanding the differences between term and whole life insurance can help you make informed choices that align with your family’s long-term financial goals.

Moreover, consider seeking quotes from multiple insurers to compare policies and find the best fit for your needs. Each insurance company may have different underwriting criteria and premium costs, and shopping around can provide you with options that suit your budget. Taking the time to research and compare can lead to significant savings and better coverage for your family.

Frequently Asked Questions

Can you get life insurance during pregnancy?

Yes, you can get life insurance during pregnancy. Most insurers allow pregnant individuals to apply for policies, especially if there are no significant health complications. Early application is recommended as it often leads to easier approval and potentially lower premiums.

What insurance options are available for pregnant women?

Pregnant women have several insurance options available, including term life insurance and whole life insurance policies. Both options provide financial security for families and can be tailored to meet the specific needs of expectant parents.

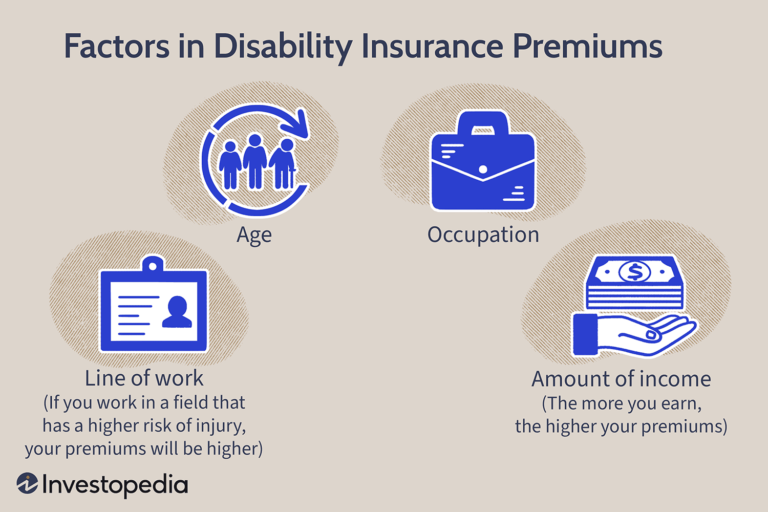

What factors influence the approval of life insurance during pregnancy?

Factors influencing the approval of life insurance during pregnancy include your overall health, medical history, pregnancy-related conditions, and any complications from previous pregnancies. Insurers will evaluate these aspects to determine coverage and premiums.

What are the life insurance benefits for families during pregnancy?

Life insurance benefits for families during pregnancy include financial protection against unforeseen events, coverage for childcare and education expenses, and long-term financial stability. It provides peace of mind knowing your loved ones are safeguarded.

When is the best time to apply for life insurance during pregnancy?

The best time to apply for life insurance during pregnancy is during the early stages, as this reduces the likelihood of delays due to health evaluations. It’s also advisable to review existing policies to ensure they meet the needs of your growing family.

How does applying for life insurance during pregnancy affect premiums?

Applying for life insurance during pregnancy can lead to lower premiums, particularly if done early when health risks are minimal. Insurers tend to offer better rates to younger, healthier applicants, which is beneficial for expectant mothers.

What should you consider when choosing life insurance during pregnancy?

When choosing life insurance during pregnancy, consider your current health status, the type of coverage you need, your family’s financial situation, and any potential pregnancy-related complications. Consulting with a professional can help find the right fit.

Can pregnancy complications affect life insurance applications?

Yes, pregnancy complications can affect life insurance applications. Conditions like gestational diabetes or preeclampsia may require additional medical information and could influence approval timelines or premiums.

| Key Point | Details |

|---|---|

| Can You Get Life Insurance While Pregnant? | Yes, life insurance is generally accessible to pregnant individuals, especially early in pregnancy without major health complications. |

| Factors That Influence Approval | 1. Health and Medical History 2. Pregnancy-Related Changes 3. Previous Pregnancies |

| Benefits of Securing Life Insurance During Pregnancy | – Financial Protection – Long-Term Stability – Lower Premiums |

| When to Apply for Life Insurance | – Apply Early – Review Existing Coverage – Be Cautious in Later Stages |

Summary

Life insurance during pregnancy is a critical consideration for expectant parents looking to secure their family’s financial future. As a significant life event, pregnancy prompts individuals to reflect on their long-term financial planning. Securing a life insurance policy can provide essential financial protection, ensuring that your loved ones are taken care of in unforeseen circumstances. It’s advisable to apply early in the pregnancy to avoid possible delays and complications. By understanding the factors that influence approval and the benefits of obtaining life insurance, expectant parents can make informed decisions that align with their family’s needs.