Life Insurance Benefits: Why It Matters at Every Age

Life insurance benefits play a crucial role in financial planning, offering peace of mind and security for you and your loved ones. Many individuals mistakenly believe that life insurance is only necessary for older adults or those with significant dependents, leading to common life insurance misconceptions that can be easily dispelled. In reality, affordable life insurance options are available, making it accessible for young adults who are just starting their financial journeys. By purchasing life insurance early, you can lock in lower premiums and ensure that your family is protected in the event of an unexpected tragedy. As we explore the various benefits of life insurance, it becomes clear that investing in a policy is a wise decision at any age, particularly for those entering the responsibilities of adulthood.

When discussing the advantages of life coverage, it’s essential to recognize the broader implications of financial protection through insurance policies. These protective measures, often referred to as death benefit policies, are not just for those with families or mortgages; they can also provide a safety net for young individuals embarking on their careers. The importance of securing a policy early cannot be overstated, as individuals in their twenties can find life insurance for young adults to be both economical and beneficial. Moreover, understanding the overall value of purchasing life insurance, including the potential for investment growth and financial stability, can help shift perspectives away from outdated beliefs about its necessity. As we delve deeper into this subject, we will clarify the true nature of life insurance and its essential role in a sound financial strategy.

Understanding Life Insurance Benefits

Life insurance benefits provide financial security and peace of mind for your loved ones in the event of your death. These benefits can cover funeral expenses, outstanding debts, and even everyday living costs, which can be crucial during a time of emotional distress. By investing in a life insurance policy, you ensure that your family is not left with financial burdens that could arise after your passing, allowing them to focus on healing rather than financial struggles.

Moreover, life insurance benefits can serve as a critical component of your financial planning. As you accumulate assets or take on more responsibilities like a mortgage or dependents, having a life insurance policy can safeguard your family’s future. It acts as a financial buffer, providing them with a death benefit that can replace lost income or secure their financial future, ensuring that your loved ones maintain their standard of living even in your absence.

Debunking Life Insurance Misconceptions

Many people hold misconceptions about life insurance that prevent them from considering it. One common myth is that life insurance is only necessary for older individuals or those with dependents. In reality, purchasing life insurance at a younger age can be more beneficial, as premiums are typically lower for younger and healthier individuals. This misconception overlooks the fact that unexpected events can happen at any age, and having a policy in place can provide essential financial protection.

Another prevalent misconception is that life insurance is too expensive. In fact, many individuals overestimate the cost of life insurance premiums. Research indicates that approximately 80% of people believe life insurance is more expensive than it truly is. By shopping around and comparing policies, many can find affordable life insurance options tailored to their financial situation, making it a viable choice for anyone regardless of age.

Affordable Life Insurance Options for Young Adults

Young adults often overlook the importance of life insurance, assuming it’s an unnecessary expense. However, affordable life insurance options are available that cater specifically to this demographic. By securing a policy early, young adults can lock in lower premium rates and avoid the increased costs associated with aging or developing health issues. This proactive approach not only provides peace of mind but can also be a wise financial investment as it builds a safety net for unforeseen circumstances.

Additionally, young adults may not realize that life insurance can serve dual purposes. Some policies accumulate cash value over time, which can be accessed later for emergencies or significant life events, such as buying a home or funding education. Therefore, investing in affordable life insurance in your 20s or early 30s can be a strategic move that offers both immediate and long-term financial benefits.

The Importance of Life Insurance for Young Families

For young families, life insurance becomes even more critical as they navigate new responsibilities. If one parent were to pass away unexpectedly, the financial strain could be overwhelming, especially if there are children involved. Life insurance can provide a safety net, ensuring that the surviving parent and children have the necessary financial support to cover living expenses, education, and other essential costs. This protection is especially vital during the formative years of a child’s life.

Furthermore, securing life insurance when you are younger and healthier often means lower premium rates. This affordability allows young families to invest in a policy that can grow with them as their financial needs change. As families expand and expenses increase, having life insurance in place can offer reassurance that, regardless of what happens, their loved ones will be cared for financially.

Building Wealth with Life Insurance

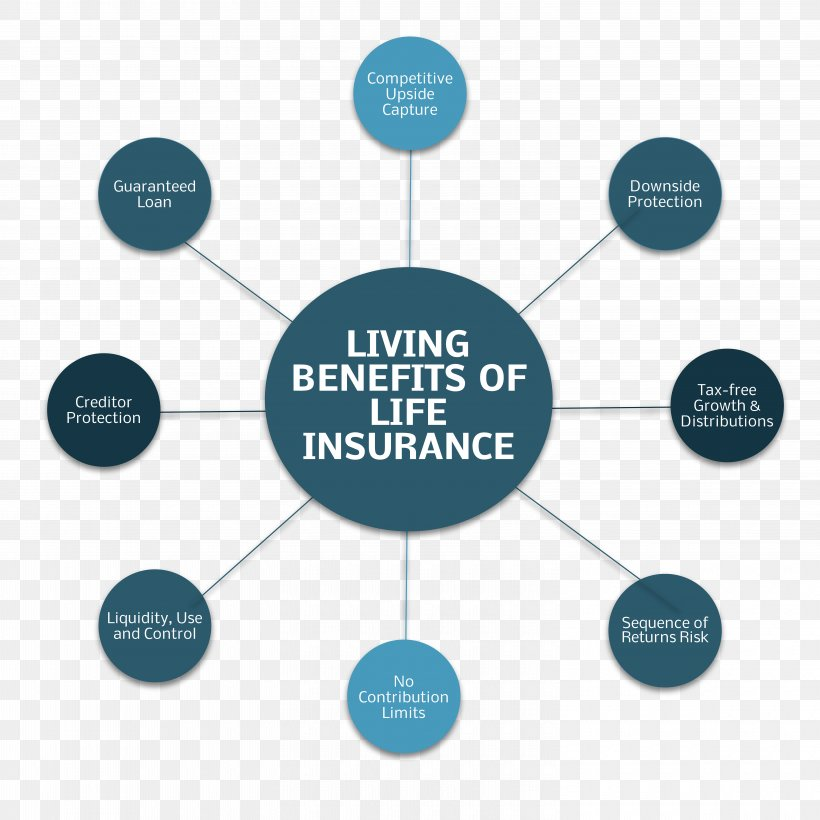

Life insurance is often viewed solely as a protective measure, but it can also play a role in wealth building. Certain types of life insurance policies, such as whole life or universal life insurance, have a cash value component that grows over time. This cash value can be borrowed against or withdrawn in the future, providing a source of funds for major life events, such as buying a home or funding college tuition. Thus, life insurance can be an integral part of a comprehensive financial strategy.

Additionally, as you continue to build wealth, life insurance can ensure that your assets are protected and passed on to your beneficiaries without the complications of probate. This feature makes it a valuable tool for estate planning, allowing you to leave a financial legacy while also safeguarding your loved ones from potential financial hardship.

Life Insurance for Seniors: A Vital Financial Tool

Seniors often underestimate the importance of life insurance, thinking it is too late for them to purchase a policy. However, life insurance remains a vital financial tool for those aged 60 and up. It can cover final expenses, such as medical bills and funeral costs, alleviating the financial burden on family members during a difficult time. Additionally, having a policy can ensure that any outstanding debts are settled, preventing financial strain on loved ones.

Moreover, life insurance can serve as a strategic asset for seniors looking to leave a legacy. Many life insurance policies offer options for tax-free payouts to beneficiaries, making it an efficient way to transfer wealth to the next generation. This financial planning ensures that aging individuals can support their family members even after they are gone, retaining their peace of mind about their family’s financial future.

Understanding the Benefits of Life Insurance Over Time

The benefits of life insurance evolve as you progress through different life stages. In your 20s, it can provide financial security and peace of mind, while in your 30s and 40s, it becomes crucial for protecting growing families and new financial responsibilities. By understanding the shifting benefits of life insurance, individuals can make informed decisions that align with their current needs and future aspirations.

Additionally, reviewing your life insurance policy periodically ensures that it reflects your current financial situation and goals. Life events such as marriage, the birth of a child, or changes in income can all impact the type and amount of coverage you need. Regularly assessing your policy allows you to adapt to these changes and ensure that your loved ones are always protected.

The Role of Life Insurance in Financial Planning

Incorporating life insurance into your financial planning is essential for ensuring comprehensive coverage. It acts as a safety net for unexpected events and can complement other financial strategies, such as retirement savings or investment portfolios. By considering life insurance as part of your overall financial plan, you create a more secure future for yourself and your family.

Furthermore, life insurance can provide additional financial flexibility. For instance, certain policies allow you to take loans against the cash value of your policy, providing a source of funds for emergencies or significant investments. This versatility makes life insurance not just a protective measure, but also a valuable financial asset that can enhance your overall wealth strategy.

Key Considerations When Buying Life Insurance

When purchasing life insurance, it’s crucial to consider your individual needs and circumstances. Factors such as age, health, financial obligations, and the number of dependents will influence the type and amount of coverage you require. Understanding these elements helps you choose the right policy that aligns with your financial goals and provides adequate protection for your loved ones.

Additionally, comparing different life insurance policies and providers can help you find the best rates and coverage options. Many people mistakenly believe that all life insurance policies are the same, but there are various types, such as term life and whole life policies, each with distinct features and benefits. Conducting thorough research and seeking professional advice can lead to informed decisions that ultimately safeguard your family’s financial future.

Frequently Asked Questions

What are the key benefits of life insurance for young adults?

Life insurance offers several key benefits for young adults, including lower premium rates, financial protection for loved ones, and the ability to lock in coverage while healthy. Young adults often underestimate the importance of life insurance, but it can provide peace of mind and financial stability in unexpected situations.

Why is it important to understand life insurance misconceptions?

Understanding life insurance misconceptions is crucial because it helps individuals make informed decisions about their financial planning. Many people believe life insurance is only necessary for older individuals or that it is too expensive. In reality, affordable life insurance options exist, and securing coverage at a younger age can provide significant long-term benefits.

How can life insurance serve as an investment option for young professionals?

Life insurance can act as a valuable investment option for young professionals by providing financial protection while accumulating cash value over time. Certain policies, like whole life insurance, can grow in value and serve as a savings tool, aiding in future financial goals while ensuring loved ones are protected.

What are the long-term benefits of life insurance as you age?

The long-term benefits of life insurance increase as you age, including providing financial security for dependents, covering outstanding debts, and assisting with funeral costs. Additionally, life insurance can help in wealth transfer to beneficiaries, ensuring a tax-efficient legacy for future generations.

How does buying life insurance at a younger age affect premium costs?

Buying life insurance at a younger age typically results in lower premium costs. Insurance companies consider younger individuals to be lower risk, allowing them to lock in more affordable rates before health issues arise, making it a financially sound decision.

What are the common financial obligations that life insurance can help cover?

Life insurance can help cover a variety of financial obligations, including mortgage payments, funeral expenses, and educational costs for children. It ensures that loved ones are not burdened with these expenses in the event of the policyholder’s untimely death.

Why should seniors consider maintaining life insurance policies?

Seniors should consider maintaining life insurance policies to cover outstanding debts, final expenses, and potential long-term care costs. Additionally, life insurance can provide a means to pass on wealth to beneficiaries, ensuring financial support for loved ones.

What is the significance of purchasing life insurance in your 30s?

Purchasing life insurance in your 30s is significant because it often coincides with major life milestones such as marriage and homeownership. At this age, individuals are likely to have dependents relying on them financially, making life insurance essential for protecting their family’s future.

How can life insurance provide peace of mind throughout different life stages?

Life insurance provides peace of mind by ensuring financial stability for your loved ones in case of unexpected events. Regardless of your stage in life—from young adulthood to retirement—having life insurance allows you to focus on enjoying life, knowing that your family is protected.

What factors should one consider when buying life insurance?

When buying life insurance, consider factors such as your age, health status, financial obligations, and the needs of your dependents. It’s crucial to assess how much coverage you require and choose a policy that fits your budget and long-term financial goals.

| Age Group | Key Benefits | Misconceptions |

|---|---|---|

| 20s | Lock in lower premiums while young and healthy; provides financial protection for loved ones. | You don’t need insurance yet. |

| 30s | Essential for those with dependents; ensures financial stability for family. | Insurance is too expensive. |

| 40s | Protects family and assets; addresses increasing health concerns. | You can wait until you’re older. |

| 50s | Important for retirement planning and covering big expenses. | It’s too late to get coverage. |

| 60s and up | Covers final expenses; can aid in wealth transfer and long-term care. | You don’t need insurance at this age. |

Summary

Life insurance benefits extend beyond just the final expenses; these policies provide financial security and peace of mind at every stage of life. Whether you’re in your 20s or a senior, having life insurance ensures that your loved ones are protected financially, allowing you to focus on living your life without the worry of unforeseen circumstances. The right life insurance policy can be a crucial part of your financial strategy, helping to cover debts, funeral costs, and even future expenses like children’s education. Therefore, investing in life insurance is a wise decision that can yield significant benefits for you and your family.