E&O Claims: Effective Strategies to Mitigate Risks

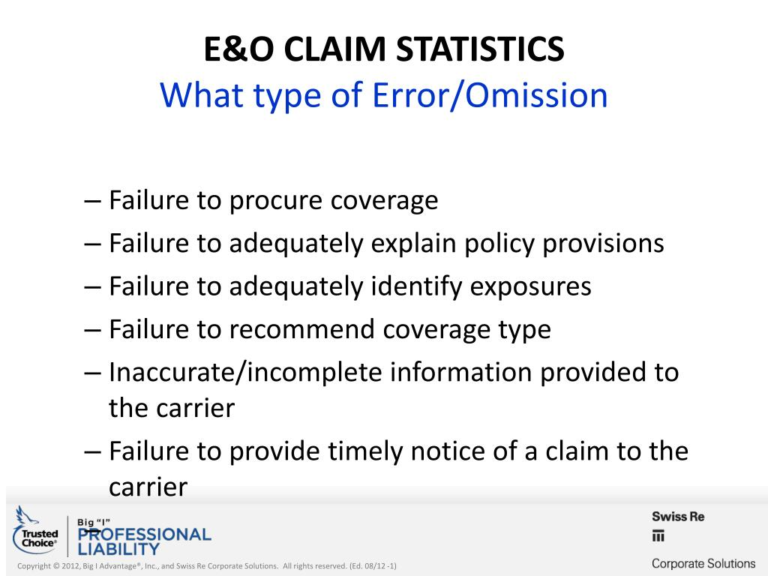

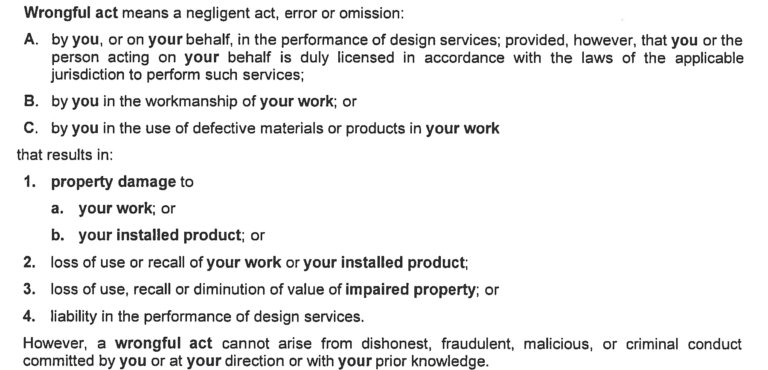

E&O claims, short for errors and omissions claims, represent a significant threat to businesses, particularly in sectors that provide professional services such as consulting, legal, and insurance.These claims typically arise when clients assert that a service provider has failed to fulfill their professional obligations or has made critical mistakes that led to financial losses.