Job Change Insurance Coverage: What You Need to Know

Are you considering a job change? If so, understanding job change insurance coverage is crucial to ensure you maintain your financial security during this transition. With the average worker changing jobs every few years, it’s essential to know how your insurance benefits, including health insurance and life insurance, may be affected. Transitioning to a new job can bring exciting opportunities, but it can also leave you vulnerable if you lose your previous coverage. This article will guide you through the intricacies of job change insurance coverage and help you navigate your options effectively.

When embarking on a new career path, many individuals ponder the implications of their insurance policies, often referred to as new job insurance. As you navigate a job transition, it’s vital to assess how this shift may impact your existing insurance benefits, particularly regarding health and life insurance. Understanding your options allows you to make informed decisions about your coverage, ensuring continuity and financial protection. This discussion will explore essential aspects of insurance during job changes, such as the potential loss of employer-sponsored plans and the availability of alternative coverage. By grasping these concepts, you can better prepare for the changes ahead and secure the insurance benefits that best suit your needs.

Understanding Job Change Insurance Coverage

When transitioning to a new job, one of the most critical aspects to consider is how job change insurance coverage may affect you. Many employees do not realize that their insurance benefits can significantly vary between employers, and understanding these changes can help you make informed decisions. If your previous position offered comprehensive health and life insurance, losing those benefits could leave you vulnerable during a crucial transition period. It’s essential to inquire about the continuity of any current insurance policies and whether they are portable to your new role.

Moreover, when evaluating a new job offer, it’s wise to thoroughly assess the insurance benefits being provided. Some companies may offer robust health insurance plans or even subsidized life insurance, which could be advantageous compared to what you had previously. Take the time to compare the insurance coverage at your new job with what you had before, ensuring that your needs are met without significant gaps during this transition. Understanding your options can provide peace of mind as you navigate the uncertainties of a new employment journey.

The Importance of Health Insurance During Job Transition

Health insurance is often a top priority for employees considering a job change. During a period of transition, it’s vital to ensure that you have continuous coverage to avoid any lapses that could lead to increased medical costs. If you’re relying on your employer for health insurance, be aware of how your new employer’s plan compares to your previous one. Investigate the premiums, deductibles, and coverage options available to you to determine how they align with your healthcare needs.

Additionally, if you are leaving a job that provided health insurance, make sure to ask about COBRA options, which may allow you to extend your previous coverage for a limited time. This can be especially beneficial if there is a gap between your old job and the start date of your new position. Understanding your rights and options regarding health insurance during a job transition is crucial for maintaining your wellbeing and ensuring that you have access to necessary medical care.

Evaluating Life Insurance Options with a New Employer

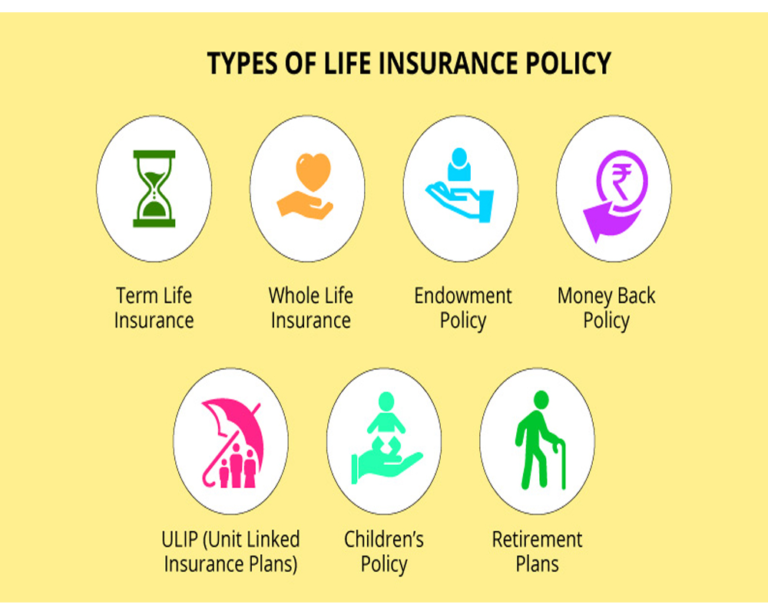

As you embark on your new job, evaluating the life insurance options provided by your employer is essential. Life insurance can offer financial security for your loved ones in the event of your untimely passing, and different employers may provide varying levels of coverage. Ask your new HR department to clarify the specifics of the life insurance policies available, including the amount of coverage, premium costs, and any waiting periods.

It’s also worth considering whether the life insurance offered is sufficient for your family’s needs. Many employer-sponsored life insurance plans only provide coverage equal to one or two times your salary, which may not be adequate. In some cases, it might be wise to supplement your employer-provided policy with an individual life insurance plan that you own, ensuring coverage that remains with you regardless of your employment status.

Common Questions About Insurance Benefits in New Jobs

When starting a new job, it’s essential to ask the right questions regarding insurance benefits. Inquire about what types of insurance are offered, including health, dental, and disability insurance, as well as any additional options like accident coverage or reimbursement plans. This information can provide clarity on how your insurance needs will be met.

Furthermore, don’t hesitate to request a detailed summary of the life insurance options available. Understand the terms of coverage, potential exclusions, and whether a medical exam is required. Knowing these details can empower you to make informed decisions about your insurance needs and ensure that you select a plan that best supports your financial security and wellbeing.

The Role of Enrollment Periods in Job Transition Insurance

Enrollment periods are a critical consideration when changing jobs, as they dictate when you can sign up for company-sponsored insurance plans. Most employers have specific windows during which new employees can enroll in benefits, typically around 30 to 90 days from the eligibility start date. Missing this window could leave you without coverage until the next enrollment period, which may not align with your needs.

It’s vital to understand the implications of these enrollment periods and plan accordingly. Ask your HR representative about key dates and whether there are any options for late enrollment due to special circumstances. Being proactive about enrollment can prevent potential gaps in critical insurance benefits, ensuring you receive the protection you need during your transition.

Understanding Employer Contributions to Insurance Premiums

One of the significant advantages of employer-sponsored insurance is the potential for employer contributions towards your premiums. Many companies offer to cover a portion, if not all, of the premiums for basic health insurance plans, making coverage more affordable for employees. When reviewing your new job’s benefits package, inquire about how much your employer will contribute to different types of coverage.

Understanding the structure of premium payments is essential for budgeting your finances effectively. Ask how payments will be deducted from your paycheck and whether the employer offers various plan options at different price points. This knowledge can help you develop a strategy for your insurance needs and financial planning, allowing you to effectively manage your expenses while maximizing your coverage.

The Impact of Job Changes on Disability Insurance

Disability insurance is another critical benefit that often changes with a new job. If your previous employer provided a group disability insurance plan, you may lose that coverage upon leaving the company. It’s essential to assess whether your new employer offers disability insurance and what the terms are, including waiting periods, coverage amounts, and the definition of disability.

In some cases, you may also have the option to convert your group disability policy to an individual plan, which can offer continued protection. However, be aware that premiums may increase significantly. As you transition, evaluate your disability insurance needs and consider whether an individual policy might be beneficial for your long-term financial security.

Strategies for Managing Insurance During Job Transitions

Managing your insurance coverage during a job transition requires careful planning and consideration. Start by reviewing your current insurance policies and understanding what will happen to them when you leave your job. If your coverage is tied to your employer, take the time to explore your options for portability or conversion to individual plans.

Next, when evaluating your new job’s benefits, compare the insurance offerings with your previous employer’s plan. Consider factors such as cost, coverage levels, and any additional options that may be available. Developing a strategy for insurance management can help you maintain adequate coverage and avoid potential gaps that could leave you financially vulnerable.

The Importance of Individual Insurance Policies

While employer-sponsored insurance plans are often beneficial, relying solely on them could expose you to risks, especially during job transitions. Individual insurance policies, such as health, life, and disability insurance, remain with you regardless of your employment status. This security can be invaluable during periods of change when you may be vulnerable to gaps in coverage.

Investing in individual insurance policies can provide peace of mind, ensuring that you and your family are protected no matter where your career takes you. As you navigate job changes, consider the long-term benefits of maintaining your own insurance coverage, which can complement any employer-sponsored plans you may have and offer comprehensive protection.

Frequently Asked Questions

What happens to my job change insurance coverage when I leave my current job?

When you leave your current job, your employer-sponsored insurance coverage typically ends. However, if your insurance is through a spouse’s plan or an independent agent, it remains intact. It’s essential to check with your HR department about the portability of your benefits, as some plans may allow you to keep coverage by converting it to an individual policy, albeit at a potentially higher cost.

How do I ensure I have adequate health insurance during a job transition?

To ensure adequate health insurance during a job transition, inquire about the health benefits offered by your new employer. Ask about coverage details, enrollment periods, and whether there are waiting periods. Additionally, consider maintaining an individual health insurance plan to bridge any gaps in coverage between jobs.

What should I consider when evaluating life insurance options during a job change?

When evaluating life insurance options during a job change, ask your new employer about the specifics of their life insurance benefits, including coverage limits, premium costs, and whether a medical exam is required. It’s wise to compare these options with individual life insurance policies that provide coverage regardless of your job status.

Is it possible to keep my life insurance coverage when changing jobs?

Yes, it’s possible to keep your life insurance coverage when changing jobs if your current plan is portable. Check with your HR department for options to convert your group policy to an individual one. However, be aware that this may increase your premiums.

What questions should I ask about insurance benefits when starting a new job?

When starting a new job, ask about the types of insurance benefits available, including health, dental, life, and disability insurance. Inquire about the specifics of each plan, the enrollment period, and how premiums will be paid. Understanding these details will help you make informed decisions about your insurance coverage.

Are there any enrollment periods I should be aware of for insurance benefits at my new job?

Yes, most employers have specific enrollment periods for insurance benefits, typically ranging from 30 to 90 days from your eligibility start date. Missing this period may delay your coverage until the next enrollment opportunity, so it’s crucial to be aware of these timelines to ensure you have the necessary insurance.

How can I manage my insurance premiums when transitioning to a new job?

To manage your insurance premiums during a job transition, discuss payment options with your new employer. Some plans may be partially funded by the employer, reducing your out-of-pocket costs. Consider starting with a lower-cost plan and reassess your coverage annually to align with your changing financial situation and job income.

What are the risks of not having insurance coverage during a job change?

The risks of not having insurance coverage during a job change include the potential for high medical expenses or lack of financial protection in case of unforeseen events, such as illness or accidents. Maintaining continuous coverage through an individual policy or ensuring prompt enrollment in your new employer’s plan can help mitigate these risks.

Can I keep my disability insurance when changing jobs?

Whether you can keep your disability insurance when changing jobs depends on the terms of your current policy. Some employer-sponsored disability insurance plans are not portable. Check with HR about your options, as you may need to convert your group policy to an individual one.

What types of insurance benefits should I prioritize when starting a new job?

When starting a new job, prioritize essential insurance benefits such as health insurance for medical needs, life insurance for financial security of your dependents, and disability insurance for income protection in case of injury or illness. Evaluate each benefit’s coverage and costs to make informed decisions.

| Key Point | Explanation |

|---|---|

| Job Change Frequency | Employees typically change jobs every four years, impacting their insurance coverage. |

| Insurance Coverage Loss | Leaving a job may result in losing employer-sponsored insurance unless it’s portable. |

| Questions to Ask | Inquire about insurance benefits, life insurance options, enrollment periods, and payment structures. |

| Employer Differences | Insurance benefits vary widely between employers; understanding these differences is crucial. |

| Personal Insurance Options | Consider individual insurance policies as a backup, regardless of employer offerings. |

Summary

Job change insurance coverage is a critical aspect to consider when transitioning to a new job. Employees often overlook the implications of their insurance benefits when leaving one job for another. It’s essential to understand what happens to your existing coverage, inquire about new benefits, and assess the overall insurance landscape to ensure you maintain adequate coverage throughout your career. By asking the right questions and being proactive, you can navigate these changes effectively and secure the best insurance options available.