Insurance Sales: Effective Strategies for Success

Insurance sales is a dynamic and rewarding field that presents numerous opportunities for motivated individuals. With a blend of effective insurance selling strategies and deep product knowledge, aspiring agents can carve out successful careers while helping clients protect what matters most. In this blog post, we will delve into proven selling insurance tips and essential insurance sales techniques that can elevate your performance and client satisfaction. By equipping yourself with the right tools and insights, you can navigate the complexities of this industry and achieve your goals. Whether you’re a seasoned professional or just starting, understanding the nuances of insurance sales is crucial for long-term success.

The realm of selling insurance encompasses a variety of practices aimed at guiding clients toward suitable coverage options. Whether you refer to it as insurance brokerage, policy sales, or risk management consultations, the essence remains the same: providing clients with protection and peace of mind. This industry requires a unique approach, as insurance products are intangible and often misunderstood. Mastering the art of insurance sales involves not only grasping the intricacies of various policies but also employing strategic communication to instill trust and confidence in prospective customers. As we explore this subject, we will highlight key tactics and insights that can pave the way for fruitful engagements in this vital sector.

The Role of Insurance Sales in the Economy

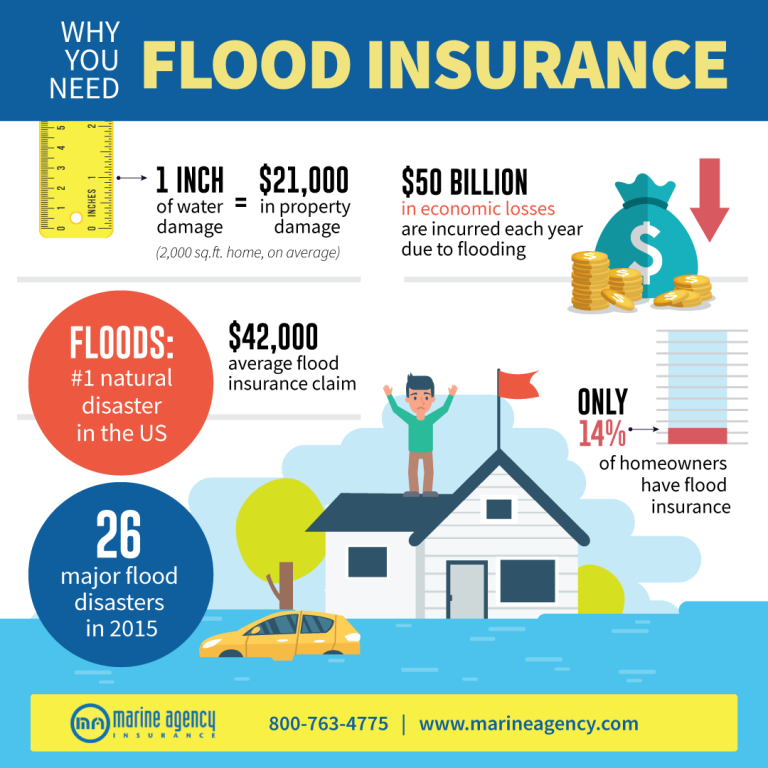

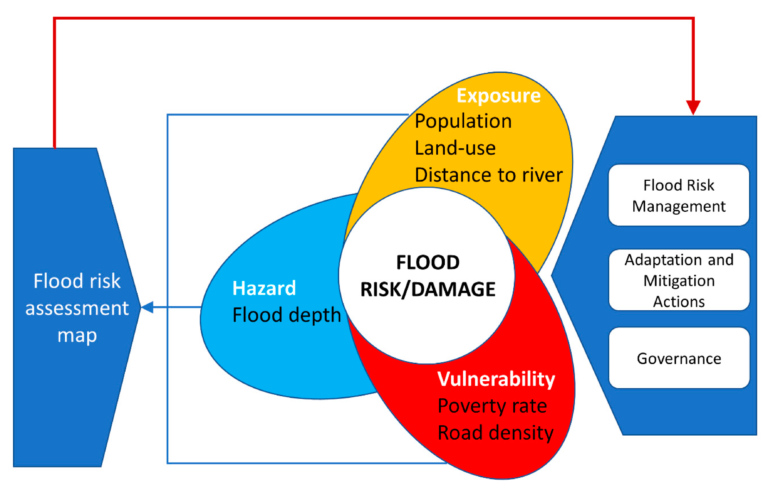

Insurance sales serve as a crucial pillar in the economy, providing financial security and risk management solutions for both individuals and businesses. By offering protection against unforeseen events, insurance products help mitigate financial uncertainties, enabling clients to manage their assets more effectively. Moreover, the insurance sales industry generates employment opportunities, contributing to economic growth and stability. Through the efforts of insurance agents, consumers are educated about the benefits of various insurance products, which fosters a more financially literate society.

Additionally, the revenue generated from insurance sales not only supports the livelihood of agents but also fuels the broader economy. The funds collected through premiums are often invested in various sectors, promoting infrastructure development and stimulating economic activity. As consumers gain confidence in their insurance coverage, they are more likely to invest in other areas of their lives, such as purchasing homes or starting businesses. Thus, the impact of insurance sales extends far beyond individual transactions, shaping the economic landscape.

Mastering Unique Selling Techniques in Insurance Sales

Selling insurance requires specialized techniques that differ from traditional sales methods. One significant aspect of successful insurance sales is the ability to establish trust and credibility with potential clients. Prospective buyers often hesitate to invest in insurance products due to their intangible nature, making it essential for agents to communicate the value and benefits clearly. Utilizing storytelling techniques and sharing testimonials from satisfied clients can help build rapport and alleviate concerns, ultimately leading to increased sales.

In addition, understanding the nuances of various insurance products is vital for agents. This knowledge allows them to tailor their sales pitch to address the specific needs of each client, enhancing the likelihood of a successful conversion. By actively listening to clients’ concerns and customizing solutions based on their unique situations, agents can demonstrate their expertise and commitment to customer satisfaction. This personalized approach not only improves sales outcomes but also fosters long-term relationships, encouraging repeat business and referrals.

Navigating the Challenges of Insurance Sales

Insurance sales can present a myriad of challenges, particularly in a competitive market where consumers are bombarded with options. One of the primary obstacles agents face is overcoming client objections, whether related to pricing, coverage, or the perceived need for insurance. Effective sales techniques involve anticipating these objections and preparing thoughtful responses that address clients’ concerns. By demonstrating empathy and providing clear, factual information, agents can help clients make informed decisions.

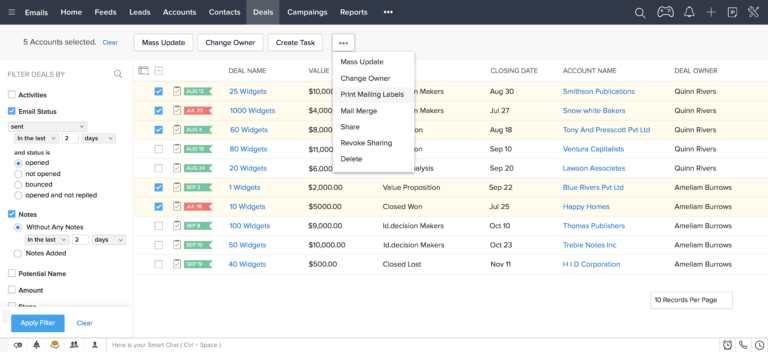

Moreover, the administrative burden associated with insurance sales can be daunting. Agents must manage extensive paperwork, compliance requirements, and ongoing training to stay updated on industry changes. To navigate these challenges successfully, it is crucial for agents to implement efficient systems and processes. Utilizing technology, such as CRM software, can streamline administrative tasks and allow agents to focus on building relationships with clients and closing sales.

Building a Strong Foundation for Insurance Sales Success

Establishing a solid foundation is crucial for any insurance agent looking to succeed in sales. Understanding the target market is a pivotal first step in this process. By conducting thorough research to identify potential customers’ needs and preferences, agents can tailor their sales strategies to resonate with their audience. This targeted approach not only enhances the effectiveness of marketing efforts but also increases the chances of converting leads into clients.

Additionally, agents must define their unique selling proposition (USP) to differentiate themselves from competitors. By clearly articulating what sets their offerings apart—be it exceptional customer service, specialized knowledge, or innovative products—agents can effectively attract clients. This clarity helps reinforce the agent’s value in the eyes of potential customers and establishes a competitive edge in the marketplace.

Enhancing Insurance Sales with Effective Marketing Strategies

In the digital age, leveraging marketing strategies is essential for success in insurance sales. Utilizing social media platforms such as Facebook and LinkedIn can expand an agent’s reach, allowing them to connect with potential clients on a personal level. By sharing valuable content, engaging in discussions, and showcasing success stories, agents can build a positive online presence that fosters trust and encourages inquiries.

Moreover, digital marketing techniques such as search engine optimization (SEO) can significantly enhance visibility. By optimizing web content with relevant keywords related to insurance products, agents can attract organic traffic to their websites. This increased exposure not only boosts brand awareness but also positions agents as knowledgeable authorities in the insurance industry, further enhancing their credibility.

Leveraging Referrals for Growth in Insurance Sales

Referrals are a powerful tool in the insurance sales arsenal. Satisfied customers often become advocates for agents, sharing their positive experiences with friends and family. To capitalize on this, agents should implement referral programs that incentivize existing clients to refer new business. This not only rewards loyal customers but also expands the agent’s network of potential leads, ultimately driving sales growth.

Additionally, following up with clients after a sale is critical in fostering these referral relationships. Regular check-ins, newsletters, and personal touches can keep agents top-of-mind, encouraging clients to recommend them to others. By consistently delivering exceptional service and maintaining communication, agents can cultivate a referral-friendly environment that leads to a steady stream of new business.

Tracking Success: Key Performance Indicators in Insurance Sales

To ensure continued success in insurance sales, agents must implement a system for tracking key performance indicators (KPIs). Metrics such as sales revenue, conversion rates, and customer retention rates provide valuable insights into the agent’s performance. By regularly analyzing these indicators, agents can identify strengths and weaknesses in their sales strategies and make informed adjustments to improve their overall effectiveness.

Furthermore, setting specific sales goals aligned with these KPIs can drive motivation and focus. For instance, aiming to increase the number of policies sold or reduce the sales cycle time can provide clear targets for agents to strive towards. By maintaining accountability and regularly reviewing progress, agents can stay on track and continuously enhance their insurance sales techniques.

The Future of Insurance Sales: Embracing Technology

As the insurance industry evolves, technology plays an increasingly vital role in shaping sales strategies. Tools such as CRM systems, automated marketing platforms, and data analytics can streamline processes, enhance customer interactions, and provide insights into market trends. Embracing these technologies not only improves efficiency but also positions agents to meet the changing demands of consumers.

Moreover, staying abreast of emerging technologies, such as artificial intelligence and machine learning, can give agents a competitive edge. These advancements can help personalize customer experiences, predict purchasing behaviors, and enhance lead generation strategies. By adapting to the digital landscape, insurance sales professionals can effectively navigate the future of the industry and continue to thrive.

Developing a Comprehensive Insurance Sales Training Program

Investing in a comprehensive training program for insurance sales teams is essential for long-term success. This training should encompass not only product knowledge and sales techniques but also industry regulations and compliance requirements. By equipping agents with the necessary tools and resources, organizations can foster a team of knowledgeable and confident sales professionals.

Additionally, ongoing training and development initiatives can help agents stay current with industry trends and evolving consumer needs. Regular workshops, webinars, and mentorship programs can provide agents with fresh insights and strategies to enhance their sales techniques. By prioritizing continuous learning, companies can ensure their sales teams remain competitive and effective in the dynamic insurance landscape.

Frequently Asked Questions

What are some effective insurance selling strategies for new agents?

New insurance agents can adopt several effective selling strategies to establish themselves in the industry. Firstly, understanding your target market is crucial; conduct thorough research to identify customer needs and preferences. Secondly, leverage digital marketing and social media to reach potential clients and showcase your unique selling proposition. Additionally, creating a sense of urgency in your sales pitches can encourage quicker decisions from prospects. Lastly, building trust through transparency and exceptional customer service will foster long-term relationships and referrals.

How can I improve my insurance sales techniques?

Improving your insurance sales techniques involves continuous learning and adaptability. Focus on honing your communication skills to explain complex insurance products clearly. Attend workshops or online courses to stay updated on industry trends and regulations. Additionally, practice active listening to better understand customer objections, which allows you to tailor your responses effectively. Utilizing CRM tools like InsuredMine can also help you track customer interactions and follow up efficiently, ultimately enhancing your sales performance.

What are some selling insurance tips for overcoming customer objections?

Overcoming customer objections is a vital skill in insurance sales. Start by acknowledging the customer’s concerns and actively listening to their objections. Use empathetic language to build rapport and trust. Provide clear and factual information that addresses their worries, emphasizing the benefits and value of the insurance products. Additionally, share testimonials or case studies from satisfied customers to reinforce credibility. Offering personalized solutions can also demonstrate your commitment to meeting their specific needs.

What makes successful insurance sales different from other sales?

Successful insurance sales differ from other types of sales primarily due to the intangible nature of insurance products. Customers cannot physically see or touch what they are purchasing, which requires agents to build trust and credibility. Additionally, insurance sales often involve complex regulations and a longer sales cycle, as clients may need time to understand their options. Agents must be adept at educating clients on policy details and benefits while addressing their unique concerns and financial situations.

How can I track and measure success in my insurance sales?

Tracking and measuring success in insurance sales can be done through key performance indicators (KPIs). Focus on metrics such as sales revenue, the number of policies sold, customer acquisition costs, and conversion rates. Regularly analyze these data points to identify trends and areas for improvement. Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals can also help keep you focused on your sales objectives. CRM systems like InsuredMine can streamline this process, providing insights into your sales performance.

What role does digital marketing play in insurance sales?

Digital marketing plays a crucial role in insurance sales by expanding your reach to potential customers and enhancing brand visibility. Utilizing social media platforms and online advertisements can attract new leads who may not be accessible through traditional marketing methods. Email marketing campaigns can keep your audience informed about new products or updates, while search engine optimization (SEO) techniques can improve your website’s visibility in search results. By integrating digital marketing strategies, insurance agents can effectively engage with clients and drive sales.

What are the best insurance sales strategies for life insurance?

The best insurance sales strategies for life insurance include understanding your clients’ needs and providing tailored solutions. Focus on educating clients about the different types of life insurance products, highlighting the financial security and peace of mind they offer. Establishing trust is critical; be transparent about policy details and address any concerns. Additionally, utilizing storytelling to illustrate real-life scenarios can make the benefits of life insurance more relatable and compelling for potential customers.

How can referrals enhance my insurance sales?

Referrals can significantly enhance insurance sales by leveraging the trust that satisfied customers have established with their friends and family. Happy clients are often willing to recommend your services if they had a positive experience. To encourage referrals, ensure you provide exceptional customer service and maintain ongoing communication with your clients. Consider implementing a referral program that rewards customers for bringing in new business, which can further incentivize them to share your services.

What challenges do insurance agents face in selling insurance?

Insurance agents face several challenges, including customer reluctance to purchase insurance due to misconceptions about its necessity or affordability. The complexity and variety of insurance products can also pose difficulties in effectively communicating benefits to potential clients. Additionally, agents must navigate the competitive landscape and keep up with changing regulations and market trends. Managing administrative tasks and paperwork can be time-consuming, detracting from time spent on selling. Developing strong insurance selling strategies can help mitigate these challenges.

What are some successful insurance sales techniques for commercial insurance?

Successful insurance sales techniques for commercial insurance involve a deep understanding of the unique needs of businesses. Begin by conducting thorough assessments of potential clients’ risk profiles and tailor your offerings accordingly. Clearly communicate the benefits of commercial insurance, such as risk management and employee protection. Building long-term relationships through regular follow-ups and providing excellent customer service can also position you as a trusted advisor in the eyes of business owners.

| Key Points | Details |

|---|---|

| The Importance of Insurance Sales | Insurance sales protect individuals and businesses from financial risks and stimulate economic growth. |

| Why Selling Insurance is Different | Insurance products are intangible and involve complex regulations, making them unique to sell. |

| The Challenges of Selling Insurance | Customers may be hesitant to buy; agents face administrative tasks and must adapt to regulatory changes. |

| Setting the Foundation | Establish a strong foundation by understanding your market and defining your sales process. |

| Sales Techniques and Strategies | Focus on building trust, creating urgency, overcoming objections, and leveraging referrals. |

| Utilizing Digital Marketing | Use social media and digital channels to reach potential customers effectively. |

| Tracking and Measuring Success | Set goals, measure performance, and analyze KPIs to improve sales strategies. |

Summary

Insurance sales is a vital career path that offers lucrative opportunities for skilled individuals. Mastering insurance sales involves understanding the unique challenges of selling intangible products, building trust with clients, and employing effective sales strategies. By leveraging digital marketing, understanding customer needs, and continuously measuring performance, insurance sales professionals can thrive in this competitive industry.