Insurance Marketing: Advantages and Disadvantages Explored

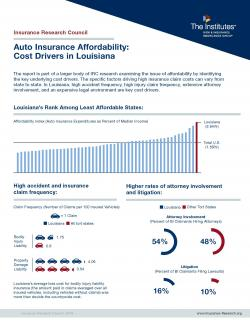

Insurance marketing is an essential aspect of the insurance industry that directly influences how potential clients perceive and engage with insurance products. With a staggering 69% of consumers in the U.S. searching online for insurance before contacting a broker, understanding the nuances of insurance marketing strategies has never been more critical. These statistics highlight the role of insurance marketing in effectively reaching a broad audience while illuminating both its advantages and disadvantages. By leveraging various advertising channels and digital platforms, insurers can educate consumers about the importance of coverage, ultimately leading to improved economic stability. However, this dynamic landscape also necessitates a conversation about the ethical implications and potential pitfalls of aggressive marketing tactics.

Promoting insurance products effectively involves a range of techniques and methodologies that fall under the umbrella of insurance promotion. This domain encompasses the strategic communication of insurance benefits to potential clients, aimed at enhancing awareness and understanding of various policies. As the digital landscape evolves, the significance of insurance promotion has grown, influencing consumer behavior and decision-making. Analyzing how these promotional strategies affect different demographics can shed light on the broader implications for both insurers and clients. Thus, a comprehensive exploration of this topic is crucial for ensuring that marketing efforts align with ethical standards and adequately address consumer needs.

The Importance of Insurance Marketing in Today’s Economy

Insurance marketing plays a pivotal role in today’s economy, particularly in the United States, where a significant portion of the population relies on various forms of insurance for financial security. As highlighted by recent statistics, a staggering 69% of consumers conduct online searches for insurance before even consulting an agent. This underscores the necessity for insurance companies to engage effectively through digital marketing strategies that not only raise awareness but also educate potential customers on the diverse insurance products available to them.

Moreover, the advantages of insurance marketing extend beyond mere consumer awareness. By utilizing targeted campaigns and leveraging data analytics, insurers can identify and reach specific demographics, ensuring that they provide tailored solutions that meet the unique needs of their clients. This strategic approach not only enhances customer satisfaction but also fosters trust and loyalty, which are essential for long-term business success.

Frequently Asked Questions

What are the advantages of insurance marketing?

The advantages of insurance marketing include increased awareness and education about the importance of insurance coverage, the expansion of the customer base through targeted strategies, consumer customization of insurance products based on specific needs, an improved competitive environment leading to better coverage options, and enhanced economic stability as more individuals obtain adequate insurance.

What are the disadvantages of insurance marketing?

Disadvantages of insurance marketing can include the potential for misleading information in campaigns, an overemphasis on sales that may pressure consumers into unnecessary purchases, higher premiums due to extensive marketing costs, targeting vulnerable populations with aggressive tactics, and limited accessibility for underserved communities.

How do insurance marketing statistics impact the industry?

Insurance marketing statistics, such as the fact that 69% of consumers search online before choosing an insurer, highlight the crucial role of digital presence in marketing strategies. These statistics guide insurers in understanding consumer behavior and tailoring their marketing efforts to reach potential clients effectively.

What role does insurance marketing play in customer education?

Insurance marketing plays a vital role in customer education by raising awareness about the necessity of insurance products. Through various marketing campaigns, insurers can inform potential customers about different types of coverage, helping them understand the protection insurance offers against unforeseen events.

What are effective insurance marketing strategies?

Effective insurance marketing strategies include content marketing that educates and engages the audience, targeted advertising that reaches specific demographics, utilizing social media platforms for broader outreach, and leveraging data analytics to customize offers based on consumer preferences and behaviors.

How does insurance marketing improve competition in the industry?

Insurance marketing improves competition by encouraging companies to enhance their offerings, provide competitive pricing, and innovate their policies. Robust marketing campaigns compel insurers to differentiate themselves, ultimately benefiting consumers with better choices and improved service quality.

What is the importance of ethical practices in insurance marketing?

Ethical practices in insurance marketing are crucial to prevent misleading information and aggressive sales tactics that may exploit consumers. Ensuring transparency and prioritizing customer education fosters trust and helps consumers make informed decisions about their insurance coverage.

How can insurance marketing contribute to economic stability?

Insurance marketing contributes to economic stability by promoting risk management and ensuring that more individuals and businesses have adequate insurance coverage. This preparedness reduces reliance on government assistance and supports financial resilience in the face of unexpected losses.

What challenges do insurance marketers face today?

Insurance marketers face challenges such as navigating regulatory requirements, addressing consumer skepticism, competing in a crowded digital space, and ensuring their marketing strategies are inclusive and accessible to diverse populations.

How can technology enhance insurance marketing efforts?

Technology enhances insurance marketing efforts by providing tools for data analysis, enabling personalized marketing campaigns, facilitating online engagement through social media, and improving customer relationship management through automation and targeted outreach.

| Key Points | Details |

|---|---|

| Online Search Behavior | 69% of insurance consumers searched online before booking an appointment. |

| Lack of Specific Insurer | 68% had no specific insurer in mind when starting their search. |

| Role of the Internet | The internet is crucial for successful insurance marketing. |

| Definition of Insurance Marketing | Insurance marketing promotes products and raises awareness about insurance benefits. |

| Job of Insurance Marketing Specialist | They create and implement marketing campaigns; average salary is $82,500. |

| Advantages of Insurance Marketing | Includes increased awareness, expanded customer base, customization, competition improvement, and economic stability. |

| Disadvantages of Insurance Marketing | Includes misleading information, overemphasis on sales, higher premiums, targeting vulnerable groups, and limited accessibility. |

Summary

Insurance marketing is an essential component of the insurance industry, influencing how consumers understand and engage with insurance products. The statistics reveal that a significant number of consumers rely on online resources before making decisions about insurance, highlighting the importance of effective digital marketing strategies. Balancing the advantages and disadvantages of insurance marketing is crucial for fostering a transparent and beneficial environment for consumers. By focusing on ethical practices and consumer education, the insurance industry can leverage marketing tools to enhance overall awareness and accessibility to insurance coverage.