India Insurance Trends 2024: Key Insights for the Industry

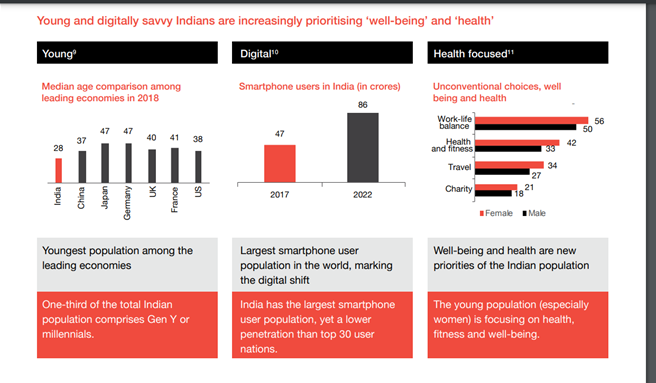

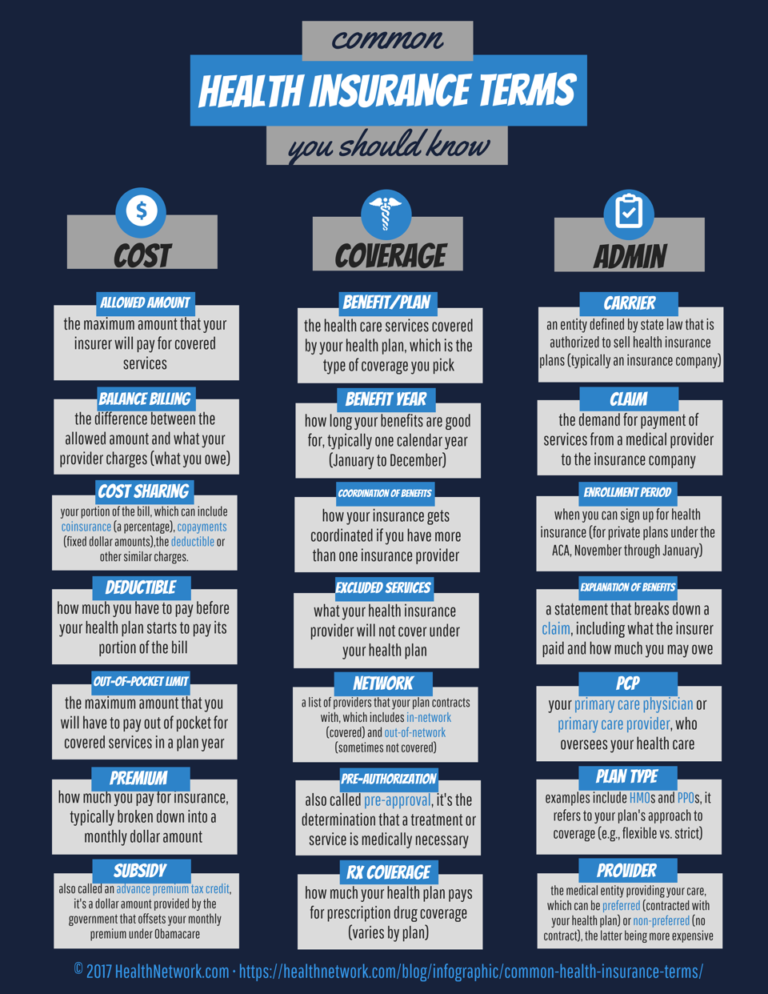

As we explore India Insurance trends 2024, it’s evident that the insurance landscape is on the brink of a transformation driven by innovation and consumer demands. The InsurTech revolution is reshaping how policies are designed and delivered, with technology playing a pivotal role in enhancing user experiences. From microinsurance products that cater to low-income families to the rise of on-demand insurance that offers flexibility for modern lifestyles, the industry is becoming more inclusive. Parametric insurance is also gaining traction, providing timely payouts based on specific triggers, which is crucial in our rapidly changing environment. Additionally, a growing emphasis on wellness programs is shifting the focus from risk management to preventive care, ensuring that insurance not only protects but also promotes healthier living.

In the context of evolving insurance dynamics, the upcoming trends for 2024 in India highlight a shift towards more personalized and accessible coverage options. This year promises a surge in innovative insurance solutions, including technology-driven platforms that enhance customer interaction and streamline claims processes. The increasing popularity of bite-sized policies, known as microinsurance, reflects a commitment to serving underserved populations, while on-demand coverage is set to redefine how consumers engage with their insurance needs. Moreover, the advent of parametric insurance represents a significant departure from traditional models, offering rapid responses to unforeseen events based on predefined criteria. Finally, the integration of wellness initiatives into insurance offerings underscores a proactive approach to health management, aligning the industry’s goals with the well-being of its clients.

The InsurTech Revolution in India: Transforming Insurance in 2024

The InsurTech revolution is fundamentally changing the landscape of the insurance industry in India. As we move into 2024, technology is not merely an auxiliary component; it has become the core driver of innovation. Companies are leveraging AI to enhance customer interactions through personalized experiences, utilizing chatbots and robo-advisors to provide 24/7 support. This shift not only improves customer satisfaction but also accelerates claim processing and risk assessment, making insurance more accessible to the masses.

Moreover, the integration of blockchain technology enhances transparency and security in transactions, allowing for real-time updates and efficient management of policies. InsurTech companies are collaborating with traditional insurers to create hybrid models that combine the agility of startups with the established trust of legacy firms. As a result, the InsurTech revolution is setting the stage for a more efficient, customer-centric insurance ecosystem in India.

Microinsurance: Catering to India’s Underserved Population in 2024

Microinsurance is poised to play a pivotal role in India’s insurance landscape in 2024, particularly as it addresses the needs of a vast, underserved population. With affordable premiums and targeted coverage options, microinsurance products are designed to provide financial protection for low-income individuals against specific risks like hospitalization or natural disasters. This trend is gaining momentum as insurers recognize the potential for growth in rural and semi-urban markets.

Collaboration between insurers, microfinance institutions, and fintech startups is essential in expanding the reach of microinsurance. By leveraging technology and innovative distribution channels, these partnerships can facilitate awareness and accessibility of microinsurance products. As we progress into 2024, microinsurance is expected to become a cornerstone of financial inclusion, empowering individuals and communities by providing them with the security they need to thrive.

On-Demand Insurance: The Future of Flexible Coverage in India

As customer preferences evolve, on-demand insurance is emerging as a key trend in India’s insurance market for 2024. This model provides flexibility, allowing individuals to purchase coverage precisely when they need it, whether for travel, car rentals, or specific activities. This shift away from traditional, static policies caters to a generation that values customization and control over their insurance needs.

In addition, usage-based insurance aligns premiums with individual behavior, promoting responsible habits. For example, drivers can benefit from lower rates by maintaining safe driving records, while health-conscious individuals may receive incentives for tracking fitness through wearables. This model not only enhances the customer experience but also encourages healthy lifestyles, making insurance more relevant and beneficial in daily life.

Parametric Insurance: A New Approach to Risk Management in 2024

Parametric insurance is set to gain traction in India as climate change and unpredictable weather patterns underscore the need for innovative risk management solutions. Unlike traditional insurance that relies on extensive claims processes, parametric insurance offers immediate payouts based on predefined triggers, such as natural disasters or severe weather events. This model provides rapid financial relief, ensuring that policyholders can recover quickly from unexpected losses.

The data-driven nature of parametric insurance aligns well with advancements in technology, enabling insurers to utilize real-time data for risk assessment. As we enter 2024, this approach is particularly relevant for businesses and individuals in vulnerable sectors, offering a proactive solution to mitigate risks associated with climate variability. Consequently, parametric insurance is positioned to transform the way risks are managed and insured in India.

Wellness Programs: Shifting Focus to Preventive Care in 2024

The insurance industry is increasingly recognizing the importance of wellness programs as we approach 2024. Rather than solely focusing on risk mitigation, insurers are embracing a holistic approach that emphasizes preventive care and health management. Programs that promote wellness and disease prevention are becoming integral to insurance offerings, encouraging policyholders to adopt healthier lifestyles and engage in regular health monitoring.

Insurers are also exploring partnerships with healthcare providers and wellness startups to create comprehensive solutions that incentivize proactive health behaviors. By integrating wearable devices and health tracking technologies, insurers can provide real-time feedback and rewards for maintaining healthy habits. This shift not only improves the overall health outcomes of policyholders but also reduces long-term healthcare costs, creating a win-win scenario for both insurers and customers.

Frequently Asked Questions

What is the InsurTech revolution and how will it impact India Insurance trends in 2024?

The InsurTech revolution is transforming the Indian insurance landscape by leveraging technology such as AI, blockchain, and data analytics. In 2024, expect these innovations to enhance customer experiences, streamline claims processing, and improve risk assessment, making insurance more efficient and accessible to a wider population.

How is microinsurance shaping the future of India Insurance trends in 2024?

Microinsurance is set to play a pivotal role in India Insurance trends in 2024 by providing affordable and tailored coverage for low-income individuals. As insurers collaborate with microfinance and fintech companies, the reach of these bite-sized policies will expand, ensuring financial security for underserved populations across rural and semi-urban areas.

What are on-demand insurance products and how do they fit into India Insurance trends 2024?

On-demand insurance products are gaining popularity in India as consumers seek flexibility and customization. In 2024, expect more policies allowing customers to purchase coverage for specific events or periods, such as pay-per-mile car insurance, catering to the evolving needs of modern consumers.

What is parametric insurance and why is it relevant to India Insurance trends in 2024?

Parametric insurance is a new approach that bases payouts on pre-defined triggers like weather events, making it particularly relevant in 2024 due to climate change. This model offers quicker and more efficient claims processing, providing financial protection against unpredictable natural disasters and extreme weather.

How are wellness programs influencing India Insurance trends in 2024?

Wellness programs are increasingly being integrated into insurance offerings in 2024, shifting the focus from risk mitigation to proactive health management. Insurers are partnering with healthcare providers to incentivize healthy living, which not only improves customer well-being but also reduces overall healthcare costs.

| Trend | Description |

|---|---|

| InsurTech Revolution | Integration of AI, chatbots, and blockchain to improve efficiency and customer experience. |

| Microinsurance Takes Center Stage | Affordable, bite-sized policies targeting underserved populations, enhancing financial security. |

| On-Demand and Usage-Based Insurance | Flexible insurance options catering to specific needs and behaviors, promoting responsible actions. |

| The Rise of Parametrics | Insurance based on predefined triggers, useful against climate change impacts and unforeseen events. |

| Focus on Wellness and Preventive Care | Shift towards proactive health management with wellness programs and partnerships with healthcare providers. |

Summary

India Insurance trends 2024 highlight a transformative era for the insurance industry, characterized by technological advancements and a customer-centric approach. As key trends such as the InsurTech revolution, the rise of microinsurance, and the emphasis on wellness emerge, stakeholders must adapt to these changes to stay relevant. The move towards on-demand and parametric insurance further underscores the industry’s responsiveness to consumer needs and environmental challenges. In summary, the insurance landscape in India is poised for significant evolution in 2024, driven by innovation and a commitment to providing tailored solutions.

Resources such as the one you mentioned right here will be extremely helpful to myself!

Ill publish a hyperlink to this web page on my

individual blog. Im positive my site guests will locate that quite beneficial.

This post is worth everyone’s attention. Where can I find out more?

I was recommended this web site by my cousin. I’m not sure whether

this post is written by him as nobody else know such detailed about my difficulty.

You are incredible! Thanks!

I loved as much as you will receive carried out right here.

The sketch is attractive, your authored subject matter stylish.

nonetheless, you command get got an impatience over that you

wish be delivering the following. unwell unquestionably come further formerly again as exactly the same nearly very often inside case

you shield this increase.