Income Annuity: Your Key to Guaranteed Lifetime Income

As you navigate the complexities of retirement, the concept of an income annuity becomes increasingly vital. An income annuity offers a secure solution, providing guaranteed lifetime income that ensures you won’t outlive your savings. This financial product is designed to help retirees maintain their standard of living by offering predictable payments over time. With a variety of fixed income annuities available, it’s essential to understand your life annuity options and how they fit into your overall retirement planning strategies. By choosing the right income annuity, you can pave the way for financial security for retirees, allowing you to enjoy your golden years without the stress of financial uncertainties.

When planning for retirement, many individuals seek reliable income streams to support their lifestyles, and one effective way to achieve this is through retirement income products. Known for their stability, these financial instruments can deliver dependable cash flow, ensuring that retirees have the necessary funds throughout their retirement years. Options such as fixed-income products and life annuity variants create tailored income solutions for different needs, addressing concerns about longevity and financial wellness. By integrating these strategies into your broader retirement preparation, you can reinforce your financial security and confidently approach your post-work life.

Understanding Income Annuities: A Key Component of Retirement Planning

Income annuities play a critical role in retirement planning, providing a reliable stream of income during the retirement years. This financial product ensures that retirees have a guaranteed lifetime income they can count on, helping to alleviate concerns about outliving their savings. With increasing life expectancy and inflation affecting purchasing power, the assurance that comes from income annuities can be invaluable. They not only offer financial security for retirees but also simplify budgeting by providing predictable monthly payments.

Incorporating income annuities into your retirement strategy can enhance your overall financial well-being. By choosing the right fixed income annuity, you can tailor your payments to meet specific needs and lifestyles. This strategic approach allows retirees to enjoy their retirement years with greater confidence, knowing they have a dependable income source that will not dwindle over time.

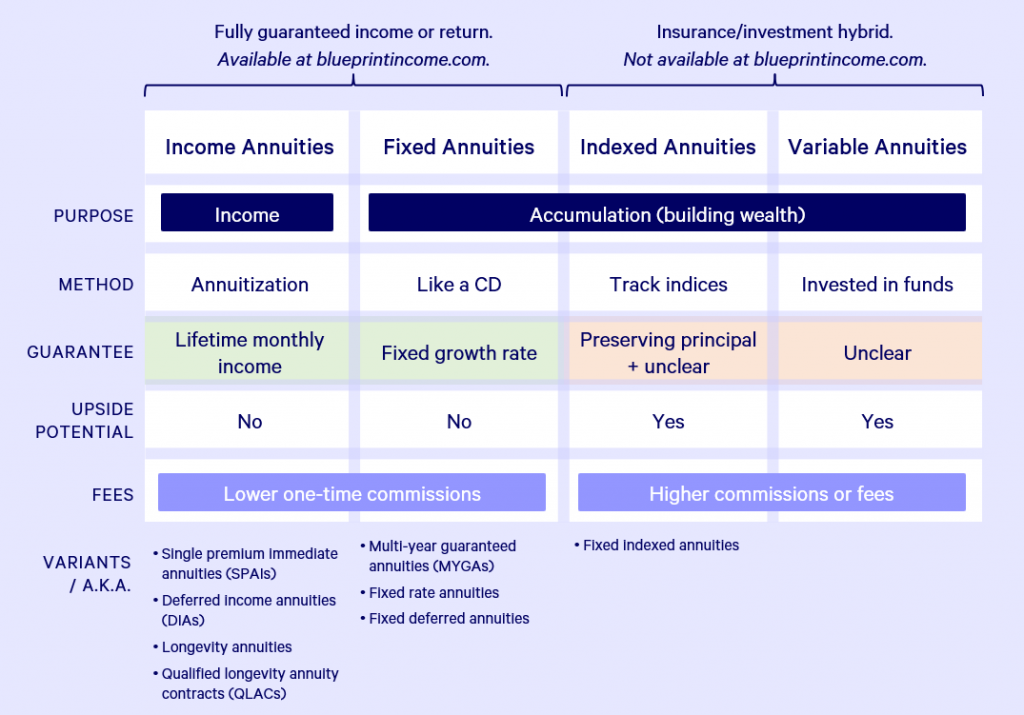

Exploring Types of Fixed Income Annuities

Fixed income annuities come in various forms, each designed to cater to different financial goals and retirement scenarios. Options such as joint life, period certain, life with a period certain, and life only annuities offer flexibility in how and when funds are disbursed. For instance, the joint life option is ideal for couples, ensuring that one partner remains financially secure even after the other has passed. This type of arrangement emphasizes the importance of longevity in managing retirement income.

Additionally, the life with a period certain option safeguards against the risk of dying too soon by guaranteeing a set number of payments to a beneficiary, which can be particularly attractive for those concerned about leaving a legacy. Understanding these choices is crucial as they enable individuals to personalize their retirement income strategy and effectively manage financial risks.

The Importance of Guaranteed Lifetime Income for Financial Security

In today’s economic climate, guaranteed lifetime income has become increasingly important for those nearing retirement. An income annuity offers a solution that many retirees find comforting, as it secures a reliable income stream that lasts throughout their life. This reduces the financial stress associated with fluctuating market conditions, providing a stable foundation for retirees to plan their expenses and maintain their desired lifestyle.

Moreover, financial security for retirees is not just about the amount of money one has saved; it’s also about ensuring that savings last. An ideal retirement income plan includes a mix of investment strategies and annuities to create a balanced portfolio. By securing a guaranteed income through an annuity, retirees can feel more at ease, knowing they will not deplete their savings prematurely, thus allowing for a more fulfilling retirement experience.

Choosing the Right Life Annuity Options

Selecting the appropriate life annuity option requires careful consideration of personal circumstances, projected lifespan, and financial objectives. Each annuity type comes with distinct features and benefits. For example, the life only annuity may appeal to those seeking maximum payouts, though it carries the risk of receiving nothing after death. On the other hand, a period certain option provides a safety net that retains inheritance possibilities, appealing to those who wish to leave money for heirs.

Prospective buyers should weigh the pros and cons of each option, considering factors such as health status and legacy desires. Consulting a financial advisor can aid in determining which combination of annuity products best suits individual needs, ensuring that retirees achieve balance and security in their financial planning.

Retirement Planning Strategies: Integrating Income Annuities

Effective retirement planning involves integrating various financial tools, and income annuities are a pivotal part of this mix. By incorporating fixed income annuities into your portfolio, you create a buffer against market volatility and unexpected expenses. These annuities provide a sense of financial independence, allowing retirees to focus on enjoying their leisure time rather than worrying about money.

Moreover, blending annuities with other retirement income sources, like pensions, Social Security, and savings accounts can create a well-rounded financial strategy. This holistic approach can maximize cash flow and minimize risk, ultimately leading to a more secure and enjoyable retirement.

Assessing Your Retirement Needs: The Role of Annuities

To effectively assess your retirement needs, it’s essential to evaluate your sources of income and expenses. Integrating income annuities into your financial assessment can clarify how they can fulfill income gaps and provide financial security. Understanding your fixed expenses and potential healthcare costs is crucial in determining the amount of guaranteed lifetime income required.

By considering factors such as lifestyle expectations, inflation, and potential longevity, retirees can make more informed decisions regarding annuities. Instead of worrying about fluctuating market conditions, the comfort of a guaranteed income allows for better financial planning and enables retirees to live more confidently.

The Benefits of Consulting a Financial Advisor on Annuities

Working with a financial advisor can provide valuable insights when navigating the complexities of income annuities. An experienced advisor can offer a tailored approach to selecting the right annuity products based on your specific financial situation and retirement goals. By understanding different life annuity options, an advisor can suggest the best strategies for maximizing income and minimizing risks.

Moreover, they can help simulate different retirement income scenarios to demonstrate how various annuities would perform over time. This personalized guidance ensures that you’re making informed decisions, aligning your income annuity choices with your broader financial plan to secure your future.

Understanding the Costs Associated with Income Annuities

While income annuities provide guaranteed income, it’s important to understand the associated costs that may impact your overall returns. Fees, commissions, and surrender charges are typical elements that potential buyers should consider. Knowing these costs upfront can help in comparing different annuity products and determining their value over time, ultimately impacting your retirement income.

Additionally, a thorough review of contract terms is essential to avoid surprises in the future. Clarity on potential penalties and fees can help you select the right annuity, ensuring it aligns with your financial strategy and retirement goals.

The Peace of Mind that Comes with Income Annuities

Choosing to invest in income annuities can significantly enhance your peace of mind during retirement. Knowing that a portion of your financial needs is secured through a guaranteed lifetime income can alleviate anxiety about future expenses and market volatility. This security allows retirees to live more freely, focusing on enjoying their time without the constant worry of financial uncertainty.

Additionally, the feeling of financial independence fosters a sense of control over one’s retirement journey. By incorporating annuities into their portfolios, individuals can achieve a balanced approach to retirement planning, contributing to an overall sense of satisfaction and well-being.

Frequently Asked Questions

What is an income annuity and how does it provide guaranteed lifetime income?

An income annuity is a financial product that converts a lump sum of money into a stream of guaranteed lifetime income. When you purchase an income annuity, the insurance company promises to make regular payments, ensuring you receive income for as long as you live, providing peace of mind and financial security for retirees.

What are the different types of fixed income annuities available for retirement planning strategies?

There are several types of fixed income annuities, including joint life, period certain only, life with a period certain, and life only options. Each type offers varying degrees of flexibility and security depending on your retirement planning strategies and income needs.

How can a life annuity option contribute to financial security for retirees?

A life annuity option provides retirees with a consistent income stream for their entire life, which can help in managing expenses and maintaining financial security during retirement. This steady income supports ongoing living costs, mitigating the risk of outliving your savings.

What are the benefits of choosing a period certain income annuity option?

A period certain income annuity option allows you to define a specific length of time to receive payments. This means if you pass away before the period ends, your chosen beneficiary will receive the remaining payments, offering a sense of security and control over your retirement finances.

Can a joint life income annuity be a smart choice for couples in retirement planning?

Yes, a joint life income annuity is an excellent option for couples as it ensures that as long as one partner is alive, they will continue to receive payments. This arrangement enhances retirement planning, providing a financial safety net for both individuals.

Why might a life only income annuity be considered the riskiest option?

The life only income annuity option pays out for the annuitant’s lifetime only, meaning that if the annuitant passes away shortly after purchasing, all future payments cease. While it offers higher payouts, it carries the risk of potentially leaving nothing for beneficiaries, making it a less popular choice.

How should I determine if an income annuity fits into my financial strategy?

To determine if an income annuity aligns with your financial strategy, consider consulting with a financial advisor. They can help assess your personal financial situation, retirement goals, and the role that guaranteed lifetime income could play in achieving financial security.

What is the average payout for fixed income annuities compared to other retirement income sources?

Fixed income annuities generally offer lower payouts compared to other retirement income sources like stocks or mutual funds. However, the trade-off is the security of guaranteed lifetime income, which can be invaluable for retirees looking for stability in their financial planning.

Can I customize my income annuity payments to suit my needs?

Yes, income annuities can often be customized based on various factors such as payment frequency, duration, and whether you want to include beneficiaries. This flexibility helps ensure that the retirement income generated aligns closely with your unique financial goals.

What should I consider before purchasing an income annuity for retirement?

Before purchasing an income annuity, consider factors such as your age, health, financial goals, and how the annuity fits into your overall retirement strategy. Additionally, understand the fees, payout options, and potential tax implications to ensure it meets your long-term needs.

| Annuity Type | Description | Benefits |

|---|---|---|

| Joint Life | Income for two individuals for life; payments continue after one passes away. | Provides financial security for couples; ongoing support for the surviving partner. |

| Period Certain Only | Specified duration of income; remaining payments go to a chosen beneficiary if death occurs. | Control over payment duration; ensures that chosen beneficiaries receive funds if needed. |

| Life with a Period Certain | Income for your lifetime; if you pass before the period ends, your beneficiary receives payments. | Hybrid of security for you and your beneficiaries; balances lifetime income with bequest. |

| Life Only | Highest payouts, but payments cease upon death. | Potentially high income, though risk of outliving annuity exists. |

Summary

An income annuity is a financial solution designed to provide guaranteed income during retirement, addressing concerns about outliving your savings. Choosing the right type of income annuity can significantly enhance your retirement experience and financial security. Whether you prefer options that support beneficiaries or prioritize higher payouts, understanding these choices is crucial for a well-rounded retirement strategy. Always consult with a financial advisor to ensure that your income annuity choice aligns with your overall financial goals.