Human Centricity in Insurance: Embracing Technology Trends

In the evolving landscape of insurance, maintaining human centricity in insurance is becoming increasingly vital as the industry embraces digital transformation. As technologies like generative AI and telematics usage-based insurance reshape traditional practices, the focus must remain on the core human experience that underpins insurance services. During the recent Joint Industry Forum, experts highlighted the importance of aligning innovative risk management technology with the emotional needs of consumers, particularly during critical moments such as claims. The integration of these technologies offers promising avenues for enhancing insurance consumer engagement, ensuring that while automation streamlines processes, it never loses sight of the personal touch that fosters trust and assurance. Ultimately, prioritizing human centricity will ensure that the insurance sector evolves to meet the needs of its clients, even as it adopts innovative solutions.

As the insurance industry undergoes a significant transformation, the emphasis on consumer-centric approaches is more important than ever. This shift towards prioritizing the individual experiences of policyholders reflects a broader trend in which insurers leverage advanced technologies to enhance client interactions. Concepts like personalized risk management and the integration of smart devices are redefining how insurance can better serve its customers. Furthermore, the focus on fostering genuine engagement between insurers and clients is essential to restore trust in a sector often viewed through a transactional lens. By embracing a more empathetic framework, the insurance industry can not only adapt to modern demands but also reinforce its foundational mission of safeguarding people’s lives and assets.

Emphasizing Human Centricity in Insurance

In today’s fast-paced, technology-driven environment, maintaining human centricity in insurance has become increasingly crucial. As industry leaders gather at forums like Triple-I’s 2024 Joint Industry Forum, the conversation often revolves around how to integrate advanced technologies while ensuring that the human experience remains at the forefront. Katherine Horowitz and Casey Kempton, among others, highlight the importance of recognizing that insurance is fundamentally a human business. The emotional weight carried by clients during claims processes underscores the need for a support system that prioritizes empathy and understanding over automation.

Kempton emphasizes that moments of loss or damage are inherently human moments, requiring a response that machines simply cannot replicate. While generative AI and digital transformation in insurance offer various efficiencies, they must enhance—not replace—the human interactions that build trust and reassurance among policyholders. By focusing on human needs, insurers can create a service model that not only addresses claims but also uplifts the emotional experience of their clients during vulnerable times.

Innovations in Risk Management Technology

The advent of risk management technology, particularly through telematics and usage-based insurance, has transformed how insurers assess and manage risk. Telematics tracks real-time driving behavior, enabling insurers to offer personalized rates based on individual habits. This innovative approach not only incentivizes safer driving but also empowers consumers by directly linking their actions to their insurance costs. As Kempton points out, this shift fosters a greater sense of responsibility among policyholders, allowing them to actively participate in their insurance journey.

Moreover, advanced smart devices such as LeakBot and Ting are paving the way for proactive risk management in homeowners’ insurance. By detecting potential issues before they escalate into significant losses, these technologies provide invaluable peace of mind to consumers. The proactive nature of these tools reflects a broader trend in the insurance industry toward integrating technology that not only mitigates risk but also enhances the overall consumer experience. Insurers that prioritize these innovations are likely to see improved customer engagement and satisfaction.

The Impact of Telematics on Usage-Based Insurance

Telematics is reshaping the landscape of usage-based insurance by providing real-time data on driving behaviors, which insurers can use to tailor policies to individual risk profiles. This technology allows insurers to reward safe driving practices with lower premiums, creating a win-win scenario for both the insurer and the insured. As consumers gain more control over their insurance costs, they become more engaged and informed about their coverage, ultimately leading to a more transparent relationship.

As the popularity of telematics grows, its impact on consumer behavior cannot be understated. Policyholders are increasingly aware that their driving habits directly affect their insurance rates, fostering a culture of safety and responsibility. This shift aligns with the broader trend of digital transformation in insurance, where data-driven insights facilitate improved risk assessment and management. As insurers continue to leverage telematics, the industry can expect to see enhanced customer satisfaction and loyalty.

Enhancing Insurance Consumer Engagement

Insurance consumer engagement has evolved dramatically with the integration of new technologies and digital platforms. Today’s consumers expect personalized experiences and proactive communication from their insurers. As noted by industry leaders, the shift toward human centricity means that engagement strategies must prioritize genuine interactions over automated responses. By leveraging data analytics and customer feedback, insurers can tailor their offerings to better meet the needs and preferences of their clients.

Moreover, the rise of generative AI in insurance plays a pivotal role in enhancing consumer engagement. By utilizing AI to analyze consumer data and predict needs, insurers can create targeted marketing campaigns and informative resources that resonate with their audience. This personalized approach not only improves customer satisfaction but also fosters trust and loyalty, essential components for long-term relationships in the insurance sector. As insurers continue to embrace digital transformation, the focus on consumer engagement will be crucial for achieving sustainable growth.

Transformational Role of Generative AI in Insurance

Generative AI is revolutionizing the insurance industry by streamlining processes and enhancing decision-making capabilities. By automating routine tasks and analyzing vast amounts of data, generative AI empowers insurers to respond more swiftly to claims and customer inquiries. This technology not only improves operational efficiency but also allows human agents to focus on delivering personalized support, reinforcing the importance of human centricity in insurance.

Additionally, generative AI facilitates the development of innovative products and services tailored to the evolving needs of consumers. By leveraging predictive analytics, insurers can identify emerging trends and design coverage options that align with changing market demands. As the insurance landscape becomes more competitive, the ability to harness generative AI effectively will be a key differentiator for companies seeking to enhance their service offerings and maintain relevance in a rapidly digitizing world.

Mitigating Loss through Effective Communication

One of the most pressing challenges in the insurance industry is overcoming public distrust, often fueled by misconceptions about the nature of insurance as a mere commodity. Effective communication is vital in shifting this narrative. Insurers must focus on the language they use, emphasizing the value of peace of mind and protection rather than solely discussing loss mitigation. As Kempton suggests, reframing the conversation around how insurers can better support consumers during challenging times is crucial for rebuilding trust.

Moreover, addressing the issues of excessive litigation and legal system abuse is essential for restoring consumer confidence. By advocating for transparency and collaboration among stakeholders, insurers can work towards a more equitable system that prioritizes the needs of policyholders. Recent reforms in various states highlight the importance of this approach, demonstrating that by aligning industry practices with consumer interests, the insurance sector can enhance its reputation and better serve its clients.

Navigating Legal System Abuse in Insurance

Legal system abuse has become a significant concern in the insurance industry, leading to increased costs for both insurers and policyholders. Excessive claims-related litigation, often driven by aggressive advertising and third-party involvement, has created a challenging environment for insurers to navigate. As highlighted by industry leaders, addressing these issues requires a collective effort to reform existing legal frameworks while promoting transparency in litigation practices.

The impact of legal system abuse extends beyond financial implications; it also erodes consumer confidence in the insurance industry. By implementing measures to mitigate these challenges, insurers can demonstrate their commitment to protecting policyholders and restoring trust. Collaborative initiatives, such as advocating for legal reforms and enhancing communication about the value of insurance, are essential for overcoming the obstacles posed by legal system abuse and ensuring a more sustainable future for the industry.

The Future of Digital Transformation in Insurance

Digital transformation is reshaping the insurance landscape, offering new opportunities for efficiency, customer engagement, and innovation. As companies increasingly adopt technologies such as AI, telematics, and data analytics, the potential to enhance service delivery and streamline operations becomes evident. Insurers that embrace digital transformation are better positioned to meet the evolving needs of consumers and adapt to market changes.

However, the journey toward digital transformation must be approached with a focus on human centricity. While technology facilitates operational improvements, the core values of empathy and support must remain at the forefront of the insurance experience. By ensuring that digital advancements enhance rather than replace human interactions, insurers can create a balanced approach that fosters trust and builds long-term customer relationships in an increasingly digital world.

Building Trust through Transparency and Education

Trust is a cornerstone of the insurance industry, yet it has been compromised by misconceptions and negative experiences. To rebuild this trust, insurers must prioritize transparency in their operations and communication. Providing clear information about policies, claims processes, and the true value of insurance can empower consumers and alleviate concerns regarding hidden costs or inadequate coverage.

Education also plays a vital role in fostering consumer confidence. Insurers can implement educational initiatives that inform policyholders about their rights, claims processes, and the importance of insurance in risk management. By equipping consumers with knowledge, insurers not only enhance engagement but also position themselves as trusted advisors in navigating complex insurance landscapes. This proactive approach is essential for creating a more informed consumer base and restoring faith in the insurance sector.

Frequently Asked Questions

What is human centricity in insurance and why is it important?

Human centricity in insurance refers to designing products and services that prioritize the needs and experiences of individuals. It is vital because insurance is fundamentally about managing risks associated with human experiences, such as loss or damage. By focusing on human centricity, insurers can build trust, enhance consumer engagement, and provide comfort during crucial moments, such as claims processing.

How does digital transformation in insurance enhance human centricity?

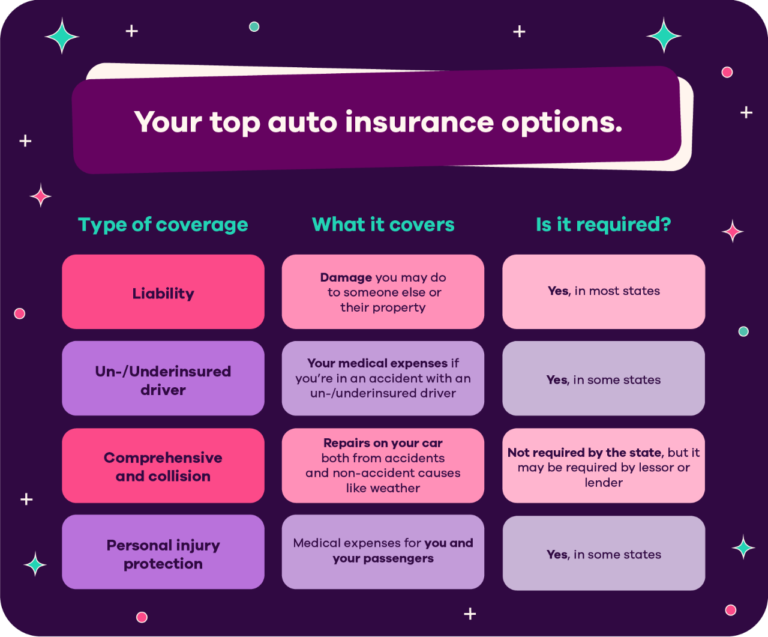

Digital transformation in insurance enhances human centricity by leveraging technology to better understand and meet consumer needs. Innovations such as generative AI and telematics usage-based insurance allow for personalized services and proactive risk management, ensuring that the human experience remains at the forefront of insurance solutions.

In what ways can generative AI improve insurance consumer engagement?

Generative AI can improve insurance consumer engagement by enabling personalized communication and tailored policy offerings. By analyzing consumer data, generative AI can create customized experiences that resonate with policyholders, ultimately fostering stronger relationships and enhancing human centricity within the insurance industry.

What role does telematics play in promoting human centricity in insurance?

Telematics plays a crucial role in promoting human centricity in insurance by allowing insurers to offer usage-based insurance that reflects the actual driving behavior of policyholders. This not only leads to fairer pricing but also encourages safer driving habits, giving consumers direct control over their insurance costs while enhancing their overall experience.

How can risk management technology support a human-centric approach in insurance?

Risk management technology supports a human-centric approach in insurance by providing tools that help insurers identify and mitigate risks before they escalate. This proactive strategy, facilitated by smart devices and data analytics, enables insurers to communicate effectively with policyholders, ensuring they are informed and prepared, thus reinforcing trust and reassurance.

Why is language important in maintaining human centricity in the insurance industry?

Language is important in maintaining human centricity in the insurance industry because it shapes consumer perceptions. By using terminology that emphasizes protection and peace of mind rather than merely mitigating loss, insurers can foster a more positive relationship with policyholders, aligning their messaging with the human experiences and emotions involved in insurance.

What are the implications of legal system abuse on human centricity in insurance?

Legal system abuse can undermine human centricity in insurance by increasing costs and complicating the claims process. When insurers face excessive litigation, it detracts from their ability to focus on policyholder needs, leading to higher premiums and diminished consumer trust. Addressing these issues through reforms can help restore the focus on protecting and caring for policyholders.

How can insurers ensure that technological innovations align with human needs?

Insurers can ensure that technological innovations align with human needs by actively involving consumers in the development process, gathering feedback, and continuously assessing the impact of these technologies on the customer experience. This ensures that advancements, such as telematics and generative AI, enhance human centricity rather than detract from it.

| Key Points | Details |

|---|---|

| Human Centricity in Insurance | The insurance industry must prioritize human needs, especially during claims, which are emotional moments requiring empathy and understanding. |

| Role of Telematics | Usage-based insurance helps tailor auto rates based on driving behavior, promoting safer habits and reducing premiums. |

| Technology for Risk Management | Advanced devices detect potential damage at home, allowing proactive risk management and notifying homeowners before losses occur. |

| Importance of Language | The insurance industry should shift language from ‘mitigating loss’ to ‘providing peace of mind’ to rebuild consumer trust. |

| Legal System Abuse | Excessive claims litigation increases costs for consumers, emphasizing the need for reforms and transparency in legal processes. |

Summary

Human centricity in insurance is vital as it emphasizes the importance of understanding and addressing the emotional aspects of insurance claims. The industry’s shift towards technology, such as telematics and advanced smart devices, allows for more proactive risk management, but the core focus must remain on the human experience. By adopting language that prioritizes consumer needs and addressing legal challenges, insurers can regain trust and demonstrate their commitment to protecting policyholders. Ultimately, the future of insurance hinges on balancing technological advancements with a human-centric approach.