Homeowners insurance for AC: What You Need to Know

Homeowners insurance for AC is an essential aspect of safeguarding not just your home but also your comfort during the sweltering summer months. Many homeowners often overlook the specifics of their homeowners insurance policy, particularly when it comes to air conditioning unit coverage. A common inquiry arises: “Does homeowners insurance cover AC?” Understanding the nuances of homeowners insurance explained can help you make informed decisions about your coverage. Whether it’s protecting against unforeseen damages or considering additional insurance for home appliances, knowing how your policy addresses AC units is crucial for long-term peace of mind.

When considering coverage for your cooling system, it’s important to explore the realm of property insurance that encompasses various household essentials. The topic of air conditioning protection often leads to questions about insurance policies and the extent of coverage for essential home appliances. Many homeowners wonder about the implications of their insurance agreements concerning breakdowns or damages to their AC units. Analyzing homeowners insurance in detail reveals that while certain perils are covered, others may not be included, emphasizing the importance of comprehending what your policy entails. By delving into air conditioning unit coverage and related terms, you can ensure your home remains a comfortable haven, regardless of the weather.

Understanding the Importance of Homeowners Insurance

Homeowners insurance is a crucial financial safety net for property owners, offering protection against a variety of unforeseen damages. This type of insurance not only safeguards the physical structure of your home but also covers personal belongings against potential risks like theft, fire, and natural disasters. It provides peace of mind, knowing that you have a reliable backup in place to help you recover from significant losses. Understanding your policy is essential, as it outlines what is covered and any limitations that may apply.

Moreover, homeowners insurance extends beyond just the structure and belongings; it can also include liability protection if someone is injured on your property. This comprehensive approach means that having homeowners insurance is not just about protecting your home; it’s also about ensuring your financial security in case of unexpected events. Therefore, homeowners should regularly review their policies to understand their coverage limits and make necessary adjustments to reflect their current needs.

Does Homeowners Insurance Cover AC Units?

A common question among homeowners is, “Does homeowners insurance cover AC?” The answer largely depends on the situation that leads to the damage of your air conditioning unit. Typically, if the damage is caused by a covered peril, such as a storm or lightning strike, your homeowners insurance may help cover the repair or replacement costs. However, it’s important to note that every policy is different, and coverage can vary significantly depending on the specific terms outlined in your homeowners insurance policy.

Additionally, homeowners should be cautious about wear and tear exclusions. Most standard homeowners insurance policies do not cover damages arising from normal wear and tear or maintenance neglect. For instance, if your AC unit breaks down due to lack of maintenance or aging, you will likely be responsible for the repair costs. To safeguard against such scenarios, some homeowners opt for additional coverage options like equipment breakdown insurance, which can provide extra protection for appliances, including air conditioning units.

The Role of Maintenance in Homeowners Insurance Coverage

Regular maintenance of your air conditioning unit is vital not only for efficiency but also for ensuring that your homeowners insurance coverage remains intact. Insurance companies often require homeowners to maintain their appliances properly to avoid voiding coverage for associated damages. Failing to follow the manufacturer’s maintenance recommendations can lead to disputes with your insurer when you file a claim for AC-related damages.

Keeping detailed records of all maintenance performed on your AC can help demonstrate your diligence to your insurance provider. This documentation can be crucial if you ever need to file a claim, as it shows that you took the necessary steps to maintain the unit. Being proactive in your maintenance efforts can ultimately save you money and ensure that you are protected in case of an unexpected failure.

Exploring Additional Coverage Options for Your AC Unit

For homeowners looking to enhance their protection, considering additional coverage options for their air conditioning unit can be beneficial. One such option is equipment breakdown insurance, which specifically covers the repair or replacement of home appliances, including air conditioning systems, due to mechanical failure. This type of coverage fills in the gaps left by standard homeowners insurance, which may not cover certain types of damage.

Another option is to review your policy for endorsements or riders that can be added to increase coverage limits for high-value items, including your AC unit. By understanding the available options, homeowners can tailor their insurance plans to better suit their needs and ensure that they are fully protected against potential losses.

Common Misconceptions About Homeowners Insurance and AC Coverage

There are several misconceptions surrounding what homeowners insurance covers, particularly regarding air conditioning units. Many homeowners believe that all types of damages to their AC system are covered under their standard policy. However, it is essential to clarify that only damages caused by specific perils listed in the policy are typically covered. Incidents such as power surges caused by storms may qualify, but normal wear and tear or lack of maintenance will not.

Another common misunderstanding is that homeowners insurance will cover the costs associated with replacing an outdated or inefficient AC system. In reality, most policies will not cover the replacement cost unless the damage is due to a covered peril. Homeowners are encouraged to read their insurance policy thoroughly and consult with their insurance agent to clarify any doubts regarding coverage for their air conditioning units.

How to File a Claim for AC Damage Under Homeowners Insurance

If you find yourself in a situation where your air conditioning unit has been damaged due to a covered peril, understanding how to file a claim is crucial. The first step is to document the damage thoroughly, taking photographs and gathering any relevant receipts or maintenance records that demonstrate your care for the unit. This information will be vital in supporting your claim and proving that you followed proper maintenance protocols.

Next, contact your insurance provider to report the damage. They will guide you through the claims process, which may include an inspection by an adjuster to assess the damage. It is essential to communicate clearly and provide all the necessary documentation to expedite the claims process. Being proactive and organized can significantly improve your chances of a successful claim for your AC unit.

Understanding Policy Exclusions Related to Air Conditioning Units

When reviewing homeowners insurance policies, it is crucial to pay attention to specific exclusions related to air conditioning units. Many policies will explicitly state what is not covered, such as damages resulting from neglect, lack of maintenance, or gradual deterioration. Understanding these exclusions can help homeowners manage their expectations and take proactive measures to ensure their AC systems remain in good working order.

Additionally, some policies may have special limits on coverage for appliances, including air conditioning units. Homeowners should inquire about these limits and consider additional coverage options if their AC unit is particularly valuable or if they live in an area prone to severe weather events. Being informed about your policy’s exclusions can prevent surprises when filing a claim.

The Impact of Seasonal Changes on Air Conditioning Coverage

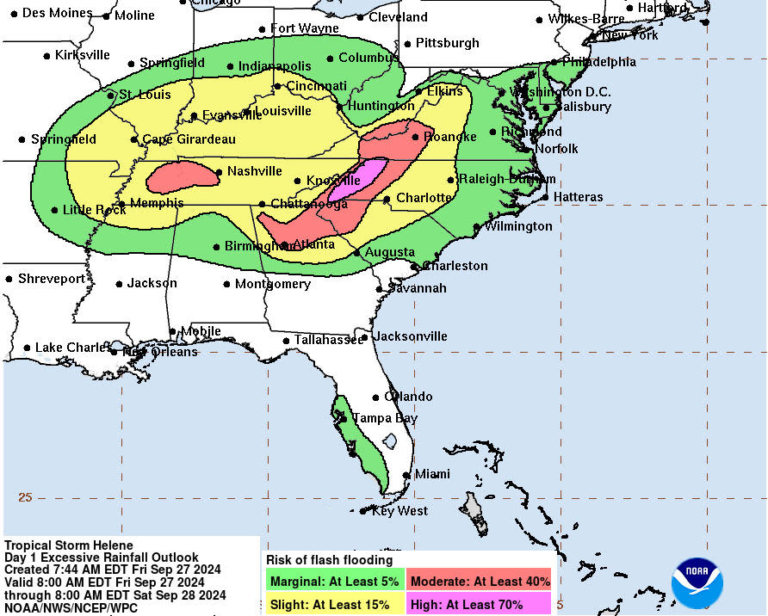

Seasonal changes can significantly impact the performance and condition of your air conditioning unit. For instance, during the summer months, your AC system works harder to maintain a comfortable indoor temperature, increasing the risk of mechanical failure. Homeowners should be aware of how these seasonal demands can affect their coverage under homeowners insurance, particularly regarding wear and tear.

As temperatures fluctuate, it’s also important to monitor your AC unit’s performance and address any issues promptly. Regular inspections and maintenance can help catch potential problems before they escalate, ensuring that your coverage remains valid. Homeowners should also be aware that claims made during peak seasons, such as summer, may be subject to more scrutiny, making it even more critical to maintain proper documentation and records.

Choosing the Right Homeowners Insurance Policy for Your Needs

Selecting the right homeowners insurance policy is essential for ensuring adequate protection for your home and its components, including your air conditioning unit. Homeowners should compare different policies and providers, considering factors like coverage limits, exclusions, and pricing. It’s also wise to seek out insurers that offer additional coverage options specifically for appliances, ensuring that your AC unit is fully protected against unforeseen damages.

Furthermore, consulting with an insurance agent can provide valuable insights into the best policy options available. An agent can help clarify complex terms and suggest coverage levels that align with your home’s value and your personal circumstances. Making informed decisions about your homeowners insurance policy is crucial to safeguarding your home and its essential systems.

Frequently Asked Questions

Does homeowners insurance cover AC units from damage?

Yes, homeowners insurance can cover AC units, but only if the damage is caused by a peril listed in your policy, such as fire or lightning. It’s important to check your homeowners insurance policy for specific coverage details.

What is included in homeowners insurance for AC systems?

Homeowners insurance generally includes coverage for air conditioning systems if they are damaged by covered perils. However, it does not cover damages due to normal wear and tear or lack of maintenance.

Are air conditioning units covered under homeowners insurance for mechanical failure?

Typically, homeowners insurance does not cover mechanical failure of air conditioning units. For this type of coverage, you may need to consider additional options like equipment breakdown insurance.

How do I file a claim for AC damage under my homeowners insurance?

To file a claim for AC damage, contact your insurance provider and provide documentation of the damage, including photos and maintenance records. Ensure the damage is from a covered peril as outlined in your homeowners insurance policy.

Does homeowners insurance cover the cost of AC maintenance?

No, homeowners insurance does not cover routine maintenance costs for your air conditioning unit. It only provides coverage for damages resulting from specific perils.

Can I get additional coverage for my air conditioning unit?

Yes, you can opt for additional coverage, such as equipment breakdown insurance, which can protect your air conditioning unit against mechanical failures not covered by standard homeowners insurance.

What should I do if my AC fails due to neglect?

If your AC fails due to neglect or lack of maintenance, homeowners insurance will likely not cover the repair costs. Regular maintenance is essential to ensure your unit remains protected under your policy.

Are there limits on air conditioning unit coverage in homeowners insurance?

Yes, some homeowners insurance policies have specific limits or exclusions for high-value items like air conditioning units. Always review your policy to understand any special limits that may apply.

| Key Points | Details |

|---|---|

| Homeowners Insurance Overview | Homeowners insurance protects against unforeseen events that can damage your home and belongings. |

| Coverage for AC Units | Coverage depends on the cause of damage to the AC unit. |

| Perils Covered | Damage caused by covered perils (e.g., lightning) may be covered. |

| Wear and Tear Exclusion | Normal wear and tear is usually not covered under homeowners insurance. |

| Maintenance Importance | Regular maintenance is crucial to avoid voiding insurance coverage. |

| Additional Coverage Options | Consider equipment breakdown insurance for additional protection. |

| Policy Limitations | Review your policy for specific limits regarding AC coverage. |

Summary

Homeowners insurance for AC is an essential consideration for any homeowner. Understanding the coverage details is crucial to ensuring your air conditioning unit is protected against potential damages. Homeowners insurance may cover repairs if damage occurs due to specific perils, but it often excludes normal wear and tear or maintenance neglect. To maximize protection, homeowners should maintain their AC units regularly and consider additional insurance options. Being proactive can save homeowners from unexpected repair costs and ensure peace of mind regarding their home’s comfort.