Homeowners Insurance Florida: Why Costs Are So High

Homeowners Insurance Florida is a critical aspect for residents looking to protect their properties from the unique risks associated with living in the Sunshine State. With homeowners insurance costs averaging around $4,000 annually, nearly double the national average, it’s essential to understand the factors driving these rates. Florida’s insurance market faces challenges due to the increasing threat of hurricanes and flooding, which necessitates additional policies like hurricane insurance Florida to safeguard homes. As property values continue to rise, homeowners insurance rates reflect the heightened rebuilding costs that insurers must anticipate. In this guide, we will explore how to navigate the complexities of homeowners insurance in Florida, ensuring you find the best coverage for your needs.

When considering property protection in Florida, it’s important to recognize the significance of residential property insurance. This type of coverage is essential for safeguarding homes against the numerous risks posed by the state’s unpredictable weather, particularly hurricanes and floods. Due to the high Florida homeowners insurance cost, many individuals are left searching for affordable alternatives within the Florida insurance market. Understanding the nuances of homeowners insurance rates and the necessity for additional coverages like flood insurance Florida can empower homeowners to make informed decisions. By analyzing these aspects, residents can secure adequate protection for their properties while potentially reducing their overall insurance expenses.

Understanding Homeowners Insurance Costs in Florida

Homeowners insurance costs in Florida can be staggering, with an average premium of about $4,000 per year. This figure is influenced by several critical factors, including the state’s susceptibility to natural disasters like hurricanes and flooding. In addition to the inherent risks associated with living in a hurricane-prone area, the rising costs of real estate and higher rebuilding expenses contribute significantly to the high rates. When evaluating homeowners insurance in Florida, it is essential to consider not just the premiums but also the coverage specifics, as many policies may not cover certain natural disasters without additional riders.

Moreover, the Florida insurance market is unique, with a variety of providers and policies available. Homeowners should be aware that while some companies offer competitive rates, they may not provide comprehensive coverage for risks like hurricanes or flooding. Therefore, before settling on a policy, it is crucial to compare options thoroughly and understand the terms of coverage, as well as any exclusions that may apply. This approach will help homeowners find a policy that not only fits their budget but also adequately protects their property against Florida’s unpredictable weather.

Key Factors Driving Up Homeowners Insurance Rates in Florida

Several factors contribute to the rising homeowners insurance rates in Florida, with natural disasters being at the forefront. The state’s geographical position makes it a hotspot for hurricanes, which leads to a higher frequency of claims due to storm damage. As a result, insurers are compelled to raise premiums to mitigate potential losses. Additionally, Florida’s flood insurance requirements further complicate the financial landscape for homeowners, as many standard policies do not include this coverage, necessitating the purchase of separate flood insurance to protect against water damage.

Another significant factor is the overall cost of real estate in Florida, which has escalated dramatically in recent years. Higher property values lead to increased rebuilding costs, prompting insurers to adjust their premiums accordingly. Homeowners must also navigate challenges within the insurance market, such as rising reinsurance costs that insurers face when covering potential large-scale claims. This intricate web of factors makes understanding homeowners insurance in Florida complex, highlighting the need for thorough research and awareness of market conditions.

Top Homeowners Insurance Providers in Florida

When searching for homeowners insurance in Florida, homeowners have several reputable providers to choose from. Companies like State Farm and Allstate are well-known for their comprehensive coverage options and strong customer service. State Farm, for instance, offers reliable policies with an average annual cost of around $3,000, making it an attractive option for homeowners looking for balanced coverage. Allstate also provides numerous discounts, especially for bundling policies, which can help reduce overall insurance costs.

Travelers is another budget-friendly option, starting its average premium at approximately $1,775 annually, making it ideal for cost-conscious homeowners. For those specifically concerned about hurricane risks, Universal Property & Casualty specializes in coverage for high-risk areas and provides tailored protection against severe weather events. By exploring these options and comparing quotes, Florida homeowners can find the best policy that suits their needs while ensuring their property is adequately protected.

Tips for Choosing the Right Homeowners Insurance in Florida

Selecting the right homeowners insurance provider in Florida involves more than just comparing costs; it’s crucial to evaluate coverage specifics and exclusions. Many policies may not cover damages caused by hurricanes or floods, which are significant risks in the region. Homeowners should carefully review the details of each policy, ensuring that it meets their needs for disaster protection. Additionally, understanding the coverage limits and any potential exclusions is essential to avoid unpleasant surprises during the claims process.

Financial stability is another critical factor when choosing an insurance provider. Given the volatility of the Florida insurance market, where some companies have exited due to high claim volumes, verifying an insurer’s financial health is vital. Homeowners can consult ratings from agencies like A.M. Best to assess an insurer’s ability to handle significant claims during natural disasters. A reliable provider not only offers good customer service but also the assurance that they can fulfill claims when needed.

Effective Strategies to Save on Homeowners Insurance in Florida

Despite the high average costs of homeowners insurance in Florida, there are effective strategies to lower premiums. One of the most impactful methods is investing in home mitigation techniques, such as installing hurricane shutters, impact-resistant windows, or reinforced roofing. These upgrades not only enhance the home’s resilience against storms but may also qualify homeowners for significant discounts on their insurance premiums. Insurance companies often reward proactive measures that reduce risk, making this an appealing option for many.

Another useful approach is to regularly compare insurance quotes from different providers. The insurance landscape can change yearly, and rates may fluctuate significantly. By taking the time to shop around annually, homeowners can ensure they are getting the best rate possible for their coverage needs. Additionally, considering a higher deductible can reduce premium costs, though it’s crucial to choose a deductible that remains manageable in the event of a claim. Participating in programs like MySafeFloridaHome can also provide financial assistance for storm-resistant improvements, further helping homeowners save on insurance costs.

Understanding the Importance of Flood Insurance in Florida

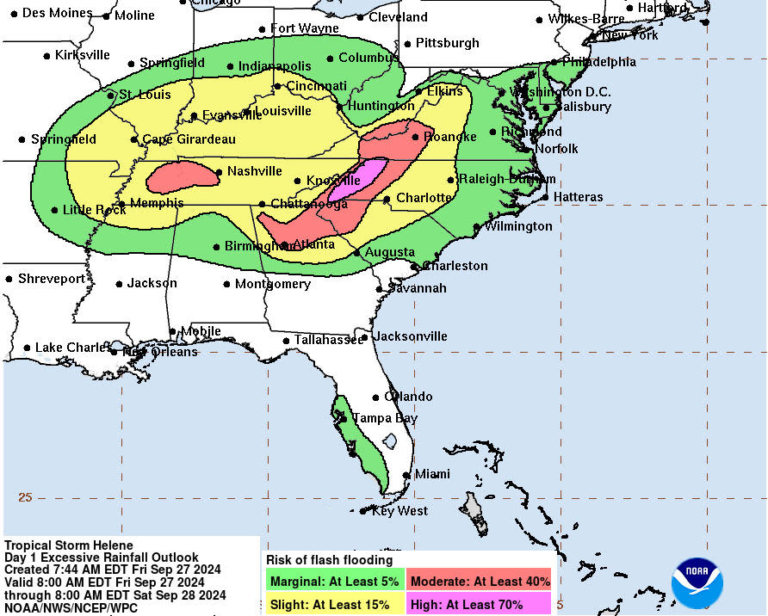

In Florida, the importance of flood insurance cannot be overstated, especially given the state’s vulnerability to heavy rains and hurricanes. Standard homeowners insurance policies typically do not cover flood damage, which means homeowners must seek separate flood insurance to protect their properties. This additional coverage is vital for safeguarding against potential water damage, which can occur even outside of hurricane season. Homeowners in flood-prone areas should carefully assess their risk and consider investing in flood insurance as part of their overall homeowners insurance strategy.

Moreover, the National Flood Insurance Program (NFIP) offers flood insurance policies that can be particularly beneficial for Florida residents. These policies are designed to provide financial protection against flooding, ensuring that homeowners can recover from flood-related damages. As climate change continues to affect weather patterns, the risk of flooding is rising, making it increasingly important for homeowners to secure this type of coverage. By understanding the nuances of flood insurance, Florida homeowners can better prepare for the unpredictable nature of their environment.

Frequently Asked Questions about Homeowners Insurance in Florida

Many homeowners in Florida have common questions regarding homeowners insurance, especially concerning its costs and coverage specifics. One frequently asked question pertains to the average cost of homeowners insurance in the state, which stands at around $4,000 annually. This figure is significantly influenced by the high risks associated with hurricanes and flooding, making it crucial for homeowners to understand the factors impacting their premiums.

Another common inquiry revolves around the coverage provided by standard homeowners insurance policies. Many homeowners are surprised to learn that hurricane damage is often not included in standard policies, necessitating the purchase of additional hurricane or flood insurance. Furthermore, homeowners often ask about the best ways to lower their premiums. Strategies such as reinforcing their homes against storms and regularly comparing insurance quotes can help significantly reduce costs, allowing homeowners to find affordable coverage that meets their needs.

Navigating the Florida Homeowners Insurance Market

Navigating the homeowners insurance market in Florida can be challenging due to the complexities of policies and the fluctuating rates based on market conditions. Homeowners should familiarize themselves with the various factors that influence premiums, including the likelihood of natural disasters, property values, and the overall financial health of insurance companies. Understanding these elements is essential for homeowners to make informed decisions when selecting their insurance provider.

Additionally, competition within the Florida insurance market plays a significant role in determining rates and coverage options. With some companies exiting the market due to financial pressures, homeowners may find fewer choices available, which can lead to higher premiums. It is vital to stay informed about changes in the market and explore all available options to secure the best homeowners insurance policy at a competitive price.

Homeowners Insurance Trends in Florida

Analyzing the trends in homeowners insurance in Florida reveals a dynamic landscape shaped by various factors, including climate change and economic conditions. Over recent years, there has been a notable increase in insurance premiums, primarily driven by the rising frequency of natural disasters such as hurricanes and flooding. Insurers are adapting to these challenges by adjusting their rates and coverage options, making it essential for homeowners to stay updated on the latest trends and policies.

Moreover, advancements in technology are beginning to influence the homeowners insurance market in Florida. Many companies are adopting digital tools to streamline the claims process, improve customer service, and enhance risk assessment. These innovations can lead to more personalized insurance solutions and potentially lower premiums for homeowners who take proactive measures to mitigate risks. Staying informed about these trends can empower Florida homeowners to make better decisions regarding their insurance coverage.

Frequently Asked Questions

What is the average cost of homeowners insurance in Florida?

The average homeowners insurance cost in Florida is about $4,000 per year, significantly higher than the national average due to factors such as hurricane risks and rising property values.

Why are homeowners insurance rates in Florida so high?

Homeowners insurance rates in Florida are high primarily because of the state’s vulnerability to hurricanes, flooding, increased rebuilding costs, and high reinsurance expenses that insurers face.

Does homeowners insurance in Florida cover hurricane damage?

Standard homeowners insurance in Florida often does not cover hurricane damage. Homeowners may need to purchase additional hurricane insurance or endorse their policy to ensure they are protected.

How can I lower my homeowners insurance premium in Florida?

To reduce homeowners insurance premiums in Florida, consider installing storm-resistant features, increasing deductibles, regularly comparing quotes, and participating in programs like MySafeFloridaHome for potential discounts.

Is flood insurance included in homeowners insurance in Florida?

No, flood insurance is not typically included in standard homeowners insurance policies in Florida. Homeowners must purchase separate flood insurance to be adequately covered against flood risks.

What factors influence Florida homeowners insurance rates?

Florida homeowners insurance rates are influenced by several factors, including hurricane and flood risks, high real estate and rebuilding costs, the insurance market’s competitiveness, and individual property characteristics.

What should I look for when choosing homeowners insurance in Florida?

When selecting homeowners insurance in Florida, consider coverage specifics for natural disasters, the insurer’s financial stability, customer service ratings, available discounts, and the balance between deductibles and premiums.

Are there any discounts available for homeowners insurance in Florida?

Yes, many insurers in Florida offer discounts for safety features such as security systems, impact-resistant windows, and participation in programs like MySafeFloridaHome that encourage storm-resistant home improvements.

What is reinsurance and how does it affect homeowners insurance costs in Florida?

Reinsurance is insurance purchased by insurers to manage risk. In Florida, high reinsurance costs due to the risk of natural disasters lead to higher premiums for homeowners insurance.

How often should I compare homeowners insurance quotes in Florida?

It’s advisable to compare homeowners insurance quotes in Florida annually, as rates can change frequently due to market conditions, allowing homeowners to find the most competitive premium.

| Key Factors | Details |

|---|---|

| Hurricane and Flood Risks | Florida’s coastal geography makes it vulnerable to hurricanes, tropical storms, and flooding, leading to higher premiums. |

| High Real Estate and Rebuilding Costs | Surging property values have resulted in higher rebuilding costs, driving up insurance premiums. |

| Reinsurance and Market Challenges | Insurers face high reinsurance costs, which are passed on to policyholders, and reduced competition due to companies exiting the market. |

| Top Providers | Top choices include State Farm, Travelers, Allstate, Universal Property & Casualty, and Chubb, each offering various strengths. |

| Choosing the Right Provider | Consider coverage specifics, financial stability, claims process, deductible balance, and available discounts when selecting a policy. |

| Cost-Saving Strategies | Homeowners can reduce expenses through home mitigation, comparing quotes, considering higher deductibles, and participating in special programs. |

Summary

Homeowners insurance in Florida is notably high, averaging about $4,000 annually, primarily due to the state’s vulnerability to severe weather events like hurricanes and floods. Homeowners Insurance Florida encompasses various factors that drive these costs, including rising property values and reinsurance expenses. To navigate these challenges successfully, Florida homeowners should evaluate their coverage needs, assess different providers, and implement strategies to reduce premiums while ensuring adequate protection for their homes.