Florida Home Insurance Market: Can It Withstand Milton?

The Florida home insurance market is currently navigating through the challenges posed by Hurricane Milton, a Category 4 storm that has raised concerns among industry experts and rating agencies. Despite warnings from AM Best and Fitch Ratings about potential liquidity strains on Florida’s residential insurers, many believe that these companies are well-equipped to handle losses and continue providing hurricane insurance coverage. The state’s recent insurance reforms have bolstered the financial condition of Florida insurers, allowing them to maintain adequate levels of reinsurance and manage risks effectively. As we analyze the implications of Hurricane Milton, the importance of catastrophe modeling in insurance becomes apparent, as it helps insurers understand and prepare for potential storm impacts. Overall, while challenges remain, the resilience of the Florida home insurance market is being tested and showcased in the face of adversity.

Within the realm of property insurance, the Florida home insurance market is witnessing significant developments as it contends with the repercussions of Hurricane Milton. The assessment of this market involves understanding its capacity to withstand catastrophic events and the ongoing reforms that aim to improve the overall financial stability of local insurers. Alternative terms such as residential property coverage and hurricane risk management are essential in discussing how Florida’s insurance landscape is evolving. Recent legislative changes have played a crucial role in transforming the conditions for insurers, enhancing their liquidity and ability to respond to claims. As the state prepares for future storms, the focus on effective catastrophe modeling will be vital for maintaining a robust insurance framework.

The Impact of Hurricane Milton on Florida’s Home Insurance Market

Hurricane Milton, classified as a Category 4 storm, has raised concerns among insurance analysts regarding its potential impact on the Florida home insurance market. AM Best and Fitch Ratings have both issued warnings that the storm could challenge the liquidity of Florida-based insurers, which primarily focus on protecting local homeowners. However, experts in the state have a more optimistic view, suggesting that Florida’s insurers are well-equipped to manage the losses anticipated from this hurricane, thanks in part to robust reinsurance strategies.

While evaluating the potential losses from Hurricane Milton, it is essential to consider the advanced catastrophe modeling techniques employed by Florida insurers. These models help accurately predict the financial implications of various storm scenarios, allowing insurers to prepare adequately. Industry leaders believe that despite the warnings from rating agencies, the overall financial health of Florida’s insurers has improved significantly due to recent legislative reforms aimed at addressing systemic issues within the insurance market.

Understanding Florida Insurance Reforms and Their Effects

In recent years, Florida has enacted a series of insurance reforms designed to stabilize the home insurance market and mitigate the adverse effects of natural disasters. These reforms, introduced in response to ongoing challenges such as legal system abuse and claim fraud, have significantly improved the financial condition of residential insurers. As noted by Mark Friedlander from Triple-I, these changes have put the market in a stronger position to absorb potential losses from hurricanes like Milton, thereby enhancing the overall resilience of Florida’s insurance landscape.

The reforms have not only bolstered the financial stability of Florida insurers but have also led to a more competitive market environment. As insurers are now better positioned to handle catastrophic events, homeowners can expect more stable premium rates and enhanced coverage options. This is vital for maintaining consumer trust and ensuring that Floridians remain protected against the financial fallout from future hurricanes.

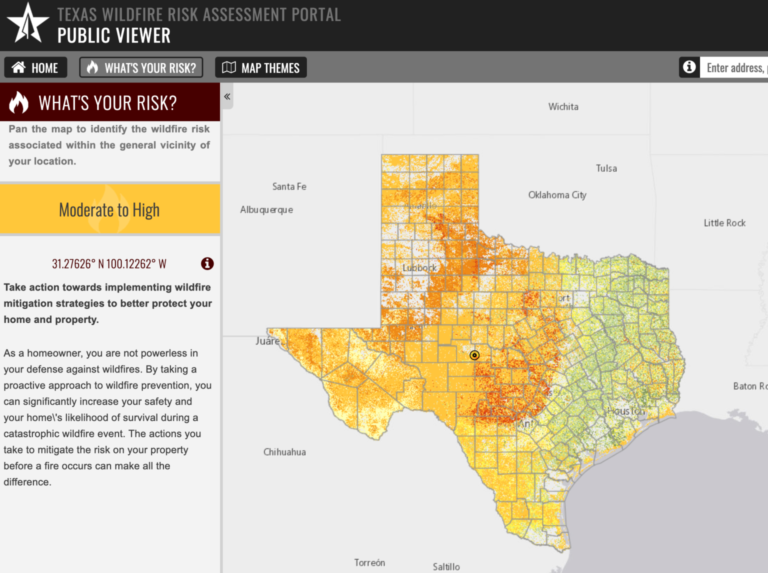

Catastrophe Modeling: A Key Tool for Florida Insurers

Catastrophe modeling has become an indispensable tool for insurers operating in Florida, especially in the wake of hurricane threats like Milton. This modeling allows insurers to simulate a wide range of disaster scenarios, assessing potential losses associated with various wind speeds and storm paths. By utilizing sophisticated algorithms and data analysis, insurers can make informed decisions regarding their reinsurance needs and overall risk management strategies.

Experts like Karen Clark emphasize that these advanced modeling techniques enable Florida’s insurers to not only anticipate potential losses but also optimize their reinsurance coverage. This proactive approach is crucial for ensuring that insurers can withstand the financial pressures associated with significant storm events, making it less likely for homeowners to face abrupt premium increases or coverage gaps during hurricane season.

Assessing Liquidity in Florida’s Insurance Market

The liquidity of Florida’s insurance market has been a point of concern in the face of potential losses from hurricanes like Milton. Rating agencies have warned that the financial strain from such events could challenge insurers’ ability to cover claims. However, industry experts argue that Florida insurers have sufficient liquidity and reinsurance arrangements in place to manage these risks effectively. This capability is essential as it allows insurers to respond swiftly to claims while maintaining operational stability.

Furthermore, as noted by Joe Petrelli of Demotech, Florida insurers have the option to secure additional reinsurance capacity if their initial resources are exhausted. This flexibility is crucial in times of disaster, ensuring that insurers can continue to operate without interruption. The combination of legislative reforms and robust liquidity management strategies positions Florida’s insurance market to handle the financial implications of hurricanes while protecting homeowners.

Hurricane Insurance Coverage: What Homeowners Should Know

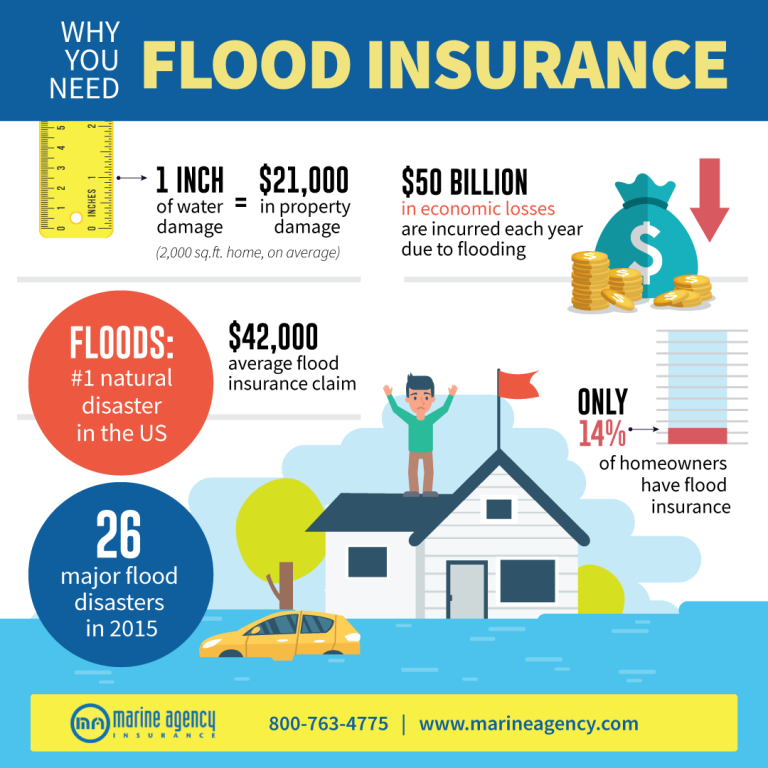

Hurricane insurance coverage is a critical aspect of homeowners’ protection in Florida, especially as the state experiences an increase in storm activity. Homeowners must understand the specifics of their policies, including what is covered and any exclusions that may apply. With recent reforms enhancing the insurance landscape, many homeowners are now finding better options and coverage terms than in previous years.

However, it is essential for homeowners to review their policies carefully, particularly in light of potential changes in the insurance market following events like Hurricane Milton. Ensuring adequate coverage against wind and flood damage can prevent significant financial losses. Homeowners should also stay informed about the implications of legislative changes, which can affect coverage options and premium rates going forward.

The Role of Reinsurance in Florida’s Insurance Market

Reinsurance plays a pivotal role in the stability of Florida’s insurance market, especially in the context of catastrophic events like hurricanes. By transferring a portion of their risk to reinsurance companies, primary insurers can protect themselves against substantial financial losses. This practice not only enhances the liquidity of insurers but also ensures that they can meet the claims demands of policyholders during a disaster.

As Florida continues to face the threat of hurricanes, the importance of reinsurance becomes even more pronounced. Insurers can leverage their reinsurance arrangements to maintain competitive premium rates while still providing comprehensive coverage. This balance is essential for fostering a sustainable insurance market and ensuring that homeowners have access to the protection they need against the financial impacts of severe weather.

Future Outlook for Florida Home Insurance Amid Climate Change

The future of Florida home insurance is closely linked to the ongoing challenges posed by climate change and increasing hurricane activity. As weather patterns become more unpredictable, insurers must adapt their strategies to account for the heightened risk of severe storms. This includes revisiting catastrophe modeling methodologies and reassessing coverage limits to ensure that they can adequately protect homeowners in the face of evolving threats.

Additionally, the insurance industry is likely to witness shifts in consumer behavior as awareness of climate risks grows. Homeowners may increasingly seek policies that offer enhanced protection against wind and flood damage, prompting insurers to innovate their products. The combination of legislative reforms and heightened consumer demand for comprehensive coverage will shape the landscape of Florida’s home insurance market for years to come.

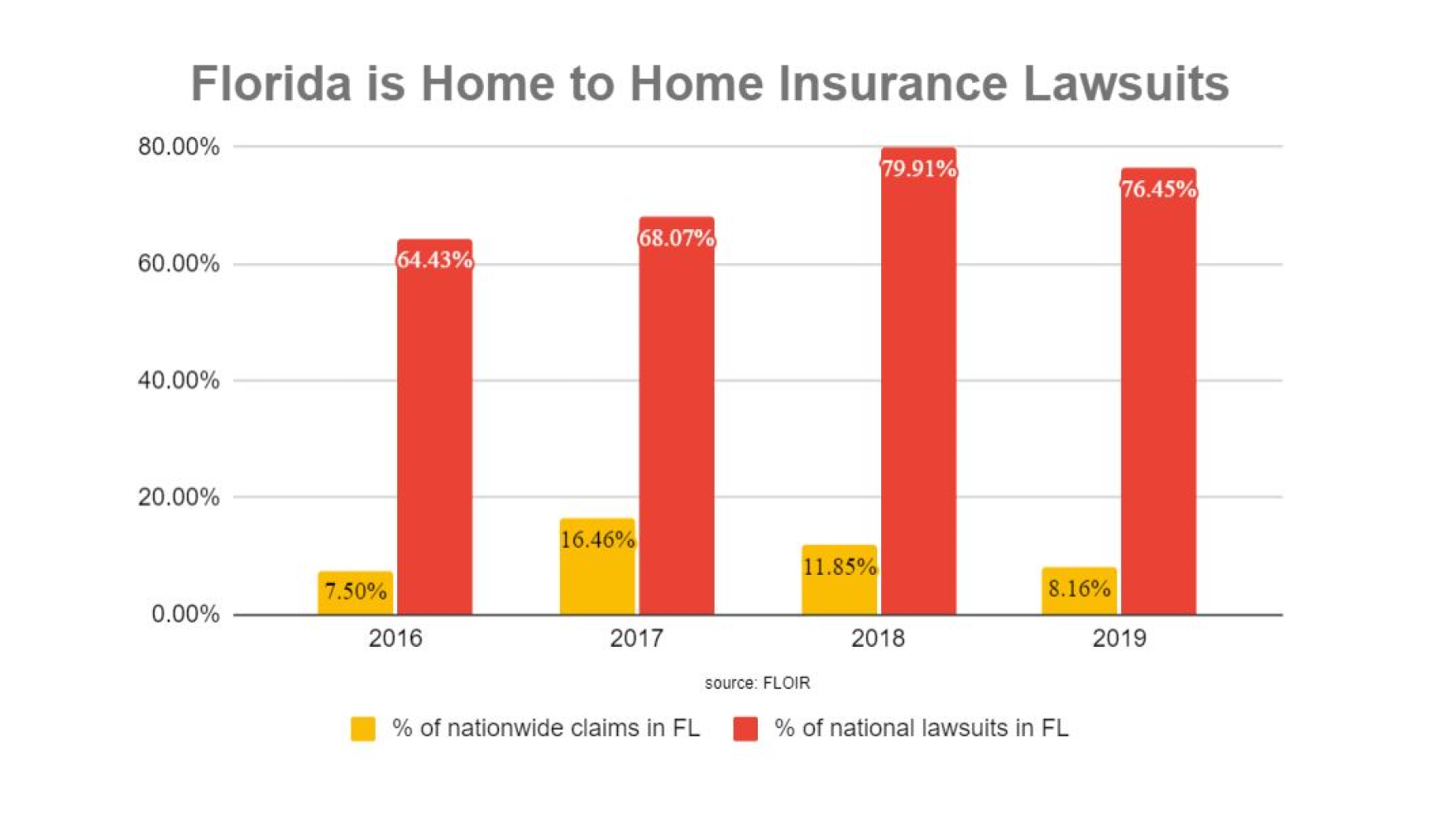

Navigating Legal Challenges in Florida’s Insurance Landscape

Legal challenges have historically posed significant hurdles for Florida’s insurance market, contributing to rising premiums and market instability. The introduction of recent legislative reforms has aimed to address these challenges by curbing legal system abuses and reducing the prevalence of fraudulent claims. These changes are expected to foster a more stable environment for insurers, allowing them to focus on their core mission of providing reliable coverage to homeowners.

As the Florida insurance market continues to evolve, it is essential for both insurers and consumers to remain vigilant regarding legal developments. Homeowners should stay informed about their rights and any changes to the legal framework that could impact their insurance policies. By enhancing transparency and accountability within the legal system, Florida can work towards a more resilient insurance market that effectively meets the needs of its residents.

Consumer Education: Empowering Florida Homeowners

Consumer education is a crucial element in strengthening Florida’s home insurance market. As homeowners become more informed about their insurance options and the factors influencing their premiums, they can make better decisions regarding coverage. This includes understanding the implications of hurricane insurance and how to navigate the claims process in the event of a disaster. Insurers and industry experts have a responsibility to provide clear and accessible information to help consumers understand their policies.

Additionally, educating homeowners about the importance of maintaining adequate coverage in light of climate change and increased hurricane activity is vital. By equipping consumers with the knowledge they need to assess their insurance needs and advocate for themselves, Florida can foster a more resilient community capable of withstanding future challenges in the insurance landscape.

Frequently Asked Questions

What is the impact of Hurricane Milton on the Florida home insurance market?

Hurricane Milton has raised concerns among insurance rating agencies regarding its potential impact on the Florida home insurance market. However, industry experts believe that Florida’s insurers are prepared to manage losses from Milton, as they have sufficient reinsurance capital and advanced catastrophe modeling tools to analyze hurricane risks.

How have Florida insurance reforms affected the home insurance market?

Recent Florida insurance reforms implemented in 2022 and 2023 have strengthened the home insurance market by addressing issues like legal system abuse and claim fraud. These reforms have improved the financial health of Florida residential insurers, enabling them to handle potential catastrophic events more effectively.

What kind of hurricane insurance coverage is available in Florida?

Florida homeowners can obtain hurricane insurance coverage as part of their homeowners’ insurance policies. This coverage typically includes protection against wind damage, flooding, and other hurricane-related risks. It’s important for homeowners to review their policies to ensure adequate coverage for potential hurricane impacts.

How does the liquidity of Florida insurers affect the home insurance market?

The liquidity of Florida insurers is crucial for the home insurance market, especially during hurricane season. Although concerns have been raised about Hurricane Milton straining liquidity, experts assert that most Florida insurers maintain adequate reinsurance and financial stability to cover losses, ensuring continued protection for homeowners.

What role does catastrophe modeling play in the Florida home insurance market?

Catastrophe modeling plays a significant role in the Florida home insurance market by helping insurers assess the risk of hurricane-related losses. Advanced modeling techniques allow insurers to predict potential damages from various hurricane scenarios, enabling them to secure appropriate reinsurance and set premiums that reflect the true risk.

How do Florida insurers prepare for potential hurricane events?

Florida insurers prepare for potential hurricane events by acquiring catastrophe reinsurance coverage, utilizing advanced modeling tools to assess risks, and maintaining sufficient capital reserves. This preparedness allows them to manage losses effectively and provide homeowners with reliable insurance coverage even during severe weather events.

| Key Points | Details |

|---|---|

| Impact of Hurricane Milton | Hurricane Milton has raised concerns about Florida’s home insurance market, but experts believe insurers are prepared to manage losses. |

| Ratings Agencies’ Warnings | AM Best and Fitch Ratings warn that Milton could strain liquidity for insurers focused on Florida homeowners. |

| Expert Opinions | Local experts argue that the ratings agencies do not assess many Florida insurers’ financial strength. |

| Reinsurance Capital | Florida insurers have sufficient reinsurance capital to withstand multiple hurricane events. |

| Comparative Loss Estimates | Expected losses from Milton are anticipated to be less than those from Hurricane Ian, despite being a Category 4 storm. |

| Legislative Reforms | Recent reforms have improved the financial condition of the Florida home insurance market. |

Summary

The Florida home insurance market is showing resilience despite concerns over Hurricane Milton’s impact. Experts suggest that the market is well-prepared to handle potential losses and has adequate reinsurance in place. With significant reforms enacted in recent years to tackle underlying issues in the insurance landscape, the market is currently in a strong financial position, ready to face any challenges posed by future storms.