Flood Risk Insurance: Opportunities for Insurers Today

Flood risk insurance is an essential safeguard for property owners facing the unpredictable threat of flooding. As natural disasters increasingly involve flooding, having adequate flood insurance coverage is crucial for protecting investments and ensuring peace of mind. The National Flood Insurance Program (NFIP) has historically provided a safety net, but the rise of private flood insurance options has expanded access to tailored coverage. Recent advancements in underwriting flood risk, particularly with the implementation of Risk Rating 2.0, have revolutionized how insurers assess and price flood insurance policies. With improved data collection and innovative technology, homeowners can now secure better flood risk insurance solutions that align more closely with their unique property risk profiles.

When discussing flood coverage, it’s important to consider various insurance options available to homeowners. Often referred to as flood protection insurance, this form of coverage is vital for mitigating the financial impact of water-related disasters. With the emergence of private flood options, homeowners can explore alternatives beyond traditional government programs, such as the National Flood Insurance Program. Moreover, risk assessment methods have evolved significantly, allowing for more precise underwriting of water hazards and a tailored approach to insurance premiums. As the landscape of flood risk management continues to change, understanding these alternatives can empower property owners to make informed decisions about their protection against flooding.

Understanding Flood Risk Insurance

Flood risk insurance is an essential component of property protection, particularly in areas prone to natural disasters. This specialized insurance covers damages caused by flooding, which is more prevalent than many realize; over 90% of natural disasters involve some form of flooding. Traditionally, the private insurance market was reluctant to provide coverage due to the complexities involved in underwriting flood risk. However, with advancements in data analytics and technology, insurers can now assess flood risks with greater accuracy, enabling them to offer more comprehensive policies.

The National Flood Insurance Program (NFIP) was established to fill the gap left by private insurers, providing federally backed flood insurance. Recent changes in the NFIP, particularly through Risk Rating 2.0, have aimed to create a more equitable pricing system aligned with the actual flood risks of individual properties. This shift not only impacts the affordability of flood insurance but also encourages private insurers to enter the market, thereby increasing competition and options for policyholders.

The Role of the National Flood Insurance Program

The National Flood Insurance Program (NFIP) plays a pivotal role in the management and mitigation of flood risks across the United States. Established in response to the inadequacy of private flood insurance, NFIP provides crucial coverage to homeowners in flood-prone areas. This program has evolved over the years, adapting to changing environmental conditions and insurance market dynamics. As part of its efforts to improve flood insurance coverage, the NFIP recently introduced Risk Rating 2.0, a new methodology designed to provide more accurate pricing based on individual property risks.

Risk Rating 2.0 addresses the discrepancies in flood insurance premiums that often left homeowners either overpaying or underinsured. By utilizing advanced data analytics and modeling, the NFIP can better reflect the true risk associated with each property, leading to fairer rates. This initiative not only enhances the affordability of flood insurance but also encourages more homeowners to acquire necessary coverage, ultimately reducing the financial burden on the federal government during flood disasters.

Advancements in Underwriting Flood Risk

The process of underwriting flood risk has undergone a significant transformation in recent years. Insurers now have access to sophisticated data sources and advanced computational tools that allow for more precise risk assessments. The ability to analyze data from multiple geographic and environmental factors means that insurers can better predict the likelihood of flooding at specific properties. Consequently, this improvement in underwriting methodologies is making flood risk insurance more accessible and affordable for a greater number of homeowners.

Furthermore, the incorporation of cutting-edge technologies, such as geographic information systems (GIS) and machine learning, has revolutionized how insurers evaluate flood risks. This shift not only increases the capacity for insurance providers but also empowers policyholders to make informed decisions regarding their flood insurance coverage. As a result, homeowners can proactively manage their exposure and potentially lower their insurance costs by understanding the specific risks they face.

Private Flood Insurance Options

The rise of private flood insurance has introduced a new level of competition into the market, providing policyholders with more options than ever before. This surge in private insurance offerings is partly due to the advancements in data analytics and the implementation of Risk Rating 2.0 by the NFIP. Insurers now have the capability to tailor their flood insurance products to meet the unique needs of individual customers, making it possible for homeowners to find coverage that fits their specific risk profile.

Private flood insurance can often provide benefits that differ from traditional NFIP policies, including higher coverage limits and broader coverage options. These policies may also include additional endorsements or features that enhance protection against various flood scenarios. As the private market continues to grow, homeowners are encouraged to explore these alternatives to find the best flood insurance coverage that aligns with their needs.

The Impact of Risk Rating 2.0 on Flood Insurance

The introduction of Risk Rating 2.0 has marked a significant shift in the landscape of flood insurance. This new pricing methodology focuses on aligning insurance premiums with the actual risk associated with each property, rather than relying solely on historical flood data. As a result, many homeowners may see their flood insurance premiums reflect a more accurate evaluation of their risk, leading to potential decreases in costs for some property owners while others may face increases.

This reassessment of risk not only improves the fairness of insurance pricing but also incentivizes property owners to invest in flood mitigation measures. By understanding their specific flood risks, homeowners are encouraged to take proactive steps to reduce their vulnerability, ultimately contributing to a more resilient community. As the NFIP and private insurers adapt to this new risk-based pricing model, the goal remains clear: to enhance flood insurance availability and affordability for all homeowners.

Bridging the Flood Protection Gap

Bridging the flood protection gap is an ongoing challenge that requires collaboration among insurers, government agencies, and communities. Companies like Swiss Re are taking proactive steps to address this issue by acquiring expertise in flood risk management, such as their acquisition of Fathom, a firm specializing in water-related risks. This strategic move highlights the commitment to enhancing flood protection measures and providing valuable insights into effective risk management.

To effectively bridge the flood protection gap, it’s essential to leverage advanced data analytics and technology to better understand flood risks. By utilizing comprehensive data, insurers can develop targeted strategies that address the unique vulnerabilities of different regions and properties. This collaborative approach not only improves insurance offerings but also empowers communities to implement better flood management practices, ultimately reducing the impact of flooding on lives and property.

The Future of Flood Insurance Market

The future of the flood insurance market appears promising, particularly as advancements in technology continue to evolve. The integration of big data, predictive analytics, and machine learning is transforming how insurers assess and price flood risks. This evolution opens up opportunities for new products and solutions that cater to the specific needs of property owners, allowing for a more customized flood insurance experience.

Moreover, as the private insurance market grows and more options become available, consumers will benefit from increased competition, potentially leading to lower premiums and better coverage terms. Insurers will also be able to develop innovative policies that address emerging flood risks, ensuring that homeowners are adequately protected against the growing threat of climate change and extreme weather events.

The Importance of Education on Flood Risks

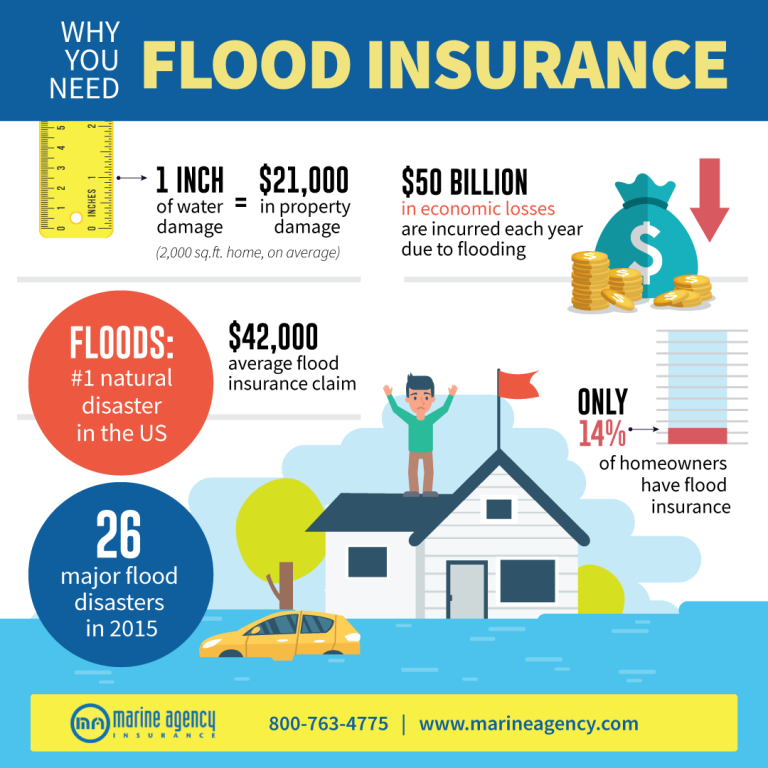

Education plays a crucial role in increasing awareness about flood risks and the importance of obtaining adequate flood insurance coverage. Many homeowners remain unaware of their vulnerabilities to flooding, particularly in areas not typically associated with flood events. By providing information on the nature of flood risks, property owners can make informed decisions regarding their insurance needs and take steps to mitigate potential damages.

Community outreach programs and resources can significantly enhance understanding of flood insurance options, including the differences between NFIP and private flood insurance. These educational initiatives can empower homeowners to assess their risk exposure and choose the most appropriate coverage. Additionally, educating communities about flood preparedness and response can further enhance resilience and reduce the overall impact of flooding.

Navigating the Flood Insurance Claims Process

Navigating the flood insurance claims process can be daunting for many homeowners, especially after experiencing a flood event. Understanding the steps involved in filing a claim is crucial for ensuring prompt and fair compensation for damages. Policyholders should familiarize themselves with their specific coverage terms and conditions, including what is covered and any necessary documentation required during the claims process.

Effective communication with insurers is vital during this period. Homeowners should keep detailed records of damages and maintain open lines of communication with their insurance providers to facilitate the claims process. Additionally, knowing the timelines and procedures for claim assessments can help manage expectations and lead to a smoother recovery process post-flood.

Frequently Asked Questions

What is flood risk insurance and how does it work?

Flood risk insurance provides coverage for damages caused by flooding, which is often excluded from standard homeowners insurance policies. It can be purchased through the National Flood Insurance Program (NFIP) or private flood insurance providers. Insurers assess flood risk based on factors like property location, flood zone, and historical flooding data to determine coverage and premiums.

How does the National Flood Insurance Program (NFIP) impact flood insurance coverage?

The National Flood Insurance Program (NFIP) offers federally backed flood insurance to property owners, renters, and businesses in participating communities. It aims to reduce the economic impact of flooding by providing affordable flood insurance coverage and promoting floodplain management practices.

What is Risk Rating 2.0 and how does it affect flood insurance premiums?

Risk Rating 2.0 is the NFIP’s updated pricing methodology that adjusts flood insurance premiums based on the specific flood risk of an individual property rather than broader flood zone classifications. This approach aims to make premiums more equitable and reflective of actual risk, potentially lowering costs for some policyholders while increasing them for others.

What advantages does private flood insurance offer compared to NFIP?

Private flood insurance often provides more flexible coverage options and higher policy limits than the NFIP. Additionally, private insurers may offer faster claims processing and broader coverage terms, catering to the specific needs of property owners and addressing gaps not covered by the NFIP.

How can property owners manage their flood risk more effectively?

Property owners can manage their flood risk by purchasing flood insurance, understanding their local flood zones, implementing preventative measures such as elevation and drainage improvements, and staying informed about weather forecasts and flood warnings. Utilizing data from insurers can also help in assessing and mitigating flood risks.

Why has there been an increase in private insurers offering flood coverage since 2016?

Since 2016, advancements in data collection and computing power have allowed private insurers to better assess and underwrite flood risk. This has led to more private insurers entering the flood insurance market, providing more options for consumers and enhancing the overall availability and affordability of flood insurance.

What role does underwriting flood risk play in securing flood insurance?

Underwriting flood risk involves evaluating the potential for flooding on a property to determine insurance coverage and premiums. Insurers use various data sources, including historical flooding patterns and geographic information, to accurately assess risks and set appropriate pricing for flood insurance.

Can I rely solely on NFIP for flood insurance coverage?

While the NFIP provides essential flood insurance coverage, property owners are encouraged to explore private flood insurance options as well. Private insurers may offer more comprehensive coverage and competitive pricing, which can be beneficial depending on individual risk profiles and needs.

| Key Point | Details |

|---|---|

| Complexity of Flood Risk | Flood risk is one of the most destructive hazards and complex for insurers to underwrite. |

| National Flood Insurance Program (NFIP) | Established due to the lack of private market coverage for flood risk. |

| Advancements in Data Collection | Improved data and computing power have changed the landscape for flood risk underwriting. |

| Flood’s Impact on Natural Disasters | Over 90% of natural disasters involve flooding in some way. |

| Insurance Underwriting Improvements | Multiple data sources enable better understanding and management of flood risks. |

| Increased Insurance Capacity | More information leads to increased capacity, enhancing insurance availability and affordability. |

| Risk Rating 2.0 | A new pricing methodology by NFIP to make flood insurance premiums more equitable. |

| Impact on Policyholder Rates | Policyholders may experience rate decreases or increases based on risk alignment. |

| Swiss Re’s Acquisition of Fathom | Focus on bridging the flood protection gap through specialized expertise. |

Summary

Flood risk insurance is a crucial area of focus for property owners and insurers alike, as it addresses one of the most destructive natural hazards. With advancements in data collection and risk assessment methodologies like Risk Rating 2.0, the landscape of flood risk insurance is evolving, making it both more accessible and affordable. Insurers are now better equipped to underwrite policies tailored to individual property risks, which can lead to fairer pricing models for policyholders. As the market becomes increasingly receptive to flood risk, the ongoing commitment from companies like Swiss Re to innovate and adapt will play a vital role in enhancing the overall flood protection framework.