Flood Insurance Policy: Essential Protection for Homeowners

A flood insurance policy is a vital safeguard for homeowners, especially those residing in flood-prone regions. With the increasing frequency of severe weather events, understanding flood insurance rates and coverage has never been more important. Many individuals mistakenly believe that their standard homeowner’s insurance will protect them from flood damage, but this is not the case. Flood coverage is essential for mitigating the financial impact of flooding, which can cause devastating losses. This article will delve into crucial flood insurance facts, including the cost of flood insurance and tips for securing competitive flood insurance rates.

When discussing flood protection, one often encounters terms like flood risk management or water damage insurance. These alternative phrases emphasize the importance of having a solid plan in place to shield your property from potential water-related disasters. Understanding the nuances of flood insurance can help you navigate the complexities of securing adequate protection for your home. Many homeowners may be unaware of the significant differences between various types of coverage and the financial implications they carry. In this guide, we will explore the essentials of flood coverage, helping you equip yourself with the knowledge needed to make informed decisions.

Understanding Flood Insurance Policies

A flood insurance policy is crucial for homeowners, especially those living in flood-prone areas. Unlike standard homeowner’s insurance, which typically excludes flood damage, a dedicated flood policy provides comprehensive coverage for damages caused by rising waters. This insurance is not only vital for safeguarding your property but also offers peace of mind knowing that you are financially protected against one of nature’s most unpredictable disasters.

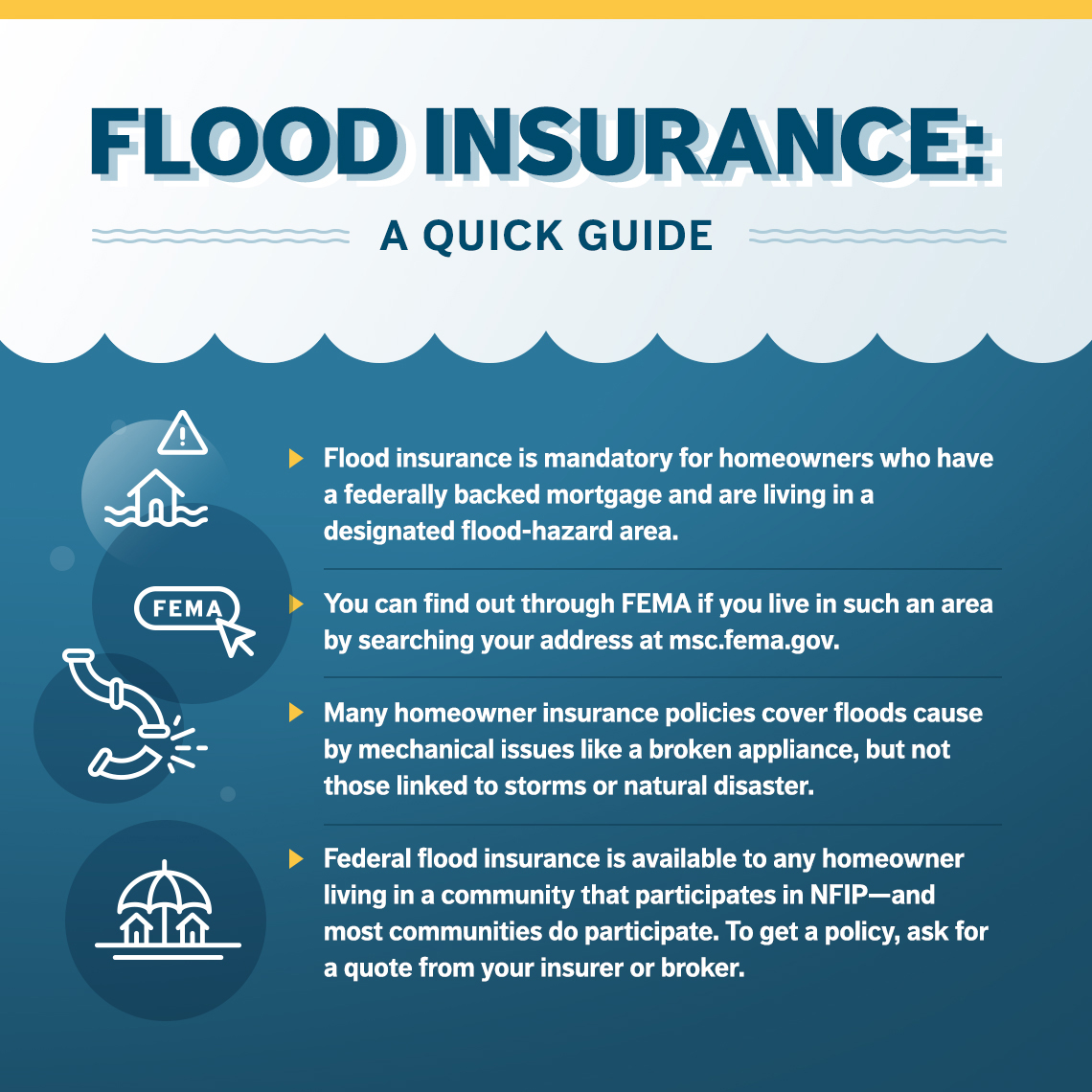

Many people mistakenly believe that their homeowner’s insurance will cover flood damage, but this is often not the case. The National Flood Insurance Program (NFIP) provides flood insurance to homeowners, renters, and businesses, making it accessible for those in high-risk zones. Understanding the specifics of your flood insurance policy, including its limits and exclusions, is essential to ensure adequate coverage.

Flood Insurance Rates: Factors and Variability

Flood insurance rates can vary significantly based on several factors, including the property’s location, the flood zone designation, and the building’s elevation relative to the Base Flood Elevation (BFE). Properties in high-risk flood zones will typically incur higher premiums due to the increased likelihood of flooding. Conversely, homes in low-risk zones may qualify for lower rates, sometimes available under the Preferred Risk Policy, which can start as low as $129 annually.

When assessing flood insurance rates, it’s important to consider the potential costs of flood damage compared to the premium. While initial rates may seem high, the financial implications of a flood event can far exceed the cost of insurance. For example, the average annual cost of flood insurance in the United States is approximately $958, a small price to pay when considering that floods can cause tens of thousands of dollars in property damage.

The Importance of Flood Coverage for Homeowners

Flood coverage is not just an option but a necessity for homeowners in flood-prone regions. With statistics showing that floods account for 90% of all natural disasters in the U.S., having a flood insurance policy can be the difference between financial stability and overwhelming debt after a disaster. Many homeowners are unaware that even a small amount of water can lead to significant damage, making flood insurance a wise investment.

Moreover, flood insurance provides coverage for personal property, including furniture and essential belongings, as well as the structure itself. This comprehensive coverage allows homeowners to recover more quickly after a flood event. It is crucial for policyholders to understand what their flood insurance covers and the process of filing a claim to ensure they can effectively address damages.

Navigating Flood Risk and Insurance Requirements

Understanding your flood risk is the first step in navigating flood insurance. The First Street Foundation’s flood-risk score can help homeowners determine their risk level and inform their insurance decisions. Properties that may seem safe could still be at risk, particularly in low- to moderate-risk areas where about 20% of flood claims originate. This highlights the need for flood insurance, even for homes not located in high-risk flood zones.

In addition, local building codes and lending requirements may necessitate flood insurance for properties in certain zones. If you are purchasing a home in a designated flood area, lenders may require proof of flood insurance before approving a mortgage. Being proactive about understanding your flood risk and insurance needs can save you from unforeseen financial burdens in the future.

The Cost of Flood Insurance by State

The cost of flood insurance can vary drastically from one state to another. For instance, Alabama has an average annual cost of $699, while Connecticut sees rates as high as $1,472. These differences are influenced by the frequency of flooding in each area, local risk assessments, and community planning efforts. Understanding these rates can help potential policyholders gauge what they might expect to pay for coverage.

Additionally, the percentage of households with flood insurance varies significantly across states. For example, Florida, prone to hurricanes and flooding, has a high percentage of households insured at 32.95%. In contrast, states like Alaska and Arizona have lower percentages, reflecting their generally lower flood risk. Homeowners should consider these statistics when evaluating their need for flood insurance, as coverage becomes increasingly essential in higher-risk states.

Making Sense of Flood Insurance Facts

Several key facts about flood insurance can help demystify its importance. For instance, flooding can occur at any time and is one of the most common natural disasters, affecting millions across the country. Understanding that homeowner’s insurance typically excludes flood damage is crucial for homeowners who may assume they are covered against all forms of water damage.

Moreover, waiting for federal disaster assistance from FEMA can be a lengthy and uncertain process. Many homeowners may find that relying solely on FEMA is not a viable option for immediate recovery. Flood insurance provides quicker access to funds for repairs and rebuilding, making it a critical component of disaster preparedness for homeowners.

The Role of FEMA in Flood Recovery

FEMA plays a significant role in disaster recovery, but it is not a guaranteed solution for flood victims. While they provide assistance after major disasters, many homeowners find that the aid does not cover all damages or may come in the form of loans with high interest. This uncertainty reinforces the necessity of having a flood insurance policy, which can offer immediate financial relief for repair and recovery.

It’s important to understand that FEMA assistance requires a disaster declaration from the President, which may not happen in every flooding event. This means that homeowners without flood insurance could be left without significant financial support in times of crisis. By securing a flood insurance policy, homeowners can ensure they are better prepared for unpredictable flooding scenarios.

Affordable Flood Insurance Options

Many homeowners are surprised to learn that flood insurance can be quite affordable, especially in low-risk areas. Policies like the Preferred Risk Policy offer coverage at rates as low as $129 per year, making it accessible to many. This low cost is a small price to pay for peace of mind, especially when considering the potential financial losses from flood damage.

Furthermore, working with reputable insurance companies can help homeowners find the best rates tailored to their specific situation. Many insurers provide discounts based on various factors, including the home’s elevation and the community’s flood management practices. Exploring these options can lead to significant savings on flood insurance premiums.

Repair and Replacement Costs Covered by Flood Insurance

Understanding what your flood insurance policy covers is essential for homeowners. Flood insurance typically covers the costs associated with repairing or replacing structures and personal belongings damaged by flooding. This includes essential repairs and professional fees, which can accumulate quickly after a flood event.

In addition to structural repairs, flood insurance can also cover the costs of alternative accommodation while your home is being restored. This aspect of coverage is particularly valuable, as it alleviates the financial burden of finding temporary housing during the recovery process. Homeowners should review their policy details to ensure they are fully aware of the coverage limits and what expenses are eligible for reimbursement.

Preparing for Flood Season: Insurance as a Safety Net

As flood season approaches, it’s crucial for homeowners to prepare by reviewing their flood insurance policies. Ensuring that coverage is adequate and understanding the claims process can save valuable time and stress during an emergency. Homeowners should also consider updating their policies to reflect any changes in property value or risk levels.

In addition to having a flood insurance policy, homeowners should create an emergency plan that includes evacuation routes and resources for immediate assistance. This comprehensive approach to disaster preparedness, combined with flood insurance, provides a robust safety net for homeowners facing potential flooding disasters.

Frequently Asked Questions

What is a flood insurance policy and why do I need one?

A flood insurance policy provides coverage for damages caused by flooding, which is typically not included in standard homeowner’s insurance. It’s essential if you live in a flood-prone area, as it protects your home and belongings from financial loss due to flood events.

How are flood insurance rates determined?

Flood insurance rates are determined based on various factors, including the property’s location, flood risk, the elevation of the building, and the type of coverage selected. Understanding these factors can help you secure a competitive flood insurance rate.

What does a flood insurance policy cover?

A flood insurance policy typically covers damages to your home, personal belongings, and other structures on your property. This includes costs for debris removal, repair or replacement of damaged items, and temporary housing if your home becomes uninhabitable.

What is the average cost of flood insurance in the United States?

The average cost of flood insurance in the United States is approximately $958 per year. However, costs can vary significantly based on your location and the level of flood risk associated with your property.

Are homes in low-risk areas still at risk for flooding?

Yes, homes in low-risk areas can still experience significant flooding. Statistics show that properties in these zones account for about 20% of all flood insurance claims, highlighting the importance of having a flood insurance policy regardless of perceived risk.

How can I find affordable flood insurance rates?

To find affordable flood insurance rates, consider shopping around with different insurers, taking advantage of any available discounts, and checking if your community participates in the National Flood Insurance Program (NFIP), which can offer lower premiums.

What happens if I don’t have flood insurance and my home floods?

If you don’t have flood insurance and your home floods, you will be responsible for all repair costs. Federal assistance through FEMA is not guaranteed and often comes in the form of loans, which may not cover the full extent of your damages.

How does a flood insurance policy differ from homeowner’s insurance?

A flood insurance policy specifically covers damage caused by flooding, while homeowner’s insurance generally does not include flood-related damages. Homeowners need to purchase a separate flood insurance policy to protect against flood risks.

Can I purchase flood insurance if I live in a high-risk flood zone?

Yes, you can purchase flood insurance if you live in a high-risk flood zone. In fact, it is often required by mortgage lenders in these areas to protect their investment against potential flood damage.

What are some common flood insurance facts I should know?

Some important facts about flood insurance include that it covers both personal property and structure damage, it is available to all homeowners regardless of risk level, and it is often more affordable than many believe, with some policies starting as low as $129 per year.

| State | Average annual cost | Average monthly cost | % households with flood insurance |

|---|---|---|---|

| Alabama | $699 | $58 | 4.03% |

| Alaska | $913 | $76 | 1.36% |

| Arizona | $720 | $60 | 1.58% |

| Arkansas | $933 | $78 | 1.81% |

| California | $865 | $72 | 2.87% |

| Colorado | $944 | $79 | 1.30% |

| Connecticut | $1472 | $123 | 3.75% |

| Delaware | $752 | $63 | 9.93% |

| District of Columbia | $817 | $68 | 1.72% |

| Florida | $597 | $50 | 32.95% |

| Georgia | $694 | $58 | 3.27% |

Summary

A flood insurance policy is crucial for homeowners in flood-prone areas, providing financial protection against the high costs of flood damage. Given that standard homeowners insurance does not cover flooding, securing a flood insurance policy is essential to safeguard your property. With increasing flood risks across many states, understanding the average costs and coverage options is vital. This policy not only covers structural damage but also assists in recovery efforts, reducing the financial burden on homeowners. As flooding remains the most common natural disaster in the U.S., investing in flood insurance is a wise decision to ensure peace of mind and financial security.