Flood Insurance Broken Pipes: What You Need to Know

Flood insurance broken pipes can leave homeowners feeling vulnerable and confused about their coverage. While flood insurance is designed to protect against rising water from natural disasters, many people wonder if it also addresses issues stemming from broken pipes. Understanding what flood insurance covers is crucial; it typically safeguards the structure of your home and essential belongings from flood-related damages. However, when it comes to water damage caused by burst pipes, homeowners may find themselves in a bind, as most flood insurance policies exclude this type of repair coverage. To ensure you are well-protected, it’s essential to explore the intricacies of flood insurance coverage, homeowners insurance, and the potential for water damage insurance to fill in the gaps.

When discussing flood insurance broken pipes, it’s also important to consider related terms such as plumbing failures and water damage incidents. Homeowners often face the dilemma of whether their existing homeowners insurance can cover damages from sudden pipe breaks or if they need additional water damage insurance to safeguard against such risks. Understanding the nuances of what flood insurance covers, including limitations and exclusions, can help homeowners make informed decisions about their policies. Whether it’s a devastating flood or an unfortunate plumbing mishap, knowing the right insurance coverage is vital for protecting your property and financial well-being. In this article, we will delve deeper into these issues, shedding light on how to navigate the complexities of insurance coverage for water-related damages.

Understanding Flood Insurance Coverage

Flood insurance is crucial for homeowners, especially in areas prone to heavy rainfall or flooding. This type of insurance provides coverage for your home and personal belongings against damages caused by rising waters. Specifically, flood insurance typically covers structural aspects of your property, such as the foundation, walls, and floors, as well as personal items like furniture and appliances that are directly affected by a flood.

It’s important for homeowners to understand the specifics of what flood insurance covers. This can include damages from natural events like hurricanes or heavy storms that lead to flooding. Homeowners should review their flood insurance policies carefully, as they may also need to consider purchasing additional coverage for specific items or situations not covered under standard flood insurance.

Frequently Asked Questions

Does flood insurance cover damages caused by broken pipes?

Flood insurance does not cover damages resulting from broken pipes. If a pipe bursts in your home and leads to water damage, your flood insurance policy will not pay for the repairs. It’s essential to check your homeowners insurance for coverage related to water damage from broken pipes.

What does flood insurance cover regarding water damage?

Flood insurance primarily covers damages caused by rising water, such as from heavy rains or overflowing rivers. This includes structural damage to your home and personal belongings. However, it does not cover water damage from broken pipes or sewer backups, so make sure to review your homeowners insurance for those specifics.

Are broken pipes covered under homeowners insurance?

Homeowners insurance typically covers water damage caused by broken pipes if the damage is sudden and accidental. However, it’s crucial to read your policy carefully, as coverage may vary and some incidents may not be included.

What types of water damage are excluded from flood insurance?

Flood insurance excludes several types of water damage, including damages from broken pipes, sewer backups, and mold or mildew resulting from flooding. Understanding these exclusions can help you plan for potential risks.

Can I get coverage for broken pipes under my flood insurance policy?

No, flood insurance does not cover damages from broken pipes. To protect against such incidents, you may want to consider a separate water damage insurance policy or an endorsement on your homeowners insurance.

What should I do if my pipes break and cause water damage?

If your pipes break, immediately turn off your main water supply to prevent further flooding. Contact a plumber for repairs and then file a claim with your homeowners insurance, as they may cover the water damage depending on your policy’s terms.

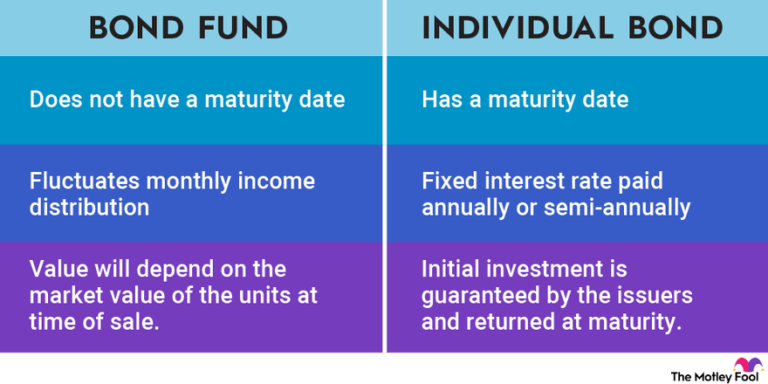

What is the difference between flood insurance and water damage insurance?

Flood insurance specifically covers damages from rising water due to floods, while water damage insurance (often part of homeowners insurance) may cover damages from various sources, including broken pipes, unless specifically excluded in the policy.

How can I ensure I have coverage for water damage from broken pipes?

To ensure coverage for water damage from broken pipes, review your homeowners insurance policy for inclusions and consider adding a water damage endorsement if necessary. Flood insurance alone will not cover this type of damage.

Is there a way to prevent coverage issues with broken pipes?

To prevent coverage issues related to broken pipes, maintain your plumbing system regularly, and ensure you have adequate homeowners insurance that covers sudden water damage. Understanding your flood insurance limitations is also essential.

What are the risks of relying solely on flood insurance for water damage?

Relying solely on flood insurance can leave you vulnerable to water damage from broken pipes, as it does not cover these incidents. It’s important to have a comprehensive homeowners insurance policy that includes water damage coverage for complete protection.

| Aspect | Details |

|---|---|

| What Flood Insurance Covers | Covers damages from rising water, including the structure of your home and certain contents like appliances and furniture. |

| What Flood Insurance Doesn’t Cover | – Damage from sewer backups – Damage from broken pipes – Damage from mold or mildew |

| Exceptions to Coverage | Neglect or poor maintenance can lead to denial of claims; does not cover earthquakes or landslides. |

| Steps If Pipes Break | 1. Turn off the main water supply. 2. Contact a plumber. 3. File a claim with your insurance if there’s damage. |

Summary

Flood insurance broken pipes are a significant concern for homeowners. Unfortunately, flood insurance does not cover the damages caused by broken pipes, which can lead to costly repairs. It is crucial for homeowners to understand what their flood insurance covers and the limitations it entails. While flood insurance protects against rising water, homeowners should also check their homeowner’s insurance for coverage on sudden pipe failures. By doing so, you can ensure your home is adequately protected from both floods and plumbing disasters.