Estate Taxes: Key Facts and Planning Strategies

Estate taxes play a crucial role in determining how wealth is transferred after death, impacting the assets left to heirs. Commonly referred to as inheritance taxes or death taxes, these levies are imposed by both federal and state governments on the total value of a deceased person’s estate. Understanding estate tax planning is essential for anyone looking to preserve their wealth for future generations. With the right strategies, such as leveraging estate tax exemptions or considering gift tax implications, individuals can significantly reduce the financial burden on their heirs. As estate taxes can vary widely by jurisdiction, it is vital to stay informed about the specific regulations that apply to your situation.

When discussing the financial implications of death, terms like inheritance tax and death tax often emerge, referring to the same underlying concept as estate taxes. These taxes are levied on the transfer of assets upon an individual’s passing, affecting how much wealth ultimately reaches beneficiaries. Estate tax planning becomes an essential tool for individuals aiming to navigate this complex landscape, allowing for strategic decisions that can mitigate tax liabilities. Additionally, understanding gift tax and the different estate tax exemptions available can empower individuals to make informed choices about their financial legacies. Ultimately, being knowledgeable about these taxes can lead to more effective estate management and wealth preservation.

Understanding Estate Taxes and Their Impact

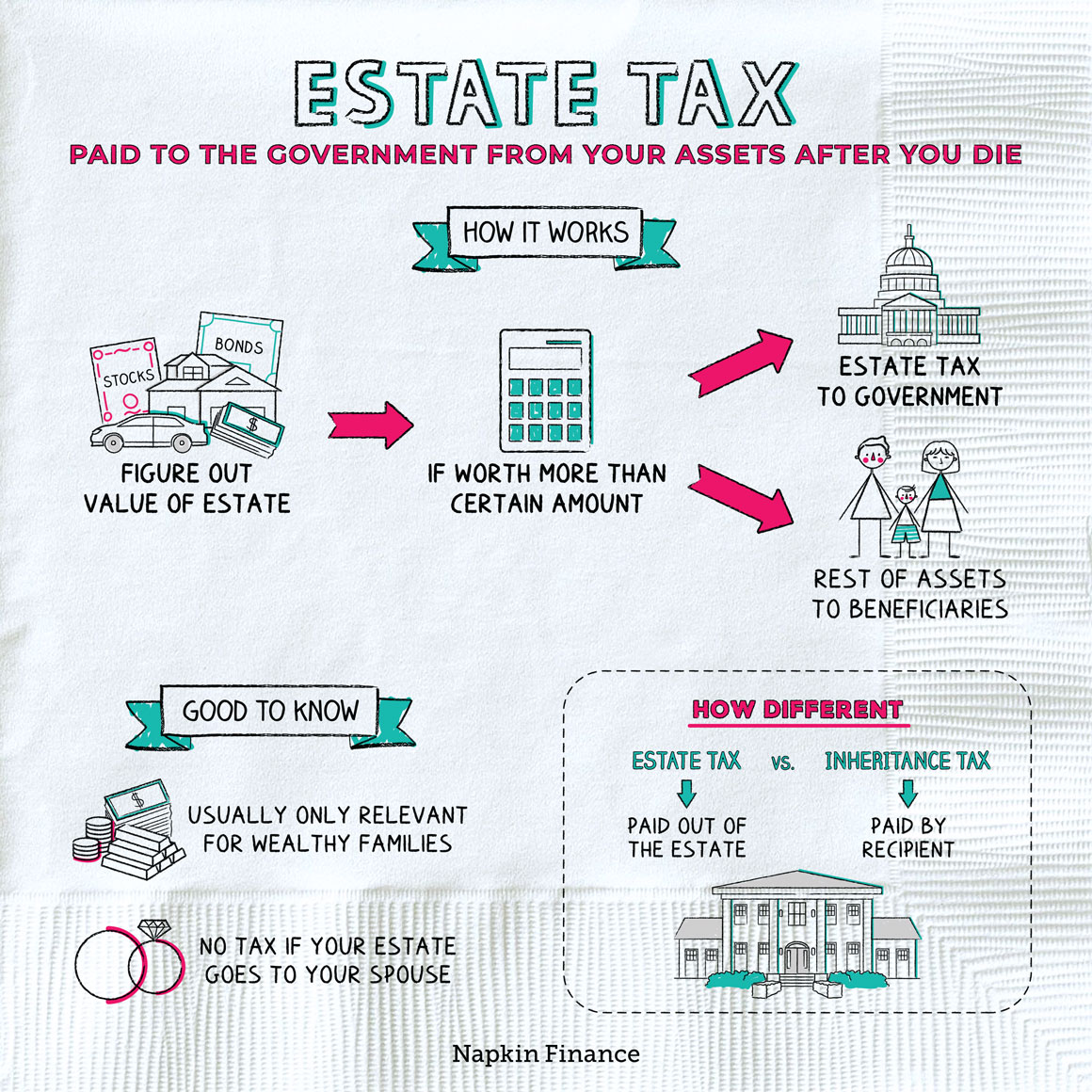

Estate taxes, often referred to as inheritance taxes or death taxes, play a crucial role in the transfer of wealth from deceased individuals to their heirs. These taxes are imposed by the government based on the total value of the estate, which includes all assets owned by the deceased at the time of death. The executor of the estate is tasked with filing necessary tax returns and ensuring that all estate taxes are settled before any assets are distributed to beneficiaries. The implications of estate taxes can significantly reduce the amount of wealth passed on to heirs, making it essential for individuals to understand how these taxes operate within their jurisdiction.

The rate and structure of estate taxes can vary greatly depending on the jurisdiction. In some areas, the estate tax system may feature progressive rates, where higher-value estates are subject to greater tax percentages. Additionally, many regions impose an exemption threshold, below which no estate taxes are charged. This means that individuals with estates valued below a certain amount can pass on their wealth without incurring tax penalties. For effective estate planning, it is vital to stay informed about local laws regarding estate taxes and any potential changes that may arise.

Key Factors Influencing Estate Tax Liability

Several key factors influence an individual’s estate tax liability, including the total value of the estate and applicable exemptions. Most jurisdictions provide a basic exemption threshold, which allows estates valued below a certain amount to avoid taxes altogether. Above this threshold, estates may be subject to escalating tax rates. Estate tax planning becomes critical for individuals with significant assets, as it enables them to devise strategies to minimize tax exposure, such as setting up trusts or making lifetime gifts.

Additionally, understanding gift tax regulations is important, as these taxes can impact overall estate tax liability. Gift taxes may apply to substantial gifts made during a person’s lifetime, which can prevent individuals from transferring wealth before death to evade estate taxes. Many jurisdictions have unified lifetime gift and estate tax exemptions, so effective planning should consider both aspects. By strategically managing gifts and understanding exemption limits, individuals can optimize their estate plans to benefit their heirs while minimizing tax burdens.

Strategies for Effective Estate Tax Planning

Estate tax planning is a proactive approach to managing one’s assets in order to minimize taxes that may be imposed upon death. Individuals can employ several strategies, including the use of trusts, which can help shield certain assets from estate taxes. By placing assets into a trust, individuals may be able to reduce the taxable value of their estate, thereby potentially lowering the estate tax owed. Moreover, establishing irrevocable trusts can further protect assets from being included in the taxable estate.

Additionally, making lifetime gifts to heirs is another effective strategy to reduce estate tax liability. By gifting assets while alive, individuals can take advantage of the annual gift tax exclusion and the lifetime exemption limits. This not only reduces the size of the estate but also allows heirs to benefit from the assets sooner rather than later. Engaging in comprehensive estate tax planning with a knowledgeable advisor can help individuals tailor their strategies to their specific financial situations and goals, ensuring that their wealth is distributed according to their wishes.

Navigating Federal and State Estate Taxes

In the United States, individuals must navigate both federal and state estate taxes, which can complicate the estate planning process. Federal estate tax regulations apply to estates exceeding a certain value, and rates can be quite steep for high-value estates. At the same time, many states impose their own estate taxes, with varying exemption thresholds and tax rates. It is imperative for individuals to consider both layers of taxation when planning their estates to avoid unexpected liabilities.

Each state has different laws regarding estate taxes, and some states may have no estate tax at all. As a result, individuals with assets in multiple states may face unique challenges, including potential double taxation. To mitigate these issues, consulting with an estate planning attorney who understands both federal and state tax laws is advisable. This professional guidance can help ensure that estate plans are compliant and optimized for the least tax impact, allowing individuals to preserve more wealth for their heirs.

The Role of Portability in Estate Tax Planning

Portability is a valuable concept in estate planning that allows a surviving spouse to inherit the unused portion of their deceased partner’s estate tax exemption. This provision is particularly beneficial for married couples, as it effectively doubles the exemption available to the surviving spouse, allowing for greater wealth transfer without incurring estate taxes. Understanding how portability works can significantly impact estate tax strategies, especially for high-net-worth families.

To take advantage of portability, the deceased spouse’s estate must file an estate tax return, even if the estate is below the taxable threshold. This filing is critical to ensure that the surviving spouse can utilize the full exemption amount. Couples should work with an experienced estate planning professional to navigate the complexities of portability and ensure that their estate plans are structured to maximize tax benefits for the surviving spouse.

Valuation of Assets and Its Importance in Estate Taxes

Accurate asset valuation is a critical component of estate tax calculations. The total value of the estate is determined based on the fair market value of all assets at the time of death, which can include real estate, investments, and personal property. In many cases, professional appraisals may be necessary to establish the true value of certain assets, particularly for unique items or real estate holdings. Failing to accurately value assets can lead to overpayment or underpayment of estate taxes, resulting in legal complications.

Additionally, the valuation process can also impact the potential tax owed on future gains. If assets are undervalued during the estate tax assessment, beneficiaries may face higher capital gains taxes when they sell the inherited assets. Therefore, it is essential for individuals to engage qualified appraisers and understand the importance of accurate asset valuation in the context of estate taxes. Proper planning in this area can lead to significant tax savings and a smoother transition of wealth to heirs.

Understanding Estate Tax Returns and Filing Requirements

Once a person passes away, their estate often must file an estate tax return to report the total value of the estate and calculate any taxes owed. The executor or administrator of the estate is typically responsible for this filing, which can be a complex process involving detailed documentation of all assets. It is crucial to adhere to the specific requirements set forth by both federal and state laws to avoid penalties and ensure compliance.

The timeline for filing estate tax returns varies by jurisdiction, and certain estates may be required to file returns even if they are below the taxable threshold. Therefore, understanding the filing requirements and deadlines is essential for executors. Engaging with an estate planning attorney or tax professional can streamline the process and help ensure that all necessary information is accurately reported, thereby minimizing the risk of errors that could lead to complications later on.

International Considerations in Estate Tax Planning

For individuals with assets located in different countries, international estate tax considerations can add a layer of complexity to estate planning. Various countries have their own estate tax laws, which may include inheritance taxes or death taxes that could apply to foreign assets. Additionally, some jurisdictions may impose double taxation, where the same estate is taxed in multiple countries, leading to a significant financial burden on heirs.

Navigating international estate tax laws requires a thorough understanding of both local and foreign tax regulations. Consulting with tax professionals who specialize in international estate planning is essential for those with cross-border assets. These experts can provide guidance on how to structure estates to minimize tax liabilities and ensure compliance with international laws, ultimately protecting the wealth that families wish to pass on to their heirs.

The Importance of Staying Informed about Estate Tax Laws

Estate tax laws are subject to change, and they can vary significantly from one jurisdiction to another. For this reason, it is essential for individuals engaged in estate planning to stay informed about current laws and any proposed changes that may affect their estate taxes. Regularly reviewing estate plans and consulting with professionals can help ensure that individuals are aware of any new exemptions, deductions, or tax rates that may arise.

By staying updated on estate tax laws, individuals can make informed decisions about their estate planning strategies and take advantage of tax-saving opportunities. This proactive approach can lead to significant savings for heirs and help ensure that the individual’s wealth is transferred according to their wishes. Overall, ongoing education about estate taxes is a critical aspect of effective financial and estate planning.

Frequently Asked Questions

What are estate taxes and how do they work?

Estate taxes, also known as inheritance taxes or death taxes, are taxes imposed by the government on the transfer of a deceased person’s assets to their heirs. These taxes are based on the total value of the estate, and the executor is responsible for filing estate tax returns and ensuring all taxes are paid before distributing assets to beneficiaries.

What is the difference between estate tax and gift tax?

Estate tax is levied on the transfer of wealth upon death, while gift tax applies to significant gifts made during a person’s lifetime. Both taxes are often interconnected, with unified exemptions that can affect overall tax liability, making estate tax planning crucial.

How do estate tax exemptions work?

Estate tax exemptions allow estates valued below a specific threshold to avoid estate taxes. The exemption amount varies by jurisdiction, and additional exemptions may apply for transfers to a surviving spouse or charity, which can help reduce the taxable estate.

What is estate tax planning and why is it important?

Estate tax planning involves strategies to minimize the impact of estate taxes on heirs. This may include setting up trusts, making lifetime gifts, and utilizing exemptions. Effective planning can preserve wealth and ensure assets are distributed according to the deceased’s wishes.

Are there state and federal estate taxes in the United States?

Yes, in the United States, both federal and state estate taxes may apply. Each state has its own estate tax laws, exemption thresholds, and rates, making it essential to consider both when planning an estate.

How is the value of an estate determined for tax purposes?

The value of an estate is determined by assessing the fair market value of all assets at the time of death. Professional appraisals may be necessary for certain assets to ensure accurate valuation for inheritance tax calculations.

What is portability in estate taxes?

Portability allows a surviving spouse to inherit any unused estate tax exemption from their deceased spouse. This can effectively double the exemption amount for married couples, providing additional tax relief.

How do international estate taxes work?

International estate taxes can be complex, especially if assets are held in multiple countries. Different jurisdictions may impose their own inheritance taxes, leading to potential double taxation. Consulting with a tax professional experienced in international tax law is advisable to navigate these issues.

What are the consequences of not filing estate tax returns?

Failing to file estate tax returns can lead to penalties, interest on unpaid taxes, and delays in asset distribution. The executor has a legal obligation to report the estate’s value and pay any owed taxes, highlighting the importance of timely and accurate filing.

Can estate taxes change over time?

Yes, estate tax laws can change due to new legislation or policy adjustments. It’s crucial to stay informed about current laws and regulations, as well as to consult with an estate planning attorney or tax advisor for personalized guidance.

| Key Point | Description |

|---|---|

| Exemption Threshold | Estates below a certain value are exempt from estate taxes. |

| Tax Rates | Progressive tax rates increase as the estate value rises. |

| Gift Tax | Tax on significant lifetime gifts to prevent evasion of estate taxes. |

| Exemptions and Deductions | Additional exemptions for spouses and charities may apply. |

| Portability | Unused exemption of a deceased spouse can be inherited. |

| State and Federal Taxes | Both federal and state estate taxes may apply in the U.S. |

| Estate Tax Planning | Strategies to minimize estate taxes include trusts and gifts. |

| Valuation of Assets | Fair market value assessments are crucial for tax calculations. |

| Estate Tax Returns | Filing returns is necessary to report estate value and taxes. |

| International Considerations | Complex issues arise for assets in multiple countries. |

Summary

Estate taxes are essential considerations in the transfer of wealth and can significantly affect the assets passed on to heirs. Understanding the various aspects of estate taxes, including exemption thresholds, progressive tax rates, and the interplay with gift taxes, is crucial for effective estate planning. Moreover, the intricacies of state and federal taxes, along with the importance of accurate asset valuation, underscore the necessity of proper estate tax planning. Consulting with a knowledgeable estate planning attorney can provide tailored advice, ensuring that your estate is managed in alignment with your wishes and minimizing potential tax burdens.