Disability Insurance: Understanding Its Importance and Cost

Disability insurance is a critical safety net for millions of Americans, providing financial support when unforeseen illnesses or injuries prevent them from working. With approximately 61 million adults living with some form of disability in the U.S., understanding disability insurance has never been more important. This type of insurance comes in two main forms: long-term disability insurance, which can replace a substantial portion of your income for years, and short-term disability insurance, designed to cover you for a limited time. Despite its significance, many people harbor misconceptions about disability insurance, often believing it is unnecessary or too costly. In this article, we will unravel these myths and discuss essential factors like disability insurance cost and eligibility to help you make informed decisions about your financial future.

When we talk about income protection during times of illness or injury, many terms come to mind, such as income replacement insurance or wage loss coverage. These alternatives to disability insurance aim to ensure that individuals can maintain their financial stability even when they are unable to work. The reality is that unforeseen circumstances can impact anyone, regardless of their current health or employment status. Exploring options like long-term and short-term income protection can help clarify the benefits and eligibility requirements associated with these policies. It’s vital to understand that safeguarding your income is not just for those who are currently facing health challenges; it’s a proactive step for all workers.

Understanding Disability Insurance: What You Need to Know

Disability insurance is a crucial financial safeguard that many individuals overlook. It offers income replacement when you are unable to work due to an illness or injury, ensuring that you can still meet your financial obligations during tough times. This type of insurance is especially relevant considering that, according to the CDC, 61 million American adults live with some form of disability. Understanding the basics of disability insurance—its types, benefits, and the importance of securing coverage—is essential for anyone who relies on a paycheck.

Many people believe that disability insurance is only for those working full-time or those who are at high risk of injury. However, this is a misconception. Disability insurance can be beneficial for part-time workers, freelancers, and even those in good health, as conditions can change unexpectedly. Therefore, it’s wise to assess your personal circumstances and consider how disability insurance might enhance your financial security.

Frequently Asked Questions

What are the common misconceptions about disability insurance?

Many people have misconceptions about disability insurance, such as believing it is only for full-time workers or that it is unnecessary if they are currently healthy. In reality, disability insurance can provide crucial financial support for anyone who relies on their income, regardless of their current health status or employment type.

Do I need to work full-time to qualify for disability insurance?

No, you do not need to work full-time to qualify for disability insurance. As long as you meet the disability insurance eligibility requirements and can demonstrate that you are losing wages due to a disability, you may be eligible for coverage. It’s important to evaluate your specific circumstances.

Is disability insurance only for people who are already disabled?

Not at all. Disability insurance is designed to protect your income in case you become disabled in the future. Even if you are currently healthy, purchasing disability insurance can safeguard your financial stability, as 1 in 4 workers will experience a disability before retirement.

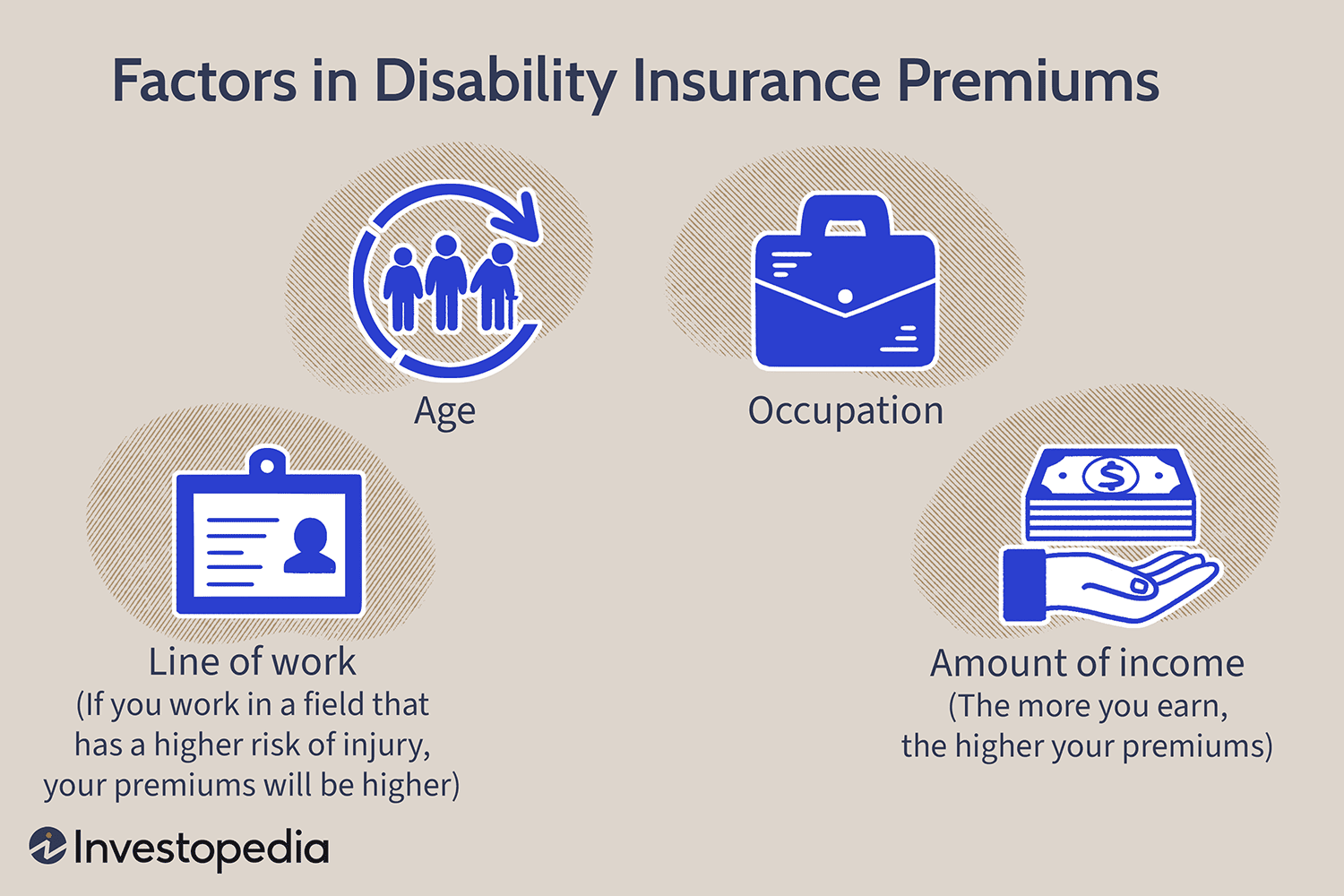

How much does disability insurance cost?

The cost of disability insurance typically ranges from 1% to 3% of your annual salary. Factors such as your age, health status, occupation, and the specifics of the policy, like benefit period and elimination period, can influence the final cost. It’s wise to compare different policies to find one that fits your budget.

What types of disability insurance are available?

There are two main types of disability insurance: short-term disability insurance, which provides coverage for a limited period (usually 3 to 6 months), and long-term disability insurance, which can last from one year up to your entire working life. Each type serves different needs depending on your situation.

Can I get disability insurance if I have a pre-existing condition?

Obtaining disability insurance with a pre-existing condition can be more challenging, but it is not impossible. Some insurers may offer coverage with specific exclusions or higher premiums. It’s important to shop around and consult with an insurance professional to find the best options available.

What should I consider when choosing a disability insurance policy?

When selecting a disability insurance policy, consider factors such as the coverage amount, benefit period, elimination period, and your specific needs and financial situation. Consulting with a qualified insurance professional can help you navigate these choices effectively.

How can I find a qualified insurance professional for disability insurance?

To find a qualified insurance professional for disability insurance, you can use resources like Life Happens’ Agent Locator, which helps you connect with licensed agents in your area. It’s beneficial to work with someone experienced to ensure you get the right coverage for your needs.

| Key Point | Explanation |

|---|---|

| Prevalence of Disability | 61 million American adults live with a disability, highlighting the importance of disability insurance. |

| Definition of Disability Insurance | Disability insurance provides a percentage of income if an illness or injury prevents work. |

| Types of Disability Insurance | Long-term and short-term disability insurance differ in duration and payout. |

| Misconceptions | Many believe they need to work full-time or be healthy to qualify for disability insurance. |

| Financial Impact | 49% of Americans would face financial hardship within six months of losing their primary wage earner. |

| Cost of Disability Insurance | Disability insurance typically costs 1% to 3% of annual salary, varying by individual circumstances. |

Summary

Disability insurance is an essential safety net for individuals in the workforce, given that 61 million American adults live with some type of disability. It provides financial support when illness or injury prevents someone from earning a living. There are common misconceptions about disability insurance, such as the belief that it is only for full-time workers or that it is unnecessary for healthy individuals. However, with the risk of disabilities affecting anyone at any time, exploring disability insurance is crucial. Additionally, the cost is relatively manageable, typically ranging from 1% to 3% of one’s salary, making it a feasible option for many. Understanding these key points can help individuals make informed decisions regarding their financial protection.