Disability Insurance: Mike Sizemore’s Inspiring Story

Disability insurance is a crucial safety net that many individuals overlook until it’s too late. For those who depend on their income to meet everyday expenses, having this type of coverage can provide essential financial support after injury. Take the real-life story of Mike Sizemore, who faced life-altering challenges after being hit by a drunk driver; his disability insurance was a lifeline during his recovery. The benefits of disability insurance extend beyond mere financial assistance, as it plays a vital role in preserving one’s quality of life during difficult times. Understanding the importance of disability insurance can empower individuals to make informed decisions that protect their livelihoods.

In essence, income protection plans, often referred to as disability coverage, serve as a financial buffer against unexpected health setbacks. These policies are designed to replace a portion of your earnings if you become unable to work due to a medical condition or injury. The experiences of individuals like Mike Sizemore highlight how these plans can significantly alleviate the burden of mounting bills during recovery periods. By securing this type of insurance, you ensure that you can maintain your standard of living even when faced with unforeseen circumstances. Recognizing the necessity of such coverage can lead to a more secure and resilient future.

Understanding the Importance of Disability Insurance

Disability insurance is a crucial safety net for anyone who relies on their income to support themselves and their families. It provides financial support in the event of an unexpected injury or illness that prevents an individual from working. The benefits of disability insurance can be life-changing, offering peace of mind during challenging times. Without this coverage, many could face significant financial strain as they attempt to cover their regular expenses, such as rent, groceries, and medical bills, all of which can pile up quickly when income is lost.

The importance of disability insurance cannot be overstated, especially in the wake of real-life stories like that of Mike Sizemore. After suffering a severe accident, Mike found himself unable to work, facing the daunting reality of supporting a household without an income. However, because he had disability insurance, he was able to maintain a level of financial stability. This highlights how critical it is for individuals to consider this type of insurance, as it can make a substantial difference in navigating life’s unpredictable challenges.

Real Life Stories: The Impact of Disability Insurance

Real-life stories provide powerful insights into the effectiveness of disability insurance. Mike Sizemore’s journey is a testament to how this coverage can alter the course of a person’s life. After being hit by a drunk driver, Mike underwent numerous surgeries and faced an uncertain future. However, thanks to his disability insurance, he received a portion of his income, enabling him to manage his bills and maintain a sense of normalcy during his recovery. His story serves as an inspiring example of how disability insurance can offer critical financial support after injury.

These real-life accounts underscore the importance of disability insurance in safeguarding one’s financial future. Mike’s experience illustrates that without this safety net, individuals may struggle to pay for their everyday living expenses, adding stress to an already challenging situation. The financial relief that comes from having disability insurance allows individuals to focus on their recovery, rather than worrying about how to make ends meet. The emotional and financial peace of mind it provides is invaluable.

Financial Support After Injury: How Disability Insurance Helps

After an injury, many individuals find themselves grappling with financial uncertainties. This is where disability insurance plays a crucial role. By providing a percentage of an individual’s income, it helps ease the burden of ongoing expenses that don’t stop just because one can’t work. This financial support is essential for maintaining a household and ensuring that basic needs are met, even when the primary income earner is unable to contribute.

For those like Mike Sizemore, disability insurance has been a vital lifeline. Following a catastrophic injury, he was able to rely on his policy to pay his bills and support his family while he focused on recovery. This financial backing not only alleviates stress but also empowers individuals to pursue rehabilitation and regain their independence without the looming fear of financial ruin. The ability to manage financial responsibilities during such a tumultuous time is a significant advantage that disability insurance provides.

The Process of Applying for Disability Insurance

Applying for disability insurance can seem daunting, but understanding the process can make it more manageable. It typically involves assessing your current health status, employment situation, and financial needs. Gathering documentation, including medical records and proof of income, is essential to support your application. Once submitted, the insurance company will review the information to determine eligibility and the extent of coverage. This thorough evaluation is crucial to ensure that those truly in need receive the support they require.

Navigating the application process can often feel overwhelming, especially when dealing with health issues. However, many insurance providers offer resources and support to help individuals through the journey. Additionally, consulting with a financial advisor or an insurance expert can provide clarity and assist in understanding the terms and conditions of the policy. Being well-informed about the application process and the necessary steps can significantly enhance one’s chances of obtaining the much-needed disability insurance.

Common Misconceptions About Disability Insurance

Disability insurance is often surrounded by misconceptions that can deter individuals from seeking coverage. One common misunderstanding is that people believe disability insurance is only for those in high-risk professions, when in fact, anyone who relies on their income should consider it. Accidents and illnesses can happen to anyone, regardless of their job type. This false perception can lead to financial vulnerability in the event of an unforeseen circumstance.

Another misconception is that individuals may think they will never need disability insurance because they are currently healthy. However, life is unpredictable, and having a safety net is essential. Mike Sizemore’s story exemplifies how quickly life can change. His tragic accident serves as a reminder that proactive measures, such as obtaining disability insurance, can protect against potential financial hardship. Addressing these misconceptions is crucial in promoting awareness of the importance of disability insurance.

How Disability Insurance Provides Long-Term Security

Disability insurance is not just a short-term solution; it offers long-term financial security for individuals facing extended recovery periods. For those like Mike Sizemore, who continue to deal with the aftermath of a significant injury, having a reliable source of income can be life-altering. This type of insurance ensures that individuals are not left without financial resources, allowing them to focus on their rehabilitation and adjust to new life circumstances.

Long-term disability insurance policies can provide coverage for several years or even until retirement age, depending on the terms of the policy. This long-term security can be crucial for individuals who may not be able to return to their previous employment or need to transition into a different career. By ensuring a steady income stream, disability insurance allows individuals to maintain their quality of life and plan for the future, even in the face of adversity.

The Role of Disability Insurance in Family Protection

Disability insurance is not only beneficial for individuals but also plays a significant role in protecting families. When a primary wage earner is unable to work due to illness or injury, it can place considerable financial strain on the entire household. Disability insurance provides the necessary support to help families maintain their standard of living during difficult times. This financial safety net ensures that families can cover essential expenses, such as housing, education, and healthcare.

For Mike Sizemore, having disability insurance meant he could provide for his family even after his accident. It allowed him to focus on recovery while also ensuring that his fiancée and son were not left in a precarious financial situation. The ability to safeguard one’s family against unforeseen circumstances is one of the most compelling reasons to invest in disability insurance. It serves as a vital resource for maintaining family stability and security during challenging times.

Top Benefits of Disability Insurance You Should Know

Disability insurance offers numerous benefits that can significantly impact an individual’s quality of life. One of the primary advantages is the financial support it provides during challenging times, allowing policyholders to cover their essential expenses without the stress of losing their home or falling behind on bills. This financial peace of mind is invaluable, especially for those who face long recovery periods after an injury or illness.

Another key benefit is the flexibility that disability insurance offers. Many policies allow for partial disability coverage, meaning that if an individual can still work part-time or in a different capacity, they can receive benefits while earning some income. This flexibility can facilitate a smoother transition back into the workforce, making it easier for individuals to regain their footing without sacrificing their financial security.

Planning for the Unexpected: The Need for Disability Insurance

Life is unpredictable, and planning for the unexpected is essential for financial security. Disability insurance serves as a proactive measure that protects against potential loss of income due to unforeseen circumstances, such as accidents or serious illnesses. By investing in this type of insurance, individuals can prepare for the unexpected and ensure they have the financial resources necessary to navigate challenging situations.

The need for disability insurance becomes even more apparent when considering real-life experiences like that of Mike Sizemore. His story serves as a powerful reminder that accidents can happen to anyone at any time. Having the foresight to secure disability insurance can provide individuals and families with the assurance that they will be financially supported during their most vulnerable moments. It’s a crucial aspect of comprehensive financial planning that should not be overlooked.

Frequently Asked Questions

What are the benefits of disability insurance for workers?

Disability insurance offers critical financial support after an injury or illness by providing a percentage of your income when you are unable to work. This coverage ensures that everyday expenses, such as bills and rent, can still be managed during recovery, preventing financial strain during difficult times.

How can real life stories, like that of Mike Sizemore, illustrate the importance of disability insurance?

Mike Sizemore’s story emphasizes the importance of disability insurance as it provided him with essential financial support after a life-changing accident. His experience showcases how disability insurance can help individuals maintain their lifestyle and meet financial obligations while recovering from severe injuries.

What is the importance of disability insurance for those in high-risk jobs?

The importance of disability insurance for those in high-risk jobs cannot be overstated. It acts as a safety net, ensuring that if an injury occurs, workers can still receive income replacement, allowing them to focus on recovery without the added stress of financial burdens.

Can you share real life stories of individuals benefiting from disability insurance?

Yes! Real life stories, like that of Mike Sizemore, highlight how disability insurance has positively impacted individuals’ lives. After a tragic accident, Mike relied on his disability insurance to cover living expenses while he focused on healing, demonstrating the practical benefits of this coverage.

How does disability insurance provide financial support after injury?

Disability insurance provides financial support after injury by replacing a portion of your lost income, ensuring that you can pay your bills and maintain your lifestyle while you recover. This support is crucial for individuals like Mike Sizemore, who faced significant challenges after a life-altering accident.

What should I consider when choosing disability insurance?

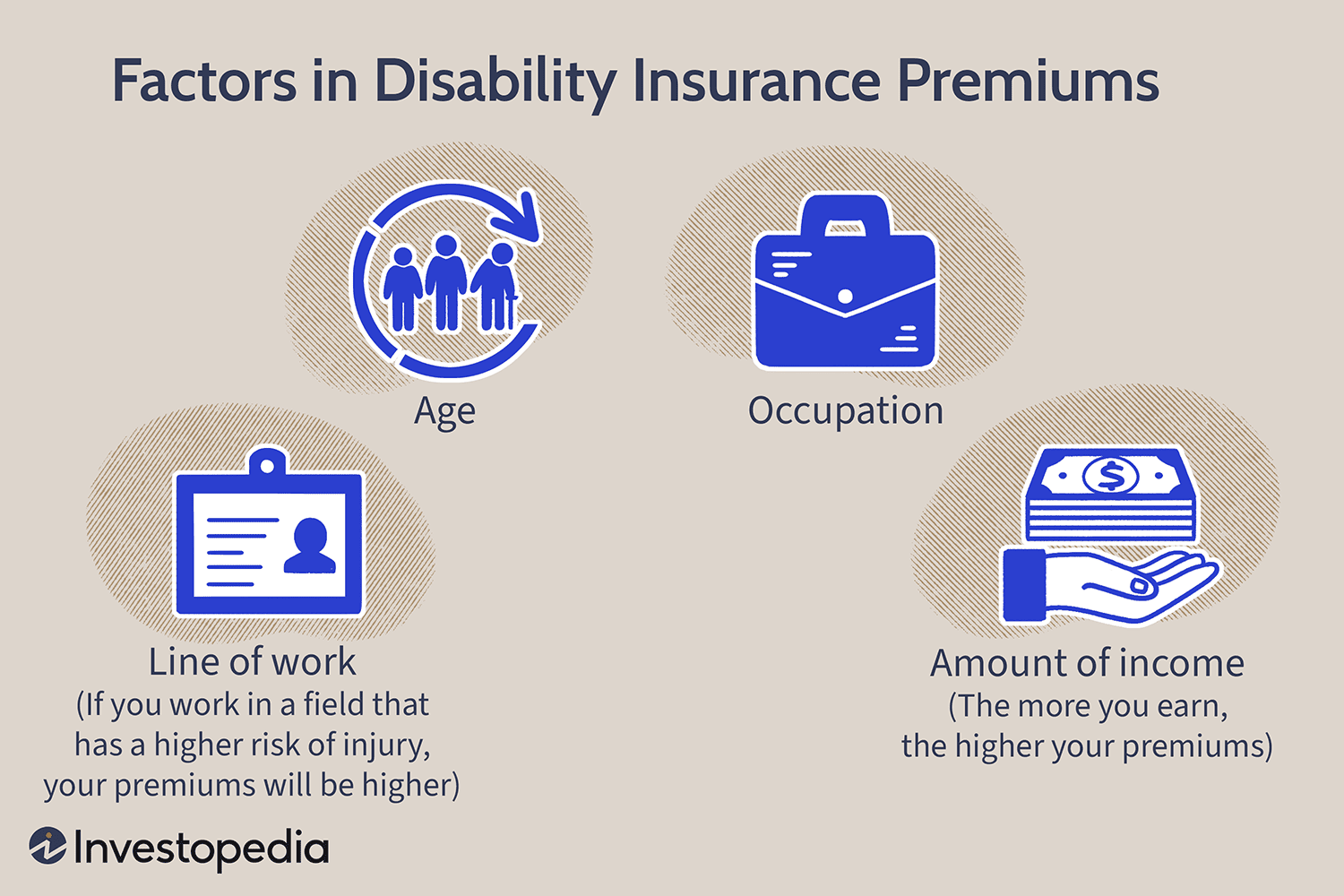

When choosing disability insurance, consider factors such as the percentage of income it covers, the duration of benefits, waiting periods, and whether it includes partial disability coverage. Understanding these elements will help ensure that you select a policy that meets your needs in case of an injury or illness.

Is disability insurance necessary for everyone?

Disability insurance is necessary for everyone who relies on their income to cover living expenses. Unexpected injuries or illnesses can happen to anyone, and disability insurance ensures that you have financial support when you need it most, just like Mike Sizemore experienced.

What types of disabilities are typically covered by disability insurance?

Disability insurance typically covers a range of disabilities, including physical injuries, chronic illnesses, and mental health conditions. Policies may vary, so it’s important to review the specific terms to understand what is covered.

How does disability insurance support individuals like Mike Sizemore in their recovery?

Disability insurance supports individuals like Mike Sizemore in their recovery by providing a source of income during their inability to work. This financial assistance allows them to focus on healing and rebuilding their lives without the burden of financial stress.

What advice do experts give regarding the necessity of disability insurance?

Experts advise that disability insurance is essential for anyone who works and relies on their income. They emphasize that unexpected events can drastically change your life, and having a safety net like disability insurance can provide peace of mind and financial security.

| Key Point | Details |

|---|---|

| Life Changing Accident | Mike Sizemore was hit by a drunk driver in 2012, leading to severe injuries and a long recovery. |

| Disability Insurance | Mike had disability insurance, which provided financial support during his recovery. |

| Impact on Life | The accident altered Mike’s outlook on life, requiring him to relearn basic functions. |

| Financial Support | Disability insurance replaced a significant portion of Mike’s income, allowing him to manage living expenses. |

| Advice for Others | Mike emphasizes the importance of disability insurance for anyone who relies on their income. |

Summary

Disability insurance is crucial for anyone who works, as it provides financial support during times when you cannot earn an income due to illness or injury. Mike Sizemore’s story exemplifies the importance of this safety net; having disability insurance allowed him to cover his expenses and focus on his recovery after a life-altering accident. By ensuring financial stability, disability insurance empowers individuals to maintain their livelihoods and quality of life, making it an essential consideration for all working individuals.