Cyber Coverage: Essential Protection for Your Business

In today’s digital landscape, cyber coverage has become a crucial component for businesses of all sizes. With the increasing frequency of data breaches and cyberattacks, having robust cybersecurity coverage is essential for safeguarding your company’s sensitive information and financial assets. Cyber coverage not only encompasses data breach insurance but also includes vital aspects of cyber risk management, ensuring your business is protected against various online threats. As organizations navigate the complexities of business cyber insurance, understanding the nuances of privacy breach protection becomes paramount. By investing in comprehensive cyber coverage, businesses can effectively mitigate risks and secure their operations against the evolving threats of the digital age.

When discussing the importance of cyber protection in the modern business environment, terms like cybersecurity insurance and data protection coverage come to the forefront. With the rise of online threats, having adequate protection against cyber risks is essential for any organization. This type of coverage, often termed as business cyber insurance, provides a safety net against various digital vulnerabilities, helping businesses recover from incidents like data breaches. Moreover, privacy breach safeguards are increasingly recognized as critical components of a holistic cyber risk management strategy. Understanding these alternative terms can enhance your approach to securing your business against the potential fallout from cyber incidents.

Understanding Cyber Coverage: The Essentials

In today’s digital landscape, understanding the nuances of cyber coverage is crucial for businesses of all sizes. Cyber coverage protects organizations from the financial fallout of data breaches, cyberattacks, and other technology-related risks. However, not all policies are created equal. Some may offer comprehensive protection, while others may have significant exclusions. Businesses need to familiarize themselves with the types of coverage available, including data breach insurance and cybersecurity coverage. This knowledge can help ensure that they select the right policy tailored to their specific needs.

One of the key components of effective cyber coverage is data breach insurance. This specific type of policy can provide vital financial support in the event of a data breach, covering expenses related to notifying affected individuals, legal fees, and potential regulatory fines. Additionally, businesses often overlook the importance of privacy breach protection, which safeguards sensitive customer and employee data. By understanding these elements, organizations can better manage their cyber risk and create a robust defense against potential threats.

The Importance of Cyber Risk Management

Cyber risk management is an essential strategy that businesses must adopt to protect themselves from the evolving landscape of cyber threats. By assessing potential vulnerabilities and implementing preventative measures, organizations can significantly reduce their exposure to cyber incidents. This proactive approach includes regular security audits, employee training, and the implementation of advanced security technologies. Integrating these practices with appropriate cyber coverage ensures that businesses are not only prepared for potential breaches but also have a safety net in place should an incident occur.

Moreover, effective cyber risk management can enhance a company’s reputation and build trust with customers. When clients see that a business takes cybersecurity seriously, they are more likely to engage with that organization. Additionally, having robust policies in place, such as business cyber insurance, can reassure clients that their data is safe, thereby giving the business a competitive edge in the market. Ultimately, investing in cyber risk management is not just about compliance; it’s about fostering a culture of security that permeates every aspect of the organization.

Exploring Different Cyber Programs

As businesses navigate the complexities of cyber coverage, it’s essential to explore the various types of cyber programs available. Cyber programs are designed to address the unique technological needs of businesses, providing services and systems that mitigate risks associated with cyber threats. These programs often include features that protect against the inadvertent transfer of malware or viruses, ensuring that companies can operate with confidence in their digital environments.

Data breach programs, often used interchangeably with privacy and security breach programs, are specifically tailored to protect businesses in the event that sensitive information is compromised. These programs outline the steps a company must take to respond to a data breach, including legal compliance and communication with affected individuals. Understanding the distinctions between these programs is vital for businesses looking to create a comprehensive cyber risk strategy.

Choosing the Right Coverage for Your Business

Selecting the right cyber coverage can be a daunting task, especially given the variety of options available. Businesses must consider their unique risk profiles, taking into account their size, industry, and the nature of the sensitive data they handle. For example, a healthcare organization may require more extensive privacy breach protection due to the sensitive nature of patient information. Conversely, a small e-commerce business might focus on coverage that protects against website-related threats and data breaches.

In addition to evaluating specific coverage types, businesses should also consider the limits and exclusions of potential policies. For instance, while some policies may cover the costs associated with data recovery and legal fees, they may not cover fines imposed by regulatory bodies. By thoroughly reviewing policy details and seeking expert advice, businesses can ensure they choose the most suitable coverage to protect against the financial implications of cyber incidents.

Cybercrime vs. Cyber Risk: Understanding the Difference

While the terms cybercrime and cyber risk may seem interchangeable, they refer to different aspects of digital threats. Cybercrime encompasses illegal activities conducted online, such as hacking, identity theft, and fraud. In contrast, cyber risk refers to the potential for loss or damage resulting from such incidents. For example, a cybercrime incident may lead to a data breach, but the risk associated with that breach is what organizations need to manage through appropriate risk assessment and coverage strategies.

Understanding this distinction is crucial for businesses as they develop their cyber risk management strategies. Organizations must implement measures to protect against cybercrime while also considering the broader implications of cyber risk, including reputational damage and loss of customer trust. By adopting a holistic approach to cybersecurity, businesses can better prepare for the challenges posed by cyber threats.

Cyber Coverage for Businesses of All Sizes

The size of your business plays a significant role in determining your cyber risk exposure. Larger organizations often deal with vast amounts of data and complex technological infrastructures, making them prime targets for cyberattacks. As a result, they may require more comprehensive cyber coverage to address their specific vulnerabilities. On the other hand, small and mid-sized businesses may not face the same level of risk; however, they are still susceptible to privacy breaches, often due to limited resources and cybersecurity measures.

Regardless of size, every business must recognize the importance of tailored cyber coverage. Industries such as healthcare, finance, and legal services, which handle sensitive information, require robust privacy breach protection to safeguard against potential data exposures. By assessing their unique risks and investing in the right type of cyber coverage, businesses can effectively protect themselves against the repercussions of cyber incidents.

Crafting a Comprehensive Cyber Strategy

In today’s digital economy, crafting a comprehensive cyber strategy is essential for ensuring the resilience of businesses against cyber threats. This strategy should encompass not only the selection of appropriate cyber coverage but also the implementation of preventative measures and ongoing education for employees. A well-rounded approach involves assessing current security protocols, identifying potential vulnerabilities, and establishing an incident response plan to mitigate the impact of any breaches.

Additionally, businesses should consider enhancing their basic cyber coverage with value-added products that provide further protection during crises. For instance, some insurers offer services such as risk assessments and incident response assistance as part of their policies. By investing in a robust cyber strategy, businesses can navigate the digital landscape with confidence, knowing they have the necessary tools and support to address any cyber challenges that may arise.

The Role of Insurance in Cyber Risk Management

Insurance plays a critical role in effective cyber risk management by providing businesses with the financial backing needed to recover from cyber incidents. Cyber insurance policies can cover various costs, including data recovery, legal fees, and notification expenses for affected parties. Understanding the scope of coverage is essential for organizations to ensure they are adequately protected against the financial fallout of a data breach or cyberattack.

Moreover, having the right insurance in place can help businesses navigate the complexities of regulatory compliance in the wake of a breach. With laws surrounding data protection becoming increasingly stringent, organizations must be prepared to respond quickly and effectively to minimize potential penalties. By incorporating cyber insurance into their overall risk management strategy, businesses can not only safeguard their financial interests but also enhance their overall security posture.

Staying Informed About Cyber Threats and Coverage

Staying informed about the latest cyber threats and the evolving landscape of cyber coverage is vital for businesses looking to protect themselves. As technology continues to advance, so do the tactics used by cybercriminals. Regularly educating employees about emerging threats and best practices for cybersecurity can help create a culture of security within the organization. Additionally, keeping abreast of changes in insurance policies and coverage options allows businesses to adapt their strategies as needed.

Furthermore, engaging with cybersecurity experts and consulting with insurance professionals can provide valuable insights into the best coverage options for specific business needs. Organizations should take advantage of resources such as white papers, webinars, and industry conferences to stay updated on cyber risk management trends. By remaining proactive and informed, businesses can better prepare themselves for the challenges posed by the ever-changing cyber threat landscape.

Frequently Asked Questions

What is cyber coverage and how does it protect my business?

Cyber coverage is a type of insurance that safeguards businesses against losses resulting from cyber incidents such as data breaches and cyber attacks. It typically covers expenses related to data recovery, legal fees, notification costs for affected customers, and other liabilities arising from a breach.

Does data breach insurance cover software repair and system recovery?

Yes, data breach insurance can cover expenses related to software repair and system recovery following a cyber incident. This includes costs associated with restoring compromised systems and ensuring your network is secure after a breach.

What is the difference between business cyber insurance and privacy breach protection?

Business cyber insurance generally covers a broader range of cyber risks, including data breaches, cyber attacks, and operational disruptions. Privacy breach protection, on the other hand, specifically focuses on the exposure of sensitive customer data and the associated liabilities.

How can cyber risk management strategies enhance my cyber coverage?

Implementing cyber risk management strategies can complement your cyber coverage by helping to identify vulnerabilities, mitigate risks, and establish protocols for responding to incidents. This proactive approach can lead to lower premiums and better coverage options.

Why is it important for small businesses to invest in cybersecurity coverage?

Small businesses often face significant cyber risks, including privacy breaches that could harm their reputation and financial stability. Investing in cybersecurity coverage ensures that they have the necessary support and resources to recover from incidents and protect sensitive data.

What types of cyber coverage should I consider for my organization?

Consider a mix of cyber coverage options that include general cyber programs, data breach programs, and privacy breach programs. Tailoring your coverage to address specific risks and compliance requirements will provide comprehensive protection.

Can cyber coverage help with regulatory compliance after a data breach?

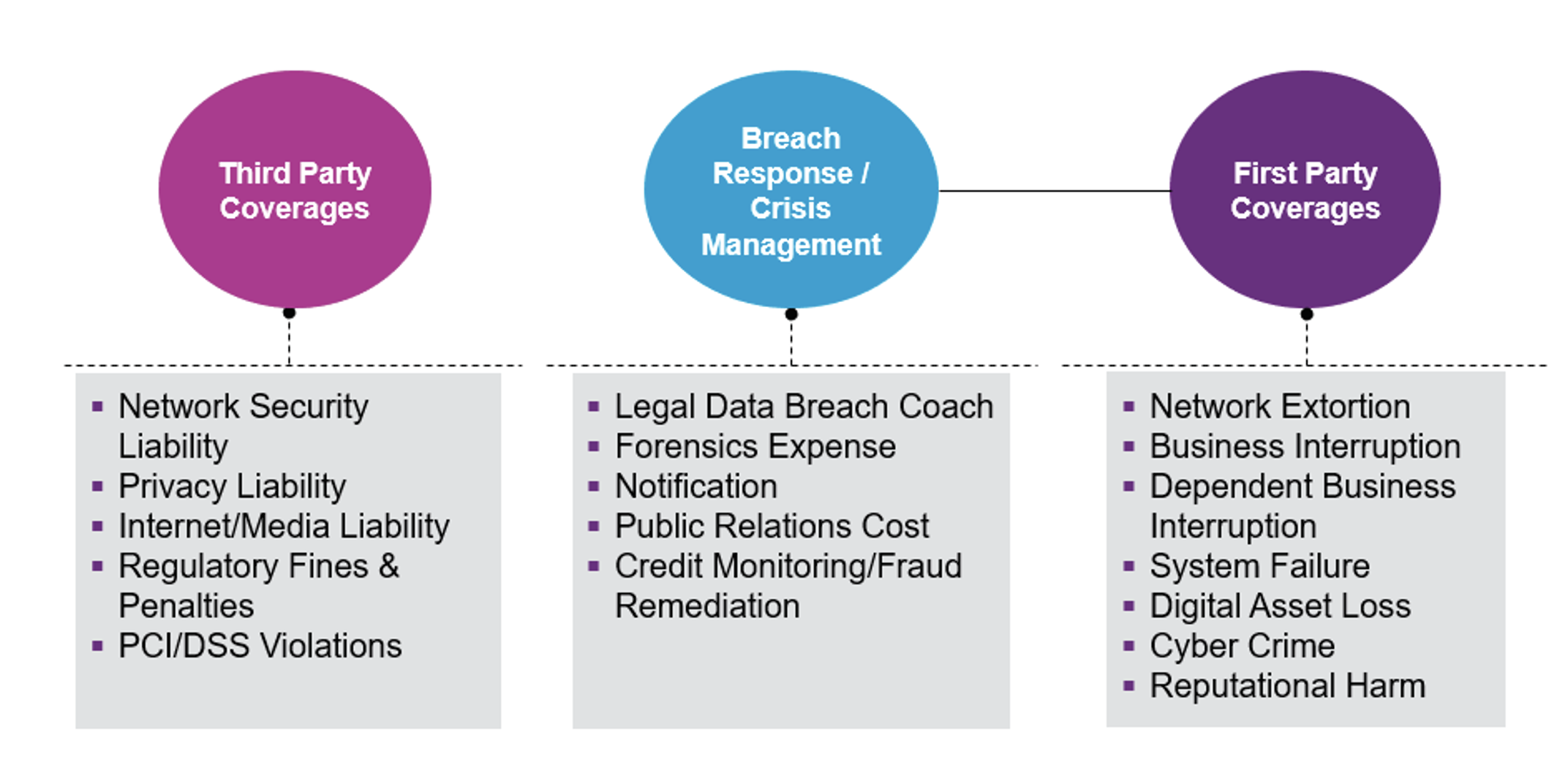

Yes, many cyber coverage policies include first-party coverage that offers legal support for regulatory compliance following a data breach. This can help businesses navigate the complexities of laws and regulations surrounding data protection.

What are the benefits of having third-party cyber coverage?

Third-party cyber coverage protects your business against liabilities arising from consumer lawsuits or regulatory actions due to a data breach. This can help cover legal fees, settlements, and associated costs, providing peace of mind.

How does cyber coverage differ for large enterprises versus small businesses?

While large enterprises often require extensive cyber coverage due to their complex operations and vast amount of data, small businesses may prioritize privacy breach protection due to their often higher risk of compromising sensitive information.

What should I look for when choosing a cyber coverage provider?

When selecting a cyber coverage provider, look for their experience in the industry, the comprehensiveness of their policies, customer support, claims process efficiency, and whether they offer risk management resources alongside insurance coverage.

| Key Point | Description |

|---|---|

| Importance of Cyber Coverage | Cyber coverage varies significantly, so businesses must understand their specific needs to ensure adequate protection. |

| Types of Cyber Programs | Different programs exist such as Cyber Programs, Data Breach Programs, and Privacy Breach Programs, each providing unique protections. |

| Coverage Types | Coverage can include cyber coverage, privacy breach coverage, first-party coverage, and third-party coverage. |

| Difference Between Cybercrime and Cyber Risk | Cybercrime is a peril within crime policies, while cyber risk encompasses various types of data breaches and losses. |

| Business Size Considerations | Larger businesses face different risks compared to small and mid-sized businesses, particularly regarding data handling and privacy breaches. |

| Crafting a Cyber Strategy | A smart cyber strategy includes choosing value-added products to enhance basic policies and prepare for crises. |

Summary

Cyber coverage is essential for businesses to navigate the complexities of digital threats and data breaches. Understanding the various types of coverage available can help organizations protect themselves effectively against potential risks. With the increasing magnitude of cyber threats, businesses must be proactive in ensuring they have the right policies in place, tailored to their size and industry. By crafting a comprehensive cyber strategy, companies can safeguard their information and maintain customer trust.