Customer Onboarding in Insurance: A Key Process for Success

Customer onboarding in insurance is a pivotal phase that ensures a smooth transition for new clients as they embark on their journey with your agency. This process encompasses various critical steps designed not only to gather essential information but also to fortify the foundations of a lasting insurance customer experience. By effectively managing the onboarding process for insurance agents, you set the tone for strong customer retention in insurance, enhancing overall client satisfaction. Utilizing advanced insurance CRM solutions, you can streamline the management of client data, ensuring that each interaction is meaningful and personalized. In an industry where strong relationships are key, a well-implemented onboarding strategy can significantly improve your agency’s success.

In the realm of insurance services, the initial engagement with new clients is often referred to as the client induction process, marking a significant opportunity to create a positive experience. This introduction phase allows you to collect vital personal data, explain policy specifics, and align your offerings with the client’s needs, paving the way for excellent future interactions. Implementing a comprehensive onboarding program not only helps new customers feel welcomed but also effectively utilizes CRM systems to track and manage their journey. Fostering a seamless onboarding experience is essential, as it directly influences customer loyalty and long-term satisfaction in the competitive landscape of insurance. By emphasizing a customer-first approach during this critical stage, you lay the groundwork for sustained business growth.

Understanding Customer Onboarding in the Insurance Sector

Customer onboarding in insurance represents a pivotal moment for both the insurance provider and the new client. This process isn’t merely a formality; it’s the bridge that transforms a potential customer into a loyal policyholder. By initiating a structured onboarding process, agents can gather essential details such as personal information, existing coverage needs, and expectations. This initial interaction should emphasize clarity, ensuring that both parties are aligned. Moreover, it’s crucial to address any common misconceptions about insurance products, helping clients navigate the myriad of options available to them.

Furthermore, effective customer onboarding goes beyond just information collection. It’s about building a relationship, understanding client needs, and establishing trust from day one. A comprehensive approach includes actively listening to the client’s concerns and tailoring the discussion to align with their expectations. This collaborative environment fosters a positive customer experience, which is essential for long-term client retention. The onboarding phase is, thus, not solely about the paperwork; it’s about demonstrating the value of the services provided and setting the stage for future interactions.

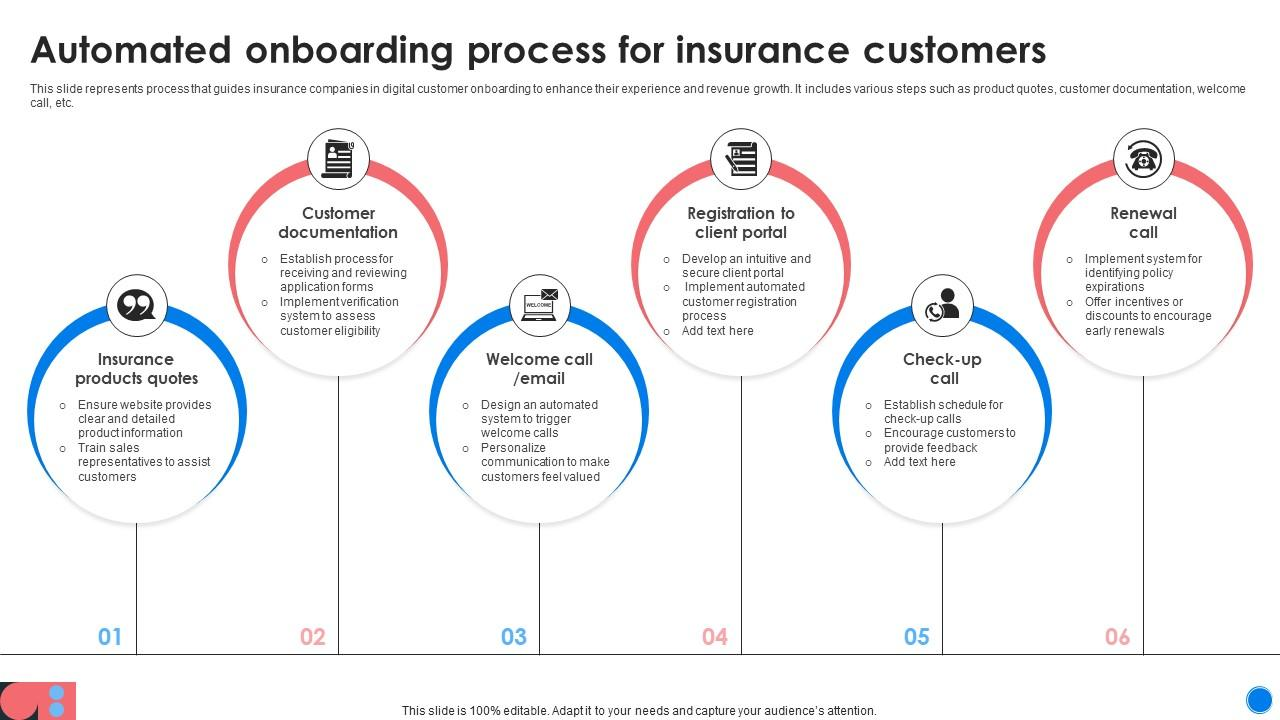

Key Elements of an Effective Onboarding Process for Insurance Agents

An effective onboarding process for insurance agents is characterized by several vital steps that ensure clarity and a positive experience for clients. Primarily, agents should focus on gathering and verifying accurate client information, as this serves as the foundation for all subsequent activities, from policy issuance to claims processing. Miscommunications during this phase can lead to dissatisfaction, highlighting the importance of diligence in data collection. Facilitating a smooth signing process for necessary documents also contributes significantly to the overall experience, making clients feel valued and understood.

Another essential aspect of the onboarding process is the establishment of a welcoming atmosphere. This can be achieved through thoughtful gestures, such as providing a well-prepared welcome package that includes helpful resources and company insights. Additionally, scheduling a follow-up consultation call creates opportunities for deeper discussions about the policy, aligning the agent’s services with the client’s requirements. By systematically addressing these elements, insurance agents can not only enhance the onboarding experience but also lay the groundwork for ongoing client engagement and loyalty.

Enhancing Customer Experience Through Effective Onboarding

The customer experience in the insurance industry is heavily influenced by how effectively an insurer handles the onboarding process. The initial interactions set expectations and pave the way for the relationship’s future trajectory. To enhance the customer journey, it’s crucial for agents to approach onboarding with empathy and professionalism. Providing clients with a detailed overview of what to expect during the onboarding process minimizes confusion and fosters a sense of security. This clarity also aids in building trust, a crucial element for customer retention in insurance.

Moreover, offering personalized insights during onboarding can significantly boost customer satisfaction. Agents should take the time to explain the nuances of various policies and how they specifically cater to the client’s unique situation. Providing tools and resources to help clients access their accounts and understand their coverage in depth will further enrich their experience. This emphasis on customer education not only aids in retention but promotes a culture of transparency—ultimately establishing a solid foundation for lasting relationships.

The Role of Technology in Streamlining Customer Onboarding

In today’s digital age, leveraging technology is vital for streamlining the customer onboarding process in insurance. Innovative tools such as CRM solutions specifically designed for insurance firms can revolutionize how client data is managed and processed. These systems enable insurers to automate various onboarding tasks, which not only enhances efficiency but also reduces the likelihood of human error. By integrating customer relationship management solutions, insurance agents can ensure smooth transitions and provide a more organized approach to managing client information.

Additionally, technology facilitates better communication throughout the onboarding journey. Automated reminders for document submissions, easily accessible online resources, and user-friendly client portals significantly enhance the overall customer experience. Clients can engage with their policies at their convenience while receiving timely updates about important developments. By integrating technological solutions into the onboarding strategy, insurance companies can ensure they remain competitive while providing exceptional customer service.

Collecting Accurate Information During Onboarding

Accurate information collection is one of the most critical components of customer onboarding in insurance. During the onboarding phase, agents should emphasize the importance of obtaining complete and precise data from the client. This includes personal details such as contact information, birthdates, and any relevant history that could influence policy decisions. By establishing clear communication channels, agents can help clients understand what information is necessary and why, thus minimizing the potential for errors or omissions.

Furthermore, fostering an open dialogue during this step allows clients to voice any questions or concerns they might have regarding the provided information. Ensuring that clients feel comfortable discussing their needs can lead to a better understanding of their unique circumstances. This attention to detail during the onboarding process can significantly reduce future misunderstandings about coverage and claims, ultimately reinforcing customer satisfaction and loyalty.

Improving Customer Retention Through Effective Onboarding

Effective customer onboarding is integral to improving customer retention in the insurance industry. A positive onboarding experience can significantly influence a client’s decision to remain with their insurance provider long-term. By prioritizing a seamless onboarding process, insurers can establish trust and rapport with new clients, ultimately fostering loyalty. Agents should aim to provide excellent service from the outset, as this sets the tone for their ongoing relationship and enhances the overall customer experience.

Moreover, incorporating invitations for ongoing feedback during the onboarding process helps agents identify areas for improvement and address client concerns proactively. Clients appreciate when their voices are heard, and responding to their feedback fosters a culture of continuous improvement. This not only enhances their experience during onboarding but also positions the insurer as a responsive and customer-centric organization, contributing positively to client retention rates over time.

Cross-Selling and Upselling Opportunities in the Onboarding Phase

The onboarding process presents valuable opportunities for cross-selling and upselling in the insurance sector. By understanding the client’s needs during initial interactions, agents can identify additional coverage options that may benefit the client. For instance, if a client is signing up for auto insurance, it might be a good moment to discuss the advantages of bundling with home or renter’s insurance. This approach not only increases potential revenue but strengthens the agent-client relationship by showcasing the agent’s commitment to providing tailored solutions.

Effective cross-selling and upselling require agents to possess a deep understanding of their product offerings and how they align with the individual needs of their clients. Providing clear and informative comparisons of different policies can empower clients to make informed decisions about their coverage. This strategy not only maximizes client satisfaction but also leads to increased sales and enhanced financial security for both the agent and the client.

Creating a Comprehensive Checklist for Customer Onboarding

A comprehensive checklist for customer onboarding is an invaluable tool for insurance agents eager to provide a structured and efficient experience. This checklist should encompass all necessary steps, from collecting essential information to scheduling follow-up meetings. By methodically approaching each step, agents can ensure that nothing is overlooked and that the client feels supported throughout the process. Elements such as sending welcome packages and preparing call agendas can enhance engagement and help clients feel valued.

Furthermore, using a checklist can help agents maintain a consistent onboarding experience across all clients, which is crucial for establishing brand reliability. Standardizing processes fosters continuity and ensures that every client receives the same level of care. Additionally, incorporating feedback mechanisms at the end of the onboarding process can help agents refine their methods continuously, adapting to client needs and preferences for future onboarding experiences.

Utilizing Feedback for Continuous Improvement in Onboarding

Feedback plays a crucial role in refining the customer onboarding process, enabling insurance providers to adapt and evolve their strategies. After the onboarding process concludes, agencies should actively request feedback from clients regarding their experience. This insight can provide valuable information about what is working well and what could use improvement. By utilizing this feedback, insurance companies can continuously enhance their onboarding methods, ensuring they remain aligned with client expectations.

Furthermore, establishing a culture of feedback not only improves the onboarding experience but also fosters a greater sense of community between clients and agents. Clients who see that their opinions matter are more likely to develop brand loyalty and become advocates for the insurance company. Therefore, actively incorporating customer feedback demonstrates a commitment to service excellence, essential for thriving in a competitive industry.

Frequently Asked Questions

What is customer onboarding in insurance and why is it important?

Customer onboarding in insurance is the process of collecting and verifying client information to provide coverage and educate them about their policies. It’s vital because it reduces misunderstandings, ensures accurate information, increases customer retention, and sets the stage for a positive insurance customer experience.

How can I improve my insurance customer experience during onboarding?

To enhance the insurance customer experience, ensure a smooth onboarding process by collecting accurate information, providing clear communication, offering a welcome package, and scheduling prompt consultation calls. Additionally, utilize effective CRM solutions like InsuredMine to manage customer interactions efficiently.

What steps should I follow in the onboarding process for insurance agents?

Key steps in the onboarding process for insurance agents include gathering basic client information, preparing and sending contracts, scheduling and conducting consultation calls, outlining next steps, and updating records in a CRM system to ensure seamless management of customer relationships.

Why is customer retention in insurance linked to effective onboarding?

Customer retention in insurance is directly tied to effective onboarding because a smooth and informative onboarding experience fosters trust, satisfaction, and loyalty. When clients feel understood and valued during onboarding, they are more likely to remain loyal and continue business with the agency.

How can I utilize insurance CRM solutions to enhance the onboarding process?

Insurance CRM solutions, like InsuredMine, can streamline the onboarding process by automating data collection, tracking customer interactions, scheduling follow-ups, and managing communications. This allows for a more organized and efficient onboarding experience, which is crucial for building long-term client relationships.

What are the common challenges in customer onboarding in insurance and how to overcome them?

Common challenges in customer onboarding include inaccuracies in client information, lack of communication, and failure to meet customer expectations. To overcome these challenges, focus on thorough data collection, maintain clear communication channels, provide comprehensive policy explanations, and use CRM solutions to track progress.

What role does feedback play in the customer onboarding process in insurance?

Feedback is essential in the customer onboarding process in insurance as it helps identify strengths and weaknesses in the process. By soliciting feedback after onboarding, agencies can enhance the customer experience, address any issues promptly, and continuously improve their onboarding procedures.

How does the onboarding process affect cross-selling and upselling opportunities in insurance?

The onboarding process affects cross-selling and upselling opportunities by creating a rapport with clients and understanding their needs. A thorough onboarding experience enables agents to present relevant additional products, like life or renters insurance, tailored to the customer’s situation, enhancing both service and revenue.

| Key Steps in Customer Onboarding | Importance of Customer Onboarding |

|---|---|

| 1. Collect Basic Information | Accurate information reduces misconceptions and customer dissatisfaction. |

| 2. Welcome Package | A positive first impression can increase customer retention. |

| 3. Scheduling Consultation Calls | Identifying needs early helps to align expectations and goals. |

| 4. Consultation Call Preparation | This step ensures effective communication and understanding. |

| 5. Post-Call Follow-up | Follow-ups establish ongoing relationships and trust. |

| 6. Feedback Collection | Gathering feedback from customers aids in continuous improvement. |

Summary

Customer onboarding in insurance is a critical phase that sets the stage for a successful long-term relationship between the insurer and the client. By effectively gathering and verifying information, providing a warm welcome, and ensuring clear communication, insurance agencies can enhance customer satisfaction and loyalty. Emphasizing the importance of this process not only helps mitigate misunderstandings but also opens avenues for additional services that can add value to the customer experience. Ultimately, a thorough onboarding process creates a solid foundation for future interactions and builds trust, enhancing customer retention and business growth.