COVID-19 Death Preparedness: Essential Actions to Take

COVID-19 death preparedness has become a crucial topic as millions grapple with uncertainty about their health and future. As we face the realities of this pandemic, many are compelled to think about difficult but necessary actions like estate planning and ensuring the security of their loved ones. Preparing your will, creating an advanced directive, and acquiring life and disability insurance are essential steps towards protecting your family’s financial stability and ensuring your wishes are respected. With so much at stake, taking proactive measures can provide peace of mind, knowing that your loved ones are taken care of, even in your absence. Embracing these preparations now is a responsible act of love and foresight that can help alleviate anxiety during these unprecedented times.

As we navigate the ongoing challenges posed by the pandemic, the concept of mortality planning has gained significant importance. Individuals are increasingly recognizing the need for thoughtful advanced arrangements concerning their estate, healthcare preferences, and financial support for dependents. The terms ‘mortality management’ and ‘preparedness for death due to COVID-19’ resonate deeply as people consider their long-term plans. Establishing a comprehensive approach that includes drafting important documents such as a will or an advanced directive, as well as investing in life or disability insurance, can provide a strong foundation for future security. Engaging in these discussions can transform daunting choices into empowering actions that protect families during uncertain times.

Understanding the Importance of Estate Planning in Uncertain Times

Estate planning has become increasingly vital during the COVID-19 pandemic as the world grapples with unforeseen health challenges. Many individuals find themselves reconsidering their personal and financial preparedness in the face of mortality. Estate planning involves arranging the management and disposal of a person’s estate during their life and after death, ensuring that assets are distributed according to their wishes. Making informed decisions about your estate can shield your loved ones from confusion and financial strain during an already challenging time.

A well-structured estate plan should include several critical components, such as a will, trusts, powers of attorney, and advanced directives. Each element serves a specific purpose—ensuring that your healthcare wishes are respected, protecting your assets, and providing for your loved ones. By taking the time to develop a comprehensive estate plan, you provide a framework that supports your family’s needs and stabilizes their future, even in the face of life’s uncertainties.

COVID-19 Death Preparedness: Taking Necessary Steps

The COVID-19 pandemic has underscored the necessity of planning for unforeseen circumstances, including death. Having a sound plan is imperative; it can bolster your loved ones’ resilience in the face of loss. While discussing mortality can be uncomfortable, taking the time to prepare ensures that your desires are honored even when you cannot communicate them. This proactive approach encompasses creating a detailed will, establishing an advanced directive, and securing proper insurance.

Beyond your will and medical directives, you might also consider setting up a digital legacy. This includes logging in to your online accounts or storing important documents in a secure location. In the current climate, where digital presence is more significant than ever, ensuring your family has access to crucial online information can prevent complications. By investing time into COVID-19 death preparedness, you may alleviate a tremendous emotional burden from your family.

The Role of Advanced Directives in Your Safety Plan

An advanced directive is a fundamental part of ensuring your medical decisions are honored when you cannot voice them. In the context of COVID-19, the need for these documents has gained prominence as more individuals confront the realities of serious illness. By outlining your healthcare preferences legally, you empower your loved ones to make informed decisions that align with your values and desires without the added stress of uncertainty.

Creating an advanced directive also includes discussing your wishes with family members and your appointed healthcare proxy. Being open about your preferences for treatment, end-of-life care, and your values fosters understanding. This conversation can provide vital emotional support during trying times, illustrating the importance of having legal documents like advanced directives that bridge communication gaps and help family members act with confidence.

Life Insurance: A Crucial Financial Safety Net

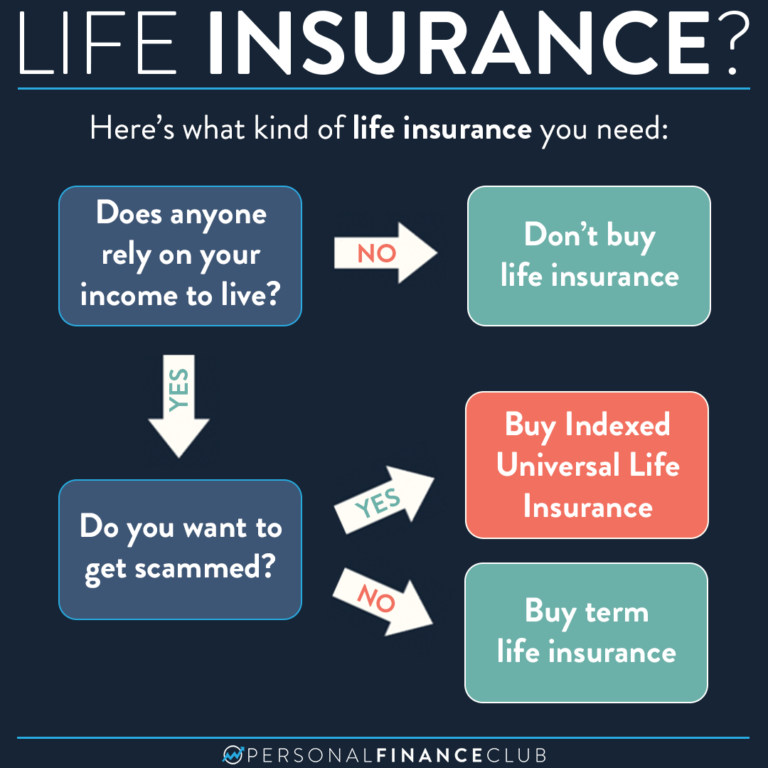

Life insurance serves as a safety net for your loved ones, providing them with financial stability in the event of your untimely passing. In light of the ongoing pandemic, many individuals are recognizing the importance of securing life insurance policies that can cover everyday expenses, medical bills, and funeral costs. With a diverse range of affordable options available, it’s essential to assess your financial situation and determine the amount of coverage appropriate for your needs.

Moreover, understanding the different types of life insurance—term life, whole life, and universal life—can enable you to choose the right policy that aligns with your long-term goals. It’s worth noting that connecting with an experienced insurance agent can help clarify terms and navigate the often-confusing landscape of insurance coverage. Regardless of your stage in life, acquiring a life insurance policy is a pivotal step towards safeguarding your family’s financial future.

Disability Insurance: Protecting Your Income

Disability insurance is a crucial safeguard against income loss from unforeseen circumstances, including illness or accidents. As COVID-19 has shown us, the need for this type of insurance has never been more apparent. Many individuals experience long-term effects from the virus, leading to an inability to work. Disability insurance provides a safety net to help ensure that essential expenses, such as mortgage payments and bills, can still be met during your recovery.

There are various options for obtaining disability insurance, including employer-sponsored plans and private policies. Evaluating your circumstances thoroughly is vital to select the plan that best fits your needs and budget. Understanding the terms, such as what constitutes a disability and waiting periods can help you make an informed decision. In a world fraught with uncertainties, having disability insurance offers peace of mind that you and your loved ones will remain secure, regardless of life’s unpredictable events.

Creating a Will: Securing Your Family’s Future

Drafting a will is perhaps one of the most critical components of estate planning, ensuring that your assets are distributed according to your wishes after your passing. Amid the COVID-19 pandemic, many people have been faced with the reality that life is unpredictable. A clear and legally binding will simplifies the process for your loved ones, alleviating the burden of decision-making during a difficult time, and protecting your beneficiaries from unnecessary legal battles.

While you can create a will using online resources, consider consulting an attorney, especially if your estate is complex with multiple assets or dependents. An attorney can guide you through the legal intricacies, ensuring that all necessary formalities are fulfilled. Overall, taking the initiative to prepare a will can bring comfort knowing your family will be supported, and your legacy will align with your wishes.

Exploring Insurance Options for Enhanced Protection

In the face of uncertainties brought on by the pandemic, it’s essential to explore all forms of insurance—life, disability, and beyond—that can protect you and your family. Evaluating available insurance options will empower you to take charge of your financial future. For instance, life insurance can cover expenses for those who depend on you, while disability insurance is vital for protecting your earning potential against unexpected events.

Navigating the insurance landscape can feel daunting, making it wise to seek professional advice. Insurance agents can provide insights tailored to your specific needs, ensuring you understand the various policies available. Additionally, an in-depth review of your existing coverage can help identify gaps that need to be filled, granting you confidence that you are adequately prepared for unforeseen incidents.

The Impact of COVID-19 on Death Preparation Practices

The COVID-19 pandemic dramatically reshaped how individuals view their mortality and, consequently, how they approach planning for their death. As the virus surged, many people experienced loss firsthand, catalyzing a growing awareness of the importance of having a well-thought-out death preparedness plan. The shock of loss has prompted individuals to reassess their estate planning strategies, demonstrating that no one is immune to the uncertainties of life.

Moreover, the last few years have propelled many to adopt more practical approaches to planning for their mortality, including creating living wills and advanced directives. As more individuals engage in these critical conversations with family members, the stigma surrounding discussions of death is easing, recognizing that these preparations lead to peace of mind and ensure one’s wishes are honored.

Navigating the Emotional Landscape of Death Planning

Discussing death and preparing for it can evoke a myriad of emotions, ranging from fear to anxiety, and even avoidance. It’s essential to acknowledge that engaging in discussions about death planning is not merely about considering the worst but about safeguarding your family. Embracing these challenging conversations can lead to emotional healing and understanding, offering loved ones reassurance that their needs will be taken care of.

Encouraging open dialogues about death can prevent misunderstandings and confusion in the future. By establishing your wishes clearly and including your family in the conversation, you can transform a potentially distressing subject into an opportunity for bonding and support. Facilitate these discussions in a respectful, empathetic manner, reassuring loved ones that it is an act of love and responsibility.

Frequently Asked Questions

What is COVID-19 death preparedness and why is it important?

COVID-19 death preparedness involves taking proactive steps to ensure your loved ones are financially and legally protected in the event of your unexpected passing due to the virus or other causes. This preparation typically includes estate planning, creating a will, obtaining life insurance, and setting up advanced directives, helping to alleviate stress and uncertainty for those left behind.

How can I prepare my will for COVID-19 death preparedness?

Preparing your will is a crucial step in COVID-19 death preparedness. A legally binding will outlines how your assets will be distributed and who will care for your children if something happens to you. Many online services, like LegalZoom or Quicken WillMaker, offer cost-effective solutions, making it easier than ever to create a will during these challenging times.

What role does life insurance play in COVID-19 death preparedness?

Life insurance is an essential component of COVID-19 death preparedness. It provides financial protection for your dependents, covering funeral expenses, debts, and daily living costs, ensuring they are taken care of if you pass away unexpectedly. Assessing your life insurance needs now can give you peace of mind for the future.

What is an advanced directive and why should I create one as part of my COVID-19 death preparedness?

An advanced directive is a legal document that specifies your medical care preferences if you become unable to communicate due to illness or injury. In the context of COVID-19 death preparedness, having an advanced directive ensures that your healthcare decisions are honored, providing clarity and reducing stress for your loved ones during critical times.

Why is disability insurance important for COVID-19 death preparedness?

Disability insurance can be vital for COVID-19 death preparedness, as it protects your income in the event of an unexpected illness or injury that prevents you from working. With the potential long-term effects of COVID-19, having disability insurance can secure your family’s financial stability during recovery or unforeseen circumstances.

What steps can I take today to enhance my COVID-19 death preparedness?

To enhance your COVID-19 death preparedness, you can start by preparing your will, creating an advanced directive, reviewing or obtaining life insurance, and considering disability insurance. Each of these steps will help secure your family’s financial future and ensure that your wishes are honored in case of an unforeseen event.

How can I ensure my loved ones benefit from my estate planning in light of COVID-19?

To ensure your loved ones benefit from your estate planning amid COVID-19, create a comprehensive will that clearly outlines your wishes and appoints responsible guardians. Incorporate life insurance and consider setting up trusts for additional financial security. Keep all documents updated and shared with key family members or legal advisors to guarantee smooth execution.

| Action | Description | Resources |

|---|---|---|

| Prepare your will | Outline your wishes for asset distribution and guardianship of minors. | LegalZoom, Quicken WillMaker & Trust, Do Your Own Will. |

| Create an advanced directive | Specify desired medical care if you cannot communicate. | State-provided forms, notarize online. |

| Look into life insurance | Protect income and cover expenses for dependents. | Contact life insurance agents; many offer remote consultations. |

| Consider disability insurance | Protect your income if you’re unable to work due to health issues. | Research different coverage methods suitable for you. |

Summary

COVID-19 death preparedness is crucial in today’s uncertain environment. Taking proactive steps such as preparing wills, creating advanced directives, obtaining life insurance, and considering disability insurance can provide peace of mind. By securing these essential documents and protections, you not only protect your loved ones’ future but also gain a sense of control during trying times. It’s never too late to prepare for the unexpected.