Commercial Auto Insurance Premiums: Key Influencing Factors

Commercial auto insurance premiums are a critical component of managing operational costs for businesses that depend on vehicles. These premiums can vary significantly based on multiple factors, making it essential for business owners to understand how to navigate them effectively. Factors such as the type of vehicles, driving history, and geographic location all play a role in determining the overall cost of commercial vehicle insurance. Additionally, implementing strategies to reduce insurance costs, such as maintaining a clean driving record or qualifying for fleet insurance discounts, can lead to significant savings. Understanding commercial auto coverage and its premiums can empower business owners to make informed decisions that protect their assets while optimizing expenses.

When discussing business vehicle insurance, it’s important to understand the various elements that contribute to the overall premiums. This type of insurance, often referred to as commercial vehicle insurance, encompasses a range of coverage options tailored for businesses with vehicles on the road. Unlike standard auto insurance, the factors influencing the insurance premium for commercial use are multifaceted and require careful consideration. From the nature of vehicle usage to the driving records of employees, each aspect plays a crucial role in calculating costs. By exploring these insurance premium factors, businesses can better strategize on how to mitigate risks and potentially lower their overall expenses.

Understanding Commercial Auto Insurance Premiums

Commercial auto insurance premiums can seem daunting at first, but understanding the factors that affect them can help business owners make informed decisions. Unlike personal auto insurance, commercial policies take into account various aspects of your business operations. Factors such as the type of vehicles you operate, your business location, and the driving history of your employees all play a critical role in determining your premiums. For instance, businesses that operate larger vehicles or specialized trucks may face higher premiums due to the increased risks associated with these vehicles.

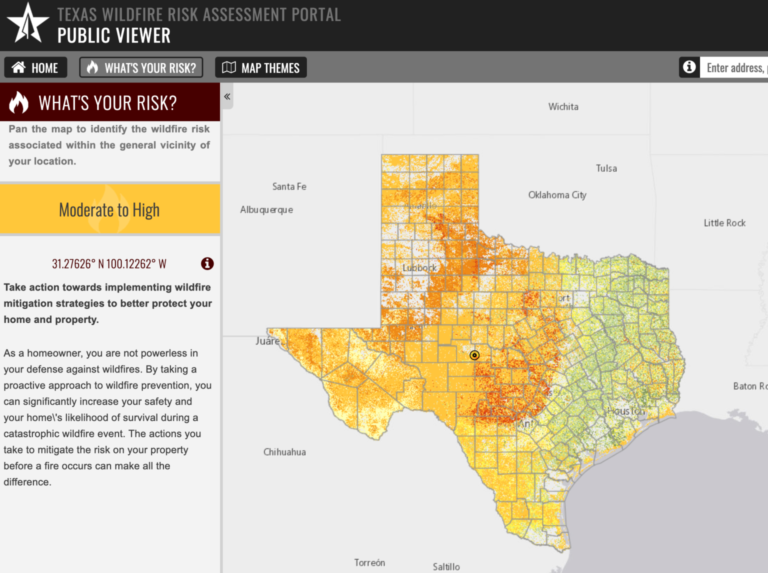

Additionally, the geographic area in which your vehicles operate can significantly impact your insurance costs. Regions with high traffic congestion or a higher incidence of accidents typically result in increased premiums. It’s also essential to consider how often and for what purpose your vehicles are used. Frequent long-distance deliveries or transporting passengers can contribute to elevated risk levels, further influencing your overall insurance expenses.

Frequently Asked Questions

What factors affect commercial auto insurance premiums?

Commercial auto insurance premiums are influenced by several key factors, including the type of vehicles you operate, your business location, driving history, the number of vehicles insured, and your chosen deductible. Companies consider these elements to assess the risk associated with insuring your business vehicles.

How can I reduce my commercial auto insurance premiums?

To reduce your commercial auto insurance premiums, maintain a safe driving culture, implement accident prevention measures, regularly review your coverage, and ensure your employees have a clean driving record. These strategies can help lower your insurance costs while keeping your fleet safe.

Why is the type of vehicle important for commercial vehicle insurance premiums?

The type of vehicle you operate is crucial for commercial vehicle insurance premiums because larger or specialized vehicles typically incur higher premiums due to increased risk and repair costs. Understanding this can help businesses choose vehicles that optimize insurance expenses.

Do fleet insurance discounts apply to commercial auto coverage?

Yes, fleet insurance discounts are available for businesses that insure multiple vehicles under a single commercial auto coverage policy. Insuring several vehicles together can often lead to lower overall premiums compared to insuring each vehicle individually.

How does my driving history impact commercial auto insurance premiums?

Your driving history significantly impacts your commercial auto insurance premiums. A clean driving record with no accidents or traffic violations typically results in lower premiums, while a history of accidents can lead to higher costs. It’s essential to manage the driving records of all employees who operate commercial vehicles.

What role does my deductible play in determining commercial auto insurance premiums?

Your deductible is the amount you agree to pay out-of-pocket before your commercial auto insurance coverage kicks in. Choosing a higher deductible can lower your premiums but increases your financial risk in the event of an accident. Balancing these factors is key to managing your insurance costs.

How often should I review my commercial auto insurance coverage?

It’s advisable to review your commercial auto insurance coverage regularly, especially as your business needs change. Regular assessments ensure that you maintain adequate protection at an optimal price, potentially leading to savings on your insurance premiums.

What is the impact of location on commercial auto insurance premiums?

The geographic location of your business plays a vital role in determining commercial auto insurance premiums. Areas with higher traffic congestion or accident rates typically lead to increased costs, so understanding local risk factors can help businesses manage their insurance expenses effectively.

| Factor | Impact on Premiums |

|---|---|

| Type of Vehicles Operated | Larger or specialized vehicles generally lead to higher premiums. |

| Business Location and Usage | Higher traffic areas or frequent usage can increase premiums. |

| Driving Record and History | A clean record results in lower premiums; accidents increase costs. |

| Number of Vehicles Insured | More vehicles mean higher costs, but fleet discounts may apply. |

| Deductible Amount | Higher deductibles can lower premiums but increase out-of-pocket costs. |

Summary

Commercial auto insurance premiums are influenced by various factors, including the type of vehicles used, business location, driving records, and the number of vehicles insured. Understanding these elements can help businesses manage their insurance costs effectively. By implementing risk mitigation strategies, such as promoting safe driving and regularly reviewing coverage, companies can potentially lower their premiums. Consulting with a knowledgeable insurance agent can further aid in finding the best coverage at competitive rates.