Cloud Integration in Insurance: A Path to Digital Transformation

Cloud integration in insurance is revolutionizing the way insurers operate, marking a significant shift towards efficiency and modernization in the industry. As insurance companies embrace digital transformation, they are increasingly turning to advanced technologies to streamline their processes and enhance customer experiences. By integrating cloud-based solutions, insurers can effectively manage tech debt, reducing the burden of outdated systems and enabling smoother workflows. Additionally, robust cloud security services ensure that sensitive data is protected while meeting compliance requirements. With the right tools, including CRM for insurers, companies can leverage their data assets to drive innovation and remain competitive in a rapidly evolving market.

In the ever-evolving landscape of the insurance sector, the adoption of cloud solutions is pivotal for driving operational efficiency and innovation. The convergence of insurance technology and cloud capabilities is empowering insurers to dismantle traditional silos, thus facilitating better collaboration and customer engagement. As organizations prioritize digital initiatives, they must also consider the implications of tech debt management to ensure sustainable growth. Moreover, leveraging comprehensive customer relationship management systems can significantly enhance data handling and streamline communication processes. This holistic approach not only strengthens security protocols but also positions insurers to adapt swiftly to changing market demands.

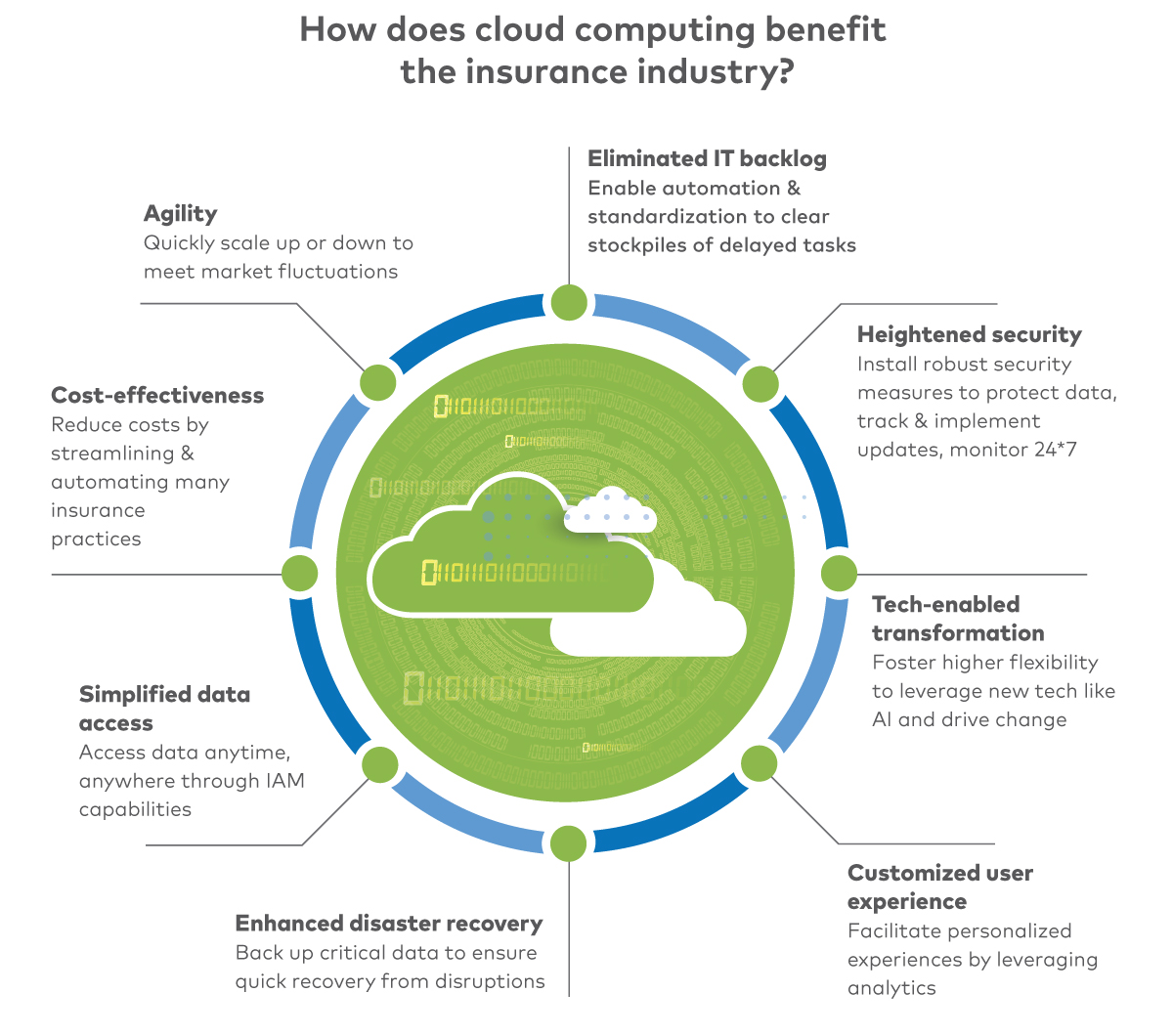

The Impact of Cloud Integration in Insurance

Cloud integration is revolutionizing the insurance industry by breaking down the barriers created by siloed systems. Traditional insurance companies often struggle with fragmented data sources and inadequate communication between various departments. By adopting cloud integration platforms, insurers can connect their policy administration systems with customer relationship management (CRM) tools, creating a seamless flow of information. This connectivity not only enhances operational efficiency but also fosters a more collaborative environment where teams can work together to provide better customer service.

Moreover, cloud integration facilitates real-time data sharing, enabling insurers to gain insights into customer behavior and preferences. This capability is critical for personalizing insurance products and services, as it allows insurers to analyze data from various touchpoints. With the ability to respond swiftly to market changes and customer needs, insurance companies can enhance their competitive edge, ultimately leading to increased customer satisfaction and loyalty.

Managing Tech Debt for Operational Efficiency

Technical debt is a significant concern for insurance companies, particularly as they undergo digital transformation. When insurers opt for quick fixes or maintain outdated legacy systems, they accumulate tech debt that hinders their ability to innovate. Effective management of this debt requires a clear understanding of the underlying technology stack and a commitment to investing in modern solutions. By prioritizing the integration of open APIs and low-code platforms, insurers can streamline operations and reduce the complexities associated with tech debt.

Addressing tech debt not only improves operational efficiency but also enhances the overall customer experience. When insurers invest in technologies that simplify processes, such as automated claims processing and efficient customer onboarding, they can reduce wait times and improve service quality. This proactive approach helps insurers mitigate the risks associated with outdated systems, allowing them to focus on strategic initiatives that drive growth and customer engagement.

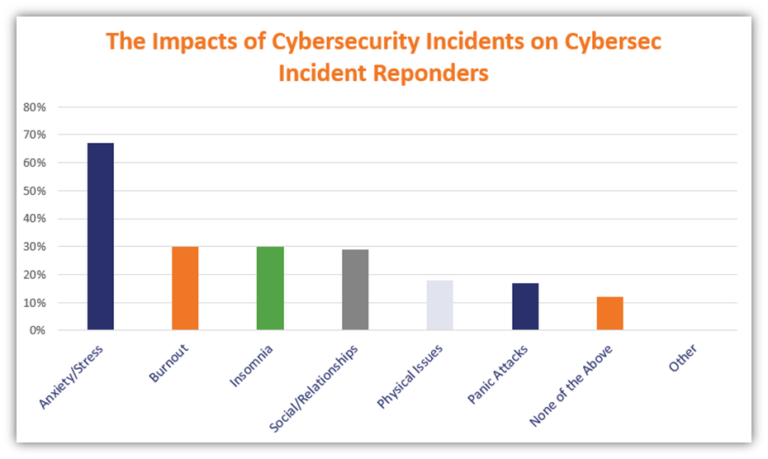

Leveraging Cloud Security Services in Insurance

In today’s digital landscape, security is a top priority for insurance companies. The shift to cloud-based systems necessitates a comprehensive approach to security and compliance. Cloud providers offer advanced security services, such as identity and access management, encryption, and threat detection, which are essential for protecting sensitive customer data. By leveraging these cloud security services, insurers can enhance their security posture and ensure compliance with industry regulations, thus building trust with their customers.

Furthermore, the integration of cloud security measures enables insurers to respond quickly to potential threats. With real-time monitoring and automated incident response capabilities, insurers can mitigate risks before they escalate into serious breaches. This proactive stance not only safeguards the organization’s assets but also reinforces customer confidence, as clients are more likely to choose insurers that prioritize their security.

Embracing Digital Transformation in Insurance

Digital transformation is reshaping the insurance landscape, pushing companies to adopt innovative technologies to stay relevant. As insurers embrace this transformation, they must not only invest in cloud integration but also re-evaluate their entire operational model. This shift involves modernizing legacy systems and ensuring that new technologies align with business objectives. Insurers that successfully navigate this transformation can expect to see enhanced customer engagement, reduced operational costs, and improved overall efficiency.

Moreover, the journey towards digital transformation is not merely about technology adoption; it also involves a cultural shift within the organization. Insurers must foster a culture of innovation that encourages collaboration and continuous improvement. By empowering employees to embrace new tools and processes, companies can unlock their full potential, adapting quickly to changes in the market while effectively meeting customer demands.

The Importance of Comprehensive CRM Solutions

Comprehensive CRM solutions play a crucial role in managing technical debt within insurance organizations. By centralizing customer data and interactions, CRMs streamline communication and eliminate the inefficiencies associated with siloed information. This consolidation allows sales and support teams to focus on delivering exceptional customer experiences, rather than getting bogged down by administrative tasks. Additionally, CRMs with robust integration capabilities can connect with various tools, further enhancing operational efficiency.

Furthermore, modern CRMs offer automation features that reduce manual data entry and minimize errors, consequently lowering the risk of accumulating technical debt. As insurers continually adapt to evolving market conditions, having a scalable CRM solution ensures that they can adjust their processes without incurring additional debt. This adaptability is vital in maintaining a competitive edge and delivering customized solutions that meet the unique needs of each customer.

Optimizing Resource Management with Cloud Technologies

Effective resource management is critical for insurers looking to optimize operational costs. Cloud technologies provide tools and services that offer visibility into spending patterns, enabling insurers to make informed decisions about resource allocation. By analyzing usage data, companies can identify underutilized resources and adjust their cloud infrastructure accordingly, ensuring they are only paying for what they need. This strategic approach helps to mitigate the impact of technical debt while maximizing return on investment.

Additionally, cloud technologies allow insurers to implement automated scaling policies that adjust resources in real-time based on demand. This flexibility not only reduces costs but also enhances service reliability, as insurers can ensure that their systems remain responsive during peak usage periods. By leveraging these capabilities, insurance companies can maintain operational efficiency and provide a better experience for their customers.

Unlocking Customer Insights through Cloud Analytics

Cloud-based analytics solutions are transforming how insurers understand their customers and assess risk. By harnessing the power of big data, insurers can gain valuable insights into customer behaviors, preferences, and trends. This wealth of information enables companies to tailor insurance products and services to better meet the needs of their clientele, ultimately leading to increased customer satisfaction and retention.

Moreover, the integration of machine learning algorithms within cloud analytics platforms allows for the automation of critical processes such as underwriting and claims assessment. This automation not only speeds up operations but also enhances accuracy in risk evaluation, reducing losses associated with fraud. As insurers continue to leverage cloud analytics, they can position themselves as industry leaders, equipped to adapt to market changes and evolving customer expectations.

Future-Proofing Insurance Business Models

As the insurance industry continues to evolve, companies must focus on future-proofing their business models to stay competitive. This entails not only adopting new technologies but also rethinking traditional practices that may no longer serve the needs of the modern consumer. By embracing cloud integration and digital transformation, insurers can create agile business models that respond swiftly to market demands, ensuring long-term sustainability.

Future-proofing also involves fostering a culture of innovation within the organization, where employees are encouraged to explore new ideas and collaborate across departments. By investing in continuous training and development, insurers can equip their workforce with the skills necessary to navigate the complexities of the digital landscape. This commitment to innovation not only enhances operational efficiency but also positions insurers to capitalize on emerging opportunities in the market.

Navigating Regulatory Compliance in a Digital Era

Regulatory compliance remains a critical concern for insurance companies, especially in an increasingly digital environment. As insurers adopt cloud technologies, they must ensure that their systems and processes comply with industry regulations. This requires a thorough understanding of compliance requirements and the effective implementation of cloud security services that support adherence to these standards.

Moreover, leveraging cloud solutions can streamline compliance efforts by automating reporting and documentation processes. Insurers can utilize advanced analytics to monitor compliance in real-time, identifying potential issues before they escalate. By integrating compliance management into their cloud strategy, insurers can reduce the risk of non-compliance while enhancing operational effectiveness.

Frequently Asked Questions

How does cloud integration in insurance improve operational efficiency?

Cloud integration in insurance enhances operational efficiency by connecting disparate systems and data sources, eliminating silos, and enabling seamless access to information. This streamlined connectivity allows insurers to leverage data-driven insights, automate processes, and improve customer interactions, ultimately leading to reduced costs and faster service delivery.

What role does cloud security services play in insurance technology?

Cloud security services are vital in insurance technology as they provide robust measures for protecting sensitive customer data and ensuring compliance with industry regulations. By utilizing services like encryption, identity and access management, and threat detection, insurers can enhance their security posture and mitigate risks associated with digital transformation.

Why is managing tech debt important for digital transformation in insurance?

Managing tech debt is crucial for digital transformation in insurance as it allows companies to modernize their legacy systems and optimize their tech stack. By addressing technical debt, insurers can improve operational efficiency, reduce costs, and enhance their ability to integrate with modern solutions, facilitating a smoother transition to a digital-first strategy.

How can a comprehensive CRM help with cloud integration in insurance?

A comprehensive CRM aids cloud integration in insurance by centralizing customer data and streamlining communication processes. It enhances efficiency by linking various tools and systems, reducing the risk of data inconsistencies, and enabling insurers to utilize cloud capabilities for better customer insights and service delivery.

What benefits do insurers gain from embracing cloud technologies for managing operational tech debt?

By embracing cloud technologies, insurers can proactively manage operational tech debt through improved data management, resource optimization, and scalable solutions. This shift allows for faster innovation, reduced time-to-market for new products, and a more agile approach to meeting evolving customer needs.

How does cloud integration facilitate the digital transformation of customer journeys in insurance?

Cloud integration facilitates digital transformation of customer journeys in insurance by enabling seamless connectivity between policy administration, claims processing, and CRM systems. This integration provides an omnichannel experience, enhancing customer interactions and ensuring timely responses to inquiries and claims.

What are the key advantages of using cloud-based analytics solutions in the insurance industry?

Cloud-based analytics solutions offer key advantages such as scalability, agility, and the ability to derive actionable insights from vast amounts of data. Insurers can better understand customer behavior, assess risk accurately, and personalize offerings, ultimately leading to improved operational efficiency and cost savings.

How can cloud cost management tools optimize resource utilization for insurers?

Cloud cost management tools optimize resource utilization for insurers by providing visibility into cloud spending, facilitating right-sizing of instances, and implementing automated scaling policies. These strategies help insurers control costs while maximizing their investment in cloud technologies.

What challenges do insurers face when integrating cloud solutions with legacy systems?

Insurers face challenges such as siloed data, compatibility issues, and the complexity of migrating legacy systems to the cloud. These hurdles can hinder the effectiveness of cloud integration, making it essential for insurers to adopt a strategic approach to modernize their infrastructure.

In what ways can cloud integration enhance compliance for insurance companies?

Cloud integration enhances compliance for insurance companies by utilizing security services that adhere to industry regulations, automating compliance reporting, and providing centralized data management. This ensures that insurers can efficiently meet regulatory requirements while maintaining a secure environment for customer data.

| Key Points | Description |

|---|---|

| Transformative Era in Insurance | The insurance industry is experiencing significant changes driven by technological advancements. |

| Importance of Cloud Integration | Cloud integration helps dismantle data silos, improving operational efficiency and collaboration. |

| Addressing Technical Debt | Insurers must invest in modern digital architectures to reduce inefficiencies caused by legacy systems. |

| Omnichannel Experience | Providing a seamless experience is vital; insurers currently use multiple tools leading to inefficiencies. |

| Cloud Security and Compliance | Cloud providers enhance security measures and ensure compliance, easing burdens on insurers. |

| CRM’s Role in Managing Tech Debt | Comprehensive CRM systems centralize data and improve efficiency, reducing technical debt. |

| Cost Management | Cloud cost management tools help insurers optimize spending and resource utilization. |

| Mastering Customer Insights | Cloud solutions enable better risk assessment and personalization through data analysis. |

Summary

Cloud integration in insurance is a pivotal strategy for the industry’s digital transformation. As insurers embrace modern technology, they can effectively reduce technical debt and enhance operational efficiency. By leveraging cloud capabilities, organizations can eliminate data silos, improve security, and gain valuable customer insights, ultimately positioning themselves for sustained growth in an evolving market.

Terrific job here. I seriously enjoyed what you

had to say. Keep going because you absolutely bring a new voice to this subject.

Not many people would say what youve said and still make it interesting.

Well, at least Im interested. Cant wait to see more

of this from you.