Car Insurance Rates for Seniors: Key Influencing Factors

Car insurance rates for seniors can be significantly influenced by various factors beyond just the driver’s age. Many auto insurance companies take into account aspects such as driving records and claims history before determining premiums. While seniors might enjoy certain discounts, it’s crucial to be aware of how insurance rates vary based on age, driving experience, and the type of vehicle owned. Additionally, residence and annual mileage can further alter the cost of coverage. Understanding these components will help seniors make informed decisions about their auto insurance for seniors, ensuring they secure the best possible rates while maintaining strong coverage.

When it comes to understanding the cost of automobile coverage for older adults, many elements play a pivotal role. The relationship between a driver’s experience and insurance premiums cannot be overlooked, especially considering that insurers evaluate factors like driving habits and accident history. Furthermore, age-related discounts and the impact of an individual’s credit score are vital considerations in calculating premiums. For seniors exploring their auto insurance options, it’s essential to grasp how the market treats different demographics and the nuances that impact policy pricing. By researching and comparing insurance rates by age and other factors, seniors can potentially unlock savings and enjoy peace of mind on the road.

Key Factors Influencing Car Insurance Rates for Seniors

Car insurance rates are influenced by a multitude of factors, especially for seniors over the age of 65. Although age is a significant consideration, it’s not the sole determinant of pricing. Insurers also evaluate a senior’s driving record, experience, and claims history. A clean driving record, for instance, suggests reliability and reduces perceived risk, often resulting in lower premiums. On the other hand, a history of accidents or traffic violations may lead to elevated rates, which can disproportionately affect older drivers, highlighting the importance of maintaining a safe driving history.

Additionally, the age and type of vehicle a senior drives plays a critical role in determining insurance costs. Vehicles with a high market value or a history of theft can cause premiums to rise, while cars with advanced safety features may qualify for discounts. Moreover, where seniors reside can also impact their insurance rates; living in urban areas often correlates with higher premiums due to increased theft and accident rates. Seniors should regularly review their driving habits and vehicle choices to find ways to optimize their insurance costs.

Car Insurance Rates for Seniors: Discounts and Benefits

Many insurance companies recognize the longevity and experience of senior drivers and offer discounts specifically tailored for them. These discounts can be based on multiple factors, including a clean driving history, low annual mileage, or participation in defensive driving courses. By taking advantage of these discounts, seniors can significantly reduce their overall insurance costs. It’s beneficial for seniors to inquire about various offers when shopping for auto insurance, as many providers have senior-specific options that ensure fair pricing.

Furthermore, understanding available discounts is essential. Apart from the safe driving record that can lead to lower rates, other potential savings include discounts for bundled policies or for considering usage-based insurance options. Seniors who drive less frequently or have lower annual mileage can also see reductions in their premiums. These discounts not only help in managing costs but also reinforce the notion that senior drivers are responsible and valuable policyholders in the insurance market.

Understanding the Impact of Driving Records on Insurance Costs

A driving record is a pivotal factor in determining car insurance rates, particularly for seniors. Insurers prioritize this record as it reflects a driver’s reliability and risk potential. Seniors with a clean driving history usually benefit from lower premiums, while those with previous traffic offenses or accidents may face increased rates. It’s crucial for senior drivers to maintain safe driving habits and avoid incidents, ensuring that their driving record remains an asset when seeking insurance quotes.

In addition, seniors should be proactive in reviewing their driving records and understanding how factors like traffic violations or accidents might affect their insurance costs. After a long period of safe driving, seniors may want to challenge their providers for better rates as they could be misclassified due to past events. This aspect reinforces the importance of continuous education on driving practices, which can ultimately help in maintaining lower insurance costs.

Evaluating Insurance Costs Based on Location

The geographic location of a senior driver significantly influences their auto insurance rates. Urban areas often experience higher insurance premiums due to increased risks associated with theft, traffic volume, and accidents. In contrast, rural areas typically enjoy lower rates because of fewer traffic incidents. For seniors contemplating a move, it’s crucial to assess how different locations might impact their insurance costs. Tools that analyze the cost of living, including insurance rates for seniors, can aid in making informed decisions.

Another vital component affected by location is the local climate and environmental risks. Regions prone to extreme weather, such as hurricanes or floods, might see higher insurance rates due to an increased likelihood of vehicle damage. Therefore, as seniors consider moving for retirement, they should research not only the quality of life in potential new areas but also how these locations will affect their car insurance rates. Such due diligence can lead to significant savings and peace of mind.

The Role of Annual Mileage in Adjusting Premiums

Seniors who drive less typically find their auto insurance premiums are lower as a result of reduced risk. Insurers assess annual mileage when calculating rates, often rewarding those who have significantly reduced their driving habits, particularly after retirement. Having fewer miles on the road minimizes exposure to potential accidents, which benefits both the insurer and the policyholder. Seniors should notify their insurance agents if they are cutting back on driving to potentially unlock lower rates.

Moreover, understanding the connection between mileage and insurance costs is essential. Senior drivers who consistently minimize their time behind the wheel not only ensure their safety but can also tap into savings. It’s wise for seniors to keep detailed records of their driving habits and promptly share changes with their insurance provider, ensuring they receive appropriate discounts reflective of their driving patterns.

Choosing Coverage and Deductibles Wisely

Selecting the right coverage and deductible is crucial for seniors aiming to balance cost and protection. Higher coverage limits may seem appealing, but they typically lead to increased premiums. Seniors should assess their individual needs and financial situation to determine the most suitable limits. Having 100/300/100 liability coverage strikes a balance between safety and affordability, as it provides solid protection without overly burdening the budget.

Additionally, considering deductibles is vital in managing insurance costs. Seniors willing to take on a higher deductible can enjoy lower premiums, which can be beneficial for those who have robust financial plans or savings set aside. By carefully weighing the benefits of different coverage options and deductible levels, seniors can find an optimal balance that meets both their budgetary constraints and their insurance needs.

The Importance of Maintaining Good Insurance History

An individual’s insurance history significantly impacts their car insurance rates, especially for seniors. Maintaining a consistent insurance policy without lapses or claims can yield lower premiums over time. Insurers typically reward long-term clients who manage their payments diligently and avoid gaps in coverage. For seniors, prioritizing timely payments and staying continuously insured can help secure better rates.

Furthermore, seniors looking to switch providers should closely examine their insurance history, as gaps can lead to higher premiums with new insurers. It’s recommended for seniors to maintain detailed records of their insurance history and ensure that they do not miss payments or experience coverage interruptions. By doing so, they can not only save money but also foster a reliable relationship with their insurers.

Understanding Gender Differences in Car Insurance Premiums

Gender plays a noteworthy role in determining car insurance premiums. Statistically, women tend to have fewer accidents and less severe driving incidents compared to men, particularly in their golden years. As a result, female seniors often benefit from lower rates. Insurance companies analyze these trends to set premiums based on statistical risk, which reflects a significant pricing difference between genders.

Seniors should be aware of these differences and understand how their gender may influence their insurance rates. Moreover, older female drivers might find it beneficial to communicate their driving experience and clean records to insurers when obtaining quotes, potentially allowing them to negotiate better rates. Awareness of these factors can empower seniors to make informed decisions regarding their auto insurance.

How Credit History Affects Auto Insurance Rates for Seniors

Credit history has become an essential factor in determining car insurance premiums, particularly in states for such practices are permitted. Insurers often use credit scores as a predictor of future claims, with studies showing a correlation between poor credit and higher risk. Seniors with good credit histories generally enjoy lower rates, while those with less favorable credit may face increased premiums.

Seniors should actively manage their credit scores by paying bills on time, avoiding unnecessary debt, and reviewing their credit reports regularly. A positive credit history not only benefits auto insurance rates but also impacts other financial opportunities. By being mindful of their credit, seniors can position themselves for better rates, ultimately leading to significant savings over time.

The Impact of Marital Status on Insurance Premiums

Marital status can affect car insurance rates, with married individuals typically enjoying lower premiums compared to their single counterparts. This is due to the perception that married drivers are generally more responsible and less likely to file claims, which influences insurers’ pricing strategies. For seniors who have experienced changes in marital status, understanding how this transition may affect their insurance costs is crucial.

However, the impact of marital status on insurance premiums can vary based on state laws. In some states, like Hawaii and Massachusetts, insurers are prohibited from using marital status as a factor in determining rates. It is advisable for seniors to inquire about how their specific situation might be viewed by insurance providers and to consider consulting with an insurance agent to navigate these complexities effectively.

Frequently Asked Questions

How do auto insurance rates for seniors differ from those for younger drivers?

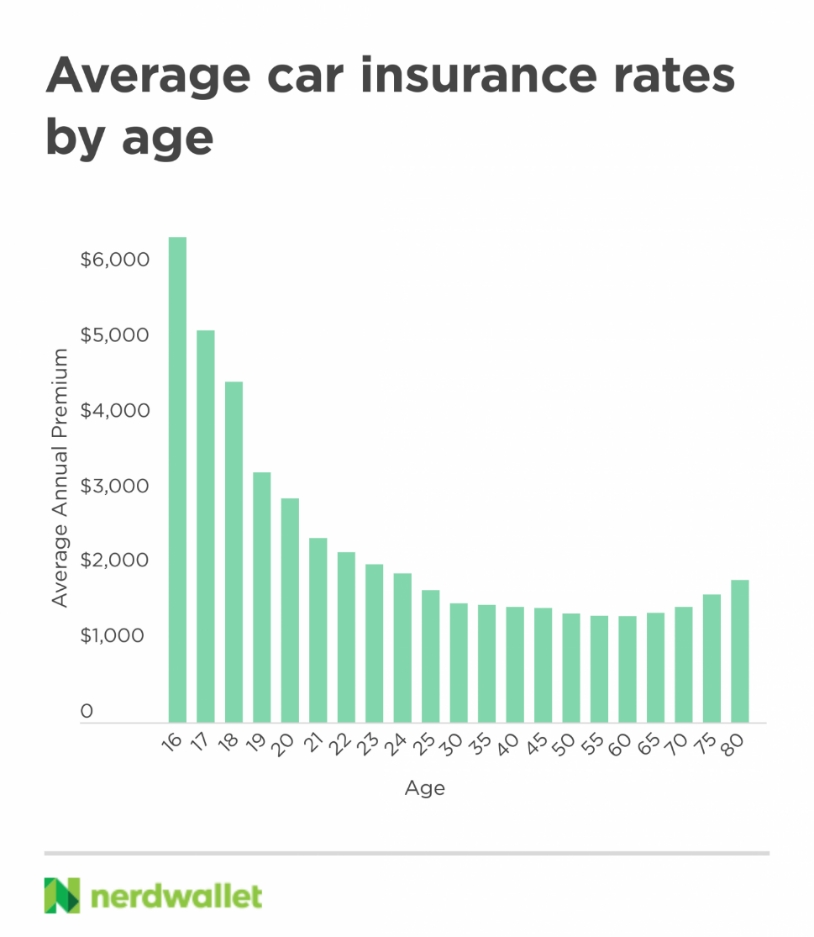

Auto insurance rates for seniors often differ from those of younger drivers due to various factors, including driving experience and claims history. While seniors may face higher rates in some states that allow age-based pricing, their extensive driving experience can lead to lower premiums if they maintain a clean driving record.

What factors affect car insurance rates for seniors?

Several factors impact car insurance rates for seniors, including driving record, the type of vehicle, annual mileage, location, and insurance history. Each of these elements is considered by insurers to determine premium costs, reflecting both the perceived risk and the insured’s history.

What discounts are available for seniors with auto insurance?

Seniors can access various car insurance discounts, such as those for safe driving, low mileage, and bundling policies. Many insurers also offer discounts for completing defensive driving courses, which can help reduce the overall cost of auto insurance for seniors.

How does driving record influence insurance rates by age for seniors?

A clean driving record is crucial for seniors when it comes to insurance rates. Insurers view a history of safe driving as indicative of lower risk, potentially leading to lower premiums. Conversely, a record with traffic offenses can significantly increase car insurance rates for seniors.

Are there specific car insurance rates for seniors over 65 compared to younger individuals?

Yes, insurance rates for seniors over 65 can differ from those of younger individuals. While some states prohibit basing rates purely on age, seniors may face higher premiums in other states due to the perception of increased risk associated with older drivers.

Does the type of vehicle affect car insurance rates for seniors?

Absolutely, the type of vehicle plays a significant role in determining car insurance rates for seniors. Factors like vehicle value, safety features, and popularity among thieves can influence premiums. More expensive or less secure vehicles often lead to higher insurance costs.

How does annual mileage impact seniors’ auto insurance rates?

Typically, lower annual mileage results in lower car insurance rates for seniors. With decreased driving, there is a reduced risk of accidents, which insurers consider a positive factor when assessing premiums.

Can a senior’s credit history affect their auto insurance rates?

Yes, a senior’s credit history can significantly impact their car insurance rates. Insurers often charge higher premiums for individuals with poor credit scores, as studies show a correlation between lower credit ratings and higher claim rates.

What role does marital status play in determining seniors’ car insurance costs?

Marital status can affect car insurance costs for seniors, with married individuals often enjoying lower rates due to being perceived as less risky drivers. However, regulations vary by state, and some states like Michigan and Massachusetts prohibit using marital status as a rating factor.

Is it beneficial for seniors to review their insurance history before getting a new policy?

Yes, it’s highly beneficial for seniors to review their insurance history before obtaining a new auto insurance policy. Maintaining a good payment history and avoiding coverage gaps can lead to better rates and coverage options.

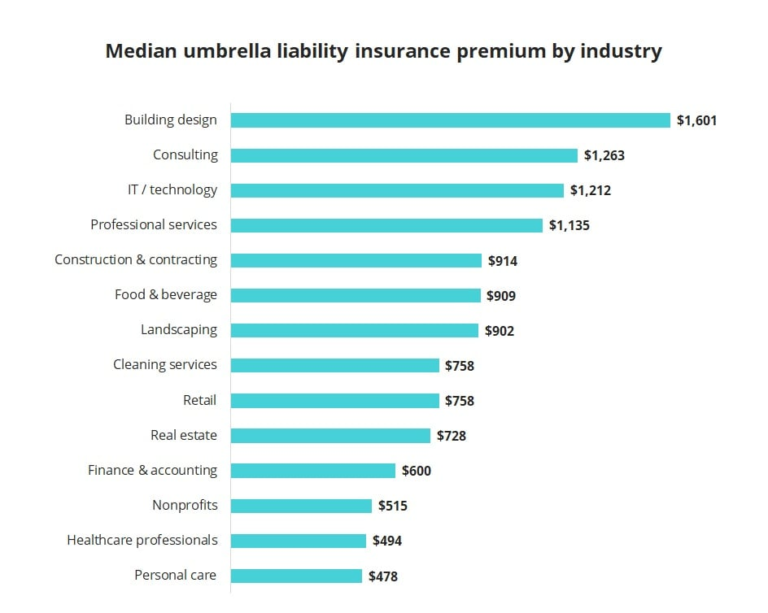

| Key Factors | Impact on Car Insurance Rates for Seniors |

|---|---|

| Age of the Driver | Rates may be higher in states allowing age as a factor; some states prohibit it. |

| Driving Record | A clean record can lower rates, while a history of traffic offenses raises premiums. |

| Vehicle Type and Intended Use | Vehicle value, theft rates, and usage (personal vs. business) affect rates. |

| Driving Experience | Experienced seniors may have lower rates, but premiums can rise with aging. |

| Claims History | No claims for three years usually means discounts; frequent claims raise premiums. |

| Where You Live | Urban areas and high-risk weather zones often have higher rates. |

| Annual Mileage | Less driving usually results in lower costs; notify insurer if reduced mileage occurs. |

| Coverage and Deductible | Higher coverage increases rates; raising deductibles can lower premiums. |

| Insurance History | Regular payments and no coverage gaps help secure better rates. |

| Gender | Statistically, women tend to have lower accident rates and premiums. |

| Credit History | Poor credit can lead to higher rates due to perceived risk. |

| Marital Status | Married individuals often pay less; marital changes can affect rates. |

Summary

Car Insurance Rates for Seniors are influenced by a variety of factors beyond just age. While it’s true that seniors may be viewed as high-risk in certain states, their insurance rates are primarily determined by their driving records, the type of vehicle they use, their claims history, and even their credit scores. Since several states have different regulations regarding these factors, it’s essential for seniors to consult with a qualified insurance agent to ensure they get the best rates available. Maintaining a clean driving record and being mindful of annual mileage can also help in securing lower premiums. In conclusion, understanding these key factors can empower seniors to make informed decisions regarding their car insurance.