Business Insurance Quote: Essential Insights for Owners

When looking for a business insurance quote, understanding the specifics can be daunting for many entrepreneurs. A business insurance quote is not just a number; it encapsulates various coverage types, insurance premiums, and policy limits that are crucial for protecting your business. With a significant percentage of small businesses facing underinsurance, it’s essential to dissect your quote thoroughly to avoid potential risks. By taking the time to analyze the details, from understanding quotes to identifying what each coverage type entails, you can make informed decisions that safeguard your investments. This article aims to simplify the complexities of a business insurance quote and guide you on how to secure the best coverage for your needs.

Navigating the landscape of commercial coverage can be challenging, especially when it comes to obtaining a precise insurance estimate. A business insurance estimate is often filled with intricate details, including various policy options, coverage limits, and deductible structures that define your financial obligations. Many business owners may find themselves overwhelmed by the terminology and numbers, which can obscure the true value of the protection offered. It’s vital to approach these quotes with a discerning eye, ensuring that you fully understand the implications of each component, such as the different types of coverage available and how they relate to your business’s unique risks. This guide will help demystify the insurance quoting process, allowing you to confidently evaluate your options and make the best choice for your enterprise.

Essential Components of a Business Insurance Quote

When evaluating a business insurance quote, it is crucial to understand the essential components that make up the final amount you will pay. Business insurance typically includes various coverages that protect against potential risks, and each of these will have its own associated premium. For example, general liability insurance, property insurance, and workers’ compensation are standard elements of most policies. Understanding what each coverage entails helps business owners appreciate why certain premiums might be higher than others. A thorough breakdown will also reveal any optional coverages that could provide additional protection tailored to your specific business needs.

Another important aspect to consider is the terminology used in quotes. Terms such as ‘policy limits’, ‘deductibles’, and ‘exclusions’ can often be confusing. Policy limits refer to the maximum amount an insurer will pay for a covered claim, while deductibles are the costs you must cover before your insurance kicks in. Exclusions are important to understand as they outline what is not covered by your policy. Being fully aware of these components allows you to make informed decisions and ensures that you’re not left vulnerable during unexpected events.

Understanding Insurance Premiums: What Affects Your Rates?

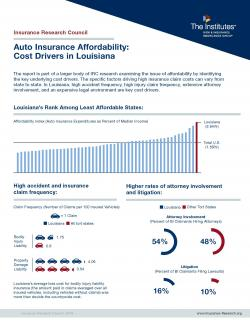

Insurance premiums are the recurring payments made to keep your policy active, and several factors influence these rates. The risk associated with your business plays a significant role; for example, industries deemed high-risk, such as construction, typically face higher premiums. Additionally, the location of your business can also impact rates. Areas prone to natural disasters may see increased costs for property coverage due to the higher likelihood of claims. Understanding these factors can help you better anticipate your insurance expenses and budget accordingly.

Another key element affecting your premiums is your claims history. Businesses with a history of frequent claims may be viewed as higher risk, leading to increased rates. It’s also essential to consider how your business activities might change over time. For instance, if your business expands and you hire more employees, your premiums may rise accordingly due to increased payroll and potential liabilities. By grasping these influencing factors, business owners can make strategic decisions to mitigate risks and potentially lower their insurance costs.

Coverage Types: What Do You Really Need?

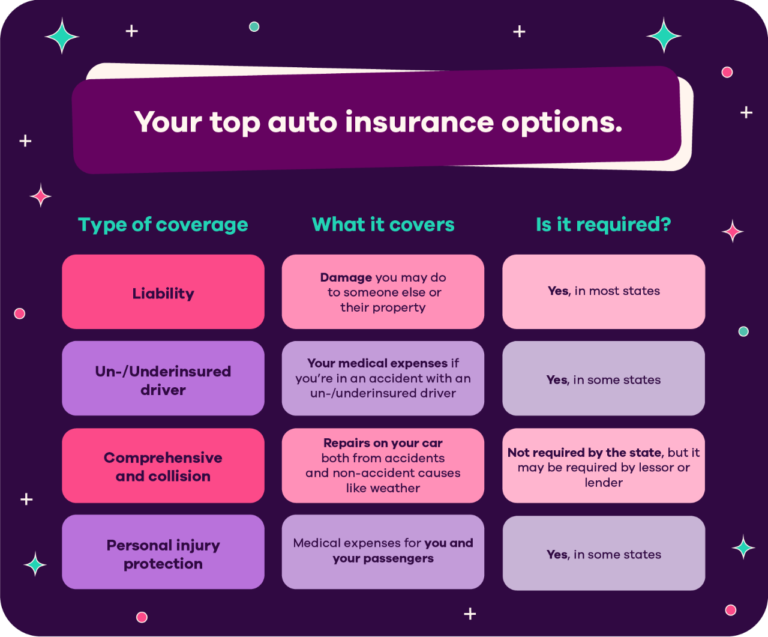

When reviewing your business insurance quote, it’s vital to understand the various types of coverage available and which ones are necessary for your specific operations. General liability insurance is one of the most common types, providing protection against bodily injury and property damage claims. Commercial property insurance is another essential form of coverage that protects your business assets, such as buildings and equipment, from risks like fire or theft. Understanding these coverage types and their implications on your overall premium can help you select the right policy for your business.

Additionally, consider specialized coverages that may be relevant to your industry. For example, professional liability insurance is crucial for service-based businesses as it protects against claims of negligence. Depending on your business activities, you may also need cyber insurance to safeguard against data breaches and cyber-attacks. Each coverage type impacts your premiums, so a thorough evaluation of your needs will ensure you only pay for the coverage that’s truly necessary, helping you maintain a balanced budget.

Policy Limits: Finding the Right Balance

Policy limits set the maximum amount an insurance company will pay for covered losses, making it a crucial aspect of your business insurance quote. Balancing these limits with your budget is essential as they are directly tied to your coverage and premium costs. For instance, businesses in high-risk industries, such as construction, might require higher liability limits to ensure adequate protection against potential claims. However, opting for higher limits can also mean increased premiums, so finding the right balance is key.

When reviewing your policy limits, consider both per-incident limits, which are the maximum payout for a single claim, and aggregate limits, which cover the total payout during a policy period. Understanding your business’s risk profile will help you determine the appropriate limits. Additionally, regularly reassessing your limits as your business grows or changes will ensure that you are adequately protected without overpaying for coverage.

Deductibles Explained: Choosing the Right Amount

Deductibles are an important element of your business insurance quote, representing the amount you must pay out-of-pocket before your insurance coverage kicks in. Typically, higher deductibles lead to lower premiums, which can be appealing for business owners looking to save on upfront costs. However, it’s crucial to choose a deductible that you can afford to pay in the event of a claim. A high deductible means taking on more financial responsibility, which could be risky if unexpected damages occur.

Conversely, selecting a lower deductible will generally result in higher premiums, but it provides greater financial protection during claims. Striking a balance between a deductible you can manage and a premium that fits within your budget is essential. Before finalizing your business insurance quote, consider your financial capacity to cover deductibles and how often you anticipate needing to file claims, ensuring you choose a deductible that aligns with your risk tolerance.

Exclusions and Endorsements: What You Need to Know

Exclusions and endorsements are vital components of your business insurance quote that can significantly impact your coverage. Exclusions specify situations or items that are not covered by your policy, which can lead to unexpected expenses if you are not aware of them. Common exclusions include natural disasters such as floods or earthquakes, which may require additional endorsements to be adequately covered. Understanding these exclusions ensures that you are not caught off guard during a claim.

Endorsements, on the other hand, are modifications to your policy that add specific coverages. For instance, if your standard commercial property policy does not cover cyber-attacks, you might consider adding a cyber liability endorsement. It’s essential to review your quote carefully and discuss any necessary endorsements with your insurance agent. This way, you can tailor your coverage to meet your business needs and mitigate potential risks effectively.

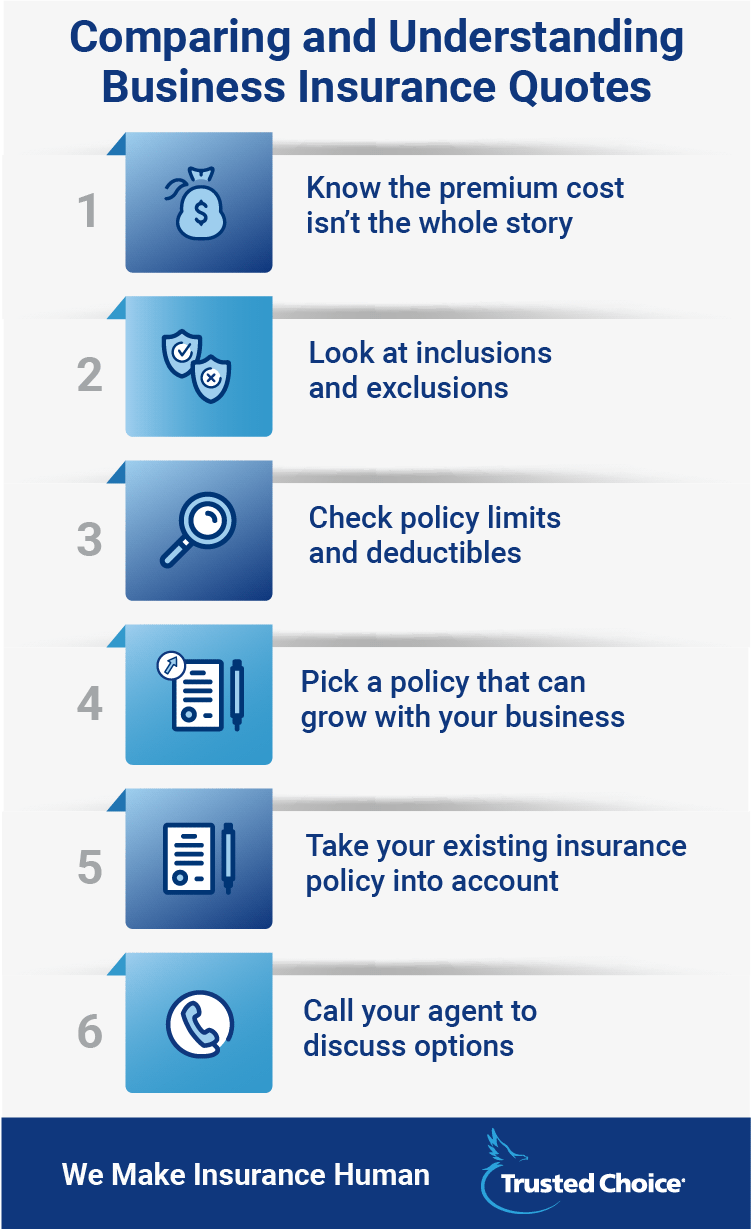

Finding the Best Fit: Comparing Multiple Quotes

Finding the right business insurance requires careful comparison of multiple quotes. While it may be tempting to select the cheapest option based solely on premium costs, it’s essential to evaluate the coverage types, limits, and exclusions presented in each quote. A comprehensive understanding of what each policy entails ensures that you are not sacrificing necessary coverage for lower premiums, which could lead to underinsurance and potential financial losses.

Additionally, consider the reputation of the insurance provider. Researching ratings from organizations like A.M. Best can help you identify financially stable insurers with a proven track record of customer service. Look for carriers with ratings of A- or better, as they are more likely to provide reliable support during claims processes. By taking the time to compare quotes thoroughly, you can find a policy that offers both affordability and comprehensive protection for your business.

How to Review and Deconstruct Your Quote

Reviewing and deconstructing your business insurance quote is a critical step in the decision-making process. Begin by breaking down each section of the quote, focusing on the premium costs, coverage types, and specific details like policy limits and exclusions. This detailed review will help you identify any gaps in coverage or areas where adjustments may be needed to better align with your business’s risk profile.

Moreover, don’t hesitate to ask questions about any terms or figures that seem unclear. Engaging with an insurance professional can provide valuable insights and help you understand the rationale behind certain costs. By fully comprehending your quote, you can make informed decisions that not only protect your business but also ensure that you are getting the best value for your investment.

The Importance of Custom Coverage Options

Custom coverage options play a vital role in ensuring that your business is adequately protected against specific risks. Many insurers, like Central Insurance, offer tailored policies that can be adjusted to fit the unique needs of your business. This customization allows you to select coverages that directly address the potential liabilities you face, rather than relying on a one-size-fits-all solution. Custom coverage options can include endorsements for specific risks, such as cyber liability or business interruption insurance.

By opting for custom coverage, you not only enhance your protection but may also find that you can optimize your insurance premiums. Tailoring your policy to your exact needs can prevent you from paying for unnecessary coverage while ensuring that critical risks are adequately managed. Work closely with your insurance agent to identify the right mix of coverages and endorsements that will provide comprehensive protection for your business.

Frequently Asked Questions

What factors influence my business insurance quote?

Several factors affect your business insurance quote, including your industry type, location, business size, and claims history. High-risk industries like construction typically face higher premiums, while businesses in areas prone to natural disasters may see increased property coverage costs. Additionally, a history of frequent claims can indicate higher risk, leading to increased premiums.

How can I understand the coverage types in my business insurance quote?

Understanding coverage types in your business insurance quote is crucial. Common types include General Liability, which protects against third-party claims; Commercial Property Insurance for physical assets; and Workers’ Compensation for employee injuries. Each coverage type has its own premium implications, so it’s important to review each to ensure adequate protection.

What is the significance of the effective date in my business insurance quote?

The effective date in your business insurance quote indicates when your coverage begins. This date is often aligned with the expiration of a previous policy or the acquisition of new property. Ensuring that the effective date matches your needs is critical to avoiding gaps in coverage.

How do deductibles affect my business insurance quote?

Deductibles represent the amount you pay out-of-pocket before your insurance covers a claim. Typically, higher deductibles result in lower premiums, while lower deductibles lead to higher premiums. Finding a balance between affordable premiums and manageable deductibles is key to effective financial planning for your business.

What are common exclusions in business insurance policies that I should be aware of?

Common exclusions in business insurance policies include natural disasters (e.g., floods, earthquakes), cyber attacks, and equipment breakdowns. Understanding these exclusions is vital, as they can lead to unexpected expenses if not addressed. Consider endorsements to cover these risks if necessary.

Why is it important to compare multiple business insurance quotes?

Comparing multiple business insurance quotes is important to ensure you receive comprehensive coverage at a competitive price. Look beyond just premiums; assess coverage types, limits, deductibles, exclusions, and the insurer’s reputation. This thorough evaluation helps you make an informed decision that protects your business effectively.

What should I do if I find my business insurance quote confusing?

If your business insurance quote is confusing, take the time to review it thoroughly and consult with an insurance professional. They can help explain the different components of the quote, clarify coverage options, and ensure that you understand your policy, helping you secure the best protection for your needs.

How can I ensure my business is not underinsured based on my quote?

To avoid being underinsured, carefully review your business insurance quote to understand coverage limits, exclusions, and deductibles. Ensure that your policy provides adequate protection for your business’s specific risks. Consulting with an insurance agent can also help tailor coverage that meets your unique needs.

What should I look for in the policy limits of my business insurance quote?

When reviewing policy limits in your business insurance quote, consider both per-incident limits and aggregate limits. Per-incident limits indicate the maximum payout for a single claim, while aggregate limits reflect the total coverage during the policy period. Balance higher limits with your budget and risk level to ensure adequate protection.

How does my claims history impact my business insurance quote?

Your claims history significantly impacts your business insurance quote. A track record of frequent claims may categorize your business as higher risk, leading to increased premiums. Insurers assess your claims history to determine pricing, meaning a clean record can help lower your insurance costs.

| Key Point | Description |

|---|---|

| Importance of Business Insurance | Essential for protecting against risks; many businesses are uninsured or underinsured. |

| Understanding Quotes | Quotes can be complex; it’s vital to understand coverages, limits, and exclusions. |

| Premiums | The cost of coverage influenced by industry, location, claims history, and policy type. |

| Types of Coverage | Includes general liability, commercial property, workers’ compensation, professional liability, and more. |

| Policy Limits | Determines max payout for losses; must balance protection with budget. |

| Deductibles | Out-of-pocket costs before insurance coverage applies; higher deductibles lower premiums. |

| Exclusions and Endorsements | Exclusions limit coverage; endorsements add specific protections. |

| Evaluating Quotes | Compare multiple quotes, focusing on coverage types, limits, and insurer reputation. |

Summary

A business insurance quote is a crucial step in securing the right coverage for your enterprise. Understanding the intricacies of the quote ensures that you are adequately protected against potential risks. With many businesses uninsured or underinsured, taking the time to analyze policy details, premiums, and coverage types can safeguard your investment and ensure long-term stability. Consulting with insurance professionals can provide tailored advice, helping you navigate the complexities of business insurance and find the best fit for your needs.