Best Car Insurance Options for Every Situation in 2024

When it comes to finding the best car insurance options, understanding your unique needs can make all the difference. With numerous choices available, including coverage for young adults and insurance for new drivers, it’s important to explore what fits your lifestyle. Additionally, if you’re looking for RV insurance, many providers now offer instant insurance quotes, making it easier than ever to compare rates. Understanding car insurance rates by state can also help you budget effectively, as premiums can vary significantly across the country. Whether you’re a seasoned driver or just starting out, having the right coverage is essential for peace of mind on the road.

Exploring the top automotive insurance solutions can significantly impact your financial security and driving experience. From policies tailored for inexperienced motorists to comprehensive plans for young adults, a variety of options exist to meet diverse requirements. Furthermore, recreational vehicle (RV) coverage is increasingly popular, allowing travelers the freedom to protect their mobile homes. Obtaining quick insurance quotes has never been simpler, enabling you to compare and select the best fit for your situation. Understanding the fluctuations in auto insurance rates across different regions also empowers you to make informed decisions.

Exploring the Best Car Insurance Options

When it comes to finding the best car insurance options, it’s essential to consider your unique circumstances and needs. Factors such as your age, driving history, and the type of vehicle you own can significantly influence your car insurance rates. For instance, young drivers often face higher premiums due to their lack of experience on the road. Understanding the average car insurance rates by state can help you make informed decisions and find a policy that fits your budget.

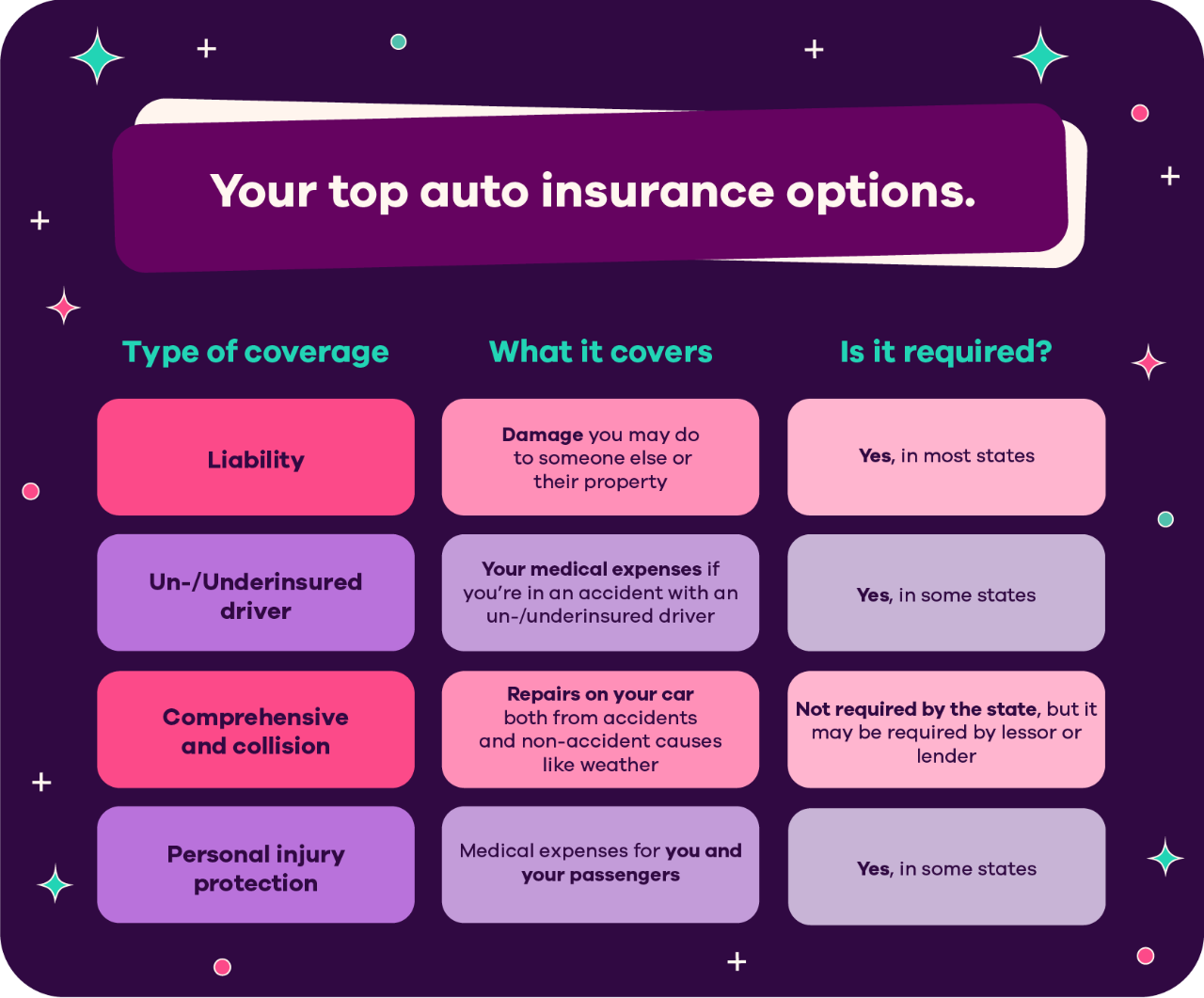

Moreover, the best car insurance options should not only provide a competitive rate but also offer comprehensive coverage. Look for policies that include liability, collision, and comprehensive coverage, which can protect you against various risks. Additionally, many insurers now offer discounts for safe driving, bundling policies, or completing defensive driving courses, which can further reduce your overall costs.

Average U.S. Car Insurance Rates by State (2024)

As of 2024, the average car insurance rates in the U.S. vary widely by state, reflecting local regulations, population density, and the frequency of accidents. States like Michigan and Louisiana are known for having some of the highest rates, often exceeding the national average due to their unique risk factors. On the other hand, states like Vermont and Maine typically offer more affordable rates, making them attractive options for budget-conscious drivers.

Understanding these differences is crucial for consumers who want to save on their car insurance premiums. By comparing rates from different states, you can identify trends and select a policy that offers the best coverage at a reasonable price. Additionally, it’s essential to consider the level of coverage you need based on your location, as certain states may require minimum coverage levels that could impact your overall costs.

Best Car Insurance for New Drivers Under 25 (2024)

Finding the best car insurance for new drivers under 25 can be challenging due to the higher risk associated with younger drivers. Insurers often charge higher premiums to this demographic, but there are providers that offer competitive rates tailored to new drivers. It’s important to shop around and obtain multiple quotes to find the most suitable policy that meets both coverage and budgetary needs.

Additionally, many insurance companies now offer specialized programs for new drivers that include discounts for good grades, completion of driver education courses, and safe driving habits. These incentives not only make insurance more affordable but also encourage responsible driving behavior among young adults. By taking advantage of these programs, new drivers can secure a policy that provides adequate coverage while keeping their costs manageable.

The Best Car Insurance for Young Adults (2024)

For young adults, securing the best car insurance involves understanding the unique challenges they face. With the transition from being a new driver to more experienced, young adults can benefit from policies that provide flexibility in coverage and payment options. It’s also vital to assess the types of vehicles they own, as sporty or high-performance cars often come with higher insurance premiums.

Furthermore, young adults should look into insurers that offer usage-based insurance programs, which reward safe driving with lower rates. These programs track driving behaviors and adjust premiums accordingly, making it an appealing option for responsible drivers. By comparing these offerings, young adults can find an insurance policy that not only protects them on the road but also fits their financial situation.

Instant Insurance Quotes for Quick Coverage

In today’s fast-paced world, getting instant insurance quotes is becoming increasingly important for consumers seeking quick and hassle-free coverage. Many online platforms now allow individuals to receive quotes within minutes, enabling them to make informed decisions without the need for lengthy consultations with agents. This streamlined process is particularly beneficial for those who prefer to handle their insurance needs independently.

Moreover, instant quotes often come with tools that allow users to customize their coverage options based on their specific needs and budgets. By entering their information online, potential policyholders can compare multiple offers from various insurers, ensuring they find the best deal. This convenience not only saves time but also empowers consumers to take control of their insurance choices.

Understanding RV Insurance: Coverage Made Easy

RV insurance is critical for those who enjoy traveling in recreational vehicles, yet many people are unaware of the coverage options available to them. Unlike standard auto insurance, RV insurance often requires additional considerations such as coverage for personal property, liability, and roadside assistance. It’s essential for RV owners to understand these differences to ensure they are adequately protected during their travels.

Fortunately, obtaining RV insurance has become easier with the advent of online platforms that allow for quick comparisons and immediate quotes. Many providers now offer user-friendly websites where individuals can apply for coverage without needing to speak to an agent, making the process more convenient. By gathering instant quotes from multiple insurers, RV owners can find the best coverage that meets their travel needs while staying within budget.

Coverage for Young Adults: Tailored Insurance Solutions

Coverage for young adults is an essential topic in the insurance landscape, as this demographic often faces unique challenges when securing a policy. Insurers typically consider factors such as driving history and type of vehicle when determining rates. However, there are tailored solutions available that cater specifically to young adults, providing them with affordable options that ensure adequate protection.

Additionally, many insurance companies offer programs designed to educate young drivers about the importance of safe driving and responsible vehicle ownership. These programs may include discounts for completing safe driving courses or maintaining a clean driving record. By taking advantage of such programs, young adults can not only reduce their insurance costs but also gain valuable knowledge that will benefit them throughout their driving years.

Insurance for New Drivers: Essential Tips

Insurance for new drivers is a critical consideration for those who have just obtained their licenses. Understanding the various types of coverage available can help new drivers make informed choices that protect them on the road. Basic liability coverage is often the minimum requirement, but many experts recommend considering additional options such as collision and comprehensive coverage to ensure full protection against accidents and damages.

Moreover, new drivers should actively seek out discounts that may be available to them. Insurers often provide incentives for students who maintain good grades or complete driver education courses. By exploring these opportunities, new drivers can significantly lower their premiums while ensuring they have the necessary coverage in place as they gain experience on the road.

Tips for Reducing Car Insurance Premiums

Reducing car insurance premiums is a goal for many drivers, and there are several strategies to achieve this. One effective method is to increase your deductible; by choosing a higher deductible, you can lower your monthly premium significantly. However, it’s essential to ensure that you can afford the deductible in case of a claim.

Additionally, comparing quotes from multiple insurers is crucial. Different companies may offer varying rates for the same coverage, so shopping around can lead to substantial savings. Many online platforms make it easy to compare rates and find the best deals available, helping you secure the most favorable policy for your needs.

Exploring Coverage Options for Different Vehicles

Different types of vehicles require different insurance considerations, and it’s vital to understand these variations when selecting a policy. For example, luxury cars, sports cars, and RVs typically come with higher insurance costs due to their value and the potential for expensive repairs. Understanding the specific coverage options available for these vehicles can help owners make informed decisions about their insurance.

Moreover, new vehicle technologies, such as advanced safety features, can also affect insurance premiums. Many insurers now offer discounts for vehicles equipped with modern safety features, which can mitigate risks and lower costs. By exploring these options, drivers can find suitable coverage that aligns with their vehicle’s needs and their budget.

Frequently Asked Questions

What are the best car insurance options for new drivers under 25?

The best car insurance options for new drivers under 25 typically offer affordable rates and comprehensive coverage. Many insurers provide discounts for good student performance, safe driving courses, and bundling policies. It’s advisable to compare quotes from various providers to find the most favorable car insurance rates for your situation.

How can I find the best car insurance rates by state?

To find the best car insurance rates by state, start by researching state-specific average premiums and coverage requirements. Numerous online tools and comparison websites can help you gather quotes from different insurers based on your location, allowing you to easily identify competitive rates and options available in your area.

What should I consider when looking for RV insurance?

When searching for RV insurance, consider factors such as coverage options, policy limits, deductible amounts, and the insurer’s reputation. The best RV insurance options often include comprehensive coverage for both your vehicle and personal belongings, along with liability protection. Additionally, look for providers that offer instant insurance quotes for convenience.

What are the best car insurance options for young adults?

For young adults, the best car insurance options often include policies that cater to their unique needs, such as affordable premiums and flexible coverage. Look for discounts available for safe driving, multi-policy bundling, or low mileage. Comparing quotes and coverage options can help young adults secure the best car insurance rates.

How can I get instant insurance quotes for car insurance?

To get instant insurance quotes for car insurance, visit online comparison websites where you can enter your information and receive multiple quotes in minutes. Many insurers allow you to customize your coverage levels and compare rates side by side, making it easy to find the best car insurance options within a short time.

What types of coverage are essential for new drivers?

New drivers should consider essential coverage types such as liability insurance, which covers damages to others, and collision coverage, which pays for damages to their own vehicle. Comprehensive coverage is also advisable to protect against non-collision-related incidents. Exploring the best car insurance options tailored for new drivers can ensure they have the necessary protection.

| Category | Description |

|---|---|

| Average U.S. Car Insurance Rates By State (2024) | Details on car insurance rates across various states in the U.S. for 2024. |

| Best Car Insurance For New Drivers Under 25 (2024) | Recommendations tailored for drivers under 25, focusing on affordability and coverage. |

| The Best Car Insurance For Young Adults (2024) | Options specifically designed for young adults, considering their unique needs and situations. |

| The Simply Insurance Way | Online RV insurance quotes and sign-up without needing to talk to agents, along with expert advice. |

| Coverage in Minutes | Ability to obtain RV insurance coverage quickly after applying for quotes. |

Summary

When searching for the best car insurance options, it’s essential to consider various factors such as your age, driving experience, and specific needs. For 2024, there are tailored recommendations for new drivers under 25, young adults, and state-specific insurance rates that can help you make an informed decision. Additionally, services like Simply Insurance provide efficient online quotes and coverage solutions, ensuring that you find the best fit for your situation without the hassle of traditional agent interactions.