Annuities and Life Insurance: Secure Your Retirement Future

Navigating the world of retirement planning can be daunting, but understanding the roles of annuities and life insurance can provide a solid foundation for financial security. These two financial products not only offer a way to secure your future but also come with significant tax advantages that can enhance your retirement income. Annuities ensure a steady stream of income during your retirement years, while life insurance safeguards your loved ones with a death benefit after your passing. By integrating annuities and life insurance into your estate planning strategy, you can achieve peace of mind knowing that both your needs and those of your beneficiaries are addressed. Together, they create a powerful combination that helps you manage risks and maintain control over your financial legacy.

When considering options for securing your financial future, it’s essential to explore alternatives such as retirement income products and death benefit policies. These instruments, including income-generating contracts and risk protection plans, not only enhance your overall financial strategy but also contribute to a robust estate plan. By utilizing retirement income solutions alongside protective policies, you can build a comprehensive approach that caters to your long-term goals. This combination not only provides assurance for your retirement but also ensures that your loved ones are taken care of in the event of your passing. Ultimately, leveraging these financial tools can lead to a more stable and prosperous future.

Understanding Annuities and Life Insurance for Retirement Planning

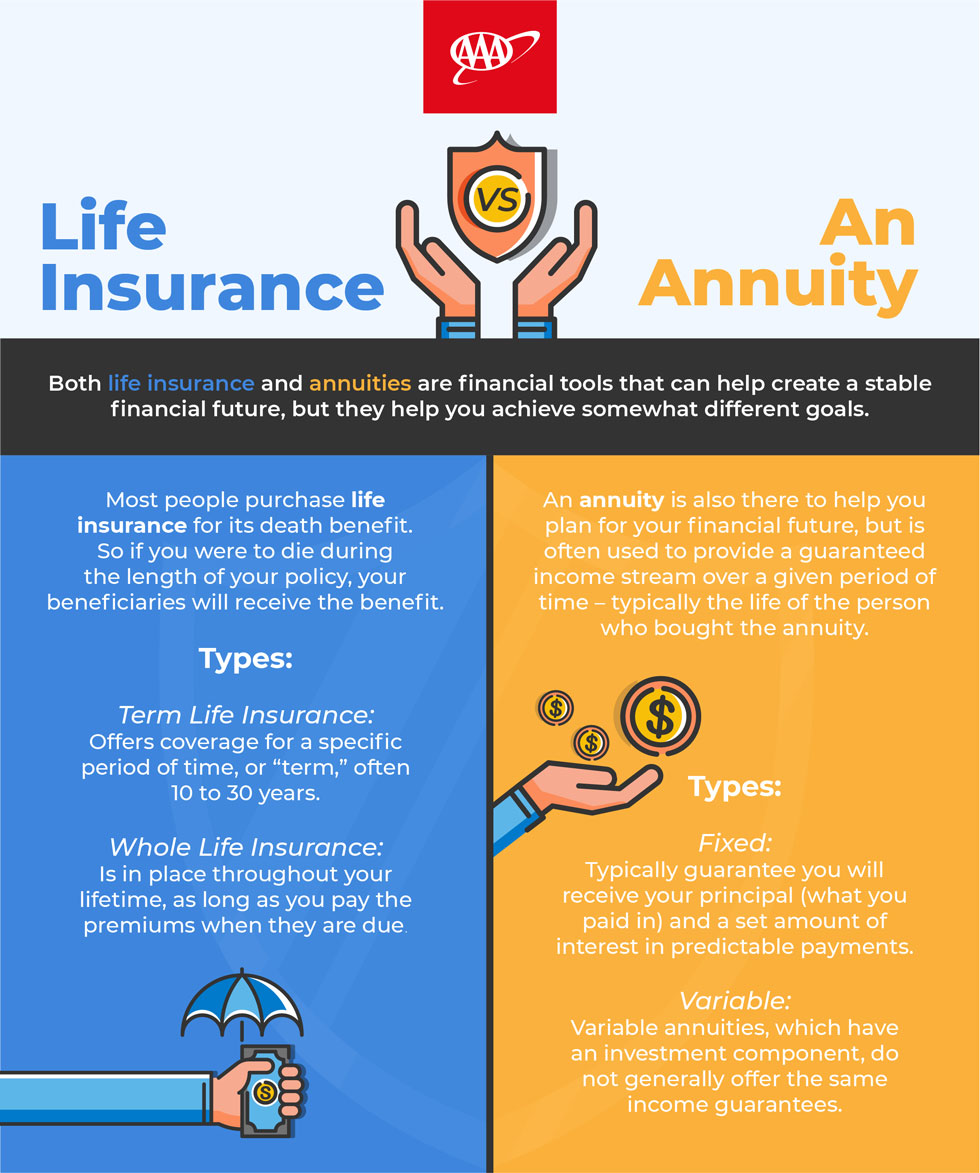

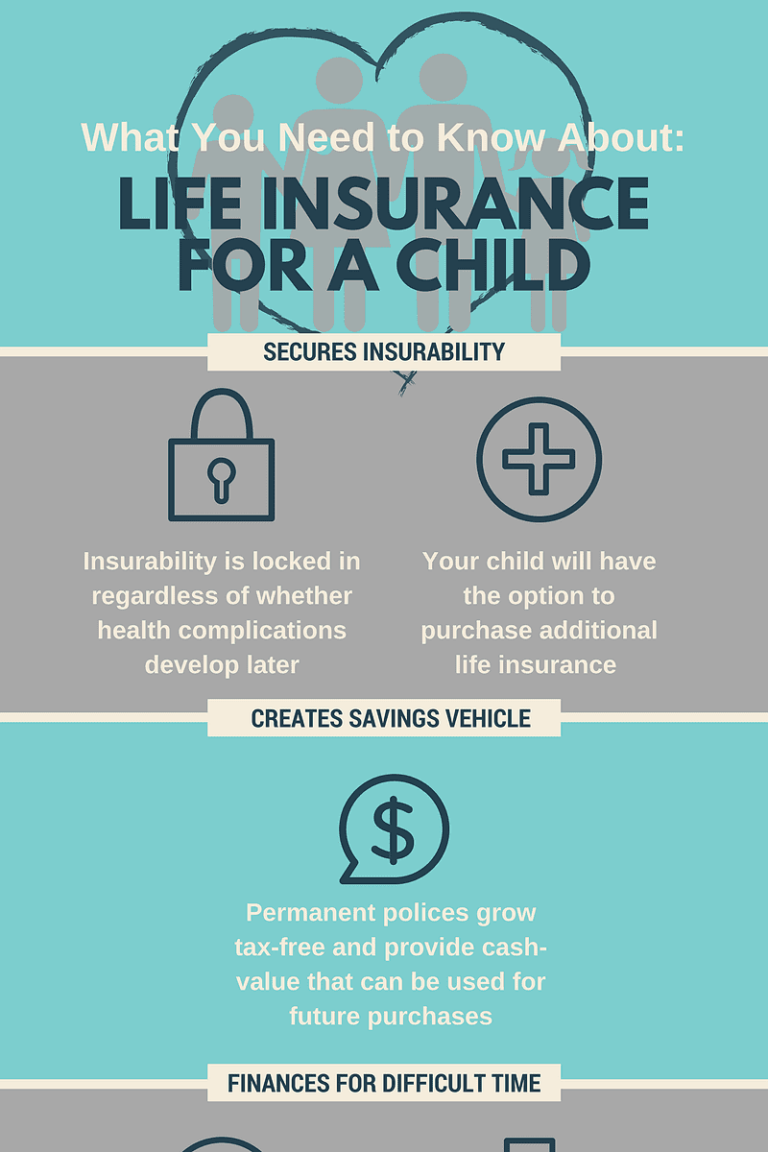

Annuities and life insurance are essential components of a comprehensive retirement planning strategy. Annuities provide a steady stream of income, which can be crucial for maintaining your lifestyle during retirement. They allow individuals to convert a lump sum into regular payments, ensuring that essential living expenses are covered. Life insurance, on the other hand, serves as a safety net for your loved ones, offering financial support after your passing. By understanding the fundamental differences and benefits of these products, retirees can better prepare for their financial future.

Integrating annuities with life insurance can significantly enhance financial security. For instance, purchasing a life insurance policy with a cash value component can be a strategic way to fund an annuity later. This combination not only provides a guaranteed income source but also helps in managing estate planning efficiently. Therefore, having a clear understanding of both annuities and life insurance empowers individuals to make informed decisions that align with their retirement goals.

Frequently Asked Questions

What is the role of annuities and life insurance in retirement planning?

Annuities and life insurance play crucial roles in retirement planning by providing financial security. Annuities offer a guaranteed income stream during retirement, while life insurance ensures that your beneficiaries receive a death benefit, helping to cover expenses and maintain financial stability after your passing.

How do annuities provide tax advantages for retirement planning?

Annuities offer tax-deferred growth, allowing your investments to grow without immediate taxation. This means you won’t pay taxes on earnings until you withdraw funds, helping to lower your tax liability during retirement. Additionally, life insurance payouts are typically income tax-free for beneficiaries, enhancing overall tax efficiency in your retirement strategy.

Can combining annuities and life insurance enhance financial security?

Yes, combining annuities and life insurance enhances financial security by providing both a reliable income during retirement and a death benefit for your loved ones. This strategy ensures that you won’t outlive your resources and that your beneficiaries are financially supported in your absence.

What are the benefits of using annuities for estate planning?

Annuities can be beneficial in estate planning as they provide a steady income stream while you are alive and can also be structured to pass on to beneficiaries, avoiding probate. This ensures that your heirs receive funds quickly and efficiently, thus supporting your overall wealth transfer strategy.

How can annuities and life insurance provide peace of mind during retirement?

Annuities offer peace of mind by guaranteeing income throughout your retirement, reducing the risk of depleting your savings. Life insurance provides additional assurance that your loved ones will be financially secure after your passing, ensuring that they can cover debts and other expenses without financial hardship.

What options do I have for integrating annuities and life insurance in my retirement plan?

You can integrate annuities and life insurance in your retirement plan by using life insurance premiums to purchase an annuity, thereby maximizing your financial coverage. Consulting with a qualified insurance professional can help you identify the best options tailored to your financial goals.

What should I consider when choosing between different types of annuities and life insurance policies?

When choosing between different types of annuities and life insurance policies, consider factors such as your retirement income needs, the financial security of your beneficiaries, tax implications, and your overall estate planning goals. Evaluating these factors with an insurance expert can help you make an informed decision.

How can I ensure that my retirement planning includes both annuities and life insurance effectively?

To ensure effective retirement planning that includes both annuities and life insurance, collaborate with a financial advisor or insurance professional who can help you assess your financial needs. They can guide you in selecting the right products that align with your goals for financial security, tax advantages, and peace of mind.

What are the risks of not incorporating annuities and life insurance into retirement planning?

Not incorporating annuities and life insurance into your retirement planning can expose you to financial risks such as running out of income during retirement and leaving your beneficiaries without adequate financial support after your death. This could lead to increased stress and uncertainty for both you and your loved ones.

How do annuities help with diversifying my retirement portfolio?

Annuities help diversify your retirement portfolio by providing a stable income source that is less affected by market volatility. This diversification can mitigate risks associated with other investments, ensuring a more balanced approach to your overall retirement strategy.

| Key Points | Details |

|---|---|

| What Are Annuities? | Financial product providing guaranteed income in exchange for regular premiums. |

| What Is Life Insurance? | Financial support for beneficiaries through a death benefit after the policyholder’s passing. |

| Guaranteed Income and Death Benefit | Combining both offers reliable income and ensures financial support for beneficiaries. |

| Tax Advantages | Annuities grow tax-deferred; life insurance payouts are generally tax-free for beneficiaries. |

| Diversification | Integrating both diversifies retirement portfolio and mitigates risk against market fluctuations. |

| Estate Planning | Life insurance aids in wealth transfer, avoiding probate, and minimizing taxes. |

| Peace of Mind | Both products offer financial security during retirement and for loved ones after passing. |

Summary

Annuities and life insurance are crucial components of a well-rounded retirement strategy. By effectively combining these two financial products, individuals can secure a steady income stream during their retirement years while also providing a safety net for their beneficiaries. This dual approach not only ensures financial stability but also offers significant tax advantages, diversification in asset management, and peace of mind knowing that loved ones are cared for. Consulting with a qualified insurance professional can help tailor these options to best fit your unique financial situation.