Homeowners Liability: Essential Risks You Must Address

Homeowners liability is a crucial aspect of property ownership that often goes unnoticed until it’s too late. As you navigate the responsibilities of homeownership, understanding the various risks associated with your property is essential for effective homeowner risk management. From liability insurance for homeowners to common homeowner liabilities, being proactive can save you from significant financial woes. Neglecting aspects like property maintenance can lead to serious accidents, causing harm not only to guests but also to your family’s peace of mind. In this article, we will delve into key strategies for mitigating homeowner risk and ensuring your property remains a safe haven.

When we talk about homeowner responsibilities, it’s vital to consider the broader implications of property ownership, including the potential liabilities that can arise. This includes everything from safeguarding against accidents to ensuring your home-based business adheres to safety regulations. The concept of homeowner risk management encompasses a range of practices designed to minimize exposure to legal and financial pitfalls, such as liability insurance tailored for homeowners. Additionally, understanding the importance of regular property maintenance can prevent common pitfalls that lead to homeowner liabilities. By recognizing these factors, you can protect your investment and create a secure living environment.

Understanding Homeowners Liability Risks

Homeowners liability risks are often underestimated, yet they play a crucial role in protecting your property and finances. Many homeowners focus on standard dangers, but they frequently overlook various liabilities lurking in their backyards. Understanding these risks is vital to effectively manage them. For instance, simple features like swimming pools and landscaping can lead to severe accidents, resulting in costly claims if proper precautions aren’t taken.

To safeguard against these potential liabilities, homeowners should conduct a thorough risk assessment of their properties. Identifying common vulnerabilities, such as unsecured play equipment or poorly maintained trees, can help homeowners take proactive steps. By implementing safety measures and adhering to best practices in property maintenance, homeowners can effectively mitigate homeowner risk and protect their assets from unforeseen circumstances.

Common Homeowner Liabilities

Several common homeowner liabilities often go unnoticed, yet they can lead to significant financial repercussions. For instance, pet-related incidents are a leading cause of liability claims, with dog bites accounting for a large percentage. Homeowners need to ensure their pets are well-trained and contained within the property to minimize risks. Additionally, the presence of features like trampolines or playsets can increase the likelihood of injury, which may result in claims against homeowners.

Moreover, homeowners must also be vigilant about their property’s landscaping and structures. Overhanging branches or dead trees can pose dangers not only to residents but also to neighbors. Regular inspections and maintenance are necessary to address these issues before they lead to accidents, thus helping homeowners avoid common liabilities that could otherwise result in expensive legal battles.

Mitigating Homeowner Risk Through Property Maintenance

Effective property maintenance is essential for mitigating homeowner risk and maintaining the safety of your environment. Regular upkeep tasks, such as roof inspections and HVAC system maintenance, can prevent small issues from escalating into major problems. For example, a neglected roof can lead to leaks and structural damage, while an unmaintained HVAC system can cause costly breakdowns. Homeowners should prioritize these tasks to ensure their property remains in optimal condition.

In addition to regular inspections, homeowners should also stay informed about the latest property maintenance tips. Simple actions, like ensuring proper drainage and removing debris from gutters, can significantly reduce risks related to water damage. Furthermore, investing in professional maintenance services when necessary can help homeowners stay ahead of potential issues, thus reinforcing their liability protection and enhancing the longevity of their properties.

The Importance of Liability Insurance for Homeowners

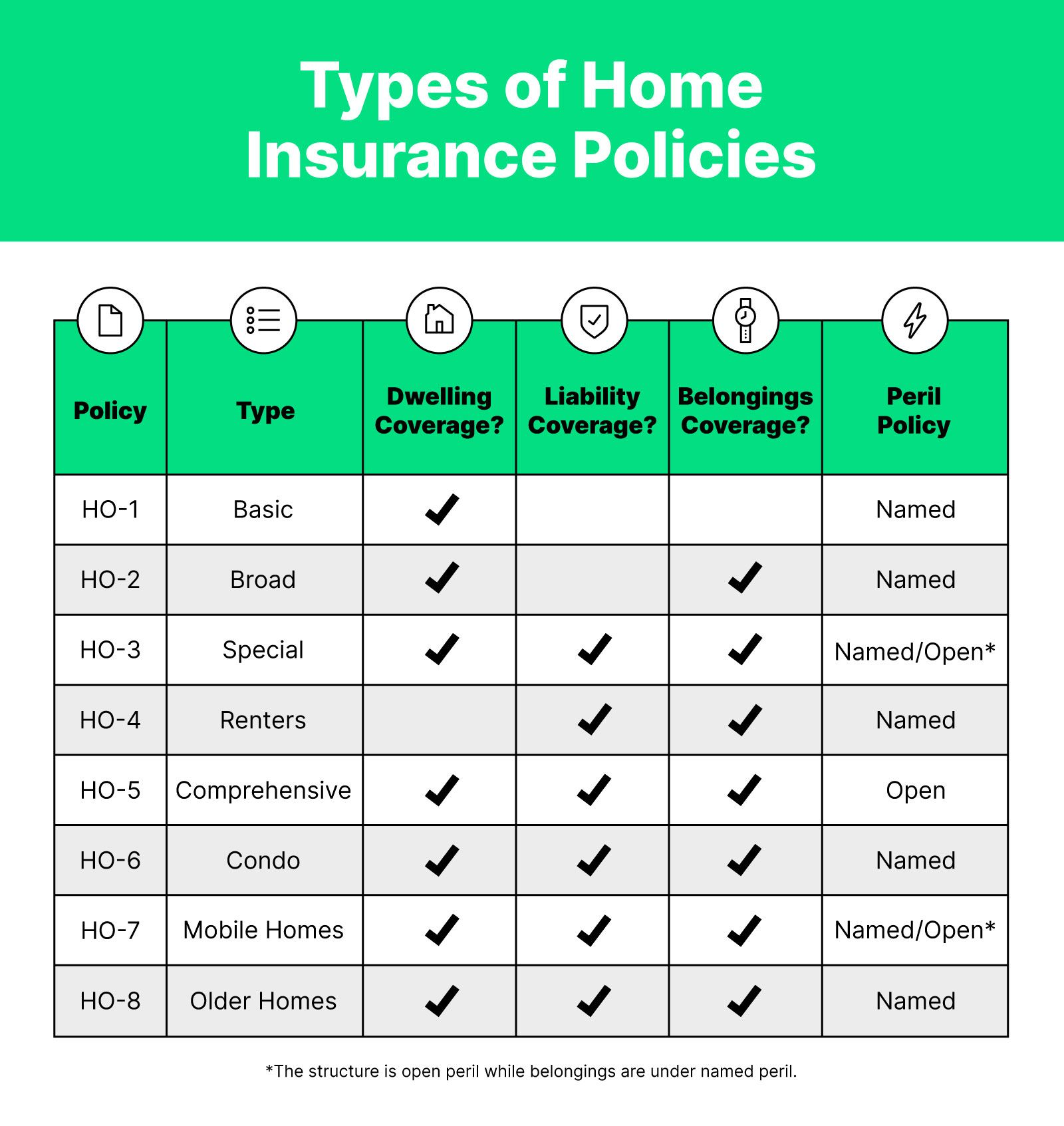

Liability insurance for homeowners is an essential component of risk management. This type of insurance provides financial protection against claims resulting from injuries or damage that occur on the property. For instance, if a guest is injured while using your swimming pool or if your pet causes harm, liability insurance can cover legal fees and medical expenses, preventing financial ruin for the homeowner.

However, it’s crucial for homeowners to review their liability insurance policies regularly to ensure adequate coverage. As circumstances change, such as adding new features like pools or trampolines, the insurance needs may evolve. Homeowners should consult with their insurance agents to explore additional coverage options and make necessary adjustments to their policies, ensuring comprehensive protection against unforeseen liabilities.

Pets as Homeowner Liabilities

Pets can be a source of joy and companionship, but they also pose significant liability risks for homeowners. Incidents such as dog bites or property damage can lead to costly liability claims. To minimize these risks, homeowners should invest time and resources in training and socializing their pets, as well as ensuring they are securely contained within the property. This proactive approach not only protects others but also guards the homeowner against financial repercussions.

Additionally, homeowners should consider obtaining specific liability insurance coverage for pet-related incidents. This specialized insurance can provide an extra layer of protection, covering potential costs associated with injuries caused by pets. By being vigilant about pet safety and securing the right insurance, homeowners can significantly reduce their liability risks and enjoy their pets without worry.

Managing Landscaping Liability

Landscaping is often an overlooked aspect of homeowner liability management, yet it can lead to serious risks. Overgrown trees and poorly maintained gardens can result in accidents, such as falling branches or injuries from tripping hazards. Regular inspections and maintenance of landscaping features are crucial to identifying potential threats and addressing them before they lead to incidents.

Homeowners should prioritize tree maintenance, including trimming overhanging branches and removing dead trees. Additionally, landscaping should be designed with safety in mind, avoiding sharp edges and unstable structures. By taking these steps, homeowners can not only enhance the aesthetic appeal of their properties but also mitigate the liability risks associated with landscaping.

The Risks of Home-Based Businesses

Running a home-based business can introduce unique liability challenges that homeowners must address. From customer injuries to property damage, the potential risks can escalate quickly. Homeowners who operate businesses from their residences should ensure they have the appropriate insurance coverage, such as a business owner’s policy, to protect against these liabilities.

It’s also important for home-based business owners to implement safety protocols and maintain a secure environment for clients and employees. This includes ensuring that workspaces are free of hazards and that any equipment used is well-maintained. By taking these precautions, homeowners can minimize their liability risks and focus on growing their businesses without the added stress of potential claims.

Neglected Maintenance and Liability Risks

Neglected maintenance is a significant contributor to homeowner liability risks, often leading to accidents and costly repairs. Homeowners who overlook routine upkeep tasks may find themselves facing issues that could have been easily avoided. For instance, failing to inspect plumbing systems can result in leaks that cause water damage, while neglecting roof maintenance can lead to structural problems over time.

To combat these risks, homeowners should establish a regular maintenance schedule that includes inspections of critical systems such as plumbing, roofing, and HVAC. By prioritizing upkeep, homeowners can prevent minor issues from escalating, thereby reducing the likelihood of accidents that could lead to liability claims. Overall, staying proactive about maintenance not only protects the property but also safeguards the homeowner’s financial well-being.

Key Takeaways on Homeowner Risk Management

In conclusion, homeowners must be aware of the various liabilities associated with their properties and take proactive measures to manage these risks effectively. Understanding common homeowner liabilities—from pets to landscaping—can help homeowners make informed decisions regarding safety and maintenance. Additionally, having the right liability insurance can provide peace of mind and financial protection against unforeseen incidents.

By implementing regular maintenance routines and reviewing insurance policies, homeowners can mitigate risks, protect their investments, and enjoy their properties without the looming threat of unexpected liabilities. It’s vital to remain vigilant and proactive in managing homeowner risks to ensure a safe and secure living environment.

Frequently Asked Questions

What is homeowners liability and why is it important?

Homeowners liability refers to the legal responsibility homeowners have for injuries or damages that occur on their property. It is crucial because it protects you from financial loss due to accidents or injuries that may occur, ensuring you have the necessary coverage in place to handle potential claims.

How can liability insurance for homeowners help mitigate risks?

Liability insurance for homeowners provides financial protection against claims resulting from injuries or accidents on your property. It helps cover legal fees, medical expenses, and damages, thus mitigating the financial risks associated with homeowner liabilities.

What are some common homeowner liabilities that are often overlooked?

Common homeowner liabilities include risks associated with pools and hot tubs, trampolines, pets, trees and landscaping, as well as issues arising from neglected maintenance. Addressing these areas can help minimize potential legal claims and financial repercussions.

What are effective homeowner risk management strategies?

Effective homeowner risk management strategies include regular property maintenance, installing safety features (like pool fences), ensuring pets are trained and secured, and obtaining adequate liability insurance coverage. These actions help prevent accidents and reduce liability exposure.

What property maintenance tips can reduce homeowner liabilities?

Property maintenance tips that can reduce homeowner liabilities include conducting regular inspections of roofs, plumbing, and HVAC systems, maintaining landscaping to prevent hazards, and ensuring safety measures are in place for pools and play areas.

How can I mitigate homeowner risk associated with pets?

To mitigate homeowner risk associated with pets, ensure they are properly trained, supervised, and secured within your property. Additionally, consider purchasing pet liability insurance to cover potential claims arising from pet-related incidents.

Why is regular inspection of trees and landscaping essential for mitigating homeowner risk?

Regular inspection of trees and landscaping is essential for mitigating homeowner risk as it helps identify potential hazards such as dead branches or unstable trees that could cause property damage or injury, thereby reducing liability claims.

What should I do if I operate a home-based business regarding liability?

If you operate a home-based business, it’s important to secure appropriate insurance coverage, such as a business owner’s policy or professional liability insurance, to protect against potential risks like customer injuries or property damage.

How does neglected maintenance contribute to homeowner liability?

Neglected maintenance can lead to safety hazards and property damage, which may result in legal liabilities. Regular upkeep is essential to prevent issues that could escalate into costly repairs or liability claims.

What are the risks associated with swimming pools and how can they be managed?

Swimming pools pose significant risks such as drowning and injuries. To manage these risks, homeowners should install secure fencing, safety covers, and alarms, and ensure proper supervision during use.

| Liability Risks | Description | Mitigation Strategies |

|---|---|---|

| Swimming Pools and Hot Tubs | Enjoyable features that pose risks of slips, falls, and drowning. | Secure fencing, safety covers, and alarms. |

| Trampolines and Play Equipment | Pose injury risks, especially for children. | Proper maintenance, safety nets, and supervision. |

| Pets | Can cause harm or property damage, leading to liability claims. | Training, socialization, and liability insurance. |

| Trees and Landscaping | Neglected trees can cause damage or injuries. | Regular inspections and maintenance. |

| Home-Based Businesses | Involves customer injuries or property damage risks. | Appropriate insurance coverage for business activities. |

| Neglected Maintenance | Can lead to safety hazards and legal liabilities. | Routine inspections and timely repairs of roofing, plumbing, HVAC, and exterior. |

Summary

Homeowners liability is a critical aspect of property ownership that requires careful consideration. Homeowners must recognize and address various potential liabilities to protect themselves, their families, and their properties. From swimming pools and trampolines to neglected maintenance issues, each liability can lead to significant financial and legal consequences. By implementing effective mitigation strategies and ensuring adequate insurance coverage, homeowners can safeguard their investments and enjoy peace of mind.