Hurricane Helene Flood Risk: Understanding Coverage Gaps

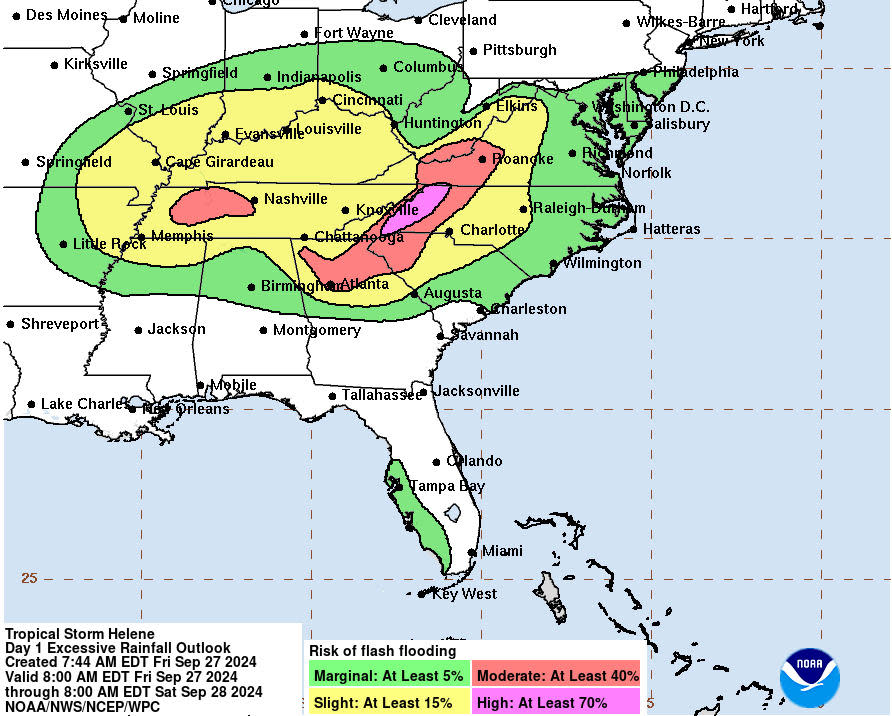

Hurricane Helene flood risk has emerged as a pressing concern for communities spanning the southeastern United States, following the storm’s catastrophic impact. The torrential downpour and extreme winds unleashed by Helene resulted in devastating inland flooding, prompting urgent calls for enhanced flood resilience planning and increased flood insurance coverage. With over 40 trillion gallons of water inundating states like Florida, North Carolina, and Virginia, the aftermath revealed a glaring protection gap in disaster recovery efforts. As many residents lacked adequate flood insurance, the burden of recovery has shifted to federal aid, which is often slow and complicated. This situation underscores the critical need for awareness and education on flood risks and insurance options to better prepare for future events.

The risk posed by Hurricane Helene highlights the broader issue of flood hazards that extend far beyond coastal areas, affecting countless communities inland. As extreme weather events become more common, understanding the implications of rising water levels and the importance of flood protection measures is vital. Many homeowners remain unaware that standard insurance policies may not cover flood damage, leading to a reliance on federal assistance for recovery. Moreover, the low uptake of flood insurance among residents indicates a significant gap in preparedness and resilience. Addressing this challenge requires a concerted effort to educate the public about the necessity of flood coverage and the benefits of proactive risk management strategies.

Understanding Hurricane Helene Flood Risk

Hurricane Helene has brought to light the significant inland flood risk that many communities face, especially those far from the coast. The storm’s extensive rainfall and resultant flooding serve as a stark reminder of how climate patterns are changing, causing hurricanes to influence areas that previously were considered safe from such threats. As the storm progressed, it dumped an astonishing 40 trillion gallons of water across several southeastern states, illustrating the extensive reach of its impact. The destruction in areas like Buncombe County, where Asheville was virtually submerged, underscores the urgent need for improved flood resilience strategies.

As communities begin to recover, the lessons learned from Hurricane Helene emphasize the importance of awareness around flood risks. Many residents were unprepared, as highlighted by the low NFIP take-up rates in affected regions. This lack of flood insurance leaves communities vulnerable, and it is crucial for homeowners to understand that standard homeowners policies often exclude flood damage. Addressing these misconceptions is vital in mitigating future flood risks and enhancing disaster recovery efforts.

The Protection Gap in Flood Insurance

The stark reality revealed by Hurricane Helene is the ongoing protection gap in flood insurance coverage. In Buncombe County, for instance, less than 1 percent of residents held federal flood insurance when the storm hit, leaving many without the necessary financial protection. This gap is not a new phenomenon; it has been a persistent issue across various regions that experience inland flooding. The aftermath of hurricanes like Helene and past storms such as Hurricane Ida highlight the dire consequences of inadequate insurance coverage, as many affected residents were forced to rely on federal grants and loans for recovery.

This protection gap is exacerbated by public misunderstanding of flood insurance policies. Many homeowners mistakenly believe that flood coverage is unnecessary unless mandated by their mortgage lender, leading to high rates of uninsured properties. As seen in recent events, when flooding occurs, the financial burden falls on individuals and communities, leading to prolonged recovery times and increased reliance on federal assistance. Educating homeowners about the importance of flood insurance is critical in bridging this protection gap and enhancing overall flood resilience.

The Role of Education and Awareness in Flood Preparedness

Education and awareness are key components in addressing the low take-up rates of flood insurance, especially in the wake of Hurricane Helene. With approximately 90 percent of all natural disasters involving flooding, it is essential for homeowners to recognize that their standard insurance policies may not provide adequate coverage. Many consumers are unaware that flood damage is often excluded, leading to a false sense of security. Increasing public knowledge about flood insurance options and the risks of flooding is vital for improving overall preparedness and reducing future vulnerabilities.

Moreover, awareness campaigns should also focus on the specifics of the National Flood Insurance Program (NFIP) and the benefits it offers. Many homeowners are uncertain about the eligibility and process of obtaining flood insurance, which can contribute to their inaction. By equipping individuals with the necessary information, communities can foster a culture of proactive risk management and enhance disaster recovery efforts following catastrophic events. Increased education will not only help residents secure coverage but also empower them to take preventive measures against potential flooding.

Innovative Insurance Solutions for Flood Resilience

In response to the challenges highlighted by Hurricane Helene, innovative insurance solutions are emerging that could improve flood resilience for communities. Tools such as parametric insurance and community-based catastrophe insurance offer new ways to address flood risk without the delays associated with traditional claims processing. Parametric insurance, for instance, activates payouts based on predetermined criteria, providing much-needed liquidity immediately after a disaster strikes. This rapid response can significantly aid recovery efforts, allowing communities to rebuild more swiftly.

Additionally, these innovative insurance products can complement existing NFIP offerings, making coverage more accessible and affordable for homeowners. As private insurers begin to engage more with flood risks, there is potential for enhanced competition and better pricing for consumers. By integrating these new insurance models with public education and coordinated investments in infrastructure, communities can bolster their overall flood resilience and mitigate the impact of future disasters.

Community Collaboration for Flood Risk Management

Hurricane Helene’s devastation underscores the importance of community collaboration in managing flood risk. Local governments, insurers, and residents must work together to develop comprehensive plans that address the unique challenges posed by inland flooding. This collaboration can involve sharing data on flood risks, engaging in community outreach programs, and creating incentives for homeowners to invest in flood insurance. By fostering a sense of shared responsibility, communities can enhance their collective resilience against future flooding events.

Moreover, intergovernmental partnerships are crucial in implementing effective zoning regulations and building codes that prioritize flood resilience. Coordinated efforts can lead to the development of safer infrastructure that minimizes the impact of flooding, ultimately reducing both human and economic losses. As communities rebuild after Hurricane Helene, prioritizing collaboration will be essential in creating a more resilient future, ensuring that they are better equipped to face the increasing risks posed by climate change.

Enhancing Flood Insurance Understanding Among Homeowners

The aftermath of Hurricane Helene has revealed significant gaps in understanding about flood insurance among homeowners. Many individuals are not aware that their typical homeowner’s insurance policy does not cover flood damage, leading to a lack of preparedness when disasters strike. As a result, educating homeowners about the specifics and importance of flood insurance is essential for disaster recovery and resilience. Community workshops, informational pamphlets, and online resources can play a vital role in disseminating this information.

Furthermore, it’s important to clarify the benefits of the National Flood Insurance Program (NFIP) and how it can assist homeowners in mitigating their financial risks. Many homeowners may not realize that securing flood insurance can provide peace of mind, knowing that they have a safety net in place should disaster occur. By enhancing understanding of flood policies and the critical role they play in risk management, communities can empower residents to make informed decisions that bolster their resilience against future flooding.

The Impact of Misinformation on Flood Recovery

Misinformation about flood recovery resources has been a significant barrier for communities impacted by Hurricane Helene. Confusion surrounding federal assistance programs, such as those offered by FEMA, has hindered timely support for victims. Many residents, unsure of their eligibility for aid, have delayed seeking the help they need, exacerbating their recovery challenges. Clear communication from authorities about what assistance is available and how to access it is essential for effective disaster recovery.

Additionally, educating the public on the realities of flood insurance and recovery options can help dispel myths and encourage proactive measures. By providing accurate information and guidance, communities can alleviate fears and uncertainties that prevent homeowners from pursuing necessary assistance. Strengthening communication channels between local governments, insurance providers, and residents will be crucial in ensuring that accurate information is disseminated, ultimately facilitating a smoother recovery process following devastating events like Hurricane Helene.

Investing in Flood Resilience Infrastructure

Investments in flood resilience infrastructure are more critical than ever, especially in light of the damages caused by Hurricane Helene. Communities must prioritize the development of climate-adaptive infrastructure that can withstand extreme weather events. This includes enhancing drainage systems, building levees, and restoring natural floodplains, all of which can mitigate the impacts of flooding. By implementing these measures, communities not only protect their residents but also reduce the long-term costs associated with disaster recovery.

Moreover, coordinated efforts between local governments, insurers, and the private sector can lead to innovative funding solutions for resilience projects. Public-private partnerships can facilitate the necessary investments in infrastructure while also fostering community engagement. As communities look to rebuild and fortify against future flooding, prioritizing infrastructure investments will be a key element in closing the flood protection gap and enhancing overall resilience.

Preparing for Future Flood Events with Strategic Planning

In the wake of Hurricane Helene, strategic planning for future flood events has become paramount. Communities must adopt a proactive approach to flood risk management, which includes developing comprehensive floodplain management plans and enhancing emergency preparedness strategies. By incorporating data-driven insights and risk assessments, local governments can better identify vulnerable areas and implement targeted interventions to protect residents from potential flooding.

Additionally, collaborating with insurance providers to understand risk exposure can lead to more tailored insurance products that meet the specific needs of communities. This proactive planning not only enhances flood resilience but also encourages higher NFIP take-up rates, as residents become more aware of their risks and the importance of securing flood insurance. By embracing strategic planning, communities can better prepare for future flood events and ensure a quicker recovery process.

Frequently Asked Questions

What is the flood risk associated with Hurricane Helene?

Hurricane Helene posed significant flood risks, particularly through inland flooding that affected states like North Carolina and Georgia. The storm resulted in catastrophic flooding, landslides, and extreme wind damage, leading to billions in insured losses. Communities faced unprecedented challenges as rivers swelled and rainfall inundated areas, emphasizing the urgent need for flood resilience planning.

How does flood insurance impact recovery from Hurricane Helene?

The lack of flood insurance significantly impeded recovery efforts in areas affected by Hurricane Helene. With less than 1% of residents in Buncombe County holding federal flood insurance, many victims were forced to rely on federal grants and loans for disaster recovery, slowing down the rebuilding process and highlighting the protection gap in flood insurance coverage.

What are NFIP take-up rates in relation to Hurricane Helene’s impact?

NFIP take-up rates were alarmingly low during Hurricane Helene, with fewer than 1% of Buncombe County residents covered by federal flood insurance. This low penetration of flood insurance showcases the ongoing challenges in raising awareness about flood risks and the importance of securing adequate coverage against inland flooding.

What steps can be taken to improve flood resilience after Hurricane Helene?

To improve flood resilience in the wake of Hurricane Helene, communities can invest in better public education about flood risks and insurance options. Additionally, adopting new insurance models like parametric insurance can provide faster payouts and support disaster recovery efforts. Coordination among government bodies and insurers on building codes and zoning can also enhance flood resilience.

Why is education about flood insurance crucial after Hurricane Helene?

Education about flood insurance is crucial following Hurricane Helene because many homeowners mistakenly believe that standard homeowners policies cover flood damage. Raising awareness that approximately 90% of U.S. natural disasters involve flooding can encourage more residents to secure flood insurance, thereby enhancing overall community resilience against future flooding events.

| Key Point | Details |

|---|---|

| Hurricane Helene Overview | Hurricane Helene spanned 500 miles across the southeastern U.S., causing catastrophic flooding and destruction. |

| Flooding Impact | Resulted in hundreds of deaths, billions in insured losses, and left areas like Buncombe County, NC, heavily affected. |

| Insurance Coverage Gap | Less than 1% of Buncombe County residents had federal flood insurance at the time of the hurricane. |

| Consumer Misunderstandings | Many homeowners are unaware that standard homeowners policies do not cover flood damage. |

| Emerging Insurance Solutions | Parametric insurance offers quicker payouts based on agreed conditions, aiding recovery. |

| Need for Education and Awareness | Improved public education and understanding of flood insurance is necessary to increase coverage rates. |

Summary

Hurricane Helene flood risk has highlighted significant vulnerabilities in flood insurance coverage across affected communities. The catastrophic impact of the hurricane, which resulted in extreme flooding and damage, underscores the urgent need for better resilience planning and increased awareness about the importance of flood insurance. With many homeowners unaware that standard policies do not cover flood damage, it’s crucial to educate the public on the necessity of flood coverage, especially in light of changing hurricane patterns and increased inland flooding risks. As communities strive to recover, addressing these gaps in understanding and coverage will be essential for mitigating future flood risks.