Florida Car Insurance Requirements You Must Know

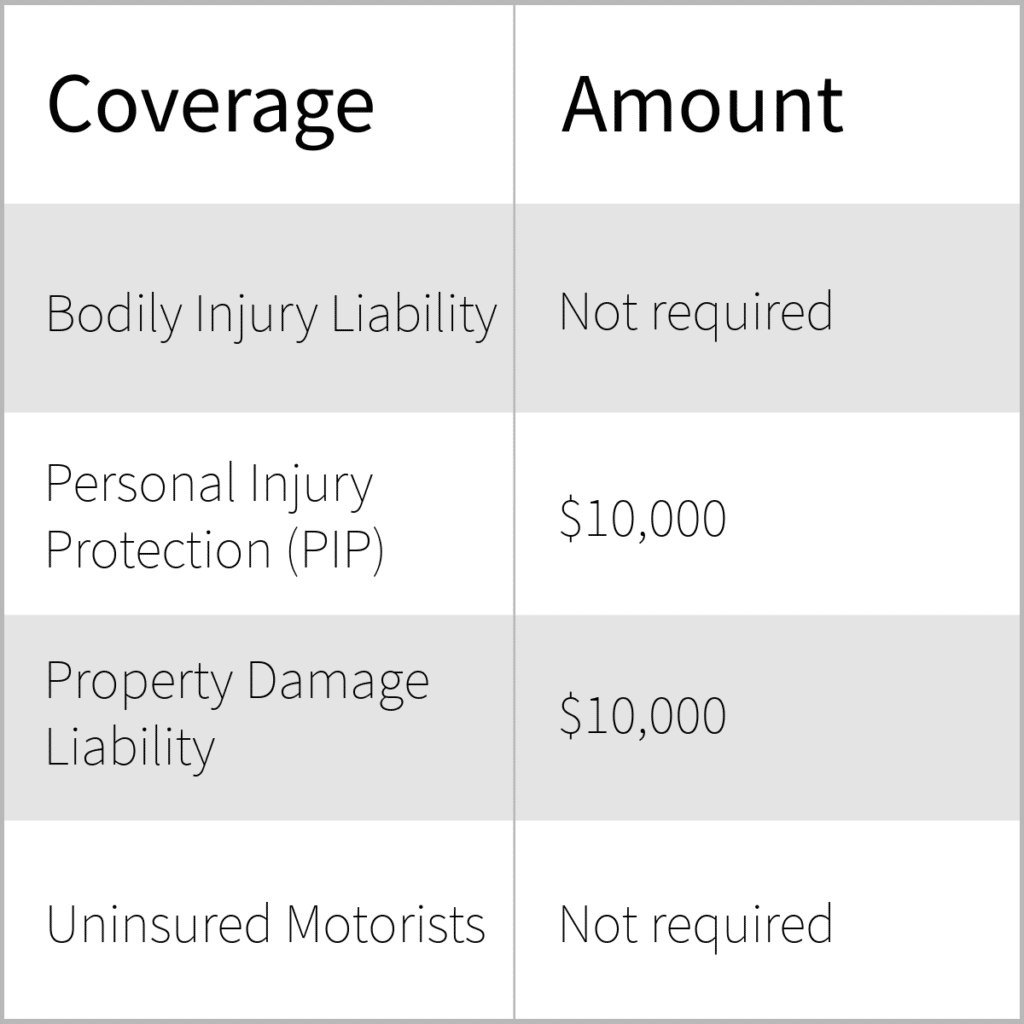

When it comes to Florida car insurance requirements, understanding the legal obligations is crucial for any driver in the Sunshine State. Florida mandates that all vehicle owners must secure Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance before they can register their vehicles. This vehicle insurance Florida law ensures that drivers have the necessary coverage to handle medical expenses and damages to others’ property in the event of an accident. With a minimum coverage of $10,000 for both PIP and PDL, it’s essential to comply with these Florida car insurance laws to avoid penalties. In this article, we will delve deeper into the necessary insurance policies and the implications of failing to meet these requirements.

Navigating the intricacies of auto insurance can be daunting, especially for those new to the state or unfamiliar with local regulations. In Florida, vehicle owners must adhere to specific insurance mandates that include PIP and PDL coverage, both crucial for protecting yourself and others on the road. These requirements are not only vital for legal compliance but also play a significant role in ensuring that drivers can manage the financial repercussions of accidents. Furthermore, understanding these car insurance laws in Florida can help you avoid costly penalties and ensure smooth vehicle registration. This overview will clarify what you need to know about securing the right vehicle insurance Florida offers to keep you driving legally and safely.

Understanding Florida Car Insurance Requirements

In Florida, the vehicle insurance requirements are strictly defined by law to ensure that all drivers maintain a minimum level of financial responsibility. To legally operate a vehicle, drivers must provide proof of having purchased Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance. This legal requirement is crucial for protecting not only the driver but also other road users. PIP insurance covers up to $10,000 for medical expenses resulting from a car accident, irrespective of fault, while PDL insurance compensates for damages inflicted on another person’s property.

It’s essential for drivers to understand that Florida mandates continuous insurance coverage throughout the vehicle’s registration period. This means that even if the vehicle is not actively being driven, the insurance must remain in effect. Failure to comply with these insurance requirements can lead to severe penalties, including suspension of driving privileges. Additionally, vehicles registered as taxis face stricter insurance stipulations, needing higher coverage limits for bodily injury liability, which underscores the importance of being well-informed about Florida’s car insurance laws.

The Importance of PIP and PDL Insurance in Florida

Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance are cornerstone components of Florida’s vehicle insurance framework. PIP insurance is particularly vital as it ensures that drivers and passengers receive immediate medical coverage, regardless of who caused the accident. This no-fault insurance system is designed to expedite the claims process and lessen the burden on the judicial system. With the cost of medical care on the rise, having adequate PIP coverage can save drivers from substantial out-of-pocket expenses.

On the other hand, PDL insurance protects drivers from financial loss when they are responsible for damaging another person’s property in an accident. This type of coverage is essential for safeguarding against the costs associated with repairs or replacements of vehicles, fences, or other property. Together, PIP and PDL create a safety net for drivers, emphasizing Florida’s commitment to promoting responsible driving and minimizing the financial impact of car accidents.

Navigating Car Insurance Laws for Non-Residents

For non-residents moving to Florida, understanding local car insurance laws is crucial. The state requires that any vehicle operated in Florida must be registered with a Florida license plate and insured with a Florida policy. This requirement is especially pertinent for individuals who establish residency through employment or enrolling children in local schools. New residents are granted a 10-day grace period to comply with these requirements, making it essential to start the insurance process as soon as possible to avoid fines or penalties.

Additionally, maintaining a Florida certificate of title for your vehicle is necessary unless an out-of-state lienholder retains the title. This regulation ensures that all vehicles on Florida roads adhere to state laws, protecting both the driver and other road users. Non-residents should consult with licensed insurance agents in Florida to ensure they meet these requirements and to understand the coverage options available to them.

What to Do When Moving Out of Florida

When relocating from Florida to another state, it is crucial not to cancel your Florida vehicle insurance until you have registered your vehicle in your new state of residence. This precaution helps prevent any lapse in coverage that could lead to penalties or fines. Florida law stipulates that all drivers must maintain continuous insurance coverage, so transitioning your policy to fit the requirements of your new state is essential.

Moreover, if you choose to stay with the same insurance company, many providers can adjust your policy to meet the new state’s regulations once you have completed your vehicle registration. It is advisable to communicate with your insurance agent about the specifics of your move to ensure a seamless transition and to avoid any potential gaps in coverage, which could jeopardize your driving privileges.

Consequences of Violating Florida Car Insurance Laws

The consequences of failing to adhere to Florida car insurance laws can be severe. Drivers are mandated to maintain the required insurance coverage throughout the registration period; otherwise, they may face suspension of their driving privileges and license plate for up to three years. Florida does not offer temporary or hardship licenses for insurance-related suspensions, which amplifies the importance of compliance with state insurance laws.

In case of a violation, turning in your license plate to the nearest driver’s license office or motor vehicle service center before canceling your car insurance is crucial. This proactive step helps avoid suspension and reinstatement fees, which can reach up to $500. Staying informed about your insurance obligations in Florida is essential for avoiding unnecessary financial burdens and maintaining your driving rights.

Choosing the Right Car Insurance in Florida

Selecting the right car insurance policy in Florida can be a daunting task, given the various options available and the specific legal requirements. Drivers must prioritize finding a policy that includes both PIP and PDL coverage, as these are mandatory. However, it’s also wise to consider additional coverages such as bodily injury liability, comprehensive, and collision insurance to ensure complete protection. Comparing quotes from multiple providers can help identify a policy that offers the best balance of coverage and cost.

Moreover, understanding the nuances of Florida’s car insurance laws can aid drivers in making informed decisions. Factors such as driving history, the type of vehicle, and personal financial situations can influence insurance rates. Therefore, consulting with a licensed insurance agent can provide valuable insights into available options and ensure compliance with Florida’s vehicle registration insurance requirements.

The Role of Florida Vehicle Registration Insurance

Florida vehicle registration insurance plays a vital role in the state’s overall motor vehicle regulations. Every vehicle that is registered in Florida must have proof of insurance that meets the minimum requirements set by the state. This registration insurance not only safeguards the vehicle owner but also enhances road safety by ensuring that all drivers have a financial safety net in the event of an accident. Without proper insurance, drivers risk facing legal repercussions and financial liabilities.

It’s important to note that maintaining vehicle insurance is not just about fulfilling legal obligations; it’s also about personal safety and responsibility. Drivers who ensure that their vehicles are properly insured are less likely to face significant financial hardships following an accident. Therefore, understanding the connection between vehicle registration and insurance in Florida is essential for anyone looking to drive legally and safely in the state.

Benefits of Comprehensive Car Insurance in Florida

Comprehensive car insurance is often overlooked by drivers in Florida, yet it offers several significant advantages. This type of insurance covers a wide range of incidents beyond just collision-related damages, including theft, vandalism, natural disasters, and animal collisions. For Florida residents, where severe weather can lead to extensive vehicle damage, having comprehensive coverage can provide peace of mind and financial security.

Additionally, comprehensive insurance can be particularly beneficial for those who own high-value vehicles or live in areas with higher rates of theft and vandalism. By investing in comprehensive coverage, drivers can protect their assets against unforeseen events, ensuring they are adequately covered in case of loss or damage. Ultimately, comprehensive car insurance complements the mandatory PIP and PDL coverage, creating a robust safety net for Florida drivers.

Understanding No-Fault Insurance in Florida

Florida operates under a no-fault insurance system, which means that in the event of an accident, drivers can file claims with their own insurance companies regardless of who was at fault. This system is designed to streamline the claims process and reduce the burden on the judicial system. For many Florida drivers, this means quicker access to medical benefits and compensation for damages, which is why understanding the no-fault insurance framework is essential.

However, there are limitations to this system. For instance, to pursue a claim for pain and suffering, the injuries must meet certain severity thresholds. Therefore, it’s crucial for Florida drivers to be aware of their rights and responsibilities under the no-fault law, and to ensure they have sufficient coverage to protect themselves in the event of an accident. This knowledge not only aids in navigating the claims process but also helps to ensure compliance with Florida’s car insurance laws.

Frequently Asked Questions

What are the Florida car insurance requirements for vehicle registration?

In Florida, to register a vehicle, you must provide proof of Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance. Each must have a minimum coverage of $10,000. This insurance must be obtained from a licensed insurance company in Florida.

What does PIP insurance in Florida cover?

PIP insurance in Florida covers 80% of necessary medical expenses resulting from a car accident, up to $10,000, regardless of fault. It is a mandatory requirement for all vehicles registered in Florida.

What is the minimum PDL insurance requirement in Florida?

The minimum Property Damage Liability (PDL) insurance requirement in Florida is $10,000. This insurance covers damages to another person’s property in case of an accident caused by you.

Are there additional Florida car insurance requirements for taxi vehicles?

Yes, taxi vehicles in Florida must carry higher insurance limits, including $125,000 for bodily injury liability per person, $250,000 per occurrence, and $50,000 for PDL coverage.

What happens if I cancel my car insurance in Florida?

If you cancel your car insurance in Florida without surrendering your license plate, you risk having your driving privileges suspended for up to three years. It’s essential to turn in your plate at a local licensing office before canceling your policy.

Do non-residents need to meet Florida car insurance requirements?

Yes, non-residents must register their vehicles in Florida and obtain a Florida license plate and insurance if they work or enroll their children in a public school in Florida. You have a 10-day grace period to fulfill these requirements.

What should I do if I move out of Florida regarding my car insurance?

Do not cancel your Florida car insurance until you have registered your vehicle in the new state. Ensure to surrender your Florida plates to avoid penalties and potential insurance-related suspensions.

What are the penalties for not maintaining Florida car insurance?

Failing to maintain the required PIP and PDL insurance in Florida can lead to a suspension of your driver’s license and vehicle registration, along with a reinstatement fee of up to $500.

Can I transfer my existing car insurance to Florida?

Yes, if you are moving to Florida, you can ask your insurance agent to transfer your current policy to a Florida-licensed policy to meet the state’s insurance requirements.

How can I check if my Florida car insurance is valid?

You can verify your Florida car insurance by contacting your insurance provider or checking your policy documents. Ensure your coverage meets the state’s minimum requirements for PIP and PDL.

| Key Points | |

|---|---|

| Proof of Insurance Required | Personal Injury Protection (PIP) and Property Damage Liability (PDL) are mandatory. |

| Coverage Amounts | Minimum $10,000 each for PIP and PDL. |

| Taxi Insurance | Taxis must have $125,000 BIL per person, $250,000 per occurrence, and $50,000 PDL. |

| Continuous Coverage | Coverage must be maintained regardless of vehicle operation status. |

| Registration for Non-Residents | Must register vehicle in Florida within 10 days of employment. |

| Moving Out of State | Do not cancel Florida insurance until registered in new state. |

| Penalties for Violations | License may be suspended for up to three years for lack of required insurance. |

Summary

Florida car insurance requirements stipulate that all drivers must carry Personal Injury Protection (PIP) and Property Damage Liability (PDL) insurance to legally operate a vehicle in the state. This ensures that drivers have coverage for medical expenses and damages to others in the event of an accident. Additionally, strict guidelines are in place for non-residents and penalties for failing to maintain the necessary insurance, emphasizing the importance of compliance to avoid severe repercussions.