E-signatures: Transforming Insurance Operations Quickly

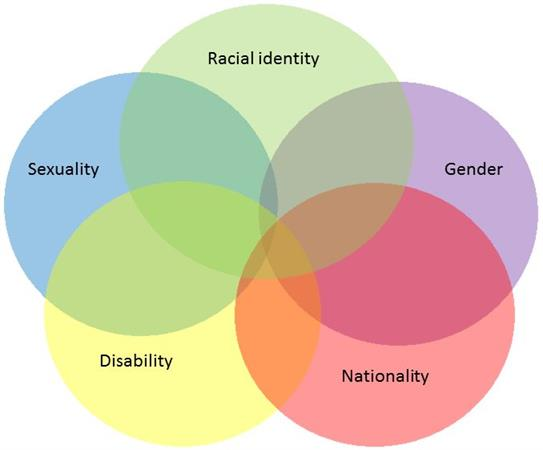

E-signatures are rapidly transforming the insurance industry, replacing cumbersome paper processes with streamlined electronic solutions. Gone are the days of waiting for documents to be printed, signed, and mailed back, as e-signatures offer a quick and efficient way to finalize agreements. This shift not only enhances operational efficiency but also significantly improves customer satisfaction, as clients appreciate the convenience of signing documents at their leisure. By leveraging electronic signatures, insurers can accelerate turnaround times and reduce the risk of lost paperwork, ultimately boosting productivity. As automation becomes increasingly integral to insurance technology, now is the perfect time to embrace document signing solutions that will future-proof your business.

When we refer to electronic signatures, we’re discussing a modern solution that facilitates the signing of documents without the need for physical paper. These digital signatures simplify the process of obtaining approvals, making it easier for clients to engage with insurance providers from anywhere, at any time. With automated signing processes, insurers can eliminate delays that often accompany traditional methods, ensuring a smooth experience for all involved. Additionally, by integrating these signing solutions with existing systems, businesses can enhance their overall workflow and efficiency. It’s clear that incorporating these innovative tools is essential for any insurer looking to stay competitive in today’s fast-paced market.

The Rise of E-Signatures in Insurance

E-signatures have emerged as a revolutionary tool in the insurance industry, replacing outdated methods of document signing that could take days or even weeks. With the shift towards digitization, insurers are now able to streamline their operations significantly. The rise in e-signatures can be attributed to the increasing demand for faster and more efficient processes. Insurers are leveraging this technology to enhance customer experiences by minimizing the time taken for policy approvals and claims processing.

Moreover, the adoption of e-signatures reduces reliance on physical documents, which not only cuts down on paper waste but also enhances data security. Each signature is encrypted and stored in a digital format, making it more secure than traditional paper methods that can be lost or damaged. As the insurance landscape continues to evolve, e-signatures stand as a vital component of modern insurance technology, allowing insurers to remain competitive and responsive to client needs.

Enhancing Insurance Efficiency with Electronic Signatures

Electronic signatures are pivotal in enhancing efficiency within insurance operations. By significantly shortening the time required to collect signatures on documents, insurers can expedite the entire workflow from policy issuance to claims processing. Historically, the manual handling of documents could lead to delays caused by postal services and client availability for signing. E-signatures eliminate these hurdles, enabling insurers to maintain a competitive edge in a fast-paced market.

Additionally, the integration of electronic signatures with existing insurance technology platforms is crucial. By utilizing document signing solutions that seamlessly connect with their Agency Management Systems (AMS), insurers can automate many administrative tasks. This automation not only speeds up the process but also reduces the likelihood of errors associated with manual data entry, ultimately fostering a more efficient operational framework.

Streamlining Document Signing Solutions

The implementation of document signing solutions has transformed how insurers manage contracts and agreements. Insurers can now send documents electronically for immediate review and signatures, drastically reducing the time involved in traditional signing processes. This shift empowers clients to interact with their policies more dynamically, enhancing engagement and satisfaction.

Moreover, document signing solutions often come equipped with user-friendly interfaces that guide clients through the signing process. This feature minimizes confusion and errors, leading to a smoother experience for both clients and insurers. By streamlining the signing process, insurers can focus more on client relationships and less on administrative burdens, ultimately fostering a more productive environment.

Automated Signing Processes for Improved Productivity

Automated signing processes are pivotal in boosting productivity within insurance firms. By automating routine tasks like sending reminders and following up on pending signatures, insurers can redirect their focus towards more complex and value-added activities. This automation not only saves time but also ensures that clients receive timely nudges to complete their paperwork, preventing delays.

Furthermore, automated processes contribute to better organization and tracking of documents. Insurers can easily monitor which documents are pending signatures and manage workflows efficiently. With less time spent on administrative follow-ups, insurance professionals can devote their expertise to enhancing customer service and addressing client inquiries, leading to improved overall satisfaction.

Advantages of Signing from Anywhere

The flexibility of e-signatures allows clients to sign documents from anywhere, at any time. This capability is particularly beneficial in today’s mobile society, where clients are often on the go. Instead of being tied down to an office or waiting for physical documents to arrive, clients can review and sign their policies or claims from their smartphones or tablets.

This convenience not only increases client satisfaction but also accelerates the pace at which insurers can complete transactions. In scenarios where a quick decision is necessary, such as securing coverage for urgent needs, the ability to sign from anywhere can make all the difference. It empowers clients to act quickly, knowing that their signatures can be captured instantly, thus enhancing the responsiveness of the insurance provider.

The Role of Automatic Reminders in E-Signing

Automatic reminders are an essential feature of e-signature platforms that enhance the efficiency of the signing process. These automated notifications can be customized to suit the needs of both the insurer and the client, ensuring that clients are gently nudged to complete their signatures without feeling overwhelmed. By eliminating the need for manual follow-ups, insurers can concentrate on servicing their clients effectively.

Moreover, automatic reminders help to create a consistent experience for clients. They can be informed about deadlines and the importance of completing their signatures promptly, thereby streamlining the entire workflow. This consistency not only improves operational efficiency but also builds trust and reliability in the relationship between insurers and their clients.

Integrating E-Signatures with Insurance Management Systems

The integration of e-signature solutions with insurance management systems is a game-changer for operational efficiency. By allowing documents signed through e-signatures to be automatically filed in the correct digital folders, insurers can significantly reduce the time spent on administrative tasks. This integration also minimizes the risk of human error associated with manual data entry, ensuring that client records are accurate and up-to-date.

Additionally, seamless integration enhances data accessibility. Insurers can quickly retrieve signed documents and client information as needed, which is crucial for timely decision-making and service delivery. By combining e-signatures with their existing AMS, insurers create a holistic workflow that promotes efficiency, accuracy, and enhanced client service.

Facilitating Multi-Party Signing with E-Signatures

One of the standout features of e-signature platforms is their ability to facilitate multi-party signing processes. This is especially beneficial in cases involving group policies or claims requiring multiple approvals. Instead of the traditional back-and-forth of passing documents between parties, e-signature solutions allow all stakeholders to sign simultaneously, regardless of their location.

This concurrent signing capability speeds up the process significantly, reducing the time it takes to finalize agreements. For insurers, this means quicker turnaround times for policy issuance and claims processing, which can lead to increased client satisfaction and retention. The efficiency gained through multi-party signing reinforces the importance of adopting e-signature technology in today’s competitive insurance landscape.

Instant Confirmation: A Key Benefit of E-Signatures

Instant confirmation of signed documents is one of the most valuable features of e-signature systems. As soon as a client completes the signing process, insurers receive immediate notification, allowing them to proceed with necessary actions without delay. This real-time feedback is crucial for maintaining the momentum of insurance operations and enhancing overall productivity.

Furthermore, instant confirmation provides reassurance to clients that their documents have been received and processed correctly. This transparency fosters trust in the insurer-client relationship, as clients are kept informed throughout the signing and approval process. By incorporating e-signatures with instant confirmation, insurers can ensure a smoother and more efficient workflow.

Reducing Paperwork and Its Environmental Impact

The widespread adoption of e-signatures leads to a significant reduction in physical paperwork, which not only streamlines operations but also has a positive environmental impact. By minimizing the need for printing, scanning, and filing, insurers can contribute to a more sustainable business model. This reduction in paper usage aligns with growing consumer expectations for environmentally responsible practices.

Additionally, digital documents are more manageable and easier to retrieve than their physical counterparts. Insurers can quickly search for and access necessary files, improving overall efficiency and organization. By reducing paperwork through the use of e-signatures, insurance companies can operate more efficiently while also demonstrating their commitment to sustainability.

Frequently Asked Questions

What are e-signatures and how do they work in insurance technology?

E-signatures, or electronic signatures, are digital representations of a person’s intent to sign documents electronically. In insurance technology, e-signatures streamline the document signing process, allowing insurers to send policies and claims for signature via email or mobile devices. This technology greatly enhances efficiency by reducing turnaround times and eliminating the need for physical paperwork.

How do e-signatures improve insurance efficiency?

E-signatures improve insurance efficiency by allowing documents to be signed instantly, regardless of location. This rapid signing capability decreases the time spent on paperwork, reduces errors associated with manual signing, and accelerates the overall claims and policy issuance processes, leading to enhanced customer satisfaction.

What are the benefits of using electronic signatures for document signing solutions?

The benefits of using electronic signatures for document signing solutions include faster document turnaround, reduced reliance on physical paperwork, and improved customer experience. E-signatures enable clients to sign documents from anywhere on any device, ensuring convenience and speed, which are essential in today’s fast-paced insurance environment.

Can e-signatures be integrated with other insurance management systems?

Yes, e-signatures can often be integrated with various insurance management systems (AMS). This integration allows for seamless workflows, where signed documents are automatically filed and client records updated, thus minimizing manual entry and the risk of errors, enhancing operational efficiency.

How do automated signing processes benefit insurance companies?

Automated signing processes benefit insurance companies by ensuring timely follow-ups with clients who have not yet signed documents. E-signature platforms with automated reminders reduce the workload for staff and maintain consistent communication with clients, thus facilitating quicker transaction completions and improving overall efficiency.

What makes electronic signatures a must-have for insurers in today’s market?

Electronic signatures are a must-have for insurers because they significantly reduce the time and resources spent on traditional paper signing methods. With features like instant confirmation, the ability to sign from anywhere, and less paperwork, e-signatures enhance customer satisfaction and operational efficiency, making them essential in a competitive insurance market.

How do e-signatures streamline claims handling in insurance?

E-signatures streamline claims handling by speeding up the process of obtaining necessary approvals and signatures. This is crucial during urgent claim situations, as it allows insurers to respond quickly and efficiently, ultimately improving customer satisfaction and reinforcing the insurer’s reputation for reliability and responsiveness.

What should insurance companies consider when implementing e-signatures?

When implementing e-signatures, insurance companies should consider compliance with industry regulations, ease of integration with existing systems, and user-friendliness for clients. Selecting a robust e-signature solution that meets these criteria will ensure a smooth transition to digital signing processes.

How do e-signatures enhance customer experience in the insurance industry?

E-signatures enhance customer experience by providing a fast, efficient, and user-friendly method for signing documents. Clients appreciate the convenience of signing from anywhere, the speed of processing, and the reduction in paper-related hassles, which collectively lead to a more satisfactory interaction with their insurance providers.

What role do e-signatures play in reducing paperwork for insurers?

E-signatures play a critical role in reducing paperwork for insurers by eliminating the need for printing, scanning, and physical storage of documents. This transition to digital documentation not only saves physical space but also enhances organization and accessibility, ultimately leading to a more efficient workflow.

| Key Point | Description |

|---|---|

| Speed | E-signatures allow insurers to send documents quickly, eliminating the need for mail and drastically reducing turnaround times. |

| Convenience | Clients can sign documents easily from any device, anywhere, enhancing user experience and satisfaction. |

| Automatic Reminders | Automated systems send reminders to clients, reducing the need for manual follow-ups and ensuring timely signing. |

| Integration with AMS | E-signature solutions can integrate with Agency Management Systems, streamlining workflows and reducing errors. |

| Multiple Signatures | E-signatures allow multiple parties to sign documents simultaneously, speeding up processes that require several approvals. |

| Instant Confirmation | Real-time notifications when documents are signed enable insurers to act quickly on approvals and claims. |

| Less Paperwork | The shift to e-signatures reduces physical paperwork, improving efficiency and organization. |

| Faster Claims Handling | E-signatures facilitate quicker processing of claims, enhancing customer satisfaction during critical times. |

Summary

E-signatures are transforming the insurance industry by streamlining processes and enhancing customer satisfaction. This innovative technology allows insurers to send documents quickly and securely, enabling clients to sign from anywhere at their convenience. With features like automatic reminders, multi-party signing capabilities, and seamless integration with management systems, e-signatures not only save time and reduce paperwork but also improve operational efficiency. As the insurance landscape continues to evolve, adopting e-signatures is no longer just an option; it’s essential for staying competitive and meeting clients’ demands.