InsuredMine CRM Features to Boost Agency Efficiency

As we look towards the future of insurance in 2025, InsuredMine CRM features stand out as essential tools for agencies aiming to boost efficiency in insurance operations and enhance client interactions. This innovative insurance agency software incorporates advanced client interaction tools, ensuring seamless communication and collaboration among team members. With exciting enhancements like eSignature improvements and automated notifications, InsuredMine CRM empowers your agency to respond swiftly to client needs. These features are not only designed to streamline workflows but also to foster a more engaging client experience. Explore the capabilities of InsuredMine CRM today and position your agency for success in the evolving insurance landscape.

In the realm of insurance management, InsuredMine CRM offers a suite of compelling functionalities that cater to the specific demands of modern agencies. By leveraging advanced client management software, agencies can enhance their operational effectiveness and promote better collaboration among their teams. Key innovations like electronic signature enhancements and integrated communication tools enable agents to maintain a proactive approach to client engagement. Furthermore, the intuitive design of InsuredMine CRM facilitates quick access to vital insurance data, ensuring that agents can provide timely responses to inquiries. This combination of features not only increases productivity but also significantly improves client satisfaction.

Enhancing Client Interactions with InsuredMine CRM Features

The latest features of InsuredMine CRM are tailored specifically to enhance client interactions, a crucial aspect of any successful insurance agency. By introducing customizable email notifications for eSignatures, agencies can streamline communication with clients and ensure that all relevant parties are informed in real-time. This improvement not only reduces delays in document processing but also fosters trust, as clients will appreciate being kept in the loop throughout the signing process. Moreover, the ‘Waiting For You’ feature further elevates client interactions by allowing multiple agents to collaborate on eSign documents, enhancing transparency and teamwork.

Additionally, the integration of Canopy Connect with InsuredMine CRM enhances client interactions by simplifying the retrieval of insurance details. Clients can share their insurance information securely, enabling agents to engage in more informed discussions about their policies. This capability not only improves the accuracy of the information available but also supports agents in offering personalized recommendations based on the client’s specific needs. Through these features, InsuredMine CRM is positioned as a pivotal tool in fostering strong relationships between clients and insurance agencies.

Boosting Efficiency in Insurance Operations

InsuredMine CRM’s new features are designed to significantly boost efficiency within insurance operations. The ability to set email notifications for NPS surveys ensures that agents receive timely feedback from clients, allowing them to act swiftly on insights gathered. This proactive approach not only enhances the client experience but also helps agencies identify areas for improvement, leading to better service delivery. Furthermore, the bulk upload feature for pipelines automates data entry tasks, reducing the administrative burden on agents and enabling them to focus on strategic initiatives that drive agency growth.

Another significant addition is the flexibility to edit workflows and pipeline automations easily. In the ever-evolving insurance landscape, the ability to adapt processes in real-time is invaluable. InsuredMine CRM provides agencies with the tools to make necessary adjustments quickly, ensuring that all team members are aligned with the latest protocols. This level of operational efficiency allows agencies to respond more effectively to client needs, ultimately leading to higher satisfaction rates and improved business outcomes.

Streamlined Document Management with eSignature Enhancements

The eSignature enhancements introduced by InsuredMine CRM streamline document management processes, making it easier for insurance agencies to handle important paperwork. The customization of email notifications ensures that all relevant parties are promptly informed about the status of eSign documents. This not only reduces the chances of miscommunication but also improves the overall client experience by keeping them updated on critical transactions. The ‘Waiting For You’ feature allows agents to see pending documents that require their attention, promoting accountability and ensuring that no document falls through the cracks.

Moreover, these eSignature enhancements facilitate better teamwork among agents, as they can communicate directly within the system to resolve any issues related to document signing. With everyone involved in the process having access to the latest information, the signing process becomes more efficient, reducing delays and enhancing client satisfaction. InsuredMine CRM’s focus on improving document management through these tools exemplifies its commitment to providing effective solutions for insurance agencies.

Improving Team Collaboration in Insurance Agencies

Effective team collaboration is essential for the success of any insurance agency, and InsuredMine CRM provides several features that enhance this aspect. The introduction of the ‘Waiting For You’ feature in the eSignature module allows agents to easily track documents that require their signatures, ensuring that everyone is aware of their responsibilities. This visibility not only fosters collaboration but also encourages agents to communicate and support one another in the signing process, ultimately leading to a more cohesive team environment.

Additionally, the ability to set up NPS survey notifications for the assigned agents or CSRs ensures that feedback is collected efficiently and directed to the right individuals. This feature encourages team members to engage with clients proactively and address concerns quickly, reinforcing a culture of collaboration and client-centric service. By equipping agencies with tools that promote teamwork, InsuredMine CRM helps create an environment where agents can thrive and clients feel valued.

Leveraging Technology for Insurance Agency Success

As we move towards 2025, leveraging technology has become more crucial than ever for insurance agencies aiming for success. InsuredMine CRM’s features are designed to enhance operational efficiency and client satisfaction, two key components of a thriving agency. The integration of Canopy Connect allows agents to access essential insurance information quickly, streamlining the data retrieval process and enabling informed discussions with clients. This technological advancement not only improves the quality of service but also positions agencies to compete effectively in the market.

Moreover, the ability to edit workflows and automation processes in real-time gives agencies the agility to adapt to changing circumstances. In a fast-paced environment, being able to pivot and implement changes swiftly can be the difference between meeting client expectations and falling short. By embracing these technological innovations, insurance agencies can optimize their operations, enhance client interactions, and ultimately drive their success in the industry.

Enhancing Client Satisfaction through Feedback Mechanisms

Client satisfaction is the cornerstone of any successful insurance agency, and InsuredMine CRM has introduced features that enhance feedback mechanisms. The new NPS survey notification system allows agents to collect client feedback promptly, ensuring that insights are gathered while experiences are still fresh. This real-time feedback collection empowers agencies to identify areas for improvement quickly and take action to address any concerns, fostering a proactive approach to client relationship management.

By acting on the feedback received, agencies can enhance their service offerings and build stronger relationships with clients. Satisfied clients are more likely to remain loyal and refer others to the agency, driving growth and success. InsuredMine CRM’s focus on client satisfaction through effective feedback mechanisms underscores its commitment to helping agencies build lasting relationships and thrive in a competitive market.

Optimizing Data Management for Insurance Agencies

Data management is a critical aspect of running a successful insurance agency, and InsuredMine CRM’s new features are designed to optimize this process. The bulk upload feature for pipelines allows users to manage large volumes of data efficiently, minimizing the time spent on manual entry. By automating data creation based on uploaded files, agencies can reduce the risk of errors and maintain accurate records, which is essential for effective client management and service delivery.

Furthermore, the integration of Canopy Connect enhances data accuracy by simplifying the retrieval of insurance details. This streamlined approach to data management enables agents to have up-to-date information at their fingertips, allowing for more informed discussions with clients. By optimizing data management processes, InsuredMine CRM empowers agencies to focus on strategic decision-making rather than getting bogged down in administrative tasks, ultimately leading to greater operational efficiency.

Transforming Workflow Automation in Insurance Agencies

Workflow automation is a game-changer for insurance agencies, and InsuredMine CRM provides tools that transform how agencies manage their processes. The ability to edit workflows and Standard Control Documents (SCDs) in real-time allows agencies to adapt quickly to changing needs and ensure that all team members are aligned with the latest procedures. This flexibility is essential for maintaining operational efficiency and preventing miscommunication within the agency.

Moreover, the automated email notifications for completed eSignatures streamline communication with clients and keep all relevant parties informed. By automating these processes, agencies can enhance their responsiveness and improve the overall client experience. InsuredMine CRM’s focus on workflow automation empowers agencies to work smarter, not harder, ultimately leading to better service delivery and increased client satisfaction.

Preparing for the Future of Insurance with InsuredMine CRM

As we approach 2025, insurance agencies must prepare for the future by leveraging innovative tools that enhance their operations. InsuredMine CRM has launched a range of features designed to increase efficiency, improve client interactions, and streamline processes. By adopting these tools, agencies can position themselves for success in the evolving insurance landscape, ensuring they meet the needs of their clients effectively.

The commitment to enhancing client satisfaction through features such as customizable email notifications and robust data management tools demonstrates InsuredMine CRM’s dedication to supporting insurance agencies. By investing in technology that facilitates better communication and operational efficiency, agencies can not only thrive in the competitive market but also build lasting relationships with their clients, setting the stage for long-term success.

Frequently Asked Questions

What are the new eSignature enhancements in InsuredMine CRM?

InsuredMine CRM has introduced significant eSignature enhancements, including customizable email notifications for completed eSignatures. Users can now designate any email address to receive alerts, ensuring all relevant parties stay informed about document statuses. Additionally, the ‘Waiting For You’ feature allows multiple agents to sign documents more efficiently, promoting better teamwork and communication during the signing process.

How does the Canopy Connect feature improve insurance agency efficiency?

The integration of Canopy Connect with InsuredMine CRM streamlines the retrieval of insurance information, allowing users to access critical details like premiums and coverage limits easily. This feature enhances operational efficiency by enabling secure sharing of insurance data with clients, which is then displayed within InsuredMine’s Account 360 and Contact 360, facilitating informed discussions and tailored recommendations.

What is the purpose of the NPS email notifications in InsuredMine CRM?

The NPS (Net Promoter Score) email notifications in InsuredMine CRM automatically send survey links to the assigned agents or CSRs for each account. This feature ensures feedback collection is efficient and timely, enabling agents to quickly gather insights about client satisfaction, identify areas for improvement, and proactively manage client relationships.

How can agencies benefit from the bulk upload feature in InsuredMine CRM?

The bulk upload feature in InsuredMine CRM allows agencies to upload large volumes of data effortlessly, significantly reducing the time and effort spent on manual data entry. This feature automatically creates deal cards based on policy numbers and expiration dates from the uploaded files, minimizing errors and enabling agencies to focus more on strategic decision-making rather than administrative tasks.

What advantages does editing workflow automation in InsuredMine CRM provide?

The ability to edit workflow and pipeline automation in InsuredMine CRM allows agencies to adapt quickly to changing circumstances. This flexibility ensures that teams always work with the most current information, enhancing operational efficiency and preventing miscommunication, which is crucial in the fast-paced insurance industry.

How do the client interaction tools in InsuredMine CRM enhance customer satisfaction?

InsuredMine CRM’s client interaction tools, such as customizable eSignature notifications and the Canopy Connect integration, significantly enhance customer satisfaction. By keeping clients informed about document statuses and securely sharing insurance information, agencies can provide a more transparent and responsive service, leading to happier clients and improved retention rates.

What improvements have been made to the email notification system for eSignatures in InsuredMine CRM?

Improvements to the email notification system for eSignatures in InsuredMine CRM now allow users to customize which email addresses receive alerts about document signing statuses. This ensures that all relevant parties, including agents and clients, are promptly notified about the signing process, enhancing communication and efficiency in document management.

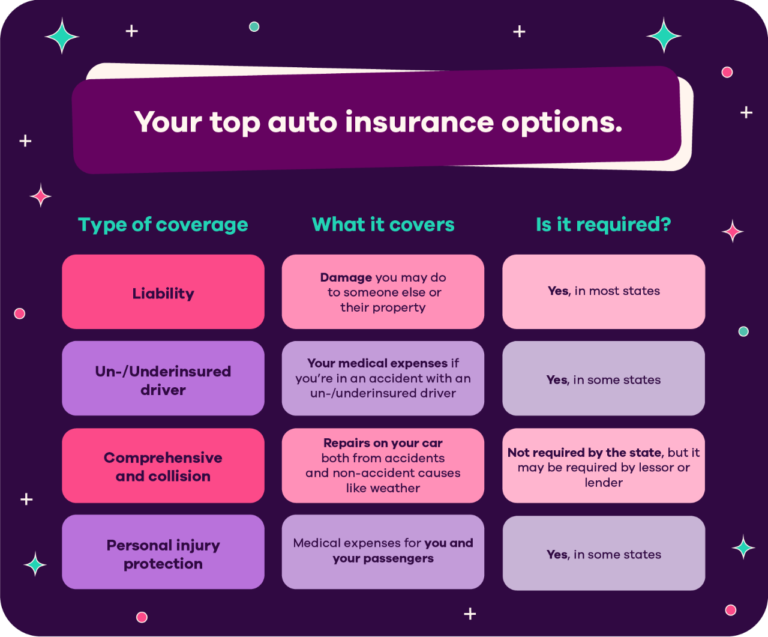

| Feature | Description | Benefits |

|---|---|---|

| Easy Email Notifications for ‘eSignatures’ | Customize email notifications for eSignatures to any desired email address. | Enhances communication and keeps all parties informed, improving client experience. |

| ‘Waiting For You’ in eSignature | Allows multiple agents to sign documents and see their status in the eSign module. | Promotes teamwork and reduces delays in the signing process. |

| Quick Access to Insurance Details with ‘Canopy Connect’ | Integrates with Canopy Connect to retrieve insurance details easily. | Improves data accuracy and client discussions, enhancing satisfaction. |

| NPS – Setting Notifications for Agents/CSRs | Automatically sends NPS survey links to the assigned agent or CSR. | Facilitates quick feedback collection and improves client retention. |

| Edit Workflow/Pipeline Automation | Enables real-time editing of workflows and pipelines. | Enhances operational efficiency and ensures updated information. |

| Bulk Upload for Pipelines | Allows bulk uploads of data to create deal cards automatically. | Saves time on data entry and minimizes errors, focusing on strategy. |

Summary

InsuredMine CRM features are designed to streamline operations and enhance client interactions, making it an essential tool for agencies looking to thrive in 2025. With new functionalities like customizable eSignature notifications, integrated access to insurance details, and automated feedback collection, agencies can improve efficiency and client satisfaction. Embracing these features not only facilitates better teamwork but also ensures that all stakeholders are informed and engaged, setting the stage for success in the upcoming year.