Term Life Insurance: What to Do When It Expires

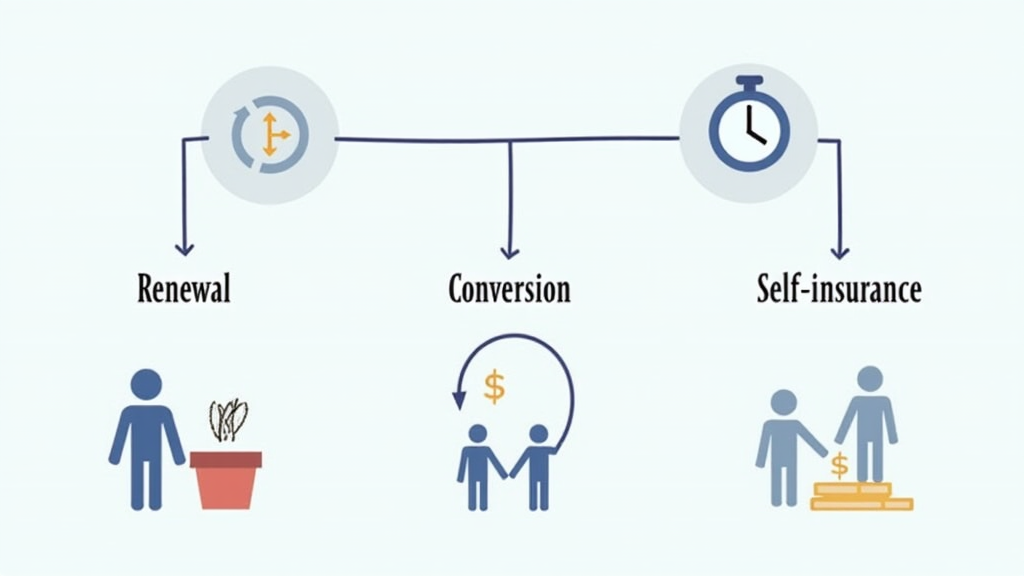

Term life insurance is a critical financial tool that provides families with peace of mind by covering essential expenses and income replacement in case of an unexpected death. Unlike permanent insurance policies, term life insurance is set for a specific duration, often 10 to 30 years, after which it expires. This expiration raises important questions about future coverage and financial protection. As you approach the end of your term life insurance, it’s crucial to explore your options, such as renewing your policy or converting it to a permanent plan. Understanding your choices, including self-insurance options or buying new term life insurance, can help ensure that your loved ones remain safeguarded against financial hardships, even after your policy ends.

When considering life insurance, many individuals are faced with the decision of choosing between temporary coverage and lifelong protection. Temporary life insurance, commonly known as term life insurance, offers a straightforward solution for those seeking coverage for a limited period. As this type of policy nears its expiration, it’s essential to evaluate alternatives like renewing your existing coverage or transitioning to a permanent insurance plan. In addition, some may prefer to explore self-insurance strategies, relying on personal savings to mitigate financial risks. By understanding the various paths available at the end of your policy’s term, you can make informed decisions that best fit your long-term financial goals.

Understanding Term Life Insurance Expiration

Term life insurance is a crucial financial tool that provides a safety net for families during critical times. However, one of the most significant aspects to understand is that these policies are not designed to last indefinitely. Typically, they last for a set duration, such as 10, 20, or 30 years, after which the coverage expires. This means that if the insured passes away after the term has ended, there will be no death benefit paid out to beneficiaries. Understanding this expiration is vital for policyholders as they plan for the future and consider their ongoing insurance needs.

As your term approaches its expiration, it’s essential to assess your current life situation. This includes evaluating any debts, dependents, and overall financial obligations. Many people may wonder what options remain available once their term life insurance expires. Preparing in advance and knowing your choices—whether to renew term life insurance, convert it to a permanent policy, or explore other options—can help ensure that you maintain necessary coverage for your loved ones.

Renewing Your Term Life Insurance Policy

Renewing your existing term life insurance policy is often one of the first options to consider as the term nears its end. Most insurers allow policyholders to renew their coverage annually after the original term expires. However, it’s crucial to note that renewal typically comes with significantly higher premiums, reflecting your advanced age and any changes in health status. Therefore, while this option offers a quick fix for short-term coverage needs, it may not be financially viable in the long run.

Before deciding to renew, it’s wise to conduct a thorough comparison of renewal costs against other possible alternatives, such as converting to a permanent policy or purchasing a new term life insurance policy. By weighing these options carefully, you can choose the most cost-effective solution to ensure that your loved ones remain protected while avoiding unnecessary financial strain.

Converting Term Life Insurance to Permanent Coverage

One of the most beneficial features of many term life insurance policies is the option to convert to a permanent policy, such as whole or universal life insurance. This conversion typically does not require a new medical exam, making it an attractive choice for those who still need coverage beyond the term period. Permanent policies offer lifelong protection and may also accumulate cash value over time, providing additional financial flexibility.

While the premiums for permanent insurance are generally higher than those for term policies, the long-term benefits can outweigh the costs, especially for individuals concerned about future insurability or those wanting to ensure their family’s financial security for life. Therefore, if you’re approaching the end of your term, consider discussing the conversion option with your insurance agent to determine if it aligns with your financial goals.

Exploring New Term Life Insurance Options

If you find yourself still in need of life insurance after your term expires, purchasing a new term life insurance policy could be a viable option, particularly if you are still relatively young and healthy. While this option may require undergoing another medical exam, securing a new policy can provide you with coverage that fits your current needs. This is especially important for those with dependents, ongoing financial obligations, or significant debts.

When considering buying a new term policy, it’s essential to evaluate the coverage amounts and terms available to ensure they align with your current financial situation. The benefits of acquiring a new policy can be substantial, providing peace of mind and ensuring that your loved ones are financially protected in the event of an untimely passing.

Self-Insurance: An Alternative After Term Life Insurance

As you approach the expiration of your term life insurance, it’s crucial to evaluate all your options, including self-insurance. This strategy involves using accumulated savings, investments, or retirement funds to support your financial needs rather than relying on a life insurance policy. Self-insurance can be a practical approach for individuals who have reached a stage in life where they no longer have major financial responsibilities or dependents.

Before transitioning to self-insurance, it’s vital to conduct a thorough assessment of your financial landscape. Ensure that your savings and investments are sufficient to cover potential expenses or emergencies. This approach can offer more control over your financial future, but it requires careful planning to avoid any gaps in coverage that could affect your loved ones.

Planning Ahead for Insurance Needs

Planning ahead is essential when it comes to your life insurance needs as you approach the expiration of your term policy. Understanding your options—whether to renew, convert, buy a new policy, or consider self-insurance—can greatly impact your financial security. Engaging with a knowledgeable insurance agent can provide valuable insights into the best course of action that aligns with your current circumstances and future goals.

At Abbate Insurance Associates Inc., we specialize in guiding individuals through the often complex decisions surrounding life insurance. By discussing your unique situation with our team, you can formulate a well-informed strategy that will maintain your family’s financial protection, ensuring that they are cared for in the event of an unexpected loss.

The Importance of Insurance Strategy

Developing a comprehensive insurance strategy is critical as you navigate the expiration of your term life insurance policy. This strategy should consider your current lifestyle, financial obligations, and any changes that may have occurred since you first purchased your insurance. By reassessing your needs and understanding the options available to you, you can craft a plan that offers the right amount of coverage for your family.

Moreover, as life circumstances change—such as the birth of a child, changes in employment, or significant financial shifts—your insurance needs may also evolve. Regularly reviewing your policy and making adjustments as necessary can ensure that you are always adequately protected.

Seeking Professional Guidance for Life Insurance

Navigating the complexities of life insurance can be challenging, especially when it comes to understanding what to do when your term life insurance expires. Seeking professional guidance is one of the best ways to ensure you make informed decisions about your insurance needs. Insurance agents can provide insights into the various options available, helping you to understand the pros and cons of each.

At Abbate Insurance Associates Inc., our expertise lies in helping clients evaluate their insurance options comprehensively. We can assist you in determining whether it’s best to renew term life insurance, convert to a permanent policy, or explore new coverage. With our professional support, you can confidently make choices that will safeguard your family’s financial future.

Evaluating Financial Obligations Before Insurance Decisions

Before making any decisions regarding your life insurance, it’s imperative to evaluate your financial obligations. This includes considering any debts, mortgage payments, or ongoing responsibilities that may require financial support in the event of your passing. Understanding these obligations will help you determine the appropriate level of coverage you need, whether through renewal, conversion, or acquiring a new policy.

Additionally, reflecting on your current lifestyle and future plans can provide clarity on how much insurance you may require. For instance, if you anticipate changes in your financial situation—such as retirement or children becoming financially independent—this will influence your insurance decisions moving forward.

The Role of Insurance in Long-Term Financial Planning

Insurance plays a critical role in long-term financial planning, serving as a safety net that can protect your loved ones from financial hardships in the event of your untimely death. As you approach the expiration of your term life insurance policy, it is essential to consider how your insurance fits into your overall financial strategy. This includes evaluating how much coverage you currently have and whether it will meet your family’s future needs.

Incorporating insurance into your long-term planning can provide peace of mind and ensure that your family’s financial future remains secure. Whether you decide to renew, convert, or purchase new coverage, understanding the implications of each choice is vital for effective financial management.

Frequently Asked Questions

What happens when my term life insurance expires?

When your term life insurance expires, your coverage typically ends, and you are no longer insured under that policy. It’s crucial to review your options, as some insurers offer renewal, but this generally comes at a higher premium due to your age and health changes.

Can I renew my term life insurance policy?

Yes, many term life insurance policies allow for renewal after the initial term ends, but expect significantly higher premiums. This may be suitable for short-term coverage needs, but it may not be cost-effective for long-term solutions.

What are my options for converting term life insurance to a permanent policy?

You may have the option to convert your term life insurance to a permanent policy without undergoing a new medical exam. This can be a beneficial choice if you need lifelong coverage and want to accumulate cash value, despite the higher premiums associated with permanent insurance.

Is it possible to buy a new term life insurance policy after my current one ends?

Yes, you can buy a new term life insurance policy after your current one expires. If you’re still young and healthy, this could be an affordable way to maintain coverage, although you will likely need to undergo another medical exam.

What are self-insurance options after my term life insurance policy expires?

If you are financially stable and no longer have significant expenses or dependents, you might consider self-insurance options. This involves relying on savings, investments, or retirement funds instead of obtaining a new policy, but it’s essential to assess your financial readiness.

How can I prepare for the expiration of my term life insurance?

Preparing for the expiration of your term life insurance involves reviewing your options early, such as considering renewal, conversion, or purchasing a new policy. Assess your financial needs and consult with an insurance professional to ensure continued protection for you and your loved ones.

What factors should I consider before renewing my term life insurance?

Before renewing your term life insurance, consider the increased premiums, your current health status, the need for coverage, and alternative options like converting to a permanent policy or buying a new policy. Evaluating these factors can help you make a more informed decision.

How do premiums compare when converting term life insurance to a permanent policy?

Premiums for permanent policies are generally higher than those for term life insurance. However, converting allows you to secure lifelong coverage without a new medical exam, making it a viable option for those wanting long-term financial protection.

| Key Points | Details |

|---|---|

| Coverage Expiration | Term life insurance coverage typically expires at the end of the term, leaving the policyholder without insurance unless they take action. |

| Renewal Option | Some insurers allow policy renewal on an annual basis at higher premiums, which may not be sustainable long-term. |

| Conversion to Permanent Policy | Many term policies offer a conversion option to switch to a permanent policy without a medical exam, though premiums will be higher. |

| Buying a New Policy | For younger, healthier individuals, purchasing a new term policy is an option, though it requires a new medical exam. |

| Self-Insurance | Financially stable individuals may opt for self-insurance using savings or investments, provided they assess their financial situation. |

Summary

Term life insurance serves as a crucial financial safety net for families, ensuring that expenses and debts are covered in the event of an unexpected death. As the policy nears its expiration, it’s vital to understand the various options available to maintain coverage, such as renewing, converting to a permanent policy, or purchasing a new term policy. Alternatively, for those in a stable financial position, self-insurance may be a viable option. By planning ahead and evaluating these choices, individuals can ensure continued financial security for themselves and their loved ones.