Commercial Property Insurance: 7 Essential Factors to Know

Commercial property insurance is an essential safeguard for anyone investing in commercial property, as it protects your valuable assets from potential risks and damages. This type of insurance not only covers the physical structure but also addresses the insurance value of property and its contents, ensuring that your investment is adequately protected. Understanding your specialized coverage needs is crucial, as different properties may face unique hazards that standard policies might not cover. Additionally, lenders often have specific insurance requirements that you must meet to secure financing, making it imperative to choose the right coverage types for property insurance. By securing comprehensive commercial property insurance, you can focus on growing your business while safeguarding your investment against unforeseen events.

When venturing into the world of commercial real estate, obtaining a robust insurance policy is paramount. Known as business property coverage, this insurance is tailored to protect physical assets, including buildings and their contents, from various threats such as fire, theft, and natural disasters. Investors must be keenly aware of their property’s specific risks, which can influence the necessary protection levels and additional policies, such as flood or earthquake insurance. Moreover, financing your property often means adhering to your lender’s stringent insurance guidelines, making it essential to navigate the landscape of coverage options effectively. Selecting the right insurance not only meets compliance but also fortifies your investment, allowing you to thrive in the competitive commercial market.

Understanding the Importance of Commercial Property Insurance

Investing in commercial property is a major financial decision, and protecting that investment with commercial property insurance is essential. This type of insurance not only safeguards against property damage but also addresses liability risks associated with owning and operating commercial real estate. As the market for commercial properties continues to evolve, ensuring that you have the right coverage in place can mean the difference between a profitable investment and significant financial loss.

Additionally, commercial property insurance provides peace of mind for property owners and investors by covering various risks, including fire, theft, and natural disasters. With the right policy, landlords can focus on growing their business rather than worrying about unforeseen events that could jeopardize their property. Therefore, understanding the nuances of commercial property insurance is vital for anyone serious about investing in commercial real estate.

Assessing Your Property’s Unique Risks

Before securing commercial property insurance, it’s crucial to conduct a thorough assessment of your property’s unique risks. Factors such as the location of the property can significantly affect insurance needs; properties situated in areas prone to natural disasters like floods or earthquakes may require additional coverage options. By identifying these risks upfront, you can tailor your insurance policy to ensure comprehensive protection.

Moreover, evaluating the building characteristics, such as its age and construction materials, can reveal vulnerabilities that may not be obvious at first glance. Older buildings, for example, may face different risks compared to newer constructions, necessitating specialized coverage. Understanding these aspects allows property owners to choose insurance coverage that adequately protects their investment against specific threats.

Determining the Accurate Insurance Value of Your Property

Determining the insurance value of your property is a critical step in obtaining the right commercial property insurance. Unlike market value, which fluctuates based on demand and location, insurance value reflects the cost to rebuild your property from the ground up. This encompasses not only the physical structure but also the contents within it. Regularly reassessing this value ensures that your coverage keeps pace with rising construction costs and accurately protects your investment.

Failure to insure your property for its accurate value can lead to significant financial issues in the event of a loss. Underinsuring can result in inadequate funds to cover repairs or replacements, while overinsuring can lead to unnecessarily high premiums. Therefore, understanding the nuances of insurance values and keeping them updated is paramount for commercial property owners.

Specialized Coverage Needs for Commercial Properties

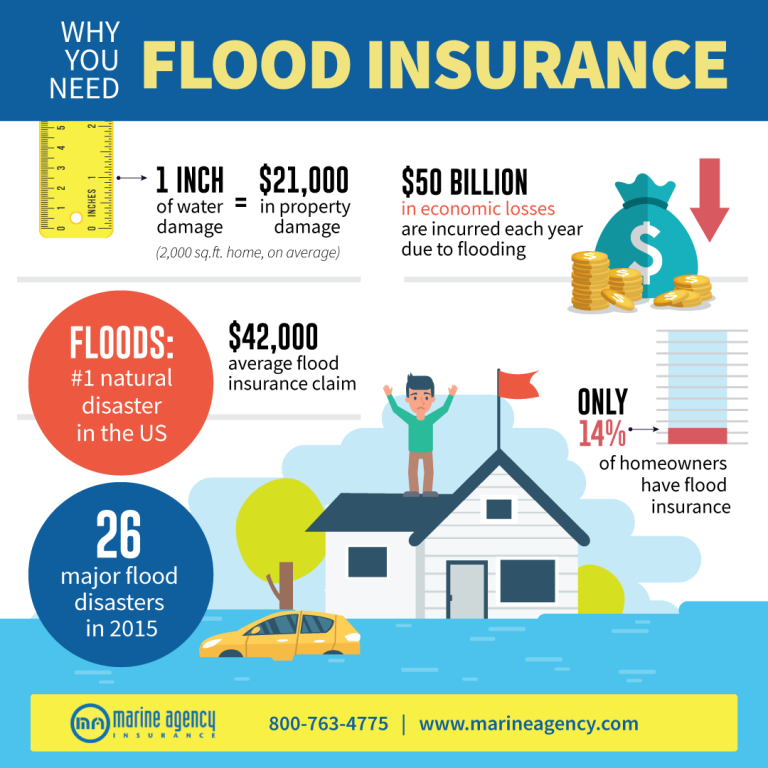

Standard commercial property insurance policies may not cover certain high-risk events, making it essential for property owners to consider specialized coverage needs. For instance, if your property is located in a flood-prone area, investing in flood insurance becomes necessary. Similarly, properties situated in seismically active regions should secure earthquake insurance to protect against potential damage.

By evaluating these specialized needs early in the insurance process, property owners can prevent significant financial losses in the future. This proactive approach ensures that all potential risks are addressed, allowing for a more comprehensive insurance strategy tailored to the specific vulnerabilities of the property.

Understanding Your Lender’s Insurance Requirements

If you are financing your commercial property, it is crucial to understand your lender’s insurance requirements. Lenders typically mandate certain coverage types and minimum policy limits to protect their investment in the property. This may include requirements for specific coverage, such as flood or earthquake insurance, depending on the property’s location and risk profile.

Failing to meet these requirements could jeopardize your financing and lead to compliance issues. Therefore, it is essential to have a clear understanding of what your lender expects regarding insurance coverage. This proactive approach not only facilitates a smoother financing process but also ensures that your investment is adequately protected.

Evaluating Policy Limits and Deductibles

When selecting a commercial property insurance policy, it is vital to carefully evaluate policy limits and deductibles. Policy limits refer to the maximum amount that the insurer will pay for a covered loss, and ensuring that these limits are sufficient can protect against unexpected financial burdens. Property owners should assess potential damages to determine appropriate coverage levels.

Deductibles, on the other hand, represent the amount that the insured must pay out of pocket before the insurance coverage kicks in. While choosing a higher deductible may lower the premium, it could lead to significant costs during a claim. Therefore, striking the right balance between policy limits and deductibles is crucial for financial security and effective risk management.

Comparing Different Types of Coverage for Property Insurance

Commercial property insurance encompasses various types of coverage, each designed to address specific risks. Property coverage protects the physical structure and its contents against damages caused by events such as fire, theft, or vandalism. Liability coverage, on the other hand, shields property owners from legal claims arising from injuries or damages occurring on their premises.

Additionally, business interruption insurance is a critical component that compensates for lost income during periods when a business cannot operate due to covered damages. Understanding these different coverage types allows property owners to create a tailored insurance policy that aligns with their business model and specific risk profile, ensuring comprehensive protection.

The Value of Consulting with Insurance Professionals

Navigating the complexities of commercial property insurance can be overwhelming, making it beneficial to consult with insurance professionals. These experts can provide valuable insights by assessing your unique risks and helping you understand the nuances of different policies. Their expertise ensures that you are not only compliant with any lender’s insurance requirements but also adequately protected against various risks associated with your property.

Moreover, insurance professionals can assist in comparing different policies and premiums, guiding you toward the best options available. By leveraging their knowledge of the market, you can make informed decisions about your insurance coverage, ultimately safeguarding your investment more effectively and ensuring that you are prepared for potential challenges.

Final Thoughts on Securing Commercial Property Insurance

Purchasing commercial property insurance is a critical step in protecting your investment from unforeseen events. By considering essential factors such as assessing risks, determining insurance value, understanding lender requirements, evaluating coverage types, and consulting with professionals, you can secure a policy that meets regulatory standards and provides peace of mind.

At Abbate Insurance, we are dedicated to helping you navigate the complexities of commercial property insurance with tailored solutions that fit your needs. Contact us today to learn how we can assist you in securing the right coverage for your commercial property investment, ensuring that you are well-protected as you grow your business.

Frequently Asked Questions

What is commercial property insurance and why is it important for investing in commercial property?

Commercial property insurance is a type of insurance designed to protect businesses from financial losses due to damage to their physical assets. This coverage is essential when investing in commercial property as it safeguards your investment against risks like fire, theft, and natural disasters, ensuring you can recover and continue operations.

How do I determine the insurance value of my commercial property?

To determine the insurance value of your commercial property, assess the cost to rebuild it from scratch, including materials and labor. It’s crucial to differentiate this from market value, as the insurance value reflects the actual rebuilding costs. Regularly updating this value will help ensure adequate coverage.

What specialized coverage needs should I consider when purchasing commercial property insurance?

When purchasing commercial property insurance, consider specialized coverage needs based on your location and property type. For instance, if your property is in a flood-prone area, flood insurance may be necessary. Similarly, earthquake insurance is essential for properties in seismically active regions.

What are my lender’s insurance requirements when investing in commercial property?

Your lender’s insurance requirements typically include minimum coverage amounts, specific types of coverage (like flood or earthquake insurance), and deductible limits. Understanding these requirements is crucial to ensure compliance and avoid jeopardizing your financing.

What should I evaluate regarding policy limits and deductibles in commercial property insurance?

When selecting a commercial property insurance policy, evaluate the policy limits, which is the maximum amount the insurer will pay for a covered loss, and the deductibles, which are the amounts you’ll pay out-of-pocket before coverage kicks in. Balancing these factors is vital for adequate protection and affordability.

What are the different coverage types available in commercial property insurance?

Commercial property insurance typically includes various coverage types such as property coverage (for physical structures and contents), liability coverage (for legal claims from injuries on your property), and business interruption insurance (for lost income during disruptions). Understanding these options will help tailor a policy that fits your needs.

Why should I consult with insurance professionals when purchasing commercial property insurance?

Consulting with insurance professionals is crucial for navigating the complexities of commercial property insurance. They can assess your specific risks, provide policy comparisons, and clarify terms and conditions, ensuring you make informed decisions that effectively protect your investment.

| Key Points | Description |

|---|---|

| Assess Your Property’s Risks | Conduct a thorough assessment of risks based on location and building characteristics. |

| Determine the Insurance Value | Understand that the insurance value should reflect the cost to rebuild, not the market value. |

| Consider Specialized Coverage Needs | Evaluate the need for additional coverage like flood or earthquake insurance based on risk. |

| Understand Your Lender’s Requirements | Know the specific insurance requirements set by your lender, such as coverage amounts. |

| Evaluate Policy Limits and Deductibles | Pay attention to the limits and deductibles to ensure adequate coverage for potential damages. |

| Review Coverage Types | Understand different coverage types including property, liability, and business interruption. |

| Consult with Insurance Professionals | Seek guidance from experts to assess risks and understand policy options. |

Summary

Commercial property insurance is essential for safeguarding your investment against unforeseen events. By considering critical factors such as risk assessment, insurance values, and lender requirements, you can secure a comprehensive policy tailored to your needs. Consulting with insurance professionals further enhances your understanding and ensures you choose the right coverage, ultimately providing peace of mind as you manage and grow your commercial property.