Insurance CRM Comparison: InsuredMine vs Agency Zoom

When it comes to choosing the right solution for managing client relationships, an Insurance CRM Comparison is essential for insurance agents looking to optimize their operations. With an array of options available, understanding the strengths of platforms like InsuredMine and Agency Zoom can significantly impact your agency’s efficiency. These CRM systems, tailored specifically for insurance agency management, offer unique features that cater to diverse operational needs. From sales automation tools that enhance lead tracking to comprehensive client communication, the right CRM can streamline your workflow and improve customer satisfaction. As technology continues to evolve in the insurance industry, making an informed choice in your CRM can set your agency apart from the competition.

Exploring the realm of client relationship management in the insurance sector, a thorough comparison of insurance-focused CRMs is vital for agents aiming to enhance their service delivery. This analysis delves into various platforms designed for insurance professionals, highlighting tools that assist in managing customer interactions and operational efficiency. Notably, InsuredMine and Agency Zoom emerge as leading contenders, each offering distinct functionalities that cater to specific agency requirements. By evaluating these systems, insurance agents can identify the most effective software to improve their sales processes and client engagement. Ultimately, a well-informed decision in selecting the right CRM can lead to increased productivity and better client relationships.

Understanding the Importance of CRM in Insurance Agencies

In the dynamic world of insurance, maintaining strong client relationships is paramount for success. A Customer Relationship Management (CRM) system serves as the backbone of an insurance agency by streamlining operations and enhancing communication with clients. With the right CRM, agents can organize client information, track interactions, and automate routine tasks, allowing them to focus more on building relationships rather than getting bogged down by administrative duties. Furthermore, utilizing a CRM tailored for insurance professionals can lead to increased efficiency and improved client satisfaction, which are crucial for long-term growth.

As technology continues to evolve, insurance agencies must adapt to remain competitive. A powerful CRM not only aids in managing client relationships but also provides insightful analytics that help agents understand their sales performance and customer behavior. By leveraging these insights, insurance professionals can make informed decisions that drive sales and optimize client engagement. Overall, a well-implemented CRM system is essential for insurance agencies looking to thrive in an increasingly digital marketplace.

Frequently Asked Questions

What are the main differences between InsuredMine and Agency Zoom in terms of customization for insurance CRM?

InsuredMine offers highly customizable dashboards, workflows, and reports, catering specifically to the unique needs of insurance agencies. In contrast, Agency Zoom provides limited customization options, focusing instead on a simplified user interface for personal lines agencies.

How does lead management differ between InsuredMine and Agency Zoom in an insurance CRM comparison?

In the insurance CRM comparison, InsuredMine features advanced lead management capabilities, including lead scoring and automated assignments, while Agency Zoom emphasizes strong lead tracking with a New Deal pipeline, ensuring no opportunities are missed.

Which CRM is more suitable for sales automation tools, InsuredMine or Agency Zoom?

Agency Zoom excels in sales automation tools, offering automated email campaigns and follow-up reminders tailored for sales processes, whereas InsuredMine provides comprehensive automation features that streamline various tasks, including policy renewals and client communications.

What kind of support can I expect from InsuredMine and Agency Zoom in their insurance agency management systems?

InsuredMine offers 24/7 customer support via phone, email, and live chat, along with one-on-one training during onboarding. Agency Zoom provides robust support through email, phone, and live chat during business hours, with personalized training available only on its highest-tier plan.

Is InsuredMine or Agency Zoom better for comprehensive policy management in insurance agency management?

InsuredMine provides comprehensive policy management features, including automated renewal reminders and policy tracking. Agency Zoom also offers effective policy management tools but is more focused on lead management and sales pipeline tracking.

How does pricing compare between InsuredMine and Agency Zoom for insurance CRM solutions?

InsuredMine offers competitive pricing starting at $99 per month for one user, with a broad range of features included. Agency Zoom has three pricing plans, starting at $149 per month, but may require higher-priced plans for full functionality.

For larger insurance agencies, which CRM is recommended: InsuredMine or Agency Zoom?

For larger insurance agencies, InsuredMine is recommended due to its all-in-one CRM and AMS capabilities, comprehensive feature set, and advanced analytics, making it ideal for robust management needs.

Can InsuredMine integrate with other systems used by insurance agencies?

Yes, InsuredMine boasts a wide range of integration options with various AMS platforms and third-party tools, making it a versatile choice for insurance agencies that require compatibility with existing systems.

Which platform offers better mobile app functionality for insurance agents, InsuredMine or Agency Zoom?

InsuredMine offers a comprehensive mobile app with full access to most features, while Agency Zoom provides a mobile app that covers essential functions like task management and customer communication.

How do the training and onboarding experiences differ between InsuredMine and Agency Zoom?

InsuredMine provides one-on-one training during onboarding and 24/7 support, while Agency Zoom offers training exclusively for its highest-tier plan and more limited support during regular business hours.

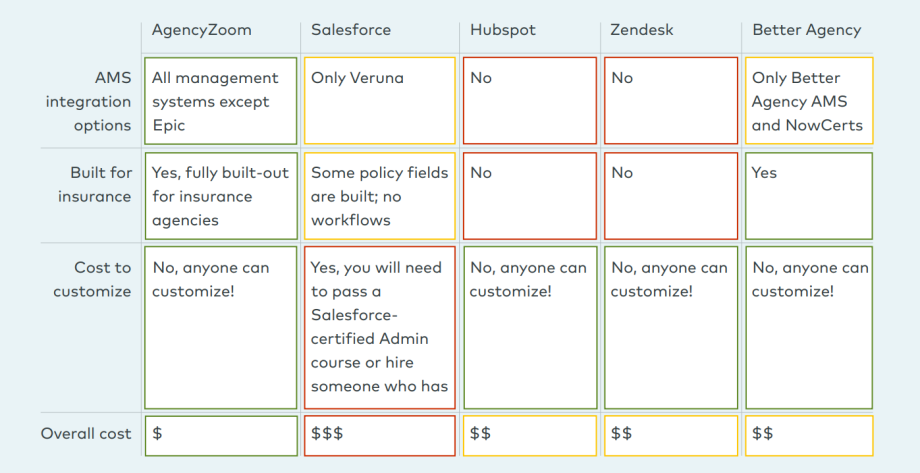

| Feature | InsuredMine | Agency Zoom |

|---|---|---|

| Integrations | Multiple advanced Integrations. | High-level Integrations with limited data fields. |

| Easy to Use | User-friendly interface designed for quick navigation and minimal learning curve. | Simple and clean interface that emphasizes ease of use. |

| Customization | Highly customizable dashboards, workflows, and reports to fit specific agency needs. | Limited workflow and automation options with minimal customization and editing capabilities. |

| Pricing | Provides a focused set of tools for sales, service, and marketing at a much more affordable price point. | Three plans, more features in higher-priced plans. |

| Support | Provides 24/7 customer support via phone, email, and live chat, along with one-on-one training during onboarding. | Provides robust customer support via email, phone, and live chat during business hours, with one-on-one training exclusively available on the highest-tier plan. |

| Automation | Features like automated email campaigns, workflow triggers, and task assignments. | Automation focused on sales processes and customer follow-ups. Limited options in workflows and automation, lacking the ability to customize and edit them as needed. |

| Mobile App | Offers a comprehensive mobile app with full access to most features. | Offers a mobile app that covers essential features like task management and customer communication. |

| Lead Management | Advanced lead management features including lead scoring, automated lead assignment, and nurturing leads. | Strong focus on lead management with features like new lead pipeline, automated lead distribution, follow-up reminders, and tracking. |

| Policy Management | Comprehensive policy management features with automated renewal reminders, policy tracking, and updates. | Effective policy management tools including automated reminders and policy tracking. |

| AMS Integration | Integrates with a wide range of AMS platforms and other third-party tools. | Simplifies integration with major AMS platforms like HawkSoft, NowCerts, and others. |

| SMS Integration | SMS texting built-in feature within the CRM. | Agency Zoom offers SMS texting through a third-party integration. |

Summary

In summary, the Insurance CRM Comparison highlights the distinct features and strengths of InsuredMine and Agency Zoom. While both platforms are effective for managing client relationships and streamlining operations, the choice ultimately depends on the specific needs of the agency. InsuredMine is ideal for agencies seeking a comprehensive, customizable solution with strong analytics capabilities, whereas Agency Zoom caters to those focusing on sales pipeline management and ease of use. Understanding these differences will empower insurance agents to select the CRM that best aligns with their operational goals.